Unlock Financial Potential: A Deep Dive into the Sources of Finance for Businesses

Table of Contents

- jaro education

- 24, July 2023

- 10:24 am

As the current business world is extremely competitive, financial management and business finance play significant roles in indicating the success or failure of an undertaking. To the entrepreneurs and business leaders who implement or oversee the financing of a business venture, knowledge of the specifics of business finance is critical.

Accordingly, business finance relates to managing funds acquisition and how these funds are managed in the context of managerial work and business growth. Whether you are defining your financial needs, seeking seed capital as a budding entrepreneur, or requiring additional funds for expansion, it is essential to understand the fundamentals and have the necessary tools at your disposal.

Business finance encompasses various approaches to financing, including both internal and external sources. It also involves the role of financial management and how these tools can be leveraged to achieve company objectives. In this guide, we will highlight the sources of finance for businesses, the role of financial management, and its importance. Read out to learn more about it.

What is Business Finance?

Corporate finance concerns how businesses fund themselves, for the accomplishment of day-to-day and strategic objectives. A finance management strategy includes elements such as operating expenses, sources of funds, fortunes of investment and capital hazards. Proper financial management makes provision of adequate cash flow for meeting business early horizon obligations as well as provision for future investments and expansion.

It is noteworthy that business finance is a dynamic and not a wasteful activity. Firms are expected to continuously revisit their financing needs and the overall economy. It also requires preparation, account statement reviewing, knowledge of the market and consequently coming up with rightful decisions to make profits. To businesses, finance is important as it defines the total finances accessible for running the business, introducing new products and services, or expanding the company.

Sources of Business Finance

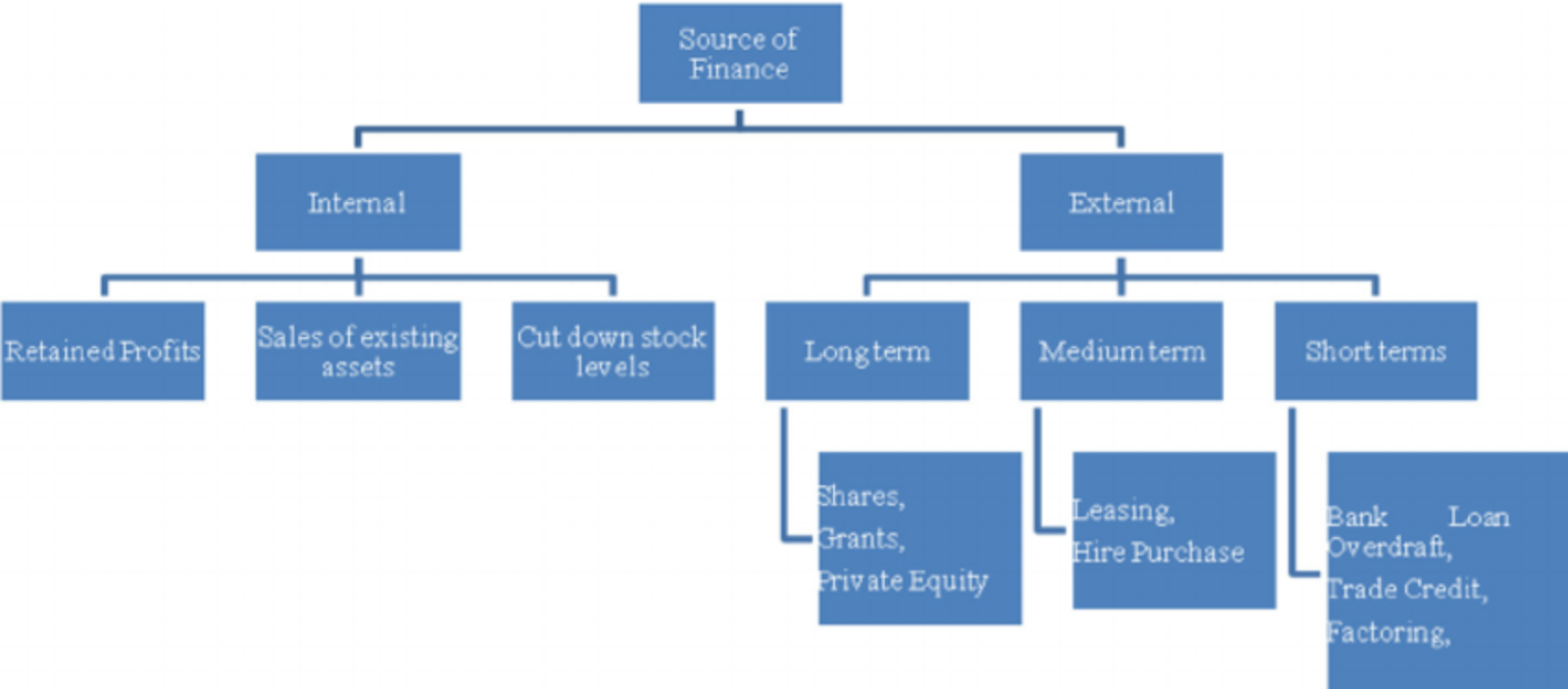

Various financial options are available to businesses for managing their financing at different stages. These sources can be further categorised into internal and external finance. Therefore, there is a need to understand these options when planning for efficient funding of business activities.

*researchgate.net

Internal Sources of Finance

1. Retained Earnings

Retained earnings refer to the profits that a business organization chooses to reinvest in the company rather than distribute to shareholders. This method of funding is cost-effective because it involves internal borrowing and does not compromise ownership of the business.

2. Sale of Assets

Occasionally, a business may secure financing from the sale of excess or idle assets, such as machinery, vehicles, or even land and buildings. While this can provide immediate support to the business’s cash flow, it is essential to carefully evaluate the long-term effects on the organisation.

3. Working Capital Management

Working capital can refer to hot funds and well-managed accounts receivable, inventory, and accounts payable that can ensure monetary benefits within the business. Proper management of the cash flow leads to the least use of external sources of funding.

External Sources of Finance

1. Equity Financing

Equity financing requires an organisation to sell its shares to people to raise cash from the shareholders. It may work best for startups and established companies since it has no measure of repaying the money with interest. However, it may reduce the sense of ownership and also may lead to a decentralisation of decision-making processes.

2. Debt Financing

Credit financing means taking money from bankers, financial houses or the public by floating the company’s bonds. It has to pay back the loan advanced to it besides the amount of interest charged on the loan. This is a popular method of finance for set-up companies, though it has drawbacks, such as increasing the companies’ liabilities.

3. Venture Capital

Venture capital firms finance high-potential startups in exchange for an ownership stake in the company. In addition, funding from venture capitalists comes with valuable experience and guidance, making it particularly beneficial for enterprises with significant growth potential.

4. Angel Investors

Like venture capitalists, Angel investors fund the project in return for an equity stake in the company. Nevertheless, angel investors are usually individual investors and they invest moderate amounts of capital. Sometimes, they contribute capital to start-ups, so they can also provide guidance and support to the venture.

5. Government Grants and Subsidies

Governments sometimes support companies by tendering them funds through instruments such as grants or subsidies. These may be to fund specific sectors, such as research and development or the development of the economy in some areas. Although very competitive, they offer ‘free’ capital that, in turn, requires no interest payment or giving of equity.

6. Trade Credit

Creditors may allow business organisations to defer payment for supplies and services. It is a source of financing that can help regulate cash flows. However, businesses must stay alert to their capacities to meet the obligatory payments to sustain their contact with suppliers.

Scope of Business Finance

Business finance goes beyond the simple acquisition of funds; it consists of a wide range of processes for managing a firm’s cash flows to ensure growth and sustainability. The scope of Business Finance is mainly in the areas of finance management, investment, risk management and overall strategic financial planning and strategy.

1. Financial Planning and Forecasting

Financial Planning involves presenting budgets and anticipating future financial requirements and strategies to acquire those needs.

2. Investment Decisions

Managers always face the challenge of figuring out how to use the available capital most effectively within the firm. Capital expenditure can be as minor as purchasing capital assets, while major expenditure may include contracting for new technology, research and development or expanding into new markets.

3. Risk Management

Risk management is a process of identifying financial risks and determining the methods of minimising those threats. It can involve diversification of investment, purchase of insurance or having strategies in place should a country’s economy downturn.

4. Financial Monitoring and Control

It is the company’s responsibility to closely keep track of its net profit in an attempt to achieve the financial target. This includes reviewing accounts, and KPI and identifying variances to variance analysis.

Importance of Business Finance

Business finance importance stands out for various reasons, such as enabling a business to:

- Maintain Cash Flow: Appropriate management of finance shows that the firm has adequate cash for its operating expenses.

- Support Growth: Anticipated and available funds enable a firm to acquire more capital and develop new stores, markets and business solutions, thus, competing effectively.

- Mitigate Risks: This means that, through working capital and financial buffers such as cash and cash equivalents, any business venture will have a cushion against market risks, economic risks, and unforeseen events.

- Innovation: There is a need to purchase and allocate financial capital for research, development, and innovation because they are central to sustainable business operations in a competitive market.

- Employee Retention and Motivation: Business financial strength enshrines a capability to pay competitive remuneration packages, which is important in talent attraction and retention.

Programme to Build a Career in Finance

Executive Programme in Business Finance by IIM Ahmedabad

MBA in Finance or Executive Management Programmes are some of the courses that equip aspirants with advanced information on financial plans and investments, risks and fiscal management. To facilitate the same. Here’s a detailed breakdown of the Executive Programme in Business Finance by IIM Ahmedabad:-

- Institution: Provided by IIM Ahmedabad, one of the premier management institutes of the world, and a top B-school in India.

- Eligibility: Intended for a mid-senior professional workforce that wants to develop their finance understanding and boost their career within the area of business finance, respectively.

- Programme Duration: An academic curriculum that takes twelve months to complete and has a flexible program that is ideal for working professionals offering a balanced combination of rigorous academic training and real-world applicability.

| Blended Mode | This course utilises the hybrid model to enable group discussions and sessions. Though it can be taken online from anywhere the physical classroom experience is offered in between the course for deeper interactions with instructors and other learners. |

| Live Online Classes | Delivered online, facilitated with sessions led by IIM Ahmedabad faculty. |

| Campus Immersion | As part of this programme, the participants get to spend two days on-campus at IIM Ahmedabad where they attend physical classes which gives them practical experience on a personal front as well as networking. |

Curriculum Focus:

| Key Subjects | Includes fundamental areas of finance including financial analysis, corporation finance, securities and markets, managing risks, and strategic financial management. |

| Practical Approach | Focus on practical problems and projects to enhance the specificity of the materials studied in the course at a professional level. |

| Certification | Upon your course completion, participants will obtain the Certificate of Completion from IIM Ahmedabad which can help further enhance the participant’s profile. |

| Programme Outcome | Course graduates would be in a position to facilitate strategic financial decisions and control the financial risks and returns associated with business operations. |

How Can Jaro Education Help You Build a Career in Finance?

Jaro Education is a higher education upskilling company that can assist you with career counselling and support, helping you identify your strengths, explore various career paths, and acquire the necessary skills to excel in your chosen field.

By enrolling through us in an MBA in finance programme, you can also leverage the given Jaro Connect benefits:

- Alumni Network of over 350,000 professionals

- Exclusive access to alumni events and additional benefits

- Stay informed with the latest insights from your alma mater

Final Thoughts

Essentials of Business Finance is important to any business that wants to grow, stabilise and expand in today’s challenging market environment. Companies have many recoverable sources that can be used to supplement their financing needs ranging from retained earnings to venture capitalists and even bank loans. But it’s not only a matter of getting finance; it’s also about being able to use it, make efficient decisions about investments and deal with risk.

With Jaro’s help, you can bridge the gap in the professional continuum. Opt for Jaro Connect via Jaro and speed up your possibilities of enrolling in one of the top financial courses.

Frequently Asked Questions

For startups, the most attractive source of financing is equity financing from an angel investor or a venture capitalist as this brings in both cash and expertise without the stress of having to pay back soon.

It is a financial source, with zero cost of capital because the business neither issues new securities nor incurs debt in using retained earnings to fund growth initiatives.

It involves paying back borrowed funds together with an agreed sum as interest and non-fulfilment of agreed loans can make businesses experience strain. In severe cases, firms can face bankruptcy, particularly businesses with unpredictable cash flows.

Budgeting enables an organisation to cope with its financial objectives, produce a workable plan for the future, and make sure that the business will have adequate cash to remain profitable in the long run.

The programmes offered by Jaro Education teach businessmen and women all that they need to know to manage the finances of their businesses via a strong foundation of financial Knowledge and skills.