Investment Banker Salary in India 2025: What to Expect and How to Maximize Your Earnings

Table of Contents

- jaro education

- 26, October 2024

- 4:00 pm

Investment banking is one of the highest-paying career paths globally, and India is no exception. As the economy grows and businesses expand, the demand for financial advisory services, capital markets expertise, and mergers & acquisitions (M&A) support increases. Investment bankers play a crucial role in facilitating these processes, making them indispensable for corporations, governments, and financial institutions.

Looking ahead, 2025 is expected to bring significant changes to the salary of investment bankers in India. With increased globalization, emerging technologies like AI in finance, and a strong demand for advisory services, the financial compensation of investment banking professionals is set to increase substantially. This blog explores the key responsibilities and skills of investment bankers, expected salary trends, the impact of certifications on earning potential, and the role of Jaro Education in helping professionals stay ahead in the competitive world of finance.

Who are Investment Bankers?

Investment bankers are financial professionals who facilitate the raising of capital for corporations, governments, and other entities. They serve as intermediaries between organizations seeking funds and potential investors, providing essential financial advisory services. Their expertise includes structuring financial transactions, conducting market analysis, and managing the complexities of investment operations.

In India, investment bankers work for a range of institutions, including multinational banks, boutique firms, and financial consultancies. Their role has become increasingly critical as India’s economy grows and diversifies, leading to higher demand for sophisticated financial services.

Key Responsibilities of Investment Bankers

- Raising Capital: Assisting clients in securing funding through equity or debt offerings.

- Advisory Services: Providing strategic advice on mergers and acquisitions, restructuring, and other financial decisions.

- Market Analysis: Conducting in-depth analyses of market conditions to identify opportunities for clients.

- Transaction Structuring: Designing financial products and transactions that meet the client’s needs and align with regulatory requirements.

Skills Essential for Investment Bankers

To succeed in the competitive field of investment banking, professionals need a diverse skill set that encompasses both technical and soft skills. Here are some essential skills that aspiring investment bankers should develop:

- Financial Analysis: Strong analytical skills are crucial for interpreting financial statements and conducting valuations. Investment bankers must be able to assess financial health and market conditions effectively.

- Industry Knowledge: Staying updated on industry trends, economic factors, and market conditions is essential. Understanding specific sectors can provide valuable insights for clients.

- Communication Skills: Clear and concise communication is vital for conveying complex financial information to clients and stakeholders. Investment bankers must excel in both verbal and written communication.

- Quantitative Skills: Proficiency in financial modeling and data analysis is critical. Investment bankers should be comfortable using tools like Excel for quantitative analysis.

- Problem-Solving Ability: The ability to navigate complex financial issues and provide innovative solutions is a must in this fast-paced environment.

- Time Management: Investment bankers often juggle multiple projects with tight deadlines. Strong organizational skills are necessary to prioritize tasks effectively.

- Teamwork and Collaboration: Many transactions require collaboration across teams. Building strong relationships and working effectively with others is essential.

- Professionalism and Ethics: Adhering to ethical standards is critical in maintaining the trust of clients and upholding the reputation of the investment banking industry.

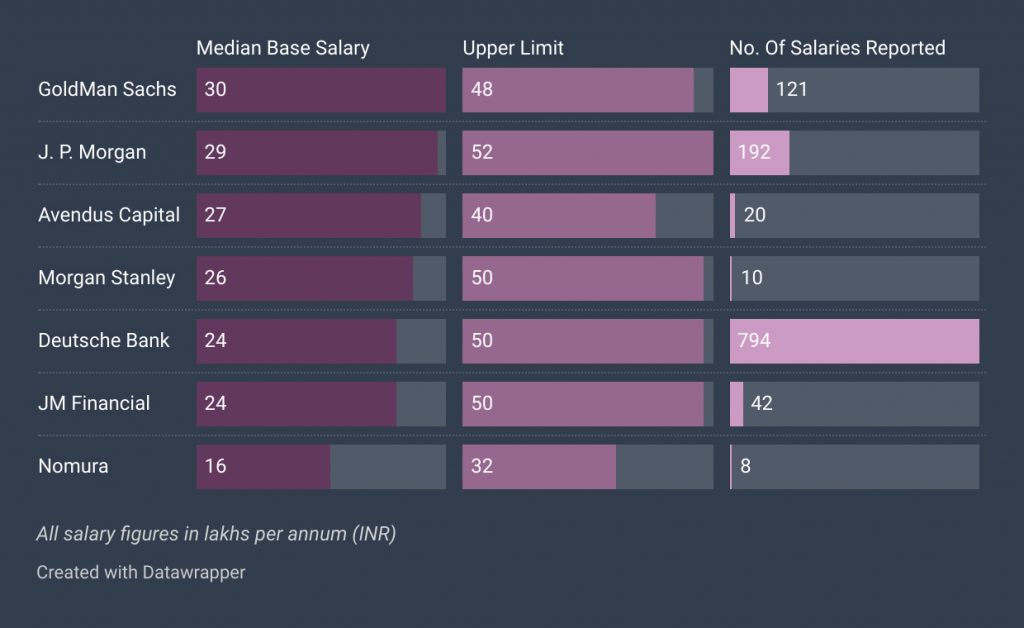

Investment Banker Salary in Different Companies in India

As of 2024, the investment banking sector in India is experiencing growth, with the competitive salary of investment bankers reflecting the rising demand for skilled professionals. The table below outlines the average salary for investment bankers at various leading firms, including projected investment banker salary for 2025.

| Company | Post | Current Salary (2024) | Projected Salary (2025) |

|---|---|---|---|

| Goldman Sachs | Investment Banker | ₹22 LPA - ₹35 LPA | ₹26 LPA - ₹40 LPA |

| J.P. Morgan | Associate, Corporate & Investment Bank | ₹20 LPA - ₹32 LPA | ₹24 LPA - ₹36 LPA |

| Morgan Stanley | Investment Banking Analyst | ₹18 LPA - ₹30 LPA | ₹22 LPA - ₹34 LPA |

| Citi | Investment Banking Associate | ₹17 LPA - ₹28 LPA | ₹21 LPA - ₹33 LPA |

| Barclays | Investment Banker | ₹19 LPA - ₹29 LPA | ₹23 LPA - ₹35 LPA |

| Deutsche Bank | Investment Banking Analyst | ₹15 LPA - ₹27 LPA | ₹19 LPA - ₹31 LPA |

| HSBC | Investment Banking Associate | ₹16 LPA - ₹26 LPA | ₹20 LPA - ₹30 LPA |

| Credit Suisse | Associate, Investment Banking | ₹18 LPA - ₹25 LPA | ₹22 LPA - ₹29 LPA |

| ICICI Bank | Investment Banker | ₹12 LPA - ₹20 LPA | ₹15 LPA - ₹25 LPA |

| Axis Bank | Investment Banking Analyst | ₹10 LPA - ₹18 LPA | ₹12 LPA - ₹22 LPA |

*QuintEdge

Factors Affecting Investment Banker Salary in India

Investment banker salary in India is influenced by several factors. Understanding these factors can help aspiring professionals navigate their career paths effectively:

- Skills: The specific skill set possessed by an investment banker plays a significant role in determining their earning potential. Skills such as financial modeling, valuation techniques, and negotiation can lead to a higher salary for investment bankers.

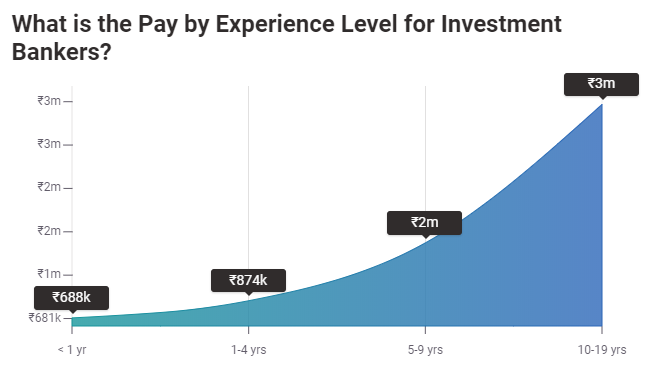

- Experience: Experience is a critical determinant of investment banker salary. Entry-level investment bankers earn significantly less than their mid- and senior-level counterparts. On average, entry-level professionals can expect to earn around ₹8-10 LPA, while those with 5-10 years of experience can command an investment banker salary between ₹20-40 LPA. Senior investment bankers with over a decade of experience can earn upwards of ₹1 crore annually.

- Location: Geographic location has a substantial impact on an investment banker’s salary. Investment bankers in major financial hubs like Mumbai and Delhi typically earn a higher investment bankers’ salary compared to those in smaller cities. The cost of living and demand for financial services also play a role.

- Employer: The type of employer—whether a multinational bank, boutique firm, or consulting firm—can greatly affect investment banker salary levels. Global banks generally offer more competitive packages than domestic firms.

- Market Conditions: Economic conditions, regulatory changes, and the overall demand for investment banking services can impact an investment banker’s salary. A thriving economy with high merger and acquisition activity can lead to higher compensation packages.

*Medium

Factors That Will Shape Investment Banker Salary in 2025

With the rapid pace of economic development, the investment banking industry is undergoing significant transformations. The following factors are expected to shape an investment banker’s salary in India by 2025:

Digitization and AI in Finance

The rise of digital transformation and AI technology is reshaping the financial sector. Tasks such as data analysis, risk assessment, and trading are increasingly being automated. As a result, investment bankers who are adept at leveraging AI, data science, and financial analytics will see a spike in demand and the investment banker’s salary. By 2025, professionals who specialize in fintech solutions or have skills in algorithmic trading and blockchain are expected to earn 10-20% more than their peers.

Globalization of Indian Finance

With India becoming a hub for international business, many global firms are establishing themselves in the country. Investment bankers with expertise in cross-border transactions, international regulations, and global market trends are likely to be in high demand. This global outlook will likely boost the salary of Indian investment bankers as firms strive to attract top global talent.

Mergers and Acquisitions (M&A) Surge

India is expected to see a rise in M&A activity, especially within sectors such as technology, healthcare, and renewable energy. Investment bankers specializing in M&A will be in high demand, which will positively impact their compensation. Professionals who are skilled at conducting valuations, due diligence, and transaction negotiations will likely see their investment banker salary rise significantly.

Green Finance

The growing emphasis on sustainability and environmental, social, and governance (ESG) factors is expected to create opportunities in green finance. Investment bankers with knowledge of sustainable investing, green bonds, and carbon credit trading will command a higher investment banker salary as these financial products become more mainstream.

Regulatory Changes

Changes in financial regulations, both at the national and international levels, will continue to impact the investment banking industry. Bankers who are skilled at navigating the complexities of regulatory environments and ensuring compliance with evolving financial laws will remain in demand. Specialized roles focusing on compliance and regulatory analysis are projected to earn a competitive investment banker salary by 2025.

*IDSFintech

Investment Banker Salary Growth After Certifications

Obtaining certifications in areas such as financial modeling, risk management, and corporate finance can lead to substantial salary increases for investment bankers. Many professionals opt for executive education programs and certifications to stay competitive in the evolving financial landscape.

Professionals who pursue advanced certifications or executive programs not only deepen their understanding of the industry but also improve their earning potential. Investment banker MBA salary is generally higher, just like other reputed certifications. For instance, an investment banker with a CFA designation can expect a salary increase of up to 30%, while those who complete an executive program from an IIM can see their earnings soar by 40%.

Jaro Education's Role in Career Enhancement

To prepare for the highly competitive investment banking industry and leverage the booming salary growth potential for 2025, professionals are increasingly turning to specialized certifications. Jaro Education, a leading provider of online executive education, offers several prestigious programs designed to accelerate careers in banking and finance. These include:

- Executive Certificate Programme in Corporate & Strategic Finance – IIM Mumbai

- Professional Certificate Programme in Investment Banking – IIM Kozhikode

- Post Graduate Certificate Programme in Banking and Finance – IIM Trichy

- Post Graduate Certificate Program in Blockchain Technologies and FinTech – IIM Visakhapatnam

By pursuing these programs through Jaro Education, professionals can bridge the gap between industry demands and their skill sets, enabling them to secure high-paying roles at top financial institutions. The executive education programs are designed to provide flexibility for working professionals, offering a mix of self-paced learning and live sessions led by renowned faculty from IIMs.

Certification and Its Impact on Investment Banker Salary

Obtaining certifications like the ones offered by Jaro Education not only strengthens your resume but can also lead to substantial salary increases. Investment bankers with relevant executive certifications often earn significantly more than their counterparts without formal certifications, in addition to other added benefits.

Benefits of Jaro Education Programs

- Industry-Relevant Curriculum: The programs are designed in collaboration with industry experts, ensuring that professionals learn the latest tools and techniques.

- Flexibility: The online format allows working professionals to balance their studies with work commitments.

- Career Enhancement: Jaro Education’s career services, such as LinkedIn profile optimization and resume building, help participants market themselves effectively in the job market.

Conclusion: Investment Banking Salary in 2025 and Beyond

By 2025, investment bankers in India can expect a competitive salary due to evolving economic conditions, growing demand for financial services, and technological advancements. Professionals who stay ahead of these changes by acquiring relevant certifications and staying informed on global trends will likely see substantial salary growth.

Investment banking will remain one of the most lucrative careers in the financial sector, and the pursuit of continuous learning, especially through executive education programs like those offered by Jaro Education, will be a key driver of success in this fast-paced field.

Frequently Asked Questions

Typically, investment bankers tend to earn more than Chartered Accountants (CAs). While both professions are highly respected, the earning potential in investment banking is generally higher due to the nature of the industry, which involves large deals, mergers and acquisitions, and significant financial transactions.

-

- Starting Salaries: A CA may have a starting salary of an investment banker in India ranging from INR 6-10 LPA, while an investment banking analyst’s salary often starts at INR 10-12 LPA in India.

- Mid-Career Salaries: Mid-level CAs can earn between INR 15-25 LPA, while investment banking associates or VPs can earn INR 25-50 LPA.

- Senior-Level: Senior investment bankers (like directors or managing directors) often earn upwards of INR 1 Cr+, while senior CAs typically earn between INR 30-50 LPA depending on their role and firm.

However, it’s important to note that the work hours and stress levels in investment banking tend to be significantly higher than in accounting.

Yes, investment bankers are known for their high earning potential, especially at senior levels. While the starting salary of investment bankers in India may range from INR 10-15 LPA, this number rises significantly as they gain experience and move up the ranks.

-

- Bonuses: Investment bankers often receive bonuses that can sometimes be higher than their base salary. This is where much of the “big money” in investment banking comes from, particularly during successful deal-making years.

- Global Figures: In global financial hubs like New York or London, investment bankers can earn base salaries between $100,000-$200,000 at entry-level, and with bonuses, the total compensation can rise dramatically, especially in managing director or partner roles where total pay packages can exceed $1 million.

A CFA (Chartered Financial Analyst) designation can boost an investment banker’s earning potential significantly. The CFA designation is highly regarded in fields like equity research, portfolio management, and investment banking.

-

- Starting Salary (CFA Investment Banker): The starting salary of a CFA-qualified investment banker in India may be between INR 12-20 LPA.

- Mid-Level Salary: As an associate or VP with a CFA, one might earn INR 25-50 LPA, which is an investment banker salary of INR 2.1-4.2 lakhs per month.

- Senior-Level Salary: With a CFA and extensive experience, senior investment bankers (directors or managing directors) can earn over INR 1 Cr annually.

While a CFA alone doesn’t guarantee a higher salary, it enhances the knowledge and skills required for critical roles in investment banking, which typically lead to higher pay brackets.