Simplified Continuous Monitoring in a Risk Management Framework

Table of Contents

- jaro education

- 26, December 2023

- 11:30 am

Imagine you’re a pilot navigating through a turbulent sky and suddenly see a dark cloud forming ahead. Will you change altitude or fly straight through? How did you detect the storm in the first place?

Gone are the days of relying solely on visual signals and intuition; today’s pilots use advanced weather radar, satellite imagery, and real-time data feeds to make informed decisions. Since everything in this world is digitised, it is one of the most important benefits for any organisation or sector. However, these benefits bring a lot of consequences in terms of risks. This is where continuous monitoring in risk management frameworks comes in to prevent risk in any organisation.

It’s not hidden that an effective continuous monitoring strategy is one of the most powerful tools in a company to protect against risks before it becomes a crisis. Thus, an organisation with a strong and advanced approach to managing risk is always at the top of its game.

So, if you want to learn about how continuous monitoring can be really helpful to support your risk management framework, this blog is for you. We will explore everything that you need to know about this business framework and how pursuing a Professional Certificate Programme in Strategic Management at IIM Kozhikode can enhance your skills in this area.

What is Continuous monitoring in Risk Management?

Continuous monitoring refers to the ongoing process of systematically tracking and assessing risks across various aspects of an organisation. Unlike traditional risk management approaches that rely on periodic reviews, continuous monitoring utilises real-time data analysis, automated tools, and key risk indicators (KRIs) to provide a dynamic view of the risk framework landscape. This proactive strategy allows organisations to identify and respond to potential risks before they escalate into significant issues.

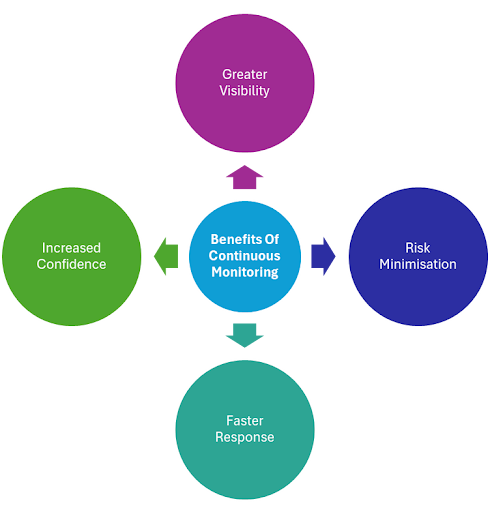

What Are The Benefits Of Continuous Monitoring in a Business?

Continuous monitoring in risk management frameworks has become essential for any business. Think of it as your company’s saviour—keeping a watchful eye over your data and unlocking a treasure trove of benefits for your organisation. Here are just a few of those advantages:

Greater Visibility

Greater visibility means you are able to have a complete, real-time understanding of what is going on in your IT environment. Continuous control monitoring in a risk management framework involves ongoing insights into systems and operations, enabling you to identify and solve issues before they become major problems.

This process contributes to the support of IT systems. It enhances the performance and activities of the network, thereby making the operations more efficient. Continuous monitoring in risk framework monitoring makes an organisation alert to potential security risks. Therefore, less system downtime and performance becomes more stable.

Risk Minimisation

-

- Maintaining awareness of potential problems

- Enabling early threat detection

- Reducing operational downtime

- Determining risks in order of seriousness

Faster Response

Another major advantage of continuous monitoring in a business is the ability to respond quickly to risks. Detecting potential issues at the earliest stages enables proactive security measures that not only reduce downtime but also minimise the time it takes to resolve incidents. This means your business can stay one step ahead of potential disruptions, ensuring smoother operations and peace of mind.

Increased Confidence

Ongoing monitoring in the risk management framework creates customer and partner confidence by proving security commitment and obligation. Demonstrating to customers that the company is actually managing risks and operations with ongoing monitoring for mitigation of risk and a more healthy security posture can signify important messages.

It ensures that operations meet agreed terms and legal requirements, maintains the organisation’s credibility, and minimises the risk of legal or financial liabilities. Additionally, this also increases customer loyalty and satisfaction towards your business.

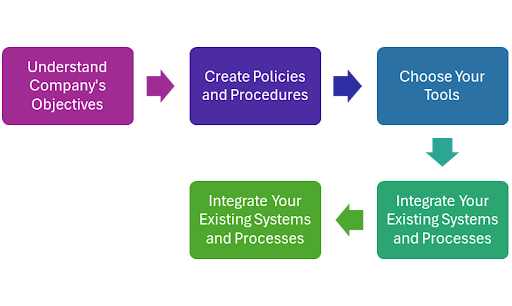

5 Crucial Steps in Building a Successful Continuous Monitoring Strategy

When it comes to creating an efficient and robust continuous monitoring strategy, a business needs to have a structured approach. But the major question is: how can it be done? Well, here are the five key steps that make sure that your continuous monitoring strategy works in a business environment.

Step 1: Understand the Company’s Objectives

The strong base of successful continuous monitoring in a risk management framework is understanding goals and objectives. First, get to the point of what you want to monitor and why. You can also involve your leaders, end-users, and stakeholders to ensure everyone has an overview of the programme.

Step 2: Create Policies and Procedures

Once you’re clear with objectives, the next step is to create clear policies and procedures that can guide continuous monitoring in risk management framework activities. There are also definitions of roles and responsibilities across different teams; there should be guidelines on incident escalation procedures, data collection and reporting standards.

Step 3: Choose Your Tools

Selecting the most suitable tools and technologies is essential in creating your continuous monitoring strategy. Your choices should be aligned with the goals and policies set within your organisation. Take into account the scalability, flexibility, and cost efficiency as you weigh your options. Opt for tools that will assist you in monitoring every process, giving you substantial insights, and responding quickly to risks.

Step 4: Integrate Your Existing System and Processes

Integrating your continuous monitoring strategy into the enterprise risk management framework is essential for smooth operation and successful implementation. The objective of integration is to enhance your overall security posture. By ensuring that continuous monitoring efforts work in conjunction with your existing security strategies, you will be able to enhance the efficacy of your security measures by a greater margin. A harmonised security infrastructure component leads to better defence.

Step 5: Review, Analyse, and Update

Review and analyse your continuous monitoring strategy risk management framework regularly and update it. Regular evaluation is required to find out how effective the performance of continuous monitoring is and identify areas of improvement. You should do this process at least every three years or based on your monitoring plan and compliance needs. A review will ensure that your strategy remains relevant and effective in allowing you to continuously monitor the new and potential risks.

Are you Ready to Build your career in Strategic management?

Undoubtedly, every organisation nowadays prioritises continuous monitoring and strategic risk management. Thus, it is important to enhance your skills in this area if you want to climb the success ladder. To help you work on your skills, IIM Kozhikode offers the Professional Certificate Programme in Strategic Management.

Let’s learn about this programme in detail:

About The Professional Certificate Programme in Strategic Management at IIM Kozhikode

Programme Duration:1 Year

Mode: Online

This programme offers a comprehensive understanding of strategic principles, and frameworks, cultivating leadership skills, gaining insights into diverse strategies, master innovative approaches to navigate digital disruption and tools necessary for effective risk management. This course is mainly tailored for ambitious professionals who want to build a thriving career and evolve as an all-encompassing leader.

Programme Highlights

- Live Classes by Accomplished Faculty from IIM Kozhikode and other Renowned Institutions

- Online Classes on Weekends or After Business Hours

- 2.5 Days On-Campus Immersion

- Peer-to-peer Learning and Mentoring from Industry Experts

- Theoretical Concepts with Practical Applications

- Hand-on workshops through experiential learning

- Curated for Working Professionals with a Practical Learning Approach

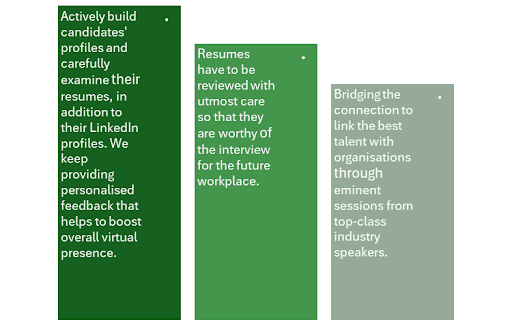

How Does Jaro Education Can Support You in Achieving Career Excellence?

When it comes to achieving career excellence, apart from education, there are other things that really matter. To support individuals on their journey, Jaro Education offers tailored academic guidance and career counselling. As a leading online higher education and upskilling company, we are here to provide an immersive lifelong learning experience, opportunities to connect with alumni, and resources to help students build their networks. Additionally, we act as a marketing and technology partner for many programmes offered by renowned IIMs and IITs.

For this programme, we offer:

Final Thoughts

Now you know how continuous monitoring in the risk management framework plays an important role in any business, no matter in which industry you are in. So, if you’re ready to excel in this field and want to learn how effectively you can strategise your business, enrol in the course The Professional Certificate Programme in Strategic Management offered by IIM Kozhikode. This is indeed a comprehensive course for professionals who want to build solid skills. You can enrol in this course through Jaro Education and get other academic and career benefits.

Frequently Asked Questions

Organisations face various types of risks that can affect operations and objectives. Each type of risk requires targeted strategies to identify, assess, and manage it to support organisational resilience. Commonly, the different types of risk can include:

- Financial risks

- Operational risks

- Strategic risks

- Compliance risks

- Reputation risks.

The programme provides comprehensive insights into strategic principles and risk management, enhancing leadership skills and equipping you with tools to navigate digital disruptions in your career.

Jaro Education provides personalised academic assistance, career counselling, profile building, and networking opportunities to help candidates enhance their career prospects.

2 thoughts on “Simplified Continuous Monitoring in a Risk Management Framework”

Normally I do not read article on blogs however I would like to say that this writeup very forced me to try and do so Your writing style has been amazed me Thanks quite great post

Many thanks for your kind words! We will strive to provide you with quality content.