What is Capital Budgeting in Corporate Finance – How Does it Work?

Table of Contents

- jaro education

- 13, June 2024

- 6:00 pm

Capital budgeting is one of the most important corporate finance decisions in business that determines long-term investment. This is the process through which appraisal and selection of projects or investments are made based on their long-term prospective benefits on future cash inflows with the purpose of wealth maximization of the growth of a firm. That is because capital budgeting helps determine the possible returns and the risks on various investment opportunities in the allocation of resources by the various organizations.

It is very important for making a decision on investment, financial risk management, and optimal management of resources in financial planning. Capital budgeting will, through careful analysis and selection of investments, ensure that the realization of strategic goals and objectives by organizations is harnessed into value for these shareholders and, in its essence, growth and eventual long-term financial stability.

What is Capital Budgeting and What is its Purpose?

Capital budgeting is the process that companies use to evaluate and prioritize potential long-term investments and projects. This involves identifying, analyzing, and selecting projects that require significant capital expenditure, such as the purchase of new equipment, expansion of operations, or development of new products. The primary focus of capital budgeting is on the long-term financial impact of these investments, considering both the expected cash inflows and outflows over the project’s lifecycle. By employing various financial techniques and analytical methods, companies can determine the feasibility and profitability of these investments, ensuring that they align with their strategic goals.

Goals and Objectives of Capital Budgeting in a corporation:

- Shareholder Value Maximization: Capital budgeting is used to make investment decisions that may improve the value of the firm and increase the wealth of the shareholder, with the selection of the project that has the highest potential return to allow the firm to grow and reach profitability.

- Efficient Allocation of Resources: It ensures that financial resources are allocated appropriately to those projects that promise the most returns. The process will develop strategies to reduce the risks to which the invested capital is exposed any day. It assures firms that their capital is put where conditions have the greatest potential for growth and return.

- Risk Management: Any capital budgeting process will develop strategies for the reduction of the risks to which the invested capital is exposed through the identification and assessment of the risks associated with potential investments.

- Long-term Financial Planning: Companies can plan their long-term investments throughout its inceptive years and beyond. Its informed choices will enable the firm to attain the objective of its strategic stakeholders and assure financial stability by making the estimate of future cash flows.

- Optimal Capital Structure: A company can be able to determine the optimum mix of debt and equity in financing new projects. Then, the company ensures that the balance sheet is healthy and can fund its growth by borrowing on sensible terms.

- Measuring Performance: Capital budgeting involves setting up benchmarks and performance metrics that measure success based on capital investments. This will aid companies to trace their projects and be ready to make changes or adjustments to reach the desired outcomes.

The Capital Budgeting Process

Capital budgeting involves a series of steps to ensure that companies make sound investment decisions. This structured approach helps in identifying, evaluating, selecting, implementing, and reviewing investment opportunities. Here’s an in-depth look at each stage of the capital budgeting process:

1. Identifying Investment Opportunities

- Sourcing Potential Projects: Investment opportunities can arise from various sources, including internal proposals, market research, competitor analysis, and strategic planning sessions. Employees at different levels within the organization may propose projects based on observed needs or potential improvements.

- Screening Potential Projects: Once potential projects are identified, they must be screened to determine their feasibility. This involves a preliminary analysis to filter out projects that do not align with the company’s strategic objectives or financial criteria.

2. Project Evaluation: Techniques for Assessing Project Viability

- Net Present Value (NPV): NPV is used to calculate the present value of inflows less the present value of outflows over a project’s expected lifetime. If this value is obtained as positive, then it would mean that the project recovers a higher value than the expense related to the project.

- Internal Rate of Return (IRR): IRR is a discount rate on the NPV of zero (net present value) in an undertaking. IRR is an anticipated rate of return. If the IRR exceeds the company’s expected rate of return, then the investment is feasible.

- Payback Period: It is the number of years that a project would take to recover the funds put in, taking into account the inflow of funds. Projects with a shorter payback period are more viable.

- Profitability Index (PI): It is the ratio of the present value of future cash flows against the project’s initial investment. A PI exceeding 1 implies that the project is expected to recover its value and more.

- Sensitivity Analysis: Changing key assumptions to see how sensitive the project’s outcomes are to changes in variables helps to understand involved risks.

3. Project Selection

Based on the evaluation, companies select projects that align with their strategic goals and financial criteria. This involves comparing the results of the various evaluation techniques and considering factors such as risk, strategic fit, and resource availability. Projects with the highest NPV, IRR, or other favorable metrics are prioritized.

4. Implementation and Monitoring

- Executing Selected Projects: Once a project is selected, detailed planning and execution begin. This includes allocating resources, setting timelines, and assigning responsibilities. Implementation plans must be clear and detailed to ensure smooth execution.

- Tracking Progress: Continuous monitoring of the project’s progress is essential to ensure that it stays on track in terms of budget, timeline, and scope. Key performance indicators (KPIs) are used to measure progress and identify any deviations from the plan. Regular updates and reviews help in making necessary adjustments.

5. Post-Implementation Review

- Analyzing Outcomes and Performance: After the project is completed, a post-implementation review is conducted to compare actual outcomes with projected results. This involves analyzing financial performance, operational effectiveness, and overall impact on the company.

- Learning and Improvement: The review helps in identifying lessons learned and areas for improvement. This feedback is crucial for refining future capital budgeting processes and enhancing decision-making.

Techniques and Methods Used in Capital Budgeting

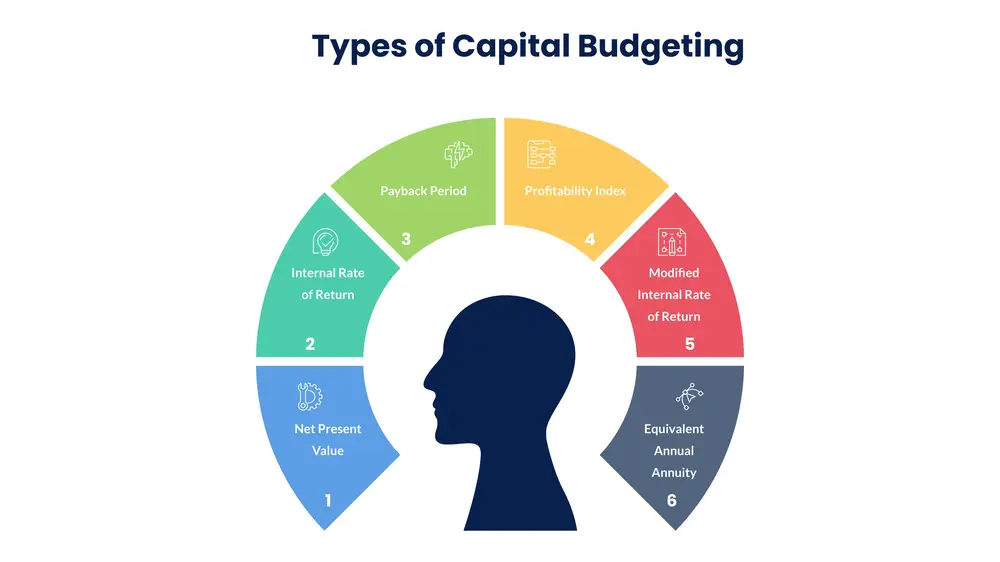

Capital budgeting involves several techniques and methods to evaluate the viability and profitability of potential investment projects. These techniques help companies make informed decisions about allocating their financial resources to maximize returns. Here are some of the most commonly used methods:

1. Net Present Value (NPV)

Calculating NPV:

- The NPV measures the difference between the present value of cash inflows and the present value of cash outflows over the life of a project. Discounting of future cash flows is assumed to give rise to a value related to the money throughout a certain period.

- Formula: NPV=∑Ct(1+r)t−C0NPV = \sum \frac{C_t}{(1 + r)^t} – C_0NPV=∑(1+r)tCt−C0

- CtC_tCt = Cash inflow at time t

- rrr = Discount rate (often the company’s cost of capital)

- ttt = Time period

- C0C_0C0 = Initial investment

Interpreting NPV:

- Positive NPV: The discounted, projected flows of earning are larger than the initial investment, which suggests the project creates value for the company.

- Negative NPV: Indicates that the project’s costs outweigh its benefits, making it unviable.

- Decision Rule: Accept projects with a positive NPV, as they are expected to generate more value than they cost.

2. Internal Rate of Return (IRR)

Understanding IRR:

- IRR is that rate of discount at which the NPV of a project equals zero. The expected rate of return of the project is useful for comparing how appropriate potential investments are.

- Calculating IRR: Solving the equation 0=∑Ct(1+IRR)t−C00 = \sum \frac{C_t}{(1 + IRR)^t} – C_00=∑(1+IRR)tCt−C0 to find the rate at which the present value of inflows equals the initial investment.

Applying IRR:

- Comparison with Required Rate of Return: Projects with an IRR higher than the company’s required rate of return or cost of capital are considered acceptable.

- Decision Rule: Accept projects where the IRR exceeds the hurdle rate (required rate of return), as they are expected to generate returns above the cost of capital.

3. Payback Period

Determining the Payback Period:

- In general, the payback period should be the period in which a project will be able to recover its investment outlay from the inflows.

- Formula (for projects with equal annual inflows): Payback Period=Initial InvestmentAnnual Cash Inflows\text{Payback Period} = \frac{\text{Initial Investment}}{\text{Annual Cash Inflows}}Payback Period=Annual Cash InflowsInitial Investment

Interpreting the Payback Period:

- Shorter Payback Period: Preferred as it indicates quicker recovery of investment, reducing the risk.

- Limitations: It does not take the time value of money into account and ignores the cash inflows received after the payback period.

- Decision Rule: Projects with a shorter payback period are generally more attractive, especially in uncertain environments.

4. Profitability Index (PI)

Using PI for Project Comparison:

- The PI is a method of comparing the present value of future cash flows against an initial investment. It can aid in comparing the relative profitability of various projects.

- Formula: PI=∑Ct(1+r)tC0PI = \frac{\sum \frac{C_t}{(1 + r)^t}}{C_0}PI=C0∑(1+r)tCt

Interpreting PI:

- PI > 1: Indicates that the project’s NPV is positive and it is expected to generate more value than its cost.

- PI < 1: Indicates that the project is not financially viable.

- Decision Rule: Accept projects with a PI greater than 1, as they are expected to be profitable.

5. Other Methods

Discounted Cash Flow (DCF) Analysis:

- A DCF analysis typically involves estimating the future cash flows of a project and discounting the expected cash flow back to present value using a discount rate, often the firm’s cost of capital.

- Comprehensive Evaluation: Considers the time value of money and helps determine the intrinsic value of a project.

- Decision Rule: If the DCF value is higher than the current cost, the project is considered worthwhile.

Accounting Rate of Return (ARR):

- ARR measures the return on investment based on accounting information rather than cash flows.

- Formula: ARR=Average Annual ProfitInitial InvestmentARR = \frac{\text{Average Annual Profit}}{\text{Initial Investment}}ARR=Initial InvestmentAverage Annual Profit

- Simple Calculation: Easy to calculate using accounting data.

- Limitations: Does not consider the time value of money or the timing of cash flows.

- Decision Rule: Projects with a higher ARR than the required rate of return are considered acceptable.

Capital budgeting covers a lot of techniques that help in assessing whether an investment project can be feasible or viable. All have their advantages and restrictions, and in fact, usually a combination of the techniques will be put in use to decide in an informed manner about the investment. Through the NPV, IRR, payback period, and PI, among many, a company may sieve out projects that would have been serving their strategic goals better and getting high financial performance.

Factors Influencing Capital Budgeting Decisions

These are the factors that together influence the capital budgeting decisions, and that the investment projects will be subjected to in terms of effectiveness and profitability. Therefore, this will enable a company to make decisions regarding whether to make investments with respect to other companies’ strategic and financial objectives.

1. Risk Assessment: Evaluating and Managing Risks Associated with Projects

- Types of Risks: Projects can be subjected to market risk, credit risk, operational risk, regulatory risk, and many others. Each risk needs to be identified and examined.

- Risk Analysis: Ability to use tools like sensitivity analysis, scenario analysis, and Monte Carlo simulation for analyzing the changes in the main assumptions of the project, which affect the project outcomes.

- Mitigation Techniques: Some of the important techniques for mitigating the risks involved with the project are done by diversifying the investments, while others can be covered by hedging, taking out insurance, or making changes to the project.

- Risk-Adjusted Return: Use of risk-adjusted return ensures that, apart from the expected return, projects are evaluated on the basis of risks involved in achieving the return.

2. Cost of Capital: Understanding the Cost of Financing

- Definition: The cost of capital is the return rate that a firm has to achieve on its investments in order to maintain the value of the firm and its funds. In simple terms, it is the discount rate for the projects.

- Components: Normally, it consists of the cost of debt (interest rates on borrowed funds) and the cost of equity (the expected return of owners).

- Weighted Average Cost of Capital (WACC): This is an average rate that is supposed to be paid by a firm to its security holders to finance their assets. It is the discount rate on which WACC is used in NPV and DCF calculations.

- Impact on Project Viability: Projects must return more than the cost of capital to make them viable. The lower the cost of capital, the more projects can be accepted, and the higher the cost of capital, the more acceptable projects must be accepted.

3. Cash Flow Estimation: Importance of Accurate Cash Flow Projections

- Forecasting Cash Flows: Accurate estimation of future cash inflows and outflows is crucial for evaluating the potential profitability of a project. This includes revenues, operating expenses, taxes, and changes in working capital.

- Accuracy: Overly optimistic or pessimistic cash flow projections can lead to poor investment decisions. It is essential to base estimates on realistic assumptions and thorough market research.

- Incremental Cash Flows: Focus on incremental cash flows, which are the additional cash flows a company expects from undertaking the project. These should exclude any sunk costs or unrelated cash flows.

- Regular Updates: Cash flow projections should be updated regularly to reflect changes in market conditions, project scope, or operational efficiency.

4. Economic and Market Conditions: Impact of External Factors on Investment Decisions

- Economic Environment: In fact, a long way is determined by the feasibility of an investment project by such macroeconomic factors as growth in GDP, inflation, interest, and exchange rates. Economic downswings or booms can change the expected returns and risks.

- Market Conditions: Industry-specific conditions, including competitive landscape, technological advancements, regulatory changes, and consumer trends, influence project outcomes. Projects in growing or stable industries are generally more attractive.

- Political and Regulatory Factors: Government policies, tax laws, trade regulations, and political stability can affect the cost, timing, and feasibility of projects. Changes in regulations can create opportunities or pose risks.

- Global Events: Events such as geopolitical tensions, pandemics, and natural disasters can have widespread effects on economic stability and market conditions, impacting the assumptions and projections used in capital budgeting.

Challenges in Capital Budgeting

Capital budgeting involves several challenges that can impact the accuracy and effectiveness of investment decisions. Addressing these challenges is essential for making informed and strategic financial decisions.

1. Estimating Cash Flows

- Accuracy: Predicting future cash flows with precision is inherently difficult due to the uncertainty of market conditions, consumer behavior, and economic trends.

- Assumptions: Estimations often rely on assumptions about future sales, costs, tax rates, and other variables. Inaccurate assumptions can lead to faulty projections.

- Complexity: Projects with multiple revenue streams or variable costs add complexity to cash flow estimations, increasing the potential for error.

- Data Availability: Limited access to historical data or market research can hinder accurate cash flow projections.

2. Uncertainty and Risk

- Market Fluctuations: Uncertain results in the performance of the achieved results are high and attributed to changes in the market conditions, such as shifts in demand, price volatility, and competitive actions.

- Economic Conditions: Such uncertainty arises from the unpredictable ways in which changes in such macroeconomic factors as inflation, interest rates, and cyclic conditions may impact the performance of projects.

- Technological Changes: Rapid technological change can quickly render a project valueless or open up new opportunities, calling for long-run forecasting, which is particularly problematic.

- Regulatory Environment: Changes in legislation and regulation have the potential to alter project viability significantly, adding yet another dimension of uncertainty.

3. Biases and Subjectivity

- Over-Optimism: Managers and project sponsors may overestimate benefits and underestimate costs due to enthusiasm or pressure to get projects approved.

- Anchoring: Relying too heavily on initial information or past experiences can skew judgment, leading to biased evaluations.

- Groupthink: Organizational culture may suppress dissenting opinions, leading to a lack of critical analysis and overly optimistic projections.

- Confirmation Bias: Favoring what somebody believes or wants to be true could lead to ignoring potential risks or negative results.

4. Capital Rationing

- Resource Allocation: When financial resources are limited, companies must prioritize projects based on their strategic importance and potential returns.

- Opportunity Cost: Capital rationing requires evaluating the opportunity cost of investing in one project over another, which can be complex and subjective.

- Ranking Projects: Establishing a ranking system for projects based on criteria such as NPV, IRR, and strategic alignment can help in making prioritization decisions.

- Balancing Short-term and Long-term Goals: Companies need to balance projects that offer quick returns with those that align with long-term strategic objectives.

Addressing These Challenges

Improving Cash Flow Estimations:

- Use advanced forecasting techniques and models to enhance the accuracy of cash flow predictions.

- Regularly update forecasts based on new information and changing conditions.

- Incorporate input from various departments and experts to capture a comprehensive view of potential cash flows.

Managing Uncertainty and Risk:

- Conduct a sensitive analysis, scenario analysis, and Monte Carlo simulations.

- Design mitigating actions against the possible risks: diversification, hedges, and contingency plans.

- Keep in touch with the changing market trends, technical developments, and regulatory environment for anticipating and responding to potential risks.

Mitigating Biases and Subjectivity:

- Implement structured decision-making processes and use standardized evaluation criteria to reduce personal and organizational biases.

- Encourage diverse perspectives and critical thinking to challenge assumptions and improve decision quality.

- Utilize third-party reviews or audits to provide an objective assessment of project evaluations.

Effective Capital Rationing:

- Develop a clear capital allocation strategy that aligns with the company’s overall strategic goals.

- Use quantitative and qualitative criteria to evaluate and rank projects, ensuring that both financial returns and strategic value are considered.

- Periodically, review and update the capital budgeting process when there are changes in the firm’s financial position and strategic priorities, as the finance officer sees fit.

Real-World Applications and Case Studies

These issues showed that the capital budgeting process is a prime process in corporate finance. There are numerous illustrative, real-life examples of this importance driving successful investments and growth. Here are just a few:

1. Apple Inc.: Investment in Research and Development (R&D)

- Overview: Apple has consistently invested heavily in R&D to innovate and maintain its competitive edge in the technology market.

- Capital Budgeting Techniques: Apple uses sophisticated NPV and IRR analyses to evaluate R&D projects, ensuring that investments align with long-term strategic goals.

- Outcome: Continued investment in R&D has led to the development of groundbreaking products like the iPhone, iPad, and Apple Watch, driving sustained revenue growth and market leadership

2. Toyota: Investment in Hybrid Technology

- Overview: Toyota’s strategic investment in hybrid technology led to the development and launch of the Toyota Prius.

- Capital Budgeting Techniques: Toyota used DCF analysis and scenario analysis to evaluate the potential market for hybrid vehicles and the associated costs.

- Outcome: The Prius became a market leader in hybrid cars, establishing Toyota as a pioneer in sustainable automotive technology and significantly boosting its brand reputation and sales.

3. Amazon: Expansion of Fulfillment Centers

- Overview: Amazon invested in expanding its network of fulfillment centers to improve delivery speed and customer service.

- Capital Budgeting Techniques: Amazon used NPV and payback period analyses to assess the profitability and feasibility of new fulfillment centers.

- Outcome: The expansion enabled Amazon to offer faster delivery times, enhancing customer satisfaction and loyalty, which contributed to its dominant position in the e-commerce market.

For those looking to gain deeper insights into capital budgeting and other crucial aspects of corporate finance, consider enrolling in the Online PGDM Program by Loyola Institute of Business Administration (LIBA), as it can aid them in elevating their professional journey with intensive coursework revolving around corporate finance, international finance and many other aspects of business.

Conclusion

Capital cost management is one of the most critical functions of corporate finance and can be taken as an anchor that lays a base from which one can make an informed long-term investment decision. It ensures the efficiency of the resources, helps meet strategic goals, and garners the maximum return from the use of that investment. The techniques include NPV, IRR, Payback Period, and PI; they provide a framework to appraise the potential projects.

Overcoming challenges like predicting future cash flows, managing risks, and addressing biases is essential for effective capital budgeting. As technological advancements and sustainability considerations grow, capital budgeting will evolve, enhancing accuracy and efficiency. Embracing these changes will help companies navigate complexities, make strategic investments, and secure financial stability and growth.