Salary Calculator 2024: A Comprehensive Tool for Estimating Your Earnings

Table of Contents

- jaro education

- 6, June 2024

- 5:22 pm

A salary is a fixed monetary compensation an employer pays employees for their work within a specified period. It is typically agreed upon through an employment contract based on factors such as the employee’s role, responsibilities, skills, and experience. Salary calculator can help deduce the important components of salary like base pay and additional components like bonuses, benefits, and allowances.

Salary calculator is an indispensable tool designed to provide an overall estimate of your earnings. Whether negotiating a new job offer, planning a career change, or simply curious about your potential income, this tool offers accurate insights into your financial future. With user-friendly features and up-to-date salary data, the Salary Calculator 2024 empowers individuals to make informed decisions about their professional trajectory. From factoring in bonuses and benefits to considering tax deductions, this tool ensures a review of your earning potential in the dynamic landscape of 2024.

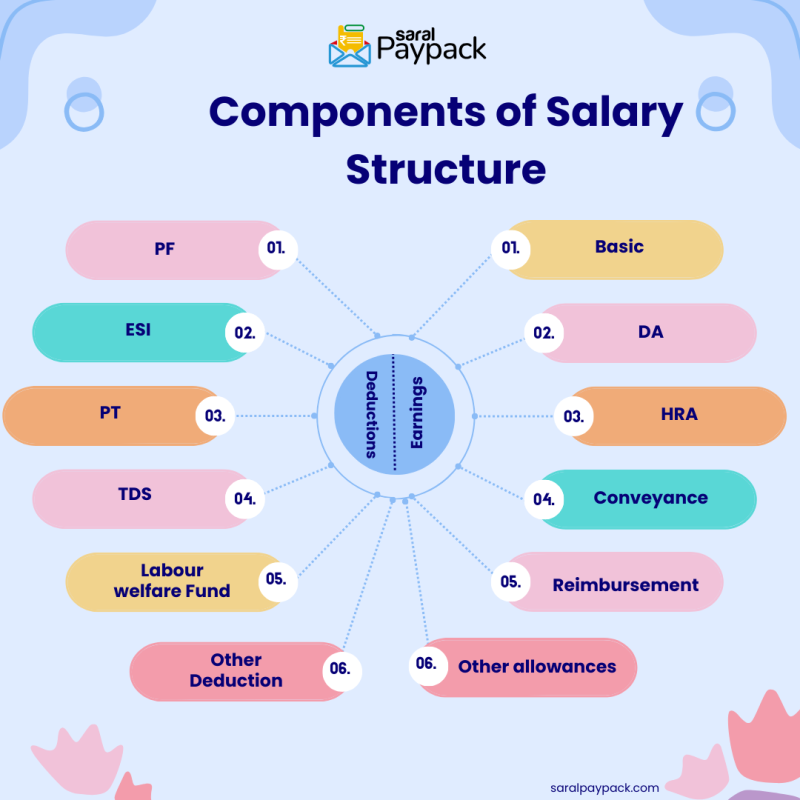

Components of Salary

Your salary encompasses more than just a figure. It comprises various components crucial for evaluating your total compensation package and planning your financial future. Here’s a detailed breakdown of the vital salary components:

- Basic Salary: The basic salary constitutes a significant portion, approximately 40% to 50%, of an employee’s total salary package. This component is determined by factors such as the employee’s skillset, experience, and qualifications. It is the foundational element of the cost-to-company (CTC) package, providing a fixed income to the employee.

- House Rent Allowance (HRA): HRA is an allowance employers provide to employees who reside in rented accommodation. This allowance aims to cover rental expenses and is either partially or fully exempt from taxes under Section 10(13A) of the Income Tax Act. However, the HRA becomes fully taxable if an employee does not live in rented accommodation.

- Leave Travel Allowance (LTA): Leave Travel Allowance (LTA) is an employer’s allowance to cover travel expenses during approved leave periods. To claim this allowance, employees must provide proof of travel. LTA is exempt from tax under Section 10(5) of the Income Tax Act.

- Special Allowance: The special allowance is a fully taxable component of the salary structure that provides employees additional financial compensation beyond their basic salary.

- Bonus: Bonuses are performance-based incentives employers provide to reward employees for their contributions. They are considered part of the gross salary and are fully taxable in the employee’s hands.

- Employee Contribution to Provident Fund: Both employers and employees contribute 12% of the employee’s basic monthly salary to the Employee Provident Fund (EPF). The employee’s contribution towards EPF is eligible for deduction under section 80C of the Income Tax Act.

- Professional Tax: Professional tax is a state-imposed tax on employment. The maximum professional taxa state can charge in a financial year is Rs 2,500. This tax is deducted from the employee’s salary and paid to the state government.

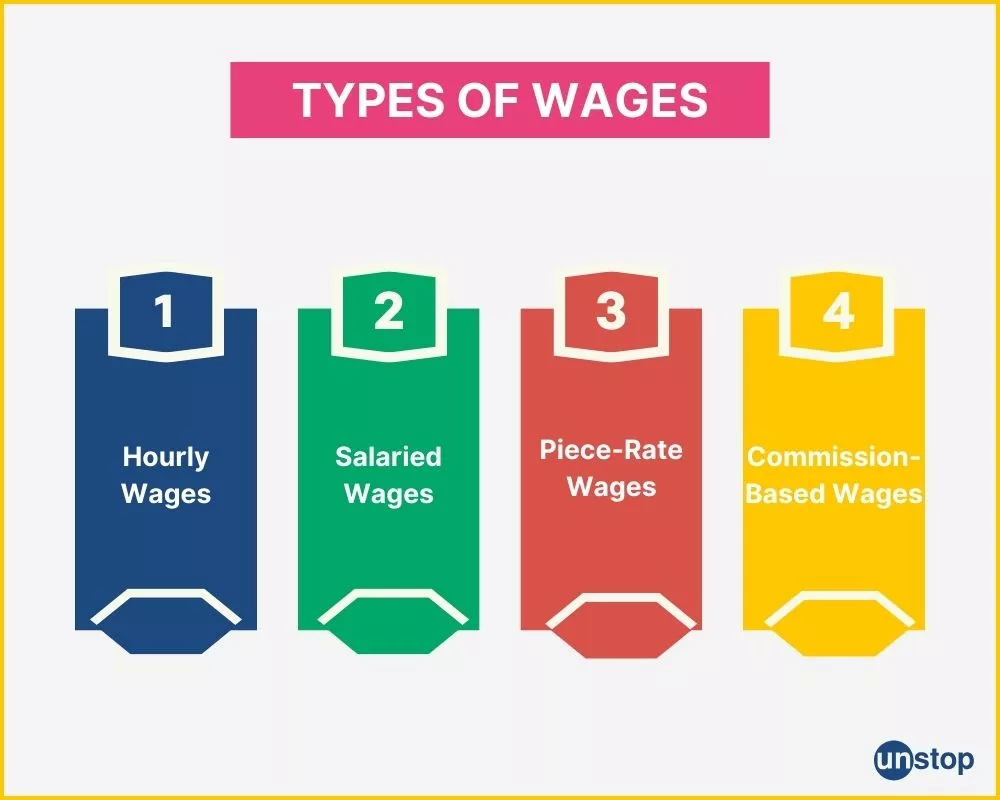

Types of Salary

Before delving into the intricacies of a salary calculator, it’s essential to grasp the meanings of basic salary, gross salary, net salary, and CTC.

- Basic Salary: Basic salary refers to the fixed amount paid to an employee before any deductions, increments, bonuses, or allowances. It remains constant and does not fluctuate like other elements of the CTC. The basic salary represents the employee’s in-hand earnings.

- Gross Salary: Gross salary denotes an employee’s total earnings within a financial year. This figure excludes deductions such as professional tax, income tax, or medical insurance premiums. However, it encompasses additions like bonuses, overtime pay, or holiday pay.

- Cost To Company (CTC): CTC, or Cost to Company, signifies the total salary package a company provides to its employees, directly or indirectly. It reflects the company’s overall expenditure on an employee throughout one financial year. You can calculate the CTC through a CTC calculator.

- Net Salary: Net salary, also known as take-home salary, shows the amount an employee receives after all deductions, such as provident fund contributions and taxes. Typically, the net wage is lower than the gross salary. However, it may be equal when the income tax liability is nil or the payable amount falls below the government’s tax slab thresholds. The gross wage incorporates various benefits like conveyance allowance, medical allowance, house rent allowance, etc.

Understanding the Salary Calculator

A salary calculator is a valuable tool designed to simulate and compute an individual’s take-home salary. It provides a comprehensive calculation of an employee’s total wage after all essential deductions have been made. The calculator typically includes a formula box where users input the Cost To Company (CTC) and any bonus included in the CTC.

The salary calculator then generates a breakdown of employer and employee provident fund contributions, professional tax, employee insurance premiums, and other applicable deductions. Ultimately, accounting for these deductions gives users an accurate estimate of their net take-home salary.

Salary Calculation Formulas

When determining your take-home salary, it’s crucial to understand the various components involved and the formulas used in the in-hand salary calculator. Here are some essential formulas to consider:

- Gross Salary Calculation:

- Gross salary = CTC – EPF – Gratuity

- Gratuity Calculation:

- Gratuity = (Basic Salary + Dearness Allowance) × 15/26 × Number of years worked for the company

- Taxable Income Calculation:

- Taxable Income = Gross Salary – EPF/PPF Contribution – Tax-free Allowance – HRA – LTA – Health Insurance – Tax-saving Investments – Other Deductions

- Net Salary Post Taxation/Take-home Salary Calculation:

- Net salary = Gross Salary – Income Tax – EPF Contribution – Professional Tax

Understanding these formulas enables you to estimate your in-hand salary accurately by accounting for various deductions and contributions.

Types of Salary Calculators Available

In India, various salary calculators are designed to meet different financial planning requirements. Here’s an overview of the primary categories:

- In-hand Pay Calculator: This calculator assists in determining your net salary by considering deductions such as Income Tax, Provident Fund (PF), and Professional Tax. After all necessary deductions, it provides a comprehensive view of your monthly take-home pay.

- Income Tax Calculator: Focused specifically on tax calculations, this tool helps estimate your annual tax liability based on your salary, allowable deductions, and exemptions per the Income Tax Act. It aids in tax planning and facilitates accurate filing of tax returns.

- NPS Calculator: Tailored for subscribers of the National Pension System (NPS), this calculator predicts the future pension and lump sum payouts from your NPS account. It considers contributions, anticipated returns, and annuity options to provide an estimate.

- Gratuity Calculator: This calculator computes the gratuity amount entitled to you upon cessation of employment, considering factors such as your tenure and final salary. It is a valuable tool for understanding the gratuity benefits at the end of your service tenure.

Exploring the Revolutionary Impact of Salary Calculator on Financial Planning

A salary calculator represents a transformative tool that can revolutionize how individuals approach financial planning. By offering precision in salary breakdowns, up-to-date tax laws, efficiency in time management, and in-depth financial planning assistance, it empowers users to make informed decisions and achieve financial goals effectively.

- Precision in Salary Breakdown: The salary calculator ensures error-free calculations, eliminating the risk of human error in salary computations. It meticulously accounts for every penny, providing users with accurate insights into their earnings. It keeps users updated with the tax regulations and changes in allowances, ensuring compliance with current calculations.

- Efficiency and Time Management: With instant results, the calculator delivers a comprehensive salary breakdown, deductions, and net pay within moments. This saves users valuable time and streamlines the process of calculating complex tax deductions, provident fund contributions, and other allowances, enhancing efficiency in financial management.

- In-Depth Financial Planning: The calculator offers invaluable assistance in budgeting, helping users understand their disposable income each month for better budgeting and expense management. Moreover, it facilitates tax planning by identifying potential tax-saving opportunities based on the salary structure, aiding in effective investment planning.

- Understanding Salary Components: As an educational tool, the calculator enables users to learn about different salary package components, enhancing their financial literacy. It provides insights into industry-standard salary structures, empowering users in salary negotiations with current or prospective employers.

- Personalization and Flexibility: Tailoring the calculator to specific salary components ensures personalized and relevant results for users. It allows for scenario analysis, enabling users to experiment with different salary scenarios and understand their impact on take-home pay, providing valuable insights for financial decision-making.

- Empowering Investment Decisions: By utilizing the insights from the salary breakdown, users can strategize their long-term investment plans effectively. They can also understand how their current salary impacts their retirement corpus, facilitating retirement planning and ensuring financial security in the future.

- User-Friendly Interface: The calculator features a simple and intuitive interface, making it accessible for individuals with varying levels of financial expertise. It offers easy navigation and ensures users can benefit from the platform’s features without complications.

- Regular Updates and Accessibility: Benefitting from regular updates, the calculator reflects the latest financial norms and regulations, ensuring users have access to accurate and relevant information. Its mobile-friendly nature allows users to manage their finances on multiple devices, providing flexibility and convenience. Additionally, its 24/7 availability ensures users can access the tool conveniently, fitting into their schedule and lifestyle seamlessly.

- Enhanced Financial Awareness: The calculator enhances users’ financial awareness by better understanding their net worth. Users can gauge their financial standing and make informed financial decisions by comprehending the exact breakdown of their earnings. Furthermore, they can compare their salary with industry standards to evaluate their market worth and career progress, empowering them in their financial journey.

Strategies to Increase Your Salary

By strategically implementing these approaches, individuals can enhance their earning potential and achieve their desired career growth trajectory.

Education Advancement: Investing in further education or acquiring additional qualifications relevant to your profession can significantly boost your earning potential. Staying updated with the developments in the industry through attending conferences, workshops, or pursuing relevant courses demonstrates commitment and expertise, which can lead to salary increments.

Accumulating Experience: Experience is often rewarded with higher salaries. As you accumulate years of experience within your industry or profession, employers are more inclined to offer salary increases. Your tenure in the field showcases your competence and capability, making you a valuable asset to the organization and increasing your bargaining power for higher remuneration.

Capitalizing on Performance Reviews: Regular performance reviews are opportunities to showcase your contributions and achievements within the organization. Positive feedback and commendations from your employer during these reviews can pave the way for salary increments. Engage in constructive discussions during performance evaluations, highlighting your accomplishments and outlining your contributions to the company’s success.

Negotiation Skills: Effective negotiation skills can lead to a higher pay package when entering a new job role or during salary renegotiations. Use your past achievements, qualifications, and market research for a higher salary. Articulate your value proposition to the employer, emphasizing your skills and potential contributions to the organization.

Job Transition: Exploring opportunities in the job market and considering job transitions can be a viable strategy to secure a substantial salary increase. Changing jobs allows you to leverage your experience, skills, and qualifications to negotiate competitive compensation packages offered by prospective employers. Evaluate job offers meticulously, considering salary, benefits, career progression, and work-life balance to make an informed decision.

Conclusion

Whether you’re venturing into a new job role or content with your current position, leveraging different calculators like monthly salary calculator or salary break-up calculator is essential for understanding your earnings breakdown. By utilizing this tool, you can dissect the components of your salary and their proportions relative to your total income, enabling you to make informed decisions about your financial future. Assessing your take-home pay empowers you to evaluate your disposable income and strategize effectively towards your financial goals. Therefore, embracing the assistance of a salary increment calculator is crucial for maximizing your financial well-being and achieving long-term stability.