Effects of Inflation: Change in Purchasing Power Parity

Table of Contents

- jaro education

- 13, April 2024

- 2:00 pm

The general upward trend in the pricing of goods and services over time is known as inflation. Between 1914 and 2023, the average annual inflation rate worldwide was about 4.1%. Therefore, mild inflation has been the expected economic situation and a reality for over a century. Because of this, it’s critical to distinguish between the effects of inflation at all rates and those exclusive to times when inflation is abnormally high. The above facts make it critical to differentiate between the implicit effects of inflation at any given point; those impacts only get exposed when inflation is abnormally high.

Purchasing power parity (PPP) signifies an accepted macroeconomic evaluation parameter that compares economic productivity and living standards among different nations. The essence of PPP is an economic fundamental that collates countries’ currencies in general with applying a “basket of goods”.

Therefore, purchasing power parity conveys the exchange rate at which one country’s currency will get converted into another to buy an identical amount of a vast range of products. As per this concept, two currencies of two nations are in equilibrium (at par) when respective authorities price a basket of goods at the same rate in both countries with due consideration of exchange rates.

There are many impacts of inflation on the economy. Inflation decreases the purchasing power of a country’s currency. The decline in purchasing power leads to an increase in the prices of commodities and services. To calculate PP using conventional economic criteria, you can compare the price of a commodity or service against an established price index like CPI (Consumer Price Index).

What Are the Inherent Effects of Inflation?

Inflation implies a rise in prices of commodities and services over a specific period. When there is a price increase, consumers invariably lose purchasing power. It signifies the power of a single currency unit losing its elasticity, which it did before. A minor degree of inflation will not be a dominating factor, but it can be when there is a steep rise in price. Still, you might be curious to know what factors govern inflation.

The most common effects of inflation are as follows:

- Consequences of inflation may lead to a marked imbalance in demand and supply. Inflation escalates when the general demand for commodities and services increases when supplies go down at intended price levels.

- Supply barriers or shocks may drive inflation. You might have heard that global crude oil prices have soared due to Russia’s occupation of Ukraine’s territories. Consequently, Russia adopted stern measures by squeezing the market considering the sanctions clamped by the international community. This significant drop in oil supply brought about an exceptional price hike.

- Besides, consumers are apprehensive when they expect inflation. When employees working in the public and private sectors anticipate a price escalation, they demand higher remuneration to protect against potential price jumps. Most manufacturing industries respond to this changing scenario by raising the cost of production, which has a decisive impact of inflation on the economy.

The effects of inflation can be a virtue or a vice. It all depends on how economic policymakers work on them. From one point of view, central banks and government authorities plan for controllable price increases by establishing inflationary objectives. Accordingly, consumers reciprocate by buying goods and services in a modest inflationary situation. However, the whole environment changes when inflation takes a steep rise. This abrupt rise may hurt the purchasing power of consumers. When inflation is at its peak, governments usually raise interest rates through central banks, reduce the reserve funds held by banks and curtail the money supply.

Advantages and Drawbacks of Inflation

Like other economic occurrences, inflation’s effects carry benefits and drawbacks for the stakeholders. These are as follows:

Advantages

The effects of Inflation can be favourable for a specific group of market borrowers. Consider mortgagors who borrowed loans at fixed interest rates—the locking by the financial institutions maybe 5%. If there is an abnormal inflationary spike, the impact will not fall on these borrowers. These factors may not favor other borrowers with an ARM (Adjustable Rate Mortgage) that fluctuates according to changes in market rates.

You may be fortunate if you are exploring real estate territory to buy a new home. Higher prices, which result in an escalation in interest rates, usually eliminate competition. It creates the scope for capitalising on the available inventory. You can possess the best of the lot if you can afford a new apartment.

Disadvantages

By now, you have reached the point that inflation reduces the purchasing power of individuals, entrepreneurs, and the country. It impacts the consumers and related communities, who stand to lose with price escalation. The flow of funds does not stretch to the desired extent and prevents consumers from procuring a reasonable number of commodities and services they can afford. Consequently, when inflation soars, most consumers think twice about buying a big-ticket item like a new air conditioner or vehicle.

Real estate consumers also feel the heat during high inflationary scenarios. The reason is simple. Prices go beyond one’s reach, and higher prices trigger higher interest rates, leading to borrowing at inflated interest rates. Consumers with a fixed income, like salaried individuals, can also experience a negative impact of inflation. Here, you may cite the instances of retired people who enjoy social security. A cost of living adjustment (COLA) improves their economic conditions. Still, it may not be sufficient to sustain a similar living standard they are accustomed to when there is a substantial price increase at certain levels.

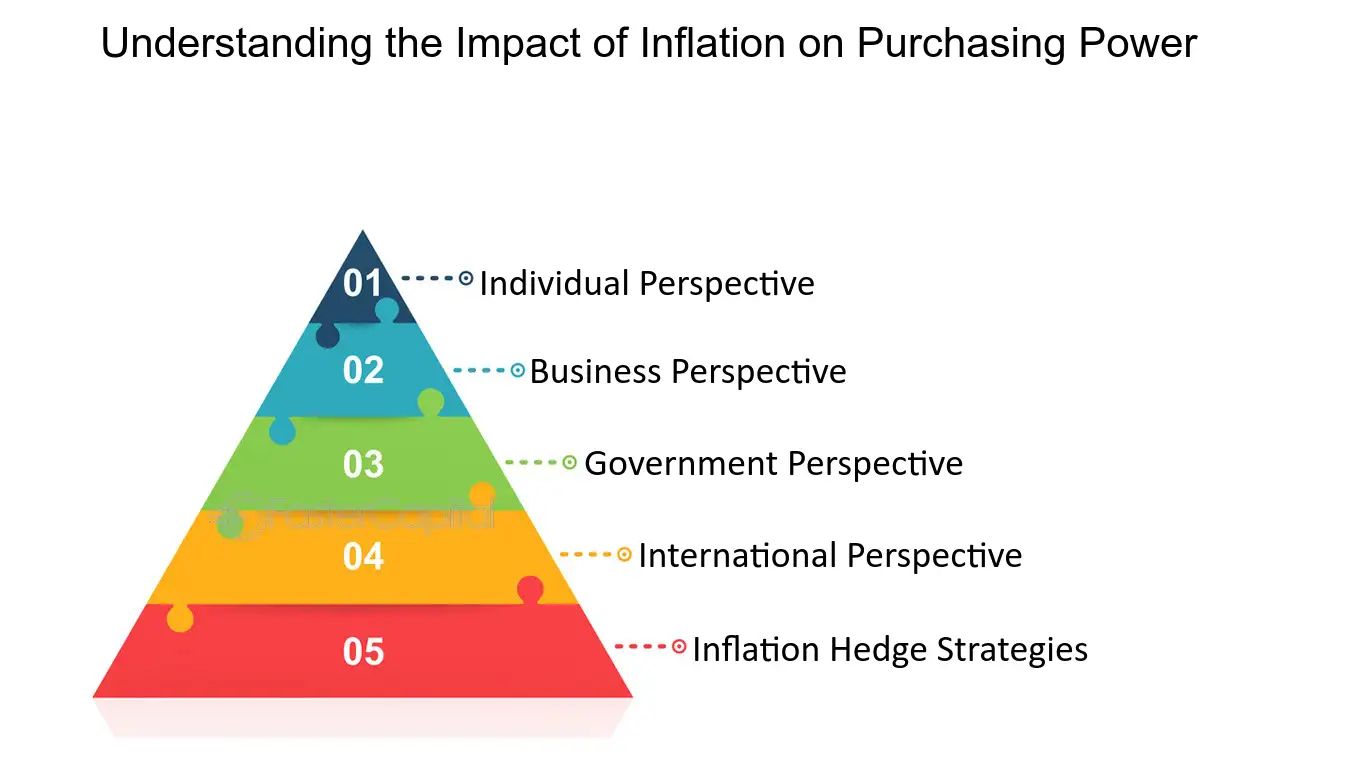

Significant Impact of Inflation on Purchasing Power Parity

Purchasing power parity focuses on abolishing price discrepancies across nations about similar commodities or standardised baskets of goods and services. If the environment of PPP is ideal, then the face value of one currency unit should carry identical purchasing power worldwide. The notable deviations from established purchasing power parity may invariably lead to undervaluation or overvaluation of currencies in terms of their original purchasing power.

The following are the significant effects of inflation on purchasing power parity:

1. Corresponding Price Levels

The consequences of inflation adversely impact relative price levels across nations. The impact falls on domestic prices in different ways depending on factors such as the country’s economic policies, disruptions in the supply chain of products and services and consumer demands. In case one nation faces the aftermath of higher inflation than the other, the currency of the former loses its face value compared to its trading partner’s currency due to a fall in purchasing power.

2. Influencing Exchange Rates

Fluctuation in inflation rates significantly influences exchange rates. These fluctuations reveal notable shifts in actual interest rates and expected returns on investments in the denomination of currencies of different countries. A steep rise in inflation frequently leads to depletion in a nation’s currency as various investors look after due compensation for retaining assets and capital denominated in a feeble currency structure with diminishing purchasing power.

*fastercapital.com

3. Distinct Trade Imbalances

Substantial inflation can disturb a country’s trade balance, influencing import costs and export efficiency. Countries experiencing modest inflation might observe their exports becoming costlier than traders facing higher inflationary conditions. It may lead to nominal export volumes and prospective trade deficits provided the undesirable plight is not offset by other factors such as exceptional technological advancements and productivity gains.

4. Flow of Investments

Inflation differentials among countries worldwide can influence FDI (Foreign Direct Investments).

The simple reason behind this narrative is that investors prefer stable ROI with relative adjustments in purchasing power with time. A spike in inflation abolishes the possibility of actual returns on investments. However, authorities responsible for economic reforms can mitigate these issues through risk premiums or notifications based on welcome changes in exchange rates propelled by splitting interest rates.

5. Policy Implementation

Central Banks of different countries frequently contemplate the implications of purchasing power parity when formulating a country’s fiscal and monetary policies. Implementation of these policies gives attention to maintaining price stability and rational economic growth. The bid to control inflation within the realm of preset objectives enables the restoration of belief in domestic currency values while helping positive efforts to align the nation’s exchange rates with cardinal principles. It adequately displays relative purchasing powers, highlighting the element of purchasing power parity.

How Purchasing Power Parity is Applied?

Economic policymakers utilise the purchasing power exchange rate to convert the currency of a target nation into a uniform currency applicable to all nations across the globe. Usually, this common currency denotes the US dollar (international dollar). It is currency projected as a baseline.

The students and experts having Economics as their major subject, might consider a broad spectrum of commodities and services to make a meaningful comparison of current prices across nations. Still, an attempt for a one-to-one price comparison is difficult due to the substantial data volume that one has to gather and go through the intricacies of the said comparisons. Late in 1968, the United Nations and the University of Pennsylvania jointly instituted the ICP (International Comparison Programme).

With this experimental programme, the purchasing power parities triggered by the ICP have created a basis for a global price survey. This survey compares the prices of millions of distinct genres of commodities and services. Therefore, this programme immensely helps Indian and international macroeconomists assess productivity and growth globally. Additionally, the World Bank publishes a relevant report that compares the growth and productivity of various nations in line with the purchasing power parity and international currency (US dollars).

The IMF (International Monetary Fund) and OECD (Organisation for Economic Cooperation and Development) apply weights on purchasing power parity parameters to make predictions and recommend appropriate economic policies. These recommendations imply instant, short-term effects on financial markets.

Some eminent forex traders utilise purchasing power parity to detect prospective undervalued overvalued currencies. Besides, those holding bonds or stocks of foreign companies may use the ICP study’s purchasing power parity statistics to forecast the effect of exchange rate variations on any country’s economy and subsequent investments.

Nominal GDP and GDP Driven by Purchasing Power Parity

Before understanding the concept of pairing purchasing power parity with gross domestic product, you must know the terms Nominal GDP and GDP by purchasing power parity.

1. Nominal GDP

Nominal GDP accounts for a nation’s economic output by adopting current market prices. It does not measure the disparities in the cost of living or purchasing power among various countries. Besides, nominal gross domestic product considers the value of commodities and services produced in a country utilising prevailing exchange rates. It delivers an uncomplicated measure of a country’s economic shape.

However, it may not precisely reflect the relative purchasing power or standard of living across nations. Nominal GDP usually finds its existence in an international comparison of the prices of goods and services and ascertains the national rankings based on respective economic outputs.

2. GDP Driven by Purchasing Power Parity

National and international economic policymakers adjust a country’s economic output by considering human cost of living and relative purchasing power distinctions. GDP PPP calculates the intrinsic value of commodities and services manufactured in a country in conformity with a standard set of price structures, notably derived from an international comparison basket.

GDP PPP gauges the reality that a similar amount of money can buy diverse commodities and services in different countries. It provides a more appropriate comparison of the nation’s standard of living and economic comfort. GDP PPP effectively compares poverty rates, living standards, and economic welfare across geographical boundaries.

*collidu.com

Integration of Purchasing Power Parity and Gross Domestic Product

When economics students go through modern editions of macroeconomics, they will come across the term GDP (Gross Domestic Product). It implies the total monetary value of commodities and services produced within one country’s jurisdiction. There are two categories of GDP.

- Nominal GDP: It calculates the monetary values on a current, absolute basis.

- Real GDP: It takes care of nominal GDP for inflationary situations.

Some considerations by economic experts go beyond boundaries by adjusting GDP for purchasing power parity value.

Example

A pertinent illustration can corroborate how gross domestic product and purchasing power parity work for any national economy. Suppose a readymade pair of branded company trousers costs $20 in the United States, and the identical pair of trousers is available in Germany for €12. The conversion of €12 into US dollars is necessary if the market exponents want to compare the two nations’ currencies as precisely as possible. Post conversion in dollars per the prevailing exchange rate, the price of the trousers in Germany may hypothetically be $25. Accordingly, the purchasing power parity equation should be 25/20 or 1.25.

To put it another way, while buying with a euro, for every $1.25 spent in Germany for a pair of trousers, it will cost $1 in the United States to purchase an identical pair of trousers. This example clarifies how purchasing power parity pairs with gross domestic product.

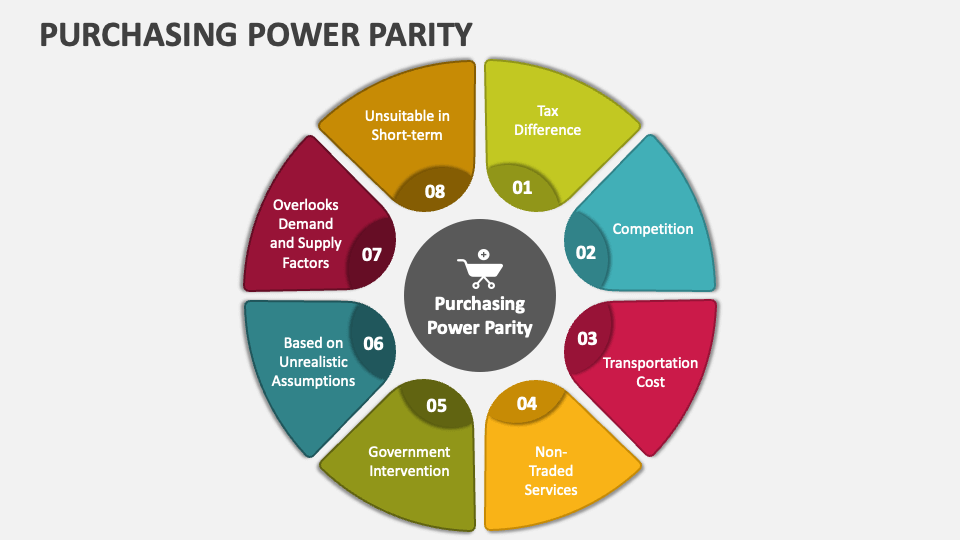

Nominal Disadvantages of Purchasing Power Parity

Though negligible, leading economists cite the following factors to explain the reasons behind the fact that the concept of purchasing power parity does not sufficiently showcase a clear reflection of reality:

- Differences in Taxes and Revenues: A country’s state and central sales tax, like VAT (value-added tax), can contribute to a rise in consumer goods and services prices in one country compared to another.

- Transport Costs: Domestic traders import goods that are unavailable in the country, resulting in substantial cargo costs. These expenditures include fuel and, most importantly, considerable import duties. Moreover, imported goods will sell at higher prices than similar locally sourced products.

- Non-Traded Services: Non-traded services include input costs that industries do not use for trading purposes. These costs consist of labour, utility, and insurance costs. These input costs do not restore parity with those at the international level.

- Intervention by State Authorities: Tariffs imposed by the government machinery can seriously inflate the prices of imported commodities. You can observe that identical goods in other countries sell relatively cheaper.

- Internal Market Competition: Goods and services may be sold more deliberately at higher prices in a specific domestic market. In certain scenarios, higher prices prevail because a commercial platform might have a competitive edge over its counterparts due to superior product quality. This business might enjoy a monopoly or belong to a cartel of commercial entities that manipulate and control prices and keep them artificially high to maximise profit.

Conclusion

The connection between inflation and purchasing power parity accentuates the criticality of national economies within the purview of the international market spectrum, where market volatility influences cross-border trades. It involves diverse currencies, which factor in various levels of purchasing power abolition over time. These ever-changing economic conditions influence overall competitiveness and monetary inflows, shaping domestic and global trade patterns.

Purchasing power parity may not be the most reliable measuring rod to calculate inflationary trends, but it can be a tool for comparing prices among countries with varying currencies. Several renowned economists, foreign exchange traders, international organisations, and reputable investors use this concept to study economic productivity and investment values.

Learning the effects of inflation and related areas cannot be completed without thorough guidance from eminent industry figures. To get it, the Executive Certificate Program in Corporate & Strategic Finance, hosted by IIM Mumbai (NITIE), is an ideal learning platform. The program comprises the critical aspects of accounting, financial statements and ratios, advanced corporate finance, asset valuation, cost management, capital budgeting, and dividend policy.