What Are the Five Methods of Financial Statement Analysis?

Table of Contents

- jaro education

- 7, August 2024

- 9:00 am

Financial statement analysis plays a vital role in evaluating a company’s financial well-being and operational performance. It involves systematically examining financial documents such as the income statement, balance sheet, and cash flow statement to gain insights into aspects like profitability, liquidity, efficiency, solvency, and overall financial stability. This analytical process is essential for investors, creditors, analysts, and stakeholders who need to make well-informed decisions regarding investments, credit risk, operational efficiency, and strategic planning.

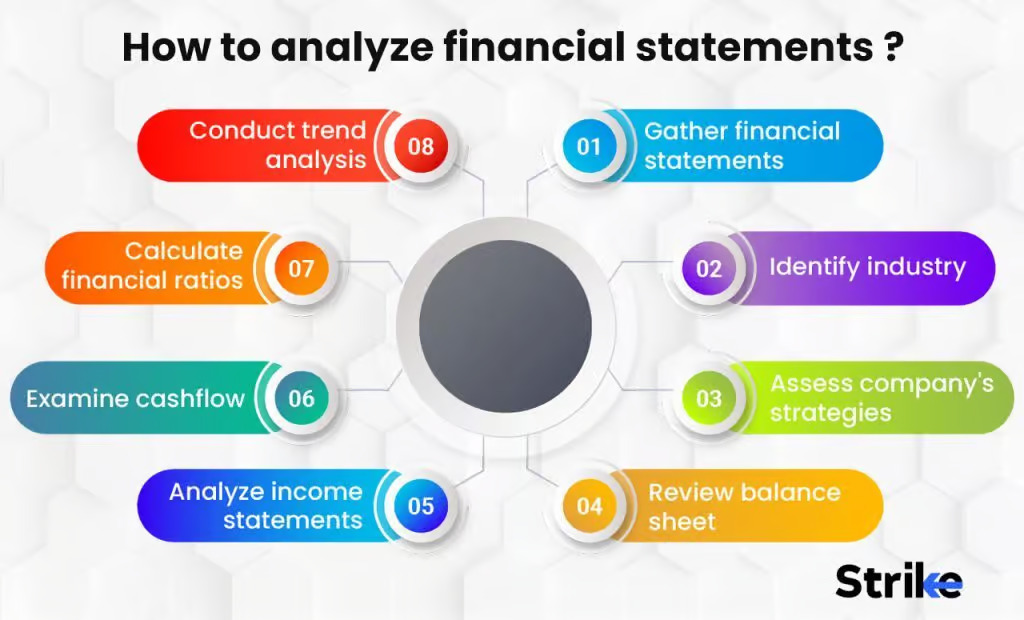

The field of financial statement analysis encompasses a range of methods and tools designed to comprehensively interpret and assess financial data. These methods not only aid in understanding a company’s current financial status but also offer insights into its historical performance and future prospects. In this comprehensive exploration, we will delve into the primary methods of financial statement analysis: horizontal analysis, vertical analysis, ratio analysis, cash flow analysis, and comparative analysis. Each of these methods provides unique perspectives and metrics that collectively contribute to a thorough evaluation of a company’s financial position and operational efficiency.

*Strike

1. Horizontal Analysis

Horizontal analysis, also known as trend analysis, is one of the methods of financial statement analysis that involves examining financial data over multiple periods to identify trends, patterns, and changes over time. Its purpose is to evaluate a company’s performance and growth trajectory by analyzing historical financial statements like income statements, balance sheets, and cash flow statements across consecutive years or quarters. This method helps analysts track the evolution of key financial metrics to understand how the company’s financial health has evolved and to spot trends that could impact future performance.

Methodology:

To conduct horizontal analysis, analysts calculate the percentage changes in financial statement line items from one period to another. For example, if a company’s revenue increased from $1 million in Year 1 to $1.2 million in Year 2, the horizontal analysis would reveal a 20% increase in revenue.

Purpose:

Horizontal analysis is one of the methods of financial statement analysis that provides insights into the direction and magnitude of changes in financial data. It helps stakeholders understand trends in revenue growth, cost management, profitability margins, and efficiency improvements over time. By identifying positive or negative trends, analysts can assess the company’s financial stability and forecast future performance.

2. Vertical Analysis

Vertical analysis, also known as common-size analysis, focuses on the relative proportions of financial statement line items within a single period. Unlike horizontal analysis that compares data across periods, vertical analysis examines the composition of financial statements by expressing each line item as a percentage of a base figure—typically total revenue or total assets.

Methodology:

In vertical analysis, each line item on the financial statement is converted into a percentage of the base figure. For instance, if total revenue is used as the base figure, all other line items on the income statement (e.g., cost of goods sold, operating expenses) are expressed as a percentage of total revenue.

Purpose:

Vertical analysis helps in understanding the structure and composition of financial statements. It highlights the relative significance of various expenses, assets, liabilities, and equity components within the financial framework of the company. By comparing percentages, analysts can identify trends in cost structures, profitability drivers, and capital allocation strategies.

3. Ratio Analysis

Ratio analysis is one of the methods of financial statement analysis that involves the calculation and interpretation of various financial ratios derived from data in financial statements. Financial ratios are quantitative indicators that provide insights into different aspects of a company’s financial performance, efficiency, profitability, liquidity, and solvency. Analysts use ratio analysis to assess the company’s operational efficiency, financial health, and overall management effectiveness.

Common Types of Ratios:

- Liquidity Ratios: Measure the company’s ability to meet short-term obligations.

- Profitability Ratios: Evaluate the company’s ability to generate profits relative to sales, assets, or equity.

- Activity (Efficiency) Ratios: Assess how effectively the company utilizes its assets to generate revenue.

- Solvency (Leverage) Ratios: Evaluate the company’s long-term financial viability and ability to meet long-term obligations.

Methodology:

To calculate ratios, analysts use formulas that involve dividing one financial metric by another. For example, the current ratio, a liquidity ratio, is calculated by dividing current assets by current liabilities.

Purpose:

Ratio analysis enables stakeholders to benchmark the company’s performance against industry standards, historical data, and competitors. By interpreting ratios, analysts can identify strengths, weaknesses, opportunities, and threats facing the company. Ratio analysis facilitates informed decision-making regarding investment opportunities, credit risk assessment, operational efficiency improvements, and strategic planning.

4. Cash Flow Analysis

Cash flow analysis is a method of financial statement analysis that examines the inflows and outflows of cash within a company over a specific period, as reported in the cash flow statement. It focuses on the sources and uses of cash generated from operating activities, investing activities, and financing activities. According to a recent study by Corporate Finance Group, the cash flow statement is considered by many investors to be the most important indicator of a company’s performance. Cash flow analysis provides insights into the company’s liquidity position, financial flexibility, and ability to generate cash to fund operations, investments, and debt obligations.

Methodology:

Cash flow analysis involves reviewing and interpreting the cash flow statement to assess trends in cash flows from operating, investing, and financing activities. Analysts analyze net cash flow, operating cash flow, free cash flow, and cash flow adequacy relative to capital expenditures and debt repayments.

Purpose:

The primary purpose of cash flow analysis is to evaluate the sustainability of a company’s cash flow and its ability to meet financial obligations. By understanding cash flow patterns, analysts can assess the company’s liquidity risk, cash flow volatility, and capacity to pursue growth opportunities. Cash flow analysis is crucial for financial planning, budgeting, and forecasting future cash flows.

5. Comparative Analysis

Comparative analysis is one of the methods of financial statement analysis that involves comparing the financial performance and metrics of a company with its competitors, industry peers, or historical data. The objective is to benchmark the company’s performance, profitability, efficiency, and financial strength against relevant benchmarks and industry standards. Comparative analysis provides insights into competitive positioning, market share, operational efficiency, and strategic advantages or disadvantages.

Methodology:

To conduct comparative analysis, analysts gather financial data from comparable companies within the same industry or sector. They compare key performance indicators (KPIs), financial ratios, profitability margins, and market valuations to assess relative strengths and weaknesses.

Purpose:

Comparative analysis helps stakeholders understand how the company performs relative to its peers and industry leaders. By identifying performance gaps, competitive advantages, and areas for improvement, analysts can recommend strategic initiatives, operational efficiencies, and investment decisions. Comparative analysis supports competitive benchmarking, market positioning, and performance evaluation across different economic cycles.

Importance of Financial Statement Analysis

Understanding these methods allows stakeholders to make informed decisions regarding investments, credit decisions, and strategic planning. Whether you’re an investor assessing the financial health of a potential investment, a creditor evaluating creditworthiness, or a manager seeking to improve operational efficiency, financial statement analysis provides the necessary tools to navigate complex financial landscapes.

For professionals seeking to enhance their analytical skills in strategic financial management, programmes like the IIM Kozhikode – Professional Certificate Programme in Strategic Sales Management and New Age Marketing offer specialized training in complementary areas of business strategy and analytics. This programme provides invaluable insights into modern business practices, such as financial statement analysis enhancing your ability to make informed financial decisions.

Conclusion

Financial statement analysis plays a crucial role in evaluating a company’s financial health, performance, and future prospects. Through methods like horizontal analysis, vertical analysis, ratio analysis, cash flow analysis, and comparative analysis, stakeholders can gain comprehensive insights into different facets of a company’s financial status and operational efficiency. Each of these methods of financial statement analysis offers distinct perspectives and tools for assessing profitability, liquidity, efficiency, solvency, and competitive positioning.

Mastering these five methods of financial statement analysis empowers investors, creditors, analysts, and managers to make well-informed decisions concerning investment opportunities, credit risk evaluation, operational enhancements, and strategic planning. By effectively applying financial analysis techniques, stakeholders can improve decision-making processes and contribute to sustainable business growth and profitability.

In conclusion, proficiency in financial statement analysis is indispensable for navigating the complexities of the business landscape and making informed decisions that foster long-term success and profitability.