Explore Top 15 Career Options After Completing M.Com in 2024

Table of Contents

- jaro education

- 1, June 2024

- 10:30 am

Introduction

An M.Com opens vast areas of career prospects across a plethora of job sectors. As the business and finance world diversifies with time, the golden chance for adept professionals who hold adequate expertise in commerce, finance, and management opens up diversely and with great innovation. Through this blog, we would like to introduce you with the top 15 career options you can go in for after completing your M.Com in the year 2024 including an overview of the roles, skills required and potential career growth. This blog will talk about the best career options after mcom and the best courses after mcom.

All About M.Com

A Master of Commerce, popularly known as M.Com, is a postgraduate degree that deepens the study of commerce, economics, accounting, finance, and business management. It is a two year program designed to enable students after the course completion, students are open to a vast variety of career options after mcom, that enables them to function in various responsible positions in the financial and business sectors. People can seek courses after mcom or simply start their job search, depending upon the individual. It comprises various subjects like advanced accounting, financial management, business law, taxation and research methodology.

Top 15 Career Options After M.Com

1. Chartered Accountant (CA)

Chartered Accountant is one of the most reputed and well-paid professional courses after mcom. CA is a finance professional who offers invaluable advice in areas like financial management, taxation, audit, etc. CAs are governed centrally by The Institute of Chartered Accountants of India.

Responsibilities

- Financial statement auditing

- Tax planning and advisement

- Corporate finance and investment control

- Compliance with financial regulations

Skills Required

- Good problem-solving skills and analytical nature

- Eye for detail

- Sound knowledge of accounting software

- Strong communication skills

Career Growth

There is an excellent career growth prospect for Chartered Accountants. They can become Chief Financial Officers or partners in accounting firms at a senior position.

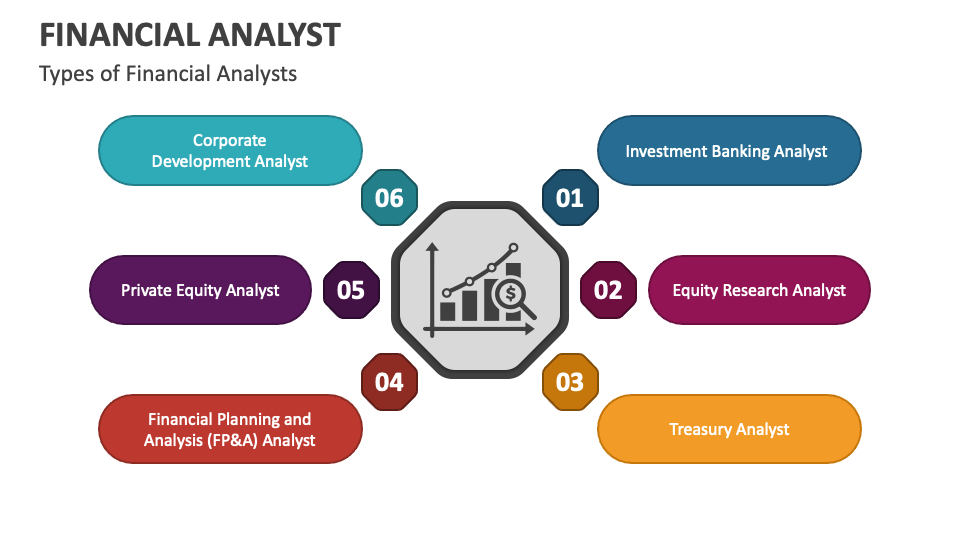

2. Financial Analyst

A Financial Analyst supports businesses to plan solid investment ventures. He examines financial statements and, along with other market information and current economic trends, prepares valuable recommendations and proposes possibilities. This is one the most pursued career options after mcom.

Responsibilities

- Analyze financial statements and evaluate performance

- Conduct research in the market trends

- Prepare reports and give presentations proposing potential investments

- Recommend new strategies that would better influence financial gains

Skills Required

- Outstanding analysis and quantitative skills

- Good financial modeling and forecasting

- Knowledge of financial software and tools

- Thorough knowledge of presentation and communication skills

Career Path

A Financial Analyst can look for a similar career option in the Senior Financial Analyst, Portfolio Manager, Director of Finance, or move on to related job options in the banking service, investment firms, and corporations.

3. Cost Accountant

Cost accountants control and reduce the cost in an organization. They do so by scrutinizing costs at various angles in cost data, preparing cost reports, and charting cost control mechanisms and strategies. People can either go for a specialization course after mcom or simply get into this career option after mcom.

Responsibilities

- Analyze production costs with an aim of identifying areas that can save on costs

- Prepare cost reports and budgets

- Implement and execute strategies that regulate cost

- Assist in decision making related to pricing

Skills Required

- Maximum analytical and problem-solving skill

- Proficient cost accounting software tool user

- High level of attention to detail

- Budget and Financial Analysis Knowledge

Career Path

Progress from Cost Accountant to Cost Accounting Manager, Financial Controller, or Chief Financial Officer (CFO) in manufacturing and other sectors, including healthcare.

4. Tax Consultant

Tax Consultants are professionals who give highly specialized recommendations on matters to do with taxes from personal and business enterprises. They help clients utilize the awkward and tough to interpret tax laws with the objective of gaining the maximum possible tax benefits. This is another best career option after mcom.

Responsibilities

- Preparation and filing of tax returns

- Giving clients information and advice about tax planning and compliance

- Representing clients in front of taxation authorities in case of tax audits and disagreements

- Keeping up to date with any amendments made to legislation related to taxation

Skills Required

- Strong knowledge related to taxation laws and regulations

- Ability to research and analyze issues accurately

- High level of accuracy and attention to detail

- Excellent communication skills and negotiation skills

Career Path

Tax Consultants can move on to become Senior Tax Consultants, Tax Managers, or Tax Partners in accounting companies, or they can open their own tax consulting firm.

5. Investment Banker

Investment Bankers help to raise capital for companies, manage mergers and acquisitions, and provide strategic financial advice. This is one of the highest paying and tough professional career options after mcom.

Responsibilities

- Advice on mergers, acquisitions, and restructuring

- Assist in capital raising by way of debt and equity issue

- Prepare detailed financial models and reports

- Conduct financial analysis and valuation

Skills Required

- Excellent skills in financial analysis and modeling

- Good communication and negotiation skills

- Capability to work under pressure

- Proficient in financial software and tools

Career Growth

One can progress to the designation of Vice President, Director, or Managing Director in an investment bank, private equity organization, or corporate finance department.

6. Corporate Finance Manager

Corporate Finance Managers help in managing all financial activities in an organization. This involves planning, budgeting, forecasting, and making investment decisions. These professionals play a crucial role in ensuring the organization is financially healthy. This is one of the most high-paying career options after mcom.

Responsibilities

- Design, develop and manage financial plans and budgets

- Conduct financial analysis and forecasting

- Make investment appraisal and risk assessment

- Overseeing financial reporting and compliance

Skills Required

- Effective planning and financial analysis competencies

- Proficient in handling financial software and other tools in the analysis of finances

- Excellent communication and leadership capabilities

- Adept at corporate finance principles and practices

Career Growth

Corporate Finance Managers can move into the position of the Chief Financial Officer, Finance Director, or Vice President of Finance within a large corporate or multinational organization.

7. Auditors

Auditors are professionals responsible for the examination and preparation of financial records and statements made by organizations. They also do internal and external compliance audits and is another high-paying career option after mcom.

Responsibilities

- Financial statements and records audit

- Examination on the efficiency of controls and risk management recommendations

- Making the recommendations to manage and improve the effectiveness of the financial processes

- Ensuring compliance with financial controls and standards

Skills Required

- Strong problem-solving and data analysis skills

- Attend to detail

- Proficient in auditing software and tools

- Good knowledge of accounting principles and standards

Career Growth

Auditors may rise to the posts of Senior Auditor, Audit Manager, or the Internal Audit Director in organizations comprising accounting firms, corporates, and government agencies.

8. Banking Professional

Banking Professionals engage in multiple roles in banks and financial institutions, such as retail banking, corporate banking, investment banking, and risk management, to offer financial services and support to people and businesses in general. People can either go for a specialization course after mcom or simply get into this career option after mcom.

Responsibilities

- Assisting clients in various bank products and services

- Account and transaction management

- Financial statement analysis and credit evaluation

- Advising customers on investment and different loan options

Skills Required

- Having great communication skills in dealing with customers

- Knowledge about the different bank products and services

- Analytical and problem-solving skills

- Detail-oriented approach

Career Path

The career path with the position of Banking Professional may proceed to the positions of Branch Manager, Relationship Manager, Credit Analyst, or Risk Manager within the Bank and Financial Institution.

9. Financial Planners

Financial Planners serve as a bridge between clients and investment analysts, offering personalized financial advisory and planning services to help clients achieve their financial objectives. They design investment, retirement, estate, and risk management strategies tailored to their clients’ needs.

Responsibilities

- Assess clients’ financial needs and goals

- Develop and implement financial plans

- Advise on investment, insurance, and pension options

- Review and monitor financial plans

Skills Required

- Strong analytical and planning abilities

- Excellent communication and interpersonal skills

- In-depth knowledge of financial products and markets

- Proficiency in financial planning software

Career Progression

Financial Planners can advance to roles such as Senior Financial Planner, Financial Planning Manager, or Certified Financial Planner (CFP) within financial advisory firms, banks, or as independent consultants. This is another best career option after mcom.

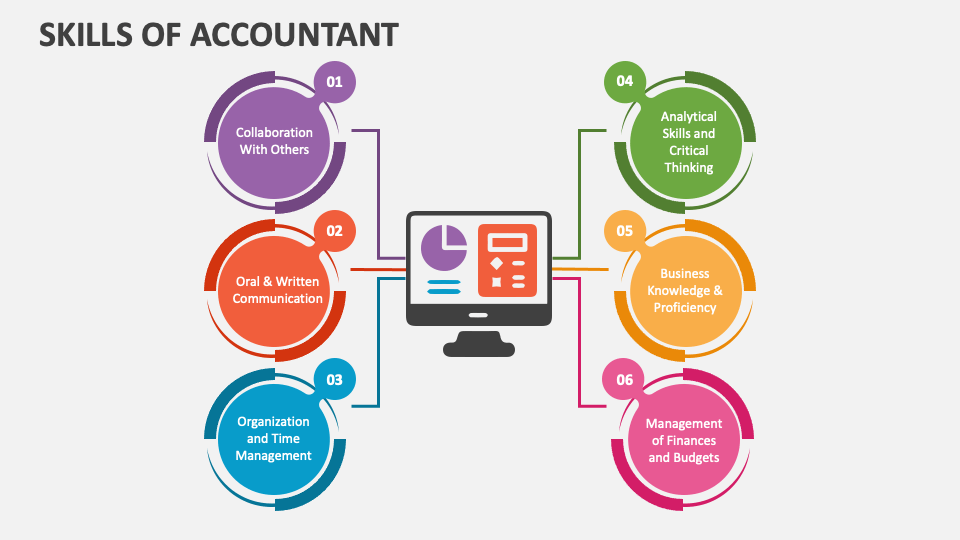

10. Accountant

Accountants maintain financial records and prepare financial statements in accordance with accounting standards. They are crucial in ensuring an organization maintains a healthy financial status. This is one of the most commonly pursued career options after mcom.

Responsibilities

- Record and maintain financial transactions

- Prepare financial statements and reports

- Ensure compliance with accounting standards and regulations

- Conduct financial analysis and budgeting

Skills Required

- Analytical and numerical skills

- Proficiency in accounting software

- Attention to detail

- Knowledge of accounting principles and standards

Career Progression

Accountants can be promoted to Senior Accountant, Accounting Manager, or Financial Controller, working across corporate, public, and non-profit sectors.

11. Academician / Lecturer

Academicians and Lecturers teach commerce-related subjects at colleges and universities, often engaging in research and writing academic papers. This is another commonly pursued career option after mcom.

Responsibilities

- Develop and teach courses in accounting, finance, economics, and business

- Write research papers

- Mentor students

- Serve on academic committees

Skills Required

- Strong subject knowledge and teaching skills

- Research and analytical abilities

- Effective communication and presentation skills

- Commitment to continuous learning and development

Career Growth

One can become an Associate Professor, Professor, or Head of Department in educational institutions, with opportunities for research grants and academic recognition.

12. Management Consultant

Management Consultants advise organizations on improving business performance, diagnosing complex issues, and achieving results. Their projects span operations, finance, human resources, and marketing. This is another best career option after mcom.

Responsibilities

- Analyze business processes and performance

- Develop and implement improvement strategies

- Advise on organizational change and development

- Conduct market research and analysis

Skills Required

- Strong analytical and problem-solving skills

- Communication and presentation abilities

- Ability to work with diverse teams

- Knowledge of business management principles

Career Growth

Management Consultants can progress to Senior Consultant, Principal Consultant, or Partner in consulting firms, working on impactful projects across various industries.

13. Company Secretary

Company Secretaries ensure organizational compliance with legal and regulatory requirements, playing a key role in corporate governance by advising the board of directors on legal matters. People can either go for a specialization course after mcom or simply get into this career option after mcom.

Responsibilities

- Ensure compliance with corporate rules and regulations

- Maintain company registers and filings and other data

- Advise the board on compliance requirements and legal changes

- Organize board meetings and prepare minutes

Skills Required

- Strong analytical skills and knowledge of corporate laws

- Strong Attention to detail and organizational skills

- Excellent communication and interpersonal skills

- Ability to work under pressure and meet deadlines

Career Growth

Company Secretaries can advance to Senior Company Secretary, Corporate Governance Advisor, or Chief Compliance Officer in large corporations and multinational companies.

14. Business Analyst

Business Analysts work at the intersection of business needs and technology solutions. They analyze business needs, identify opportunities for process improvements, and facilitate effective solution implementation.

Responsibilities

- Analyze business processes and requirements

- Develop business cases and project plans

- Collaborate with IT and business teams

- Monitor and assess project outcomes

Skills Required

- Strong analytical skills

- Excellent communication and stakeholder management

- Proficiency in tools and technologies that help in business analysis

- Data analysis and reporting skills

Career Growth

This is the best career option after mcom as Business Analysts can advance to Senior Business Analyst, Business Analysis Manager, or Project Manager roles in sectors such as IT, finance, and healthcare.

15. Stock Broker

Stock Brokers facilitate the buying and selling of securities for clients and provide investment advice, helping clients achieve their investment goals.

Responsibilities

- Execute buy and sell orders for securities

- Provide investment advice and recommendations

- Conduct market research and analysis

- Manage client portfolios

Skills Required

- Strong knowledge of financial markets and securities

- Excellent communication and sales skills

- Analytical and research abilities

- Ability to work under pressure and meet targe

Career Growth

Stock Brokers can progress to roles like Senior Stock Broker, Portfolio Manager, or Wealth Management Advisor, working in brokerage firms, investment banks, and financial advisory companies. This is another commonly followed career option after mcom.

Conclusion

Pursuing an M.Com. degree opens up a wide array of career opportunities in finance, accounting, consulting, and academia. Each career path offers unique advantages, allowing you to utilize your skills and knowledge for professional success. Align your opportunities with your interests and strengths to achieve a fulfilling and rewarding career.