Investment Banking VS Corporate Investment Banking: Which is Better?

Table of Contents

- jaro education

- 19, August 2023

- 3:00 pm

Being thoroughly aware of the professions one wants to pursue is crucial. It is possible to compare careers more thoroughly if you know the benefits and drawbacks. Because a job has a significant impact on one’s career trajectory, it is imperative to choose it correctly. Corporate investment banking primarily involves providing banking services, including loans, to businesses, whereas investment banking concentrates on raising capital rather than managing it.

India’s investment banking market has been expanding quickly, which has helped the nation’s GDP expand at high rates and opened up new job opportunities. A curriculum has been created to look at the structure, management, and practices of this industry within the context of India to understand how it operates. The Investment Banking Programme at IIM Kozhikode aims to give participants the theoretical and conceptual tools required by investment banks to analyse the primary line of business of investment banks, understand the perks and challenges of the sector, and grasp corporate finance.

Basic Understanding of Corporate Investment Banking

Corporate investment banking is the term used to describe organisations’ financial actions and plans to increase their total financial worth and maximise shareholder returns. It encompasses several procedures, including securing funding, managing resources, choosing investments, and enhancing the company’s financial structure.

Banks and other financial organisations primarily make corporate finance solutions available to firms. These alternatives can include growing a company’s operations, boosting earnings by investing in fresh goods or markets or acquiring lines of credit to help with ongoing operations. The amount of available corporate finance support is determined by the company’s size, current debt obligations, and overall business plan.

Investment Banking: Raising Capital and Facilitating Financial Transactions

Investment banking includes all aspects of the process of financing businesses or other organisations through financial institutions. Investment banks are essential for providing capital and financing, assisting in mergers and acquisitions, and determining the viability of investments in new or existing enterprises. Through a variety of securities and financial tools, they make it easier to raise money.

Corporate Banking vs Investment Banking: Qualifications required

Both fields require a strong educational foundation and a set of specific skills tailored to the respective banking sector. By acquiring the necessary qualifications and honing the required skills, individuals can enhance their prospects for a successful career in investment banking or corporate investment banking.

Investment Banking

To enter the investment banking sector as an associate, undergraduates are advised to pursue an MBA from a business school. Essential skills to develop include a deep understanding of corporate finance, strong calculation abilities, and proficiency in organisational analysis. Excellent communication skills are also essential for success in investment banking.

Corporate Investment Banking

For a career in corporate banking, qualifications in subjects such as law, business studies, management, accountancy, finance, mathematics, or economics can be advantageous. Obtaining an MBA or similar professional qualification can provide additional opportunities. Other essential skills include numeracy, problem-solving, negotiation, and working under pressure.

Serving Clients: Corporate Banking vs Investment Banking

Corporate Investment banking and investment banking divisions primarily cater to corporate clients, providing them with various financial services. These divisions share similarities in their client base but also differentiating factors.

Corporate Investment Banking

Building long-term relationships with Corporations Corporate banking involves establishing enduring relationships between financial institutions and major corporations. The focus is on meeting the financial requirements of corporate clients for the long term. Corporate bankers provide a range of services such as loans, credit facilities, cash management solutions, trade finance, and risk management. These services support corporations in managing their day-to-day financial operations and facilitating their growth and expansion.

Investment Banking

Investment banks often serve government entities as clients alongside corporations. Governments, including local and federal levels, seek to raise capital to finance specific projects and initiatives. Investment banks play a vital role in assisting governments in capital-raising efforts, offering expertise in structuring financing solutions and managing government debt.

Services Offered by Corporate Banking and Investment Banking

Corporate investment banking provides companies with ongoing financial services, including loans, treasury management, risk management, and foreign exchange services. On the other hand, investment banking offers transactional services such as debt and equity financing, mergers and acquisitions advisory, and securities sales and trading.

Corporate Investment Banking Services

Loans and Lines of Credit

Corporate banks provide financing to companies through various types of loans and revolving lines of credit, enabling them to fund specific projects or maintain ongoing liquidity.

Management of Treasury

Corporate investment banking divisions offer a range of treasury management services to assist companies in managing their financial operations. This includes cash flow management, online banking, accounts payable and receivables management, fraud prevention, and reporting.

Risk Management

Corporate bankers collaborate with companies to assess and mitigate risks such as interest rate fluctuations and equity risks, helping businesses minimise financial losses.

Foreign Exchange Services

Internationally active businesses, like many major corporations, look to corporate banking sections for assistance with foreign currency services. Corporate bankers assist businesses with currency receipt and transfer, management of receivables and payables in several currencies, and exchange prevention.

Investment Banking Services

Equity Financing

Investment banks assist corporations in raising capital through equity financing, such as initial public offerings (IPOs), follow-on offerings, and private placements. They help companies sell ownership stakes in the form of equity shares.

Debt Financing

Every known investment bank assists businesses and governments in borrowing money. Frequently, they execute debt financing by creating and managing bonds for the business. By purchasing the bonds, investors are essentially making a capital loan to the business. Investment banks help firms not just underwrite bonds but also price them appropriately, get bond credit ratings, and more.

Mergers and Acquisitions

From advisory services for mergers, acquisitions, and other strategic transactions, investment banks govern all duties associated with mergers and acquisitions. They assist in identifying potential target companies, valuing the companies, conducting due diligence, and facilitating the transaction process.

Sales and Trading

Investment banks offer sales and trading services, acting as intermediaries to facilitate the buying and selling of securities. They provide liquidity in the market and may also offer research and analysis on various securities.

Corporate Banking and Investment Banking: Similarities

Corporate and investment banking share several key similarities, highlighting their common objective of providing financial resources and expertise to businesses. Here are some notable similarities:

Financing for Companies

Corporate financing and investment banking involve providing financial resources to companies. They aim to support the growth, operations, and strategic initiatives of businesses through various funding mechanisms.

Capital Commitment

These facilities often involve a significant commitment of capital. Whether through loans, equity investments, or underwriting securities offerings, both processes allocate substantial financial resources to businesses, with specific terms and expectations for repayment or return on investment.

Professional Entry Requirements

Both corporate financing and investment banking require highly skilled and educated professionals. These fields attract individuals with advanced degrees in finance, economics, or related disciplines. The roles within corporate financing and investment banking often involve complex financial analysis, valuation, and decision-making.

While there are similarities between the two, it’s important to note that corporate financing typically focuses on meeting the financial needs of a specific company or entity, whereas investment banking encompasses a broader range of financial services such as capital raising, advisory, and securities trading for both corporations and other entities.

*Prosple

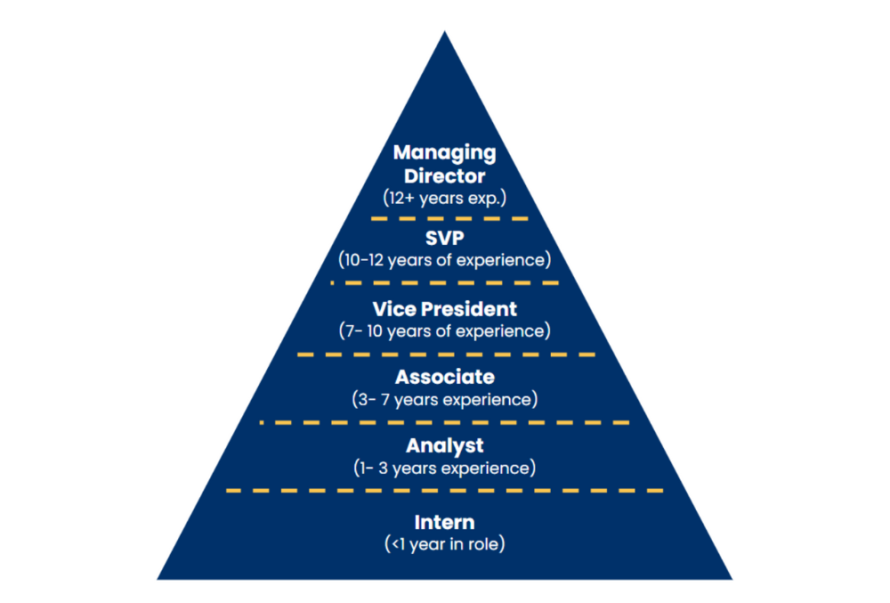

Job Profile in Investment Banking and Corporate Banking

These positions offer diverse career paths within the banking industry, each with its own set of responsibilities and opportunities for growth. When choosing between investment banking and corporate banking roles, it is essential to consider personal interests, skills, and long-term career goals.

Investment Banking Positions

Analyst

The entry-level position in investment banking involves creating financial models, performing company analysis, conducting due diligence, and assisting with pitch book creation. Typically, at least one year of experience as an analyst is required before advancing to the associate role.

Associate

Similar to analysts, associates perform financial analysis and due diligence. However, they also act as intermediaries between junior and senior bankers. Associates usually work for three to four years before being considered for promotion to the position of Vice President.

Vice President

As a Vice President, responsibilities are similar to those of analysts and associates, but with additional leadership and client management duties. Vice Presidents are experienced professionals who have demonstrated strong expertise in investment banking.

Managing Director

Managing Directors are highly experienced individuals who represent the firm in crucial meetings and often have decision-making authority. They hold strategic roles within the company and play a key part in shaping its direction.

Corporate Banking Positions

Loan Officer

Loan officers assess client loan eligibility, monitor their financial conditions, and provide suitable loan options. They evaluate loan applications and ensure compliance with lending policies.

Branch Manager

Branch managers oversee branch operations, including managing employees, ensuring the smooth delivery of financial services, and maintaining business relationships with clients.

Trust Officer

Professionals in this designation specialise in trust services, estate planning, taxes, and investments. They provide expertise and guidance to clients on matters related to trusts and estates.

Takeaway

It is important to evaluate available options objectively. This involves assessing your skills and comparing them with the requirements of the role, as well as considering whether you would fit into the organisation’s work culture. This holds for both corporate investment banking and investment banking. Both fields are highly competitive within the finance industry, but investment banking often offers higher salaries and greater opportunities for professional growth. However, when making a decision, it is important not to let a single factor heavily influence the choice, whether it is work hours or compensation. Having a balanced perspective and considering various criteria is advisable before deciding on a particular job role. Ultimately, finding a career that aligns with your skills, interests, and values will lead to long-term satisfaction and success.

If you are more aligned towards being an investment banker, join the IIM Kozhikode programme in investment banking through Jaro Education. Participating in this programme will give you the knowledge and abilities to succeed in the industry and advance your investment banking career. The 12-month programme comprises lectures by IIM faculty members with substantial industry experience and is designed to be provided online.