Demystifying Financial Ratios: A Comprehensive Guide

Table of Contents

- jaro education

- 3, July 2024

- 1:30 pm

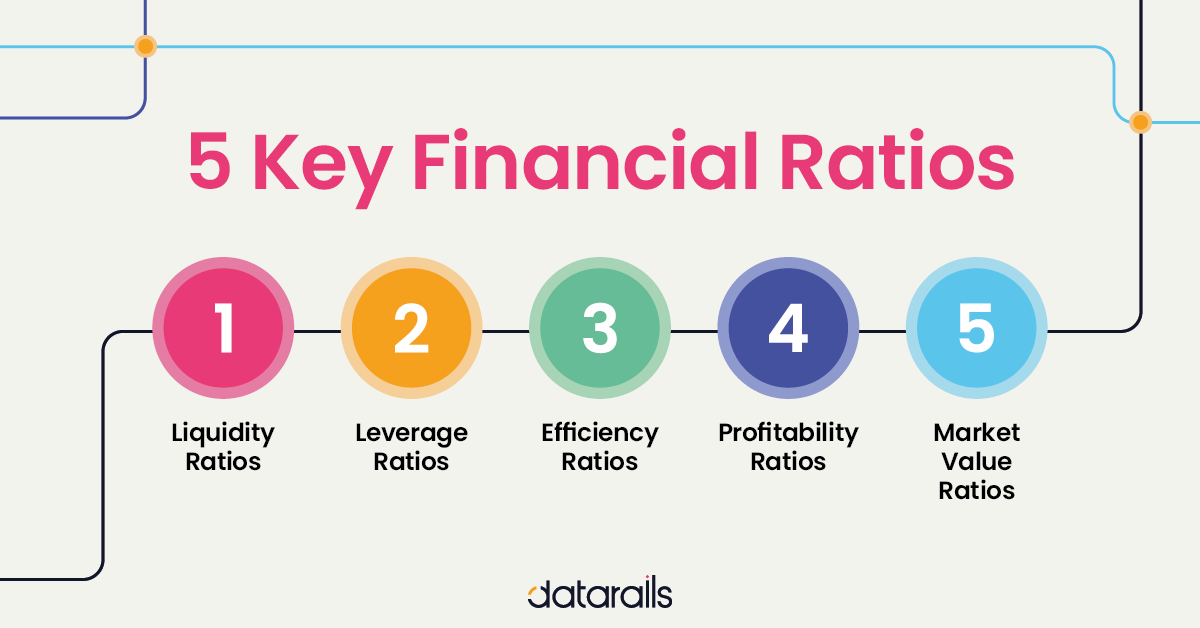

Financial ratios are essential for performing quantitative analysis to gain deeper insights into your organization. They help assess various aspects of your business, from profitability to market value, and are crucial for finance teams, investors, and analysts. Financial ratios are categorized into five main types: Profitability Ratios, Liquidity Ratios, Efficiency Ratios, Leverage Ratios, and Market Value Ratios. Each category includes specific ratios that provide valuable information about your business operations and financial health.

What is Ratio Analysis?

Ratio analysis is a quantitative method for examining a company’s financial statements, such as the balance sheet and income statement, to gain insights into its liquidity, operational efficiency, and profitability. It forms a cornerstone of fundamental equity analysis, enabling stakeholders to make informed decisions about a company’s financial health and performance.

What Does Ratio Analysis Tell You?

Ratio analysis serves several crucial functions for investors and analysts. By scrutinizing past and current financial statements, it allows them to:

- Evaluate Financial Health: Investors and analysts can assess a company’s overall financial condition, determining its ability to meet short-term and long-term obligations.

- Assess Performance Over Time: Comparative data from ratio analysis can highlight how a company’s performance has evolved, identifying trends and patterns that indicate improvements or deteriorations in financial health.

- Estimate Future Performance:Historical ratios can be used to project future performance, indicating likely future profitability, liquidity, and efficiency.

- Compare with Industry Averages: Ratios enable comparisons between a company’s financial standing and industry benchmarks, revealing how it stacks up against peers.

- Benchmark Against Competitors: By evaluating stocks within an industry, ratio analysis helps measure a company’s performance relative to its competitors.

Types of Financial Ratios

The five types of financial ratios are as follows:

datarails*

1. Profitability Ratios

Profitability ratios measure your organization’s ability to generate profit relative to various elements such as revenue, operating costs, balance sheet assets, and shareholder equity. These ratios are crucial for understanding your company’s overall efficiency and performance in generating earnings. Common profitability ratios include:

- Gross Profit Margin: Indicates the percentage of revenue that exceeds the cost of goods sold.

- Net Profit Margin: Measures the percentage of revenue that remains as profit after all expenses are deducted.

- Return on Assets (ROA): Evaluate how efficiently your company utilizes its assets to generate profit.

- Return on Equity (ROE): Assesses the profitability relative to shareholders’ equity.

2. Liquidity Ratios

Liquidity ratios gauge your company’s ability to pay its current debts without raising additional capital. These ratios are vital for understanding your business’s short-term financial stability and operational efficiency. Key liquidity ratios include:

- Current Ratio: Compares current assets to current liabilities to determine if the company can cover its short-term obligations.

- Quick Ratio: This ratio is similar to the current ratio but excludes inventory from current assets, providing a more stringent measure of liquidity.

- Cash Ratio: Measures the company’s ability to pay off short-term debt with its most liquid assets, i.e., cash and cash equivalents.

3. Leverage Ratios

Leverage ratios determine how much your organization relies on debt to finance its growth and operations. These ratios are important for assessing your business’s financial risk and capital structure. Key leverage ratios include:

- Debt-to-Equity Ratio: This ratio compares total debt to shareholders’ equity, indicating the proportion of equity and debt used to finance assets.

- Debt Ratio: Measures the percentage of total assets financed by debt.

- Interest Coverage Ratio: Assesses the company’s ability to pay interest on its outstanding debt from its operating income.

4. Market Value Ratios

Market value ratios calculate the current share price of a publicly held company, aiding investors in evaluating whether the shares are overpriced or underpriced. These ratios provide insights into the market perception and valuation of your business. Common market value ratios include:

- Price-to-Earnings (P/E) Ratio: This ratio compares the company’s current share price to its earnings per share (EPS).

- Market to Book Ratio: Evaluates the market value of a company’s stock relative to its book value.

- Dividend Yield: Measures the annual dividends paid to shareholders relative to the share price.

Key Benefits of Ratio Analysis

The key benefits of ratio analysis are as follows:

- Accessibility: Investors can easily use ratio analysis, as every figure needed to calculate the ratios is found in a company’s financial statements.

- Comparative Evaluation: Ratios serve as comparison points, enabling evaluations of companies within the same industry and assessments of a company’s current performance against its historical numbers.

- Management Strategy Insights: Understanding the variables driving ratios is crucial since management can alter strategies to present more attractive stock and company ratios.

- Holistic View: Ratios are typically not used in isolation but in combination with other ratios, providing a comprehensive view of the company’s financial health from different angles.

- Spotting Red Flags: A well-rounded knowledge of the ratios across various categories helps identify potential red flags that might indicate financial instability or inefficiency.

Application of Ratio Analysis

Ratio analysis involves comparing multiple financial figures to derive a calculated value. This value may hold little significance. Instead, the true utility of ratio analysis emerges when these values are compared to benchmarks, historical data, or industry standards to determine a company’s financial health, whether it is strong, weak, improving, or deteriorating.

Ratio Analysis Over Time

Performing ratio analysis over time allows a company to gain insights into its financial trajectory. Rather than focusing solely on the present, the company can evaluate past performance, identify effective changes, and assess ongoing risks for future planning. This longitudinal analysis is crucial for making long-term strategic decisions.

To conduct ratio analysis over time, a company selects a specific financial ratio and calculates it on a regular schedule, such as monthly or quarterly. Consider seasonality and temporary fluctuations that might affect month-over-month ratio calculations. The company then analyzes how the ratio has evolved, examining whether it is improving, the rate of change and whether the desired changes align with strategic goals.

Ratio Analysis Across Companies

Ratio analysis is also valuable for comparing a company’s performance against its competitors. For example, a company might feel satisfied with a particular financial ratio until it realizes its competitors are achieving significantly better results. This comparative analysis helps a company understand its relative performance within the industry.

To implement ratio analysis effectively across companies, it is essential to compare similar companies within the same industry. Considerations should include capital structure differences and company size, as these factors can influence efficiency and financial ratios. Additionally, companies with diverse product lines might exhibit varying impacts on ratio analysis. For instance, a technology company offering both products and services will have different ratio implications compared to one focusing solely on products.

Different industries have distinct ratio expectations. A debt-equity ratio considered normal for a utility company, which can obtain low-cost debt, might be viewed as unsustainably high for a technology company that relies more on private investor funding.

Conclusion

Financial ratio analysis is a powerful tool that provides a comprehensive view of a company’s financial health, performance, and efficiency. By examining various financial ratios, investors, analysts, and management can gain valuable insights into a company’s liquidity, profitability, efficiency, leverage, and market value. These ratios serve as essential benchmarks for evaluating a company’s financial condition, comparing it to industry standards, and identifying areas for improvement. By conducting ratio analysis over time, across companies, and against benchmarks, stakeholders can make informed decisions about a company’s financial health and performance, ultimately driving strategic planning and growth.

To learn more about financial ratios and other components of corporate and strategic finance, you can choose IIM Mumbai’s Executive Certificate Programme in Corporate & Strategic Finance. It is designed to equip seasoned finance professionals and aspiring leaders with a deep understanding of key financial concepts, strategies, and ratios. The programme emphasizes experiential learning through hands-on exercises, case studies, and interactive sessions, providing a comprehensive view of financial health and performance.