What Is Financial Analytics & Why Is It Important?

Table of Contents

In this dynamic and fast-moving financial world, organisations are relying more and more on data-driven insights to make their strategic decisions. Financial analytics is a type of financial management that uses quantitative analysis to improve financial performance and manage risks in order to drive profitability. Businesses have a vast amount of financial data that can be analysed using advanced analytical strategies and tools to identify trends, make predictions, and support large-scale practical decisions. If you want to work in financial analytics, you’re in the right place.

To give you an overview of what financial analytics is, we have created this comprehensive blog. Here, we will also discuss why it is important and how aspiring professionals can perfect their careers in this field.

What is Financial Analytics?

Financial analytics refers to processes and techniques aimed at obtaining insights from financial data to support better decision-making. This field combines financial theories, statistical methods, and data analysis tools to provide insights that will improve financial performance. Some of the key components of financial analytics include:

1. Descriptive Analysis

This analyses past data to understand previous performance better. By studying past financial records, organisations can identify patterns and trends that will steer future strategies.

2. Predictive Analysis

This uses statistical algorithms and machine learning techniques to analyse historical data and make predictions about future financial performance. Predictive analytics helps businesses position themselves for future changes in the marketplace, understand market conditions, and anticipate changes in customer behaviour and risk levels.

Why Is Financial Analytics Important?

Financial analytics plays a crucial role in business intelligence and performance management, influencing various aspects of your organisation. It’s not just about numbers; it’s a powerful tool that helps your company forecast and strategies for the future. By utilising vast amounts of financial data and related insights, you can understand trends and make informed predictions that drive success.

1. Better Understanding of Financial Performance

One of the primary benefits of financial analytics is its ability to support data-driven decision-making. By utilising analytics, organisations can base their financial strategies on solid evidence rather than intuition or guesswork. This leads to more accurate forecasts and better resource allocation.

2. Optimising Your Processes

As a business owner, what do you want for your business? Not just functional stability but financial soundness, right? This is where financial analysis and reporting comes in. It guides you to optimise financial resources and find the most cost-effective suppliers. In marketing, analytics provides insights into effective strategies, fostering efficient resource allocation. This also makes your role more impactful, as financial analytics aligns operations with financial goals.

3. Risk Management

Financial analytics is essential for identifying potential risks using data and market trends, allowing organisations to prevent them before they become real-time problems. This is particularly important in today’s fluctuating economic conditions.

4. Measurement of Performance

Financial analytics enables companies to keep a close eye on their performance regarding key financial indicators. Continuous monitoring of these metrics helps organisations spot areas needing improvement and assess progress toward corporate financial goals. Ongoing assessments are key to obtaining a competitive advantage.

5. Cost-Cutting

Examining financial data at a micro level allows organisations to identify areas where they can be cost-effective. Financial analytics helps an organisation understand the nuances of its spending and keep eyes where cost structures could be optimised in the pursuit of profitability.

6. Strategic Planning

Financial analytics facilitates strategic planning by providing insights into future goals. Market trends and consumer behaviour inform organisations on tactics with which they can develop strategies that not only meet financial goals but also ensure future growth is sustainable.

Benefits of Financial Analytics

Fraud Detection and Prevention

Machine learning algorithms help financial institutions identify unusual consumer behaviour. This is valuable for enabling banks to take quick action to prevent potential losses for businesses and customers. With the rise of cybercrime, many banks have implemented algorithms to address issues arising from unusual activities by fraudsters.

Predictive Analytics and Planning

The algorithms used in predictive analytics utilise various data, such as customers’ past payment records, current financial strength, and market conditions, to predict whether a customer will pay on time. This type of data helps companies identify doubtful debts and debtors so they can manage their accounts accordingly.

Staying Competitive

The technological revolution is affecting every business and motivating them to outperform the competition. Financial statement analytics tools are easy to use, automated, and capable of integrating with existing systems. Business users can gain a competitive advantage by achieving greater efficiency and understanding the core tasks that require cognitive skills.

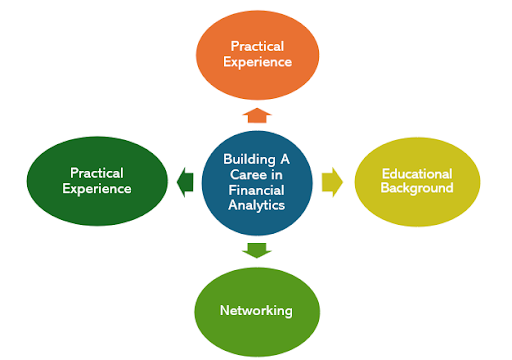

Tips To Build a Brighter Career Path in Financial Analytics

Due to the increasing demand for data-driven insights, a career in financial analytics is promising. Here are the steps for beginners and professionals alike who are willing to advance their careers in this domain:

1. Educational Background

A solid education is one of the key factors contributing to a successful career in financial analytics. Most professionals hold degrees in finance, accounting, economics, or data science. A degree in financial analytics or business analytics would also be beneficial.

2. Developing Analytical Skills

To work in financial analytics, one must develop strong skills. Knowledge of statistical methods, data analysis techniques, and financial modelling is essential. Familiarity with Excel, SQL, and data visualisation software such as Tableau and Power BI will further enhance your credentials.

3. Practical Experience

Experience is important in financial analytics. Look for internships or entry-level jobs that offer exposure to financial data and financial statement analysis tools. Such hands-on experience helps build a solid skill set that can enhance employability.

4. Networking

Networking is key to advancing your career. Attend industry conferences, workshops, and networking events to connect with professionals in your desired field. These connections can lead to mentorship or job referrals

How Jaro Education Can Help You Build Your Career

Jaro Education – a leading higher education and upskilling company, offers career counselling and support to launch your career in business analytics. Whether you’re starting your journey or looking to advance your career, Jaro Education is here to support you every step of the way.

With Jaro, you’ll get access to a range of exciting benefits:

- Best Suited Mentors: Learn with the top industry experts, mentors, and faculties to ensure you understand the latest business analytics techniques and technologies.

- Personalised Support: Receive support from an experienced counsellor for career development and academic decision-making.

- Doubt Resolution: Be a part of discussions and forums for enhanced learning

- Network Building: Get a chance to build networks with alumni and attend events.

Conclusion

Undoubtedly, financial decision-making has become a core component of success in this competitive business world. Across industries, the demand for financial analysts is increasing, making it a promising career choice with endless opportunities. If you want to gain skills and become an aspiring financial analyst, you can consider pursuing a master’s degree in business administration with a finance specialisation. This educational path will help you gain essential financial knowledge and analytical skills, enhancing your ability to make informed decisions in the financial sector. Additionally, practical experience through internships can further strengthen your expertise and employability in this competitive field.

Frequently Asked Questions

Financial analytics offers a base for strategic planning and forecasting by offering insights into past performance and future trends. This can aid your company in setting realistic goals, allocating resources efficiently, and planning for long-term growth.

Usually, financial analysts begin by focusing on a certain area of investment. They can choose the mix of investments for a company’s portfolio and eventually become portfolio managers as they gain expertise. They can also manage huge investment portfolios for individual investors by becoming fund managers.

Financial analyst employment is expected to increase by 9% overall between 2023 and 2033, which is much faster than the average for all occupations. Over the next ten years, an average of 30,700 financial analyst positions are expected to become available annually.

You can improve your analytical skills, by:

-

- Building up learning habits

- Focusing on mathematics

- Reading regularly

- Building up your observing powder

- Asking frequent questions.

1 thought on “What Is Financial Analytics & Why Is It Important?”

Great article! It effectively highlights the significance of financial analytics in driving informed decision-making and improving business performance.