Post Graduate Certificate Programme in Financial Technologies (FinTech) - IIM Nagpur

02:00 PM to 05:15 PM

Programme Overview

Be future-ready with IIM Nagpur PG Certificate Programme in FinTech. This interdisciplinary programme can help you gain a deeper understanding of the modern technologies that have transformed the banking and financial ecosystem. Learn Live with a diverse cohort about Blockchain, Cryptocurrency, Machine Learning, Artificial Intelligence and Big Data – use these technologies to design & manage financial products or services.

The global FinTech disruption continues to reshape the future industry. To transform boldly and open new avenues of career opportunities, stand out with the new intake of IIM Nagpur – PG Certificate Programme in Financial Technologies (FinTech). This programme encompasses you to delve deeper into the modern technologies that have transformed the banking and financial ecosystem. Uncover the most popular tools and technologies like Blockchain, Cryptocurrency, Machine Learning, Artificial Intelligence and Big Data to design & manage financial products or services. Learn navigating organizational dynamics, insight on key levers for banking transformation, develop new-age strategies for managing FinTech and much more.

Programme Highlights

PG Certificate & Executive Alumni Status

Integrative project mentored by IIM Nagpur Faculty

Get exposure of various business problems from Industry experts

Chamber Consulting Sessions

*Conducted course-wise subjective to faculty’s discretion & availability

Gain exposure to the technologies being used in the FinTech ecosystem

3 Days Campus Immersion

Admission Criteria

Eligibility for PG Certificate Programme in Fintech

- Diploma (10+2+3)/Graduate / PG from Universities recognized by Association of Indian Universities with minimum 50% marks in either Diploma or graduation or post-graduation (or its equivalent).

- Minimum 3 years of work experience.

- Specific domain/industry BFSI, NBFC, Banking and finance services, IT services or IT.

Campus Immersion

- 3 days visit at the end of the programme for project presentations and valediction.

Syllabus Breakdown

- Foundation of Financial Statements

- Financial Statement Analysis

- Basic concepts of Finance

- Free Cash Flows

- Evolution of Financial Services

- Introduction to Financial System

- Financial Services Industry

- Technological intervention in Financial Services & Banking Industry

- Overview of FinTech Services

- FinTech Ecosystem

- Blockchain - The Tech Part

- Evolution of Money

- Central Bank

- Cryptocurrency Introduction

- History of cryptocurrencies

- Different kinds of Cryptos, and ICOs

- Crypto currency or Crypto Asset

- Artificial Intelligence / Machine Learning

- Natural Language Processing

- Robotic Process Automation (RPA)

- Application Programming Interface (API)

- Consumer psychology towards money

- Prospect Theory, Mental Accounting

- Goal Based Investing

- Strategic Decision Making

- Analysing Business Environment for Opportunities & Threats

- Leveraging Resources & Capabilities (VRIN framework)

- Organic & Inorganic Business strategies for Profitable Growth

- Global Payment Systems

- Payment Gateways, Bill Payments, Mobile Digital Wallets, Mobile POS

- New technologies in Payment system

- Crypto Exchanges

- Investment, RoboAdvisors, Alternative investment platforms

- Aggregators, Claim processors, Policy Management

- Financial Inclusion at BOP

- P2P lending

- Consumer Lending

- Business Lending

- IndiaStack, AA and OCEN

- FinTechs as Key Levers for Banking Transformation

- Top Use Cases for FinTech Implementation in Banks

- User Experience Design for FinTechs

- Service Design for FinTechs

- Challenges of Doing B2B Business for FinTechs

- Consumers Ask of FinTechs

- How should you sell your proposition?

- To Whom should you sell your proposition?

- Navigating the organizational dynamics

- The participants are expected to work in groups towards identifying, studying & solving real life organizational issues in the FinTech context.

- All the participant groups would receive mentorship & guidance from IIMN faculty to help improve the quality of the project deliverables.

- In the project, the participants are expected to demonstrate a holistic understanding of the FinTech domain and showcase integrated learning of various concepts covered as part of various courses in the programme.

- Global Payment Systems

- Payment Gateways, Bill Payments, Mobile Digital Wallets, Mobile POS

- Aggregators, Claim processors, Policy Management

- Financial Inclusion at BOP

- P2P lending

- Consumer Lending

- Business Lending

- IndiaStack, AA and OCEN

- Crypto Exchanges

- Investments, RoboAdvisors, Alternative investment platforms

- FinTechs as Key Levers for Banking Transformation

- Top Use Cases for FinTech Implementation in Banks

- User Experience Design for FinTechs

- Service Design for FinTechs

- Challenges of Doing B2B Business for FinTechs

- Consumers Ask of FinTechs

- How should you sell your proposition?

- To whom should you sell your proposition?

- Navigating the organizational dynamics

- The participants are expected to work in groups towards identifying, studying & solving real-life organizational issues in the fintech context

- All the participant groups would receive mentorship & guidance from IIMN faculty to help improve the quality of the project deliverables

- In the project, the participants are expected to demonstrate a holistic understanding of the fintech domain and showcase integrated learning of various concepts covered as part of various courses in the program.

About IIM Nagpur

IIM Nagpur seeks to distinguish itself as an institution that promotes constant industry engagement of a ‘problem-solving’ nature. Executive Education, therefore, is an important thrust area for the Institute. With an array of programmes designed by a faculty body with a stellar record of research, teaching, and industry engagement, the Executive Education programme at IIM Nagpur equips managers and executives with the capabilities to perform effectively in their current roles, and take up greater challenges through various stages of their careers.

Know The Facilitators

Hear For The Facilitator

Programme Certification

Programme Structure

- All the amounts mentioned above are exclusive of 18% of GST.

- Loan Options is a service offered by Jaro Education. IIM Nagpur is not responsible for the same.

- Campus immersion is mandatory and participants will have to arrange for their travel to the institution at their own cost. Charges for lodging and food are included in the total programme fee.

Learners Speak

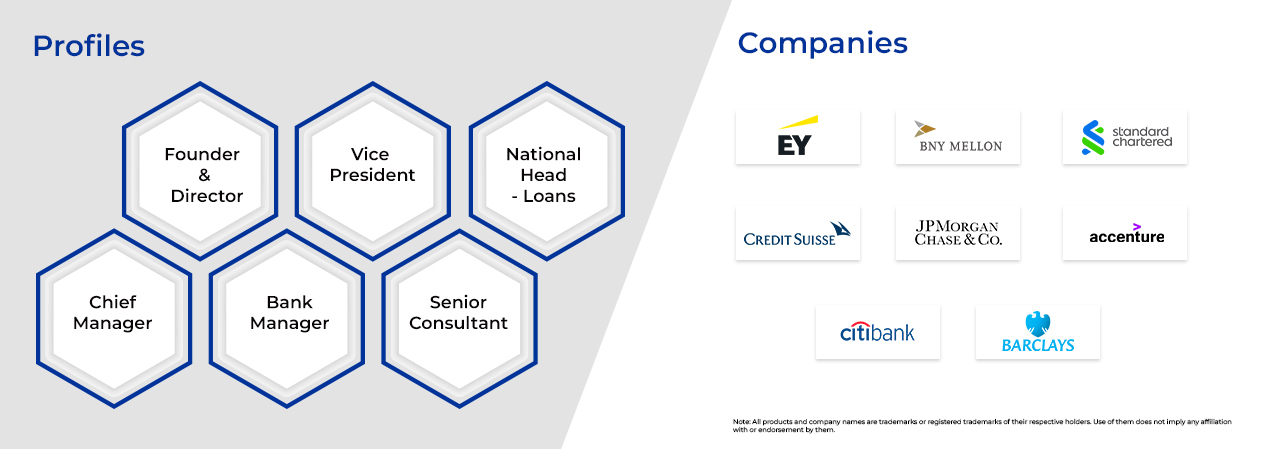

Career Transitions

It seems we can't find what you're looking for.

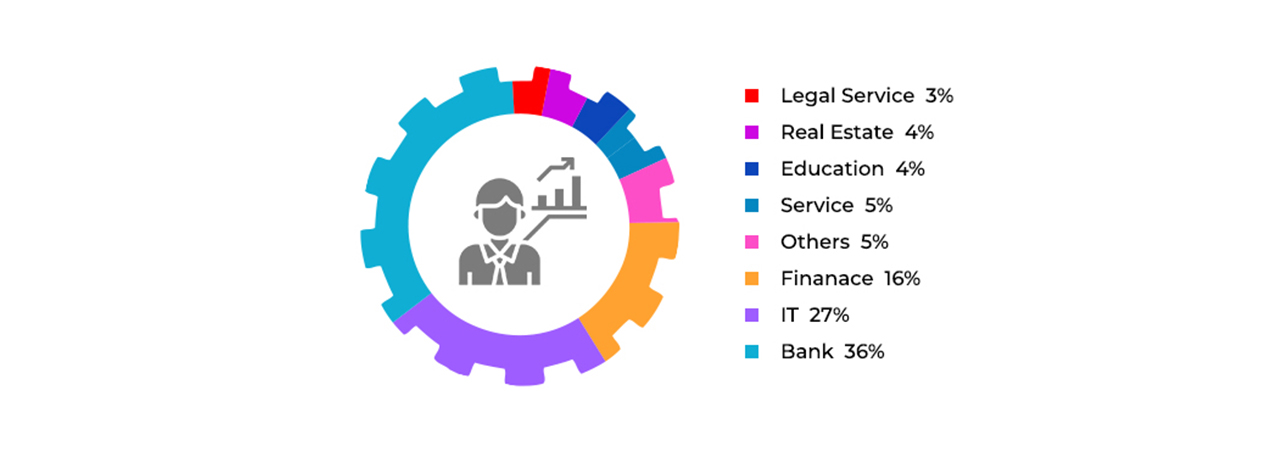

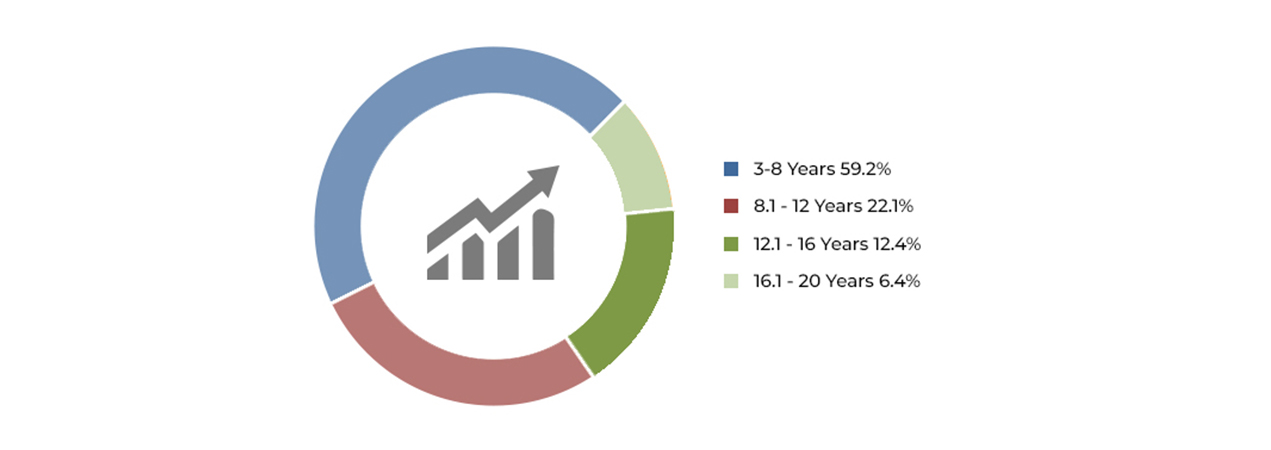

Recent Batch Analysis

- Highlighted above are the collective batch demographics from Batch 01 to Batch 05 of IIM Nagpur’s FinTech.

- The above list is partial.

- All company names are trademarks or registered trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Recent Batch Analyasis

The Jaro Advantage

- Unparalleled career guidance and support

- Dedicated student support

- Immersive and lifelong learning experiences

- Learn from the best-suited academic, faculty, and industry mentors

- Be a part of discussions and forums for enhanced learning

- Leverage peer-to-peer learning experience

- Alumni Network of 3,50,000+ Professionals

- Access to alumni events & other benefits

- Stay up to date with the latest insights from your alma mater

Jaro Expedite - Career Booster

Profile Building

Career Assistance

Career assistance offers 16-18 job recommendation links based on profile preferences, helping to discover opportunities that align with skills and career goals.

Career Enhancement Sessions

Career enhancement sessions provide access to bootcamps and masterclasses on trending topics, led by industry experts. These sessions help participants stay updated with industry trends and enhance their professional skills.

Note: IIM Nagpur or Jaro Education do not guarantee or promise you a job or advancement in your existing position. Career Services is simply provided as a service to help you manage your career in a proactive manner. Jaro Education provides the Career Services described here. IIM Nagpur is not involved in any way with the Career Services described above and offer no commitments.

Build 21st-Century Skill set to Gain Career Edge in the VUCA World

You’ll learn

- Be familiar with the technologies being used in Fintech such as Blockchain, Artificial Intelligence/Machine Learning, Bitcoin and Cryptocurrencies and apply them to solve the problem at hand.

- Have knowledge about the vast FinTech ecosystem and recognize the variety of innovations happening around.

- Be able to combine your knowledge of technology and the landscape and create new financial products solving existing problems.

All students are entitled to obtain a PG Certificate at the end of the IIM Nagpur- FinTech Programme.

The Financial Technology Programme from the Top B School, IIM Nagpur is for 12 months duration.

IIM Nagpur- FinTech Programme is of 1-year duration where students will get exposure to Device to Device (D2D) mode.

- Minimum 50% marks in graduation from a recognized university (national or international)

- A minimum of 3 years of work experience

- Specific domain/industry BFSI, NBFC, Banking and finance services, IT services or IT