Top 10 Investment Banking Companies

Table of Contents

- jaro education

- 20, August 2023

- 4:00 pm

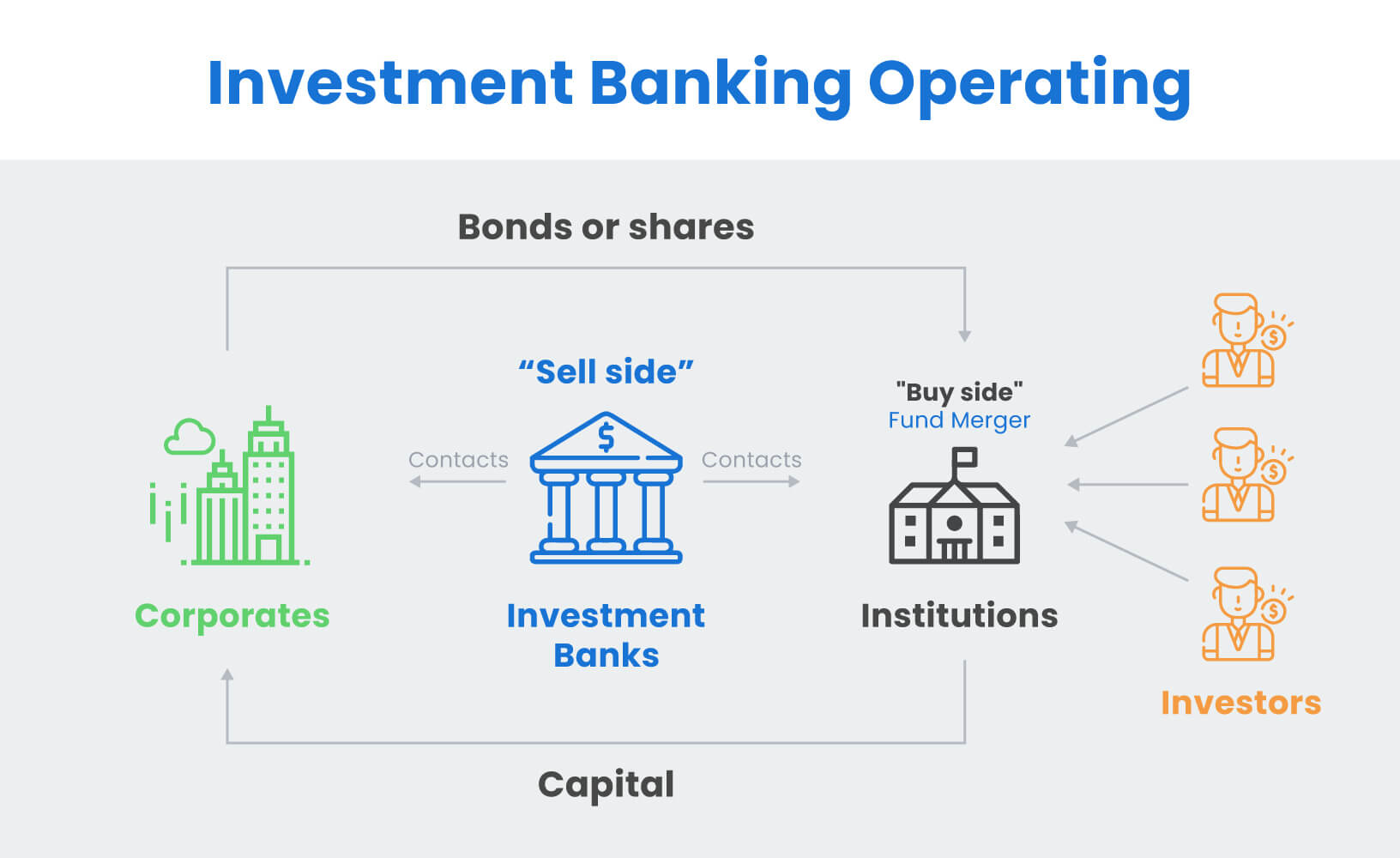

Investment banking is a banking segment that assists individuals and organizations in raising funds and providing financial advice. Top investment banking companies provide investment banking services, requiring highly skilled financial management and planning to deploy the biggest investment banking in India services. These banks were created to help corporations, high-income individuals, organizations, and even the government to make educated investment decisions to attain their financial objectives.

Investment banks in India are divided into public and private segments. The split ensures the confidentiality of documents from the general public. The private portion of the banks will deal with privileged information, while the public portion will deal with publicly available data.

The scope of investment banking is increasing exponentially in India and the world. If you want to uplift your career in this field, IIM Kozhikode’s Professional Certificate Programme in Investment Banking is the best resort. This program will provide candidates with fundamental insights into top investment banking companies in India, different banking companies, and their primary line of business. To learn more about the course, you can register with Jaro Education.

Fundamentals of Investment Banking

*Dealroom.net

Investment banking focuses on financing a company and its business development and meeting its financial needs. Wholesale clients who are from small businesses or from large financial institutions require more sophisticated financial products due to the nature or size of their business. This banking section has some key concepts that will help aspiring investment bankers comprehend the fundamentals of investment banking.

1. Shares

The equal parts into which an organization’s capital is split are called shares. These are traded on stock exchanges. Stock markets are sites where buyers want to pay money for shares. It is an opportunity for companies to raise money by selling the shares they own and a chance for buyers to purchase a portion of the company and make a profit out of it.

2. Bonds

It is a debt security which is issued by a company or government that is sold to investors in financial markets to obtain cash for supporting its operations. The bond issuer guarantees to pay the sum of money to the bondholder along with a fixed interest amount. At the time of selling a bond, issuers often seek the aid of financial institutions, which function as placement agents.

3. Initial public offering

An Initial public offering (IPO) is a growth strategy in which a company sells its stock in a controlled public market. This transaction enables companies to accelerate expansion by raising the cash required to materialize their business strategy while allowing private shareholders to materialize the value of their shares, diversify their assets, and increase liquidity.

4. M&A

Mergers and Acquisitions, also known as M&A, refers to the business growth strategy in which a company acquires, buys a share, collaborates or takes over another company’s business or assets to expand its current business. Investment banks serve as advisors focusing on resolving company issues and providing suggestions to increase shareholder value.

Top Investment Banking Companies

Investment banking companies have access to the industry’s top personnel. As a result, they ensure that their staff are suitably compensated with some of the best incomes accessible in India. If you are considering making this field your career, here are the top 10 investment banking companies with great pay-scale.

1. JP Morgan Chase

*iStock

One of the top investment banking companies in India, JP Morgan Chase is also recognized globally. The company offers a myriad of financial investment firm services in different nations and regions. While JP Morgan Chase’s headquarters is in New York, its India-based office is in Mumbai. The company initially provided financial banking services. But it quickly became one of the world’s leading investment banking firms. As ranked by S&P Global, its services are often related to the financial investment firms areas. JP Morgan Chase continuously seeks fresh workers who want to progress and thrive within their organization. They provide an excellent working environment with a diversified and competent team of experts whose primary goal is to reach greater heights.

2. Barclays Bank

*World Finance

With 300+ years of history, Barclays is a well-known British multinational universal bank. Founded by James Barclay, the bank started its journey in London, UK. In India, Barclays Bank has branches in Pune, Mumbai, and Delhi. With 85,000+ employees, the company showcases an impressive workforce and has worked its way to become one of the top investment banking companies in India and around the world. In addition to providing investment banking services, the company also provides personalised banking services to individuals and companies.

3. Goldman Sachs

*People Matters

Goldman Sachs, headquartered in New York City, is one of the world’s most recognized and respected top investment banking companies in India. The company also has a strong presence in Bangalore, making it one of the top financial investment firms in India. Goldman Sachs offers a wide range of services, including wealth management, securities trading and global markets. The firm presently employs over 30,000 individuals and is always looking for additional employees as part of its continued commitment to serving its consumers.

4. JM Financial Institutions Securities

*signup.jmfonline.in

When it comes to top investment banking companies in India, JM Financial Institutions Securities (JMFIS) has gained significant traction. The company was founded in 1998, and it offers numerous investment banking services like private equity services, wealth and asset management, and distressed credit brokerage services. JM Financial Institutions Securities has headquarters in Mumbai, and it also provides mortgage loan services to people.

5. Axis Capital Limited

*Fortune India

Another investment banking company in India is Axis Capital Limited, founded in 2005. This investment bank is holding a company of Axis Bank that is touted to be an industry leader in equities capital markets and boutiques. Like many investment banks, Axis Capital Limited also has its foothold in Mumbai. It deals with businesses like capital markets, and structured finance, among others. Furthermore, with their full suite of solutions, they have successfully acquired a solid footing in the Indian investment banking sector.

6. IDBI Capital

*IDBI Capital

A completely owned subsidiary of IDBI Bank, IDBI Capital was established in 1993. The company is conveniently located in the heart of the city of Mumbai and offers various services like private wealth management and research, capital markets institutional broking, and distribution. Every employee or brand ambassador associated with IDBI Capital is treated with the utmost respect.

7. O3 Capital Global Advisory Services

O3 Capital Global Advisory Services is one of India’s best investment banking companies, with a long history of delivering alternative asset management services and corporate financing since 1993. Their skilled team of specialists has accomplished much in the sector, assisting in developing creative methods that have allowed them to expand beyond India into other nations. O3 Capital Global Advisory Services is a mid-market top investment banking company in India and it has its office in none other than Mumbai.

8. Bank of America Merrill Lynch

*Barrons

Recently branded as Bofa Securities, Bank of America Merrill Lynch is among the largest investment banking companies around the world. It has branches in the USA’s North Carolina and India’s Bangalore, Mumbai, Delhi, and Chennai. Regarding revenue, Bofa Securities is one of the top investment banks, with over 200,000 workers encouraged to innovate and advance their careers. Bank of America Merrill Lynch completed its acquisition in 2009 and changed its name to Bofa Securities in 2019.

9. HSBC

*iStock

The Hong Kong and Shanghai Banking Corporation, or HSBC, is commonly considered one of the major banks of the world. Its network extends over 4000 sites and 65 nations, from Hong Kong to London. This financial investment firms conglomerate provides its consumers with a wide range of services, including private banking and investment banking. It also has a presence in several Indian cities, and as a result, it is regarded as one of India’s top investment banking companies in India. The current headquarters of this company is in Hong Kong. In India, HSBC has branches in Delhi, Mumbai, and Bangalore.

10. Edelweiss Financial Services

*EquityPandit

Founded by Rajesh Shah in 1955, Edelweiss Financial Services is unquestionably one of India’s top investment banking companies. The company aims to deliver a variety of services, such as credit facilities, advisory insurance, and asset management. The company, part of the Edelweiss Group conglomerate, has become one of India’s premier investment banking organizations. Edelweiss Financial Services’ headquarters are in Mumbai, and its services are extensively used throughout the country.

Kickstart Your Banking Career with Jaro Education's Expert Guidance

Founded by Rajesh Shah in 1955, Edelweiss Financial Services is unquestionably one of India’s top investment banking companies. The company aims to deliver a variety of services, such as credit facilities, advisory insurance, and asset management. The company, part of the Edelweiss Group conglomerate, has become one of India’s premier investment banking organizations. Edelweiss Financial Services’ headquarters are in Mumbai, and its services are extensively used throughout the country.

| Institute | Program Name |

|---|---|

| Indian Institute of Management Kozhikode (IIMK) | Professional Certificate Programme in Investment Banking |

Investment banking is certainly an attractive proposition for professionals to experience rapid advancement within their careers. So, if you also want to pace up your career, consider taking the Professional Certificate Programme in Investment Banking from IIM Kozhikode. It is a 12-month program equipping candidates with conceptual and theoretical tools used by investment banks, various interactive sessions, different case studies, and capstone projects. With this course, you can learn A-Z of investment banking and it prepares you to get a high-salaried job at any of the top investment banking companies in India.

Final Thoughts

In today’s world, investment banking is stated to be obligated to serve the purposes and corporate entities for the rest of their existence. The major role of top investment banking companies in India is to assist in the underwriting of new loans and the provision of equity securities for various enterprises. It aids them in the process of reorganization to secure their private investors. They also assist numerous MNC organizations and governments in managing their financial investment firms demands when major projects occur in a certain location.

Frequently Asked Questions

The key difference lies in their functions:

-

- Investment Banks focus on facilitating capital raising, M&A activities, and trading in financial markets.

- Commercial Banks offer traditional banking services like savings and checking accounts, loans, and mortgages.

Investment banks generate revenue primarily through fees and commissions from services such as underwriting, advisory fees, trading commissions, and asset management. They also earn by taking a portion of the profits from successful investment ventures, such as private equity deals or M&A transactions.

An investment banker’s role is to facilitate financial transactions, help raise capital, and provide advisory services. They assist companies in going public, guide them through M&A transactions, and often help structure deals to maximize value. Investment bankers also provide research and analysis to investors on market conditions, helping them make informed decisions.

Yes, individuals can engage with investment banks, especially through wealth management services or by investing in securities. However, investment banks primarily serve corporations, governments, and institutional investors rather than individual retail clients.