Working Capital Financing–What It Is And How To Get It?

Table of Contents

- jaro education

- 22, August 2023

- 3:00 pm

Working capital financing is a part of business finance that funds a company’s investment in short-term assets, like receivable accounts and inventory. The financing also provides liquidity so a company can cover its everyday operations, such as covering overhead, paying employees and other expenditures. When a company’s current liabilities exceed its recent assets, working financial financing is found useful. Working capital finance can be obtained through guarantees, assignments, loans, sales, and preferential terms from clients.

To learn how working capital financing works, aspiring financial experts should pursue an Executive Programme in Business Finance from IIM Ahmedabad. Along with working capital financing, this programme will focus on financial analysis, cost-optimisation projects, and expenditure evaluation. To know more about this programme, contact Jaro Education.

What is working capital financing?

Working capital financing is designed to raise the working capital needed for different objectives by business owners. From plugging in infrequent cash flow shortfalls to corporate development, working capital financing is needed for everything in between. In simple terms, this financing enables borrowers to free up operating cash for their businesses that they plan to recoup in the near future.

Borrowed money is commonly used by businesses of all sizes to satisfy their demands. But, before exploring working capital financing, business owners need to figure out what their needs are.

Types of working capital financing

PDepending on the type and size of a venture, the authorities can choose from 8 different varieties of working capital financing. The various types of working capital financing are as follows:

Vendor Credit

Vendor financing is a type of credit in which a buyer borrows money from a supplier for his goods and services. Vendor credit allows you to defer payment for goods or services obtained from a supplier or vendor for a certain period of time. Payment conditions might include a discount for early payment or a late payment fee.

Trade Finance

The tools and products used by businesses to enable international trade and commerce are called trade financing. Trade financing involves a third party in transactions to remove supply and payment concerns. The exporter gets receivables or payments in line with the contract in trade finance, while the importer may be provided credit to complete the trade order.

Merchant Cash Advances

Merchant cash advances (MCAs) are up-front payments obtained in exchange for a part of future daily credit/debit card receipts. An MCA, rather than a loan, is a sale of future revenue. Although this financing is expensive, it may be the best option for a firm that uses credit cards often but has little or no credit history.

Working capital revolver

A working capital revolver is a line of credit whose maximum borrowing limit is set by the inventory amount and accounts receivable on a company’s balance sheet. This secured credit line is known as a revolver because money may be borrowed, paid back, and reborrowed frequently.

Purchase order financing

A type of commercial finance, purchase order financing offers funds to pay suppliers in advance for confirmed purchase orders. A third party agrees to give a supplier enough money to cover a customer’s purchase order under such an arrangement. Purchase order loans can fund the whole order in certain cases or only a portion of it in others.

MRP Credit

A monthly recurring revenue (MRP) line of credit is a form of loan product in which the amount that can be borrowed is directly tied to the borrower’s monthly recurring income. Lines of credit are often made available to firms with inventory or accounts receivable to act as security for the loan.

Customer Advances

The momentary payments made to a company before it offers items or services to its consumers are called customer advances. These advances provide a large source of “no-cost” working capital credit. Of course, the company becomes obligated to supply the items or services to the customer in the future; this obligation is sometimes reflected as a deferred revenue liability on the company’s balance sheet.

Accounts Receivable Factoring

By trading unpaid invoices for cash advances, accounts receivable factoring allows businesses to fund a company. A factoring company pays a significant percentage of the outstanding invoice amount, seeks client payment, and then pays the remainder of the debt, less costs. Only businesses that sell on credit terms are eligible for factoring as a funding source. This means that the borrower (the vendor) sells an item (or service) and provides an invoice to the client for payment at a later date. This anticipated future payment is shown on the vendor’s balance sheet as an account receivable (a current asset).

Benefits of working capital financing

At its core, working capital financing is intended to fund current orders in which a company obtains a promissory note from a client for a particular amount of items to be delivered. It is also used less often to fund accounts payable when overdue bills are to be paid. This guarantees that the borrower does not owe more than they can afford to repay.

This financing has some other benefits like:

Speedy approvals

Working capital finance has the advantage of allowing a company with a strong credit score to obtain funding quickly. Banks and other financial institutions recognise the need for speedy financing for a company to satisfy its urgent cash flow needs. There are reports that show the ease and speed with which firms may acquire a working capital infusion and restart their operations.

Repayment option is flexible

Working capital finance offers greater flexibility and changing payback periods to seasonal firms. Businesses having high peaks throughout the year might use a working capital loan to balance out their cash flow and have a continuous supply of reserves on hand in times of need. When an emergency arises, these reserves provides surplus capital as a liquidity cushion. This provides a company with the necessary leverage and confidence to take on extra risks.

Zero Collateral

No collateral is necessary when it comes to working capital financing. Obtaining a fund is a quick and simple procedure for most businesses with a decent credit score. Businesses are not required to use assets or inventory as collateral to obtain the loan. Nonetheless, failing to be responsible and make timely payments might result in a poorer credit score and perhaps legal action from the lender.

Where to apply for working capital financing?

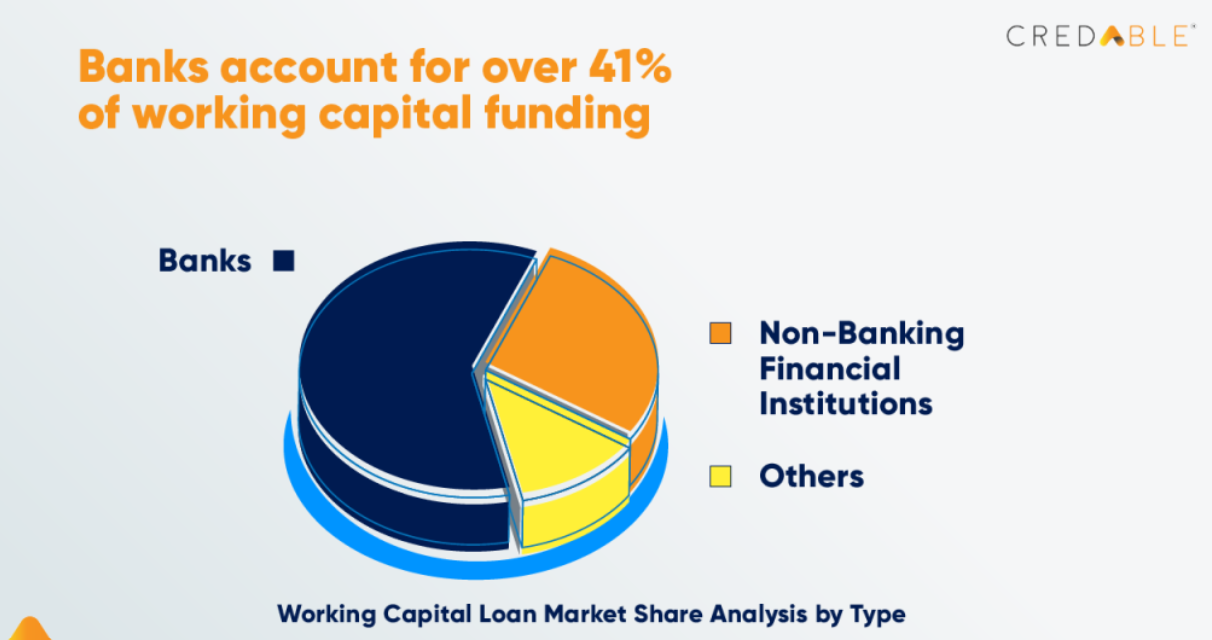

Working capital financing can be received from various sources, such as:

Banking institutions

When looking for working capital financing, banks serve as excellent sources. Most major Indian banks, including PNB, State Bank of India, IndusInd Bank, ICICI Bank, and others, provide competitive working capital funding. Business owners may verify their eligibility for a working capital loan online or visit a branch and chat with a finance expert who will walk them through the full procedure.

If business owners are already customers of a certain bank, the process of working capital financing becomes easier. The bank would not need to investigate credit history because the majority of the information would be readily available to them.

Online bank aggregators

There are several bank aggregators available online who can assist with much-needed finance. Some innovative technology platforms provide a variety of funding alternatives from various non-banking financial corporations (NBFCs), lending institutions and banks with differing interest rates and periods. On these platforms, the application procedure is pretty simple and easy.

Online lender platforms

There are various additional lenders’ tech platforms that provide a variety of advantages. These platforms give distinct perks and immediate financing provided you fulfil their credit requirements. You may use their app on iQS or Android to seek the newest discounts or live promotions that may make borrowing cheaper in the long term.

Final Thoughts

Working capital financing helps in keeping businesses’ cash flow positive. If a business is in much need of cash, owners may want to consider a suitable working capital financing method to get their business up and running. If the cash flow is negative, it can be alarming for the growth of the company’s business.

If pursuing a career in business finance is your passion, join IIM Ahmedabad’s Executive Programme in Business Finance. This 6-7 months course would provide you with a deeper knowledge of financial accounting. The faculty and top financial experts will offer insights into financial analysis that you can use in real-life projects. At the end of the intake, participants who successfully complete the programme would receive a completion certificate from IIM Ahmedabad, which would help in accelerate their careers.