The Role of Technology in Corporate Finance: Innovations and Trends

Table of Contents

- jaro education

- 23, November 2024

- 4:00 pm

How do you define technology? A machine that performs all your tasks, or an algorithm that processes data and provides insights? You’re right—technology can be anything. Today, we are having a chance to use highly functional mobile phones and laptops and ease our day-to-day work; where does all that come from? Technology, correct? It has truly impacted everyone’s life: how we think, act, and move. In fact, these days, if a business is not effectively utilising technology, it is likely lagging and missing opportunities, especially in the corporate finance sector.

In this sector, technology has completely taken over traditional finance work, making it a core part of the industry. Wondering how? Let us show you. Handling vast amounts of data manually can be time-consuming and, of course, nearly impossible. This is where automated systems come in. They not only help with processing large datasets efficiently but also enhance accuracy and reduce human error.

Now, it’s time to dive into understanding the important trends and innovations taking place in the finance sector and how it has impacted the whole financial landscape. Stay tuned with us to learn more.

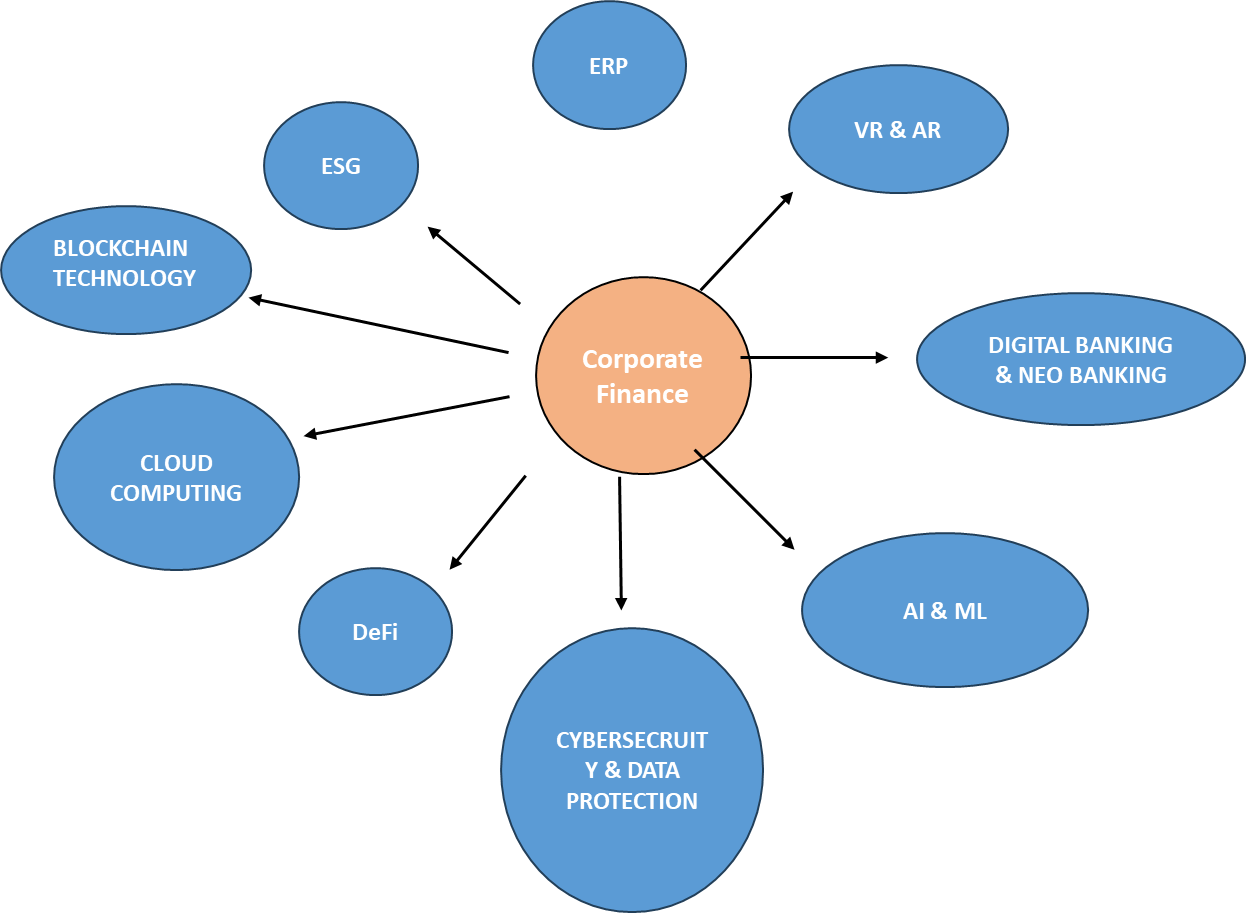

9 latest trends and Innovations in Corporate Finance

Digital Banking and Neobanks

Despite the formation of Digital India, the banking industry still faces many challenges, one of which is digitalisation. This is where Digital Banking and Neobanks are emerging as key players.

Digital banking, also called online banking, is a digitalisation of traditional banking services. Neobanks are gaining significant popularity among Generation, driven by their ability to bypass traditional banking barriers through advanced digital technology. These banks offer a range of sophisticated financial services that are available 24/7, delivering convenience, speed and cost efficiency.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning are the two major concepts that have been the main players in the corporate finance world for a few years now. Their applications vary from automating complex processes to better decision-making and giving profound information from the data.

Moreover, AI & ML are mostly used in the areas of risk management, fraud detection, and financial forecasting. Financial institutions are currently using AI to easily asses huge data in real time. As a result, it helps in more accurate predictions and faster operations.

Cybersecurity and Data Protection

As the saying goes, ‘As financial technology advances, the chances of data exposure also increase.’ We all know that fintech companies rely heavily on data, calculations, and insights, and as businesses embrace digitalization, they face potential threats and risks of data loss.

So, what’s the solution? Cybersecurity will remain a top priority for banks not only in 2025 but for many years to come. Companies will continue to invest in various tools and technologies to protect their financial data systems, including the development of security protocols and regular vulnerability assessments.

Decentralised Finance (DeFi): Financial Inclusivity

Commonly known as DeFi, decentralised finance is a great move to transform the traditional and complicated financial system into one that is more open, transparent, and inclusive. It is an umbrella term for corporate finance tools and services that are based on blockchain technology. Financial technology. It mainly operates on the Ethereum blockchain and has been intended to copy and further develop the functions of lending, borrowing, investing, and trading.

Decentralised finance is a well-known finance technology that allows anyone who has the necessary means to access the internet and crypto walled to freely enter the finance world.

Cloud-computing

In corporate finance, massive amounts of data are generated every day, but the major question is: where does all that data go? As data starts to add up, companies and banks need a model that is more safe and feasible. This is because most of the data is sensitive and includes all the personal banking and investment details.

Thus, you definitely require reliable and highly secure storage solutions for the day. Cloud computing is surely becoming one of the great trends in financial services. It is a lot more than just storing data. It helps to identify fraudsters, cut storage costs and provides customers with personalised services.

Blockchain Technology

Wouldn’t it be wonderful if corporate finance systems could be connected to one single system that makes it possible to minimise risks, verify the authenticity of data, and allow safe currency transfer all in one? This is where Blockchain technology proved to be a remarkably rewarding trend for the financial sector as it offers multiple approaches and tricks to ensure that business transactions are done properly and efficiently.

Sustainable Finance and ESG Investing

Now, you must be thinking about what sustainable corporate finance technology is. Many of you might come across environmental, Social, and governance (ESG) for the first time. So, let us explain to you.

ESG is an important criterion in corporate finance as investors and stakeholders are also eager to see green credentials with companies. Besides, investors are likely to connect with companies that have strong ESG frameworks.

Thus, reinforcing corporate responsibility and ensuring sustainability. Plus, ESG investing is becoming more and more popular, so it is also encouraging financial institutions to bring out new products and services that help in the development of this market. You can learn about sustainable courses and other technology by pursuing finance courses.

Enterprise Resource Planning (ERP)

As new players enter the ERP space with specialised applications and microservices that integrate with ERP platforms, we can anticipate a change in the landscape. And in this, adopting cloud-based ERP will help companies stay ahead.

Corporate finance is entering a golden age of technology. As the cloud becomes the norm for ERP, finance applications and microservices will proliferate. Organisations will be able to drastically reduce the complexity and cost of technology without sacrificing functionality.

Virtual Reality and Augmented Reality

Virtual Reality(VR) and Augmented Reality (AR) are two main players that are making significant changes in the corporate finance world. Not only are they useful in introducing engaging solutions that help to make informed financial decisions, but they also assist in monitoring real-time market changes. These technologies are perfect for increasing user experience and transforming the whole scenario about how investors see your portfolios.

By showcasing the 3D visualisation and manipulation of financial data, VR and AR delegate investors to get through understanding and navigate complex market dynamics with accuracy and clarity.

What Opportunities Do the Latest Financial Technology Trends Present for Businesses?

*acropolium.com

This image illustrates the state of the global fintech market and how financial technology is driving significant change. Indeed, the future is vast, and global opportunities are limitless

The rapid development of corporate finance brings a pool of opportunities for businesses across various sectors. Some of the common ways are:

| Opportunities | Description |

|---|---|

| Operational Efficiency | Firstly, RPA and AI technologies are playing a major role in automating multiple tasks, minimising human errors, and saving staff costs. This also leads to increased productivity and cost savings. |

| Improved Decision-Making | Technology like data analytics and machine learning are gaining access to the end or even huge amounts of data, enabling users to examine the relationships, insights, and values that were previously unacceptable. This can also help businesses to make an informed decision. |

| Enhanced Customer Experience | Corporate finance's latest innovations and trends, like digital banking services, voice-enabled payments, and online delivery, make overall transactions more user-friendly. With such facilities, businesses can improve customer satisfaction and loyalty. |

| Increased Security | Biometric security, along with blockchain technology, not only makes financial transactions more secure but also helps to reduce fraud risk and increase customer trust. |

| New Revenue Stream | Banking and blockchain technology are introducing many new avenues of revenue generation. For example - in addition to working with third-party providers of financial services and selling fintech products. |

Are You Ready To Enter the Technology Industry To Build A Successful Career?

If you have come here, it shows that you’re really passionate about jumping into the corporate finance sector as a leader. But confused about what to do. Let us help you. Whether you are a working professional or an individual who wants to pursue online education in the technology sector from a reputed university, we have a solution.

Develop a Strong Financial Foundation With IIM Mumbai

IIM Mumbai, formerly known as NITIE, is one of the most renowned institutes for management education. This institute is a pioneer in industrial management and has been positioned 7th amongst the management schools in India by the NIRF(National Institutional Ranking Framework) in 2023.

So, if you have strong ambitions to drive social change through the power of financial innovation, your exciting journey could begin with an Executive Certificate Programme in Corporate & Strategic Finance at IIM Mumbai. It is one of the most sorted and demanding finance courses which will help you acquire a solid educational foundation in topics like financial concepts and strategies, fundamental financial statements, fintech innovations, etc. In addition, you will also get exposure to hands-on exercises, case studies, interactive sessions and much more. Reach out to us today to learn more about these opportunities.

Duration: 10 Months

Programme Highlights

- The programme is designed by 2nd Best Institute in India

- You will get a certification of Completion from IIM Mumbai

- You will get a chance to learn from IIM Nagpur faculties and industry experts

- Get 3 days of campus immersion

- Last but not least, peer-to-peer networking opportunities.

How Can Jaro Education Be a Reliable Partner in Your Journey?

Jaro Education is a leading online higher education and upskilling company with years of experience and expertise in the industry. We have in-house professionals who are ready to offer the best career counselling and academic support to very passionate students. For most of the programmes offered by well-known IIM and IITs, Jaro Education acts as a marketing and technology partner. With us, not only do you get a lifelong learning experience but also a chance to connect with professionals and build a network.

Final Thoughts

Yes, these days, technology is one of the most important parts of corporate finance. Not only does it help businesses to liberate themselves from rigid data structures, but it also keeps you away from the outfit process. Also, your business can indeed overcome underperformance and improve productivity, leading to a better future and success.

Undoubtedly, the demand for this technology will keep growing. So, if you are ready to crush today’s highly competitive business landscape, it’s time to embrace a mindset that goes above and beyond normal metrics. This can be done by enrolling in the programme through Jaro Education. It’s time to pave the path to success in fintech and build a thriving career that you always dreamed of having.

Frequently Asked Questions

The corporate finance sector has frequently been one of the key boosters of new and emerging technologies. This is possible because the finance sector can leverage technological solutions to operate client issues more efficiently, calculate risks, run massive data sets, and develop the business.

Absolutely. IIM Mumbai is one of the most renowned institutes in India, and it is known for providing transformative education. By earning an Executive Certificate Programme in Corporate & Strategic Finance, you’re eligible to work in global companies. The program will help you equip knowledge with all the current and latest modules that are required to be a successful financial leader.

When it comes to building a successful career, networking and academic support play a major role. And this is where Jaro Education comes in. When you’re enrolling in a program through our website, you will get the benefit of the following:

-

- Dedicated student support

- Immersive and lifelong learning experiences

- Learn from the best-suited academic, faculty, and industry mentors

- Be a part of discussions and forums for enhanced learning

- Leverage peer-to-peer learning experience

2 thoughts on “The Role of Technology in Corporate Finance: Innovations and Trends”

It’s actually a nice and useful piece of info. I am

happy that you shared this helpful info with us. Please keep us informed like this.

Thanks for sharing.

We’re glad you found the information useful! We’ll continue to share helpful content. Stay tuned for more updates.