What is a Business Cycle and How to Measure It?

Table of Contents

- jaro education

- 9, July 2024

- 3:00 pm

In the business or finance landscape, you can expect the economy to expand or fluctuate regularly. This phenomenon is known as the business cycle. This cycle has a substantial influence on expenditure, potentially affecting the sector or organisation. By anticipating these changes, you can ensure that a business firm is facing fewer negative consequences. But what is the business cycle, and how does it work? In this blog, you will learn everyth

What is the Business Cycle?

A business cycle refers to the natural rise and fall of economic activity in a country over time. It is also known as the economic or trade cycle, and it starts and concludes with the increase and collapse of a country’s GDP. A cycle also impacts the stock values of different organisations.

In capitalist economies, business cycles are typical occurrences economists have studied for decades. The reasons for trade cycles are diverse, encompassing both internal and external variables. Internal variables may include fiscal and monetary policies, consumer and corporate confidence shifts, and technological advancements. On the other hand, external variables might include political events, natural disasters and global economic circumstances.

How to Measure the Business Cycle?

There are different ways to measure cycles of business or economic cycles. Some of them are as follows:

Unemployment Rate

The unemployment rate is a labour market indicator that can be used to assess a country’s overall economic health. When the economy is healthy and growing, companies often hire, hence reducing the unemployment rate. On the contrary, when the economy is weak and declining, organisations may lay off workers or hire new employees, increasing unemployment. The unemployment rate rises during a recession and falls during an upswing, making it a useful metric of the cycle of business.

Stock Market

When the stock market is performing well, it is generally a sign of a strong economy, as companies are performing well and investors are confident about the future. Conversely, when the stock market performs poorly, it can signify a weak economy. The stock market is used to track the performance of a broad-based stock index.

Inflation

Inflation may influence the cycle in a variety of ways. When inflation is strong, it may suggest that the economy is expanding and that demand for products and services is rising. However, if inflation becomes too high, it can cause economic instability and impede growth. To quantify the cycle of business using inflation, consider how the rate of inflation fluctuates over time. For example, a regular increase in inflation might indicate a thriving economy. On the other hand, a regular decrease in inflation may indicate a struggling economy.

Gross Domestic Product (GDP)

One can measure the cycle of business by tracking the changes in GDP over time. GDP often increases during times of economic boom. Low unemployment rates and soaring stock market values frequently follow this. But, if there is a time of economic downfall or recession, the GDP tends to contract as the unemployment rate rises. The GDP growth rate is one method for measuring the economic cycle. If the GDP growth rate is positive, it indicates economic expansion. If the GDP growth rate is negative, it indicates economic recession.

Industrial Production

Industrial production means the output of mines, factories and utilities. A cycle of business is often measured in terms of the quantity of things produced or the amount of power generated. Industrial output is a good measure of economic activity in the manufacturing sector and can give information about the general health of the economy.

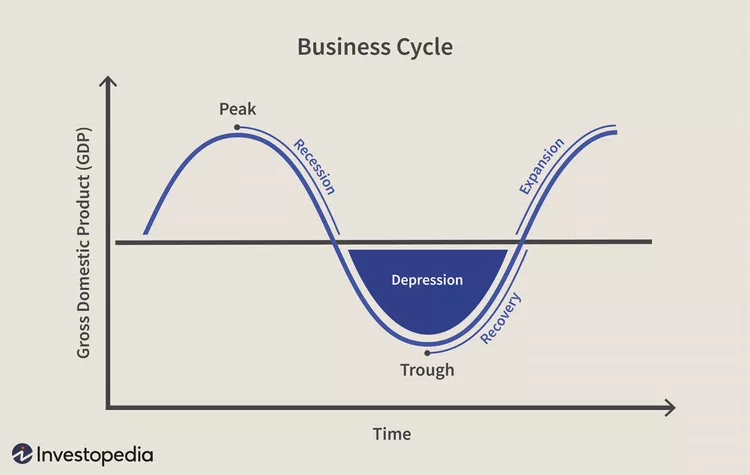

Stages of a Business Cycle

Business cycles can range from a few days to several years. The duration of a trade cycle is determined by the time it takes to complete the different phases. The different business cycle stages are as follows:

Expansion

The initial stage of a business cycle is expansion. At this stage, there are favourable economic indicators like demand, income, supply, employment and profit growth. As a firm expands, the frequency of investments rises, and both corporations and people make timely loan repayments.

Peak

The cycle of business reaches its peak when the economy becomes saturated, and upward expansion can no longer persist. Wages, employment rates and the cost of products and services have reached their maximum levels at this stage. These economic indicators can reach a point where they may not increase further. Many businesses and people can review their budgets in anticipation of a drop in economic activity.

Contraction

This contraction stage of the cycle is often known as the recession stage. When the economy declines and economic indicators like GDP, employment, and consumer spending fall, it is called contraction. During the contraction phase, firms may face decreased profitability, layoffs, and bankruptcy. Consumers may also cut down on spending, further weakening the economy.

Trough

The trough stage is marked by the lowest levels of GDP, employment and consumer spending. It is the point at which the contraction stage of the cycle ends. During the trough phase, firms may struggle, and unemployment may be significant. This might lead to lower consumer spending and a further decline in economic growth. The trough period is frequently seen to mark the beginning of a recession.

Recovery

The recovery stage begins when the economy’s GDP falls to its lowest point in the cycle. Currently, the economy has the potential to recover and reverse negative trends. When demand increases, so does supply. Investments may ultimately restart, resulting in increased employment and output. The recovery phase lasts until the economy’s growth rate resumes a more constant pace. The current business cycle comes to an end at this time, and a new one begins as it enters the expansion stage.

Which Factors Influence the Business Cycle?

Various factors influence the business cycle. Some of them are as follows:

Consumer and Business Confidence

Confidence greatly impacts the cycle. When consumers and companies feel positive about the future, they are more inclined to spend money and contribute to economic growth. When people lose confidence, they are less inclined to spend money, causing the economy to stall.

Technological Advancements

Technological advancements may have a significant influence on the cycle. For example, the introduction of new technology can boost productivity and economic growth, but the obsolescence of existing technologies might result in a drop in economic activity.

Global Economic Conditions

Economic conditions in other countries might influence a country’s cycle of business. For example, the cycle of a country that exports a lot of goods to, say, a major trade partner may be influenced by that partner’s recession.

Political Instability

War, social upheaval, and governmental changes may all have an impact on the economy.

Economic Policy

Economic policies of the government and central banks may have a significant influence on the cycle of business. Adjustments to fiscal or monetary policy, such as changes in government expenditure, can impact economic activity.

Natural Disasters

Natural catastrophes like droughts, hurricanes and earthquakes can disrupt economic activity and affect the cycle of business.

What is the Significance of Business Cycles?

Understanding business cycles is critical for business professionals, as well as financial and economic experts. Knowing where the economy is in its cycle allows you to make better-informed strategic decisions. During the expansion phase, investors make investments, but they frequently get overconfident and inflate prices at the peak period. During a recession or depression, investors stop purchasing and instead sell, leading prices to decline. As an investor, one can see which assets perform well during different economic cycle stages, helping you make better-educated financial decisions.

Final Thoughts

To know the country’s economic standing, understanding the periodic ups and downs of businesses is important. This business expansion and contraction cycle is known as the business cycle/trade cycle/economic cycle. If you want to be part of the business or finance industry, you must be well aware of the business cycle, its stages and how long it can last. This way, you can predict unforeseen circumstances and employ different strategies to control the fall.

There are also other things that you need to learn if you want a career in the business industry. For better career opportunities, you can sign up for the Online M.Com Programme at Chandigarh University. The curriculum of this programme is equivalent to the offline M.Com courses and takes place for 2 years. For more details, register with Jaro Education.