Debt vs. Equity Financing: Understanding the Trade-Offs

Table of Contents

- jaro education

- 14, April 2024

- 10:00 am

The school of business studies is constantly weighing the proposition of debt financing vs. equity financing. This comparison is essential for emerging global markets, where new MNCs and e-commerce platforms are cropping up daily to meet consumer needs and preferences. Debt and equity are factors companies can use to raise investment funds. So, understanding the critical aspects of these two financial approaches is vital for making informed financial decisions.

All companies have a choice regarding debt or equity financing. This selection frequently hinges on which funding source is easily accessible, be it sources of equity financing or debt financing, its cash flow, and the significance of control mechanisms in the hands of principal owners. The inherent debt-to-equity ratio reveals the extent of a company’s proportionate financing ascertained by debt and equity.

Fundamental Comparison of Debt Financing vs Equity Financing

Debts and equity are two types of capital companies use for their financial needs. The difference between debt financing and equity financing is that debt involves borrowing money for a specific period, which the business must repay with interest. In contrast, equity entails raising capital by selling shares and parting with a portion of ownership and control.

Several factors determine the selection between debt and equity financing. These elements are as under:

- The capital cost

- Debt capacity of the business

- Dilution of the ownership

- Tax considerations

To illustrate, a company might opt for debt financing if it has a sizable debt capacity and borrows less than the equity cost. Alternatively, a business may be attracted to equity financing if the owners intend to avoid incurring debts or prospective shareholders agree to pay a premium for ownership.

Advantages and Disadvantages of Debt vs Equity Financing

An extensive evaluation of the benefits and drawbacks while comparing debt financing vs equity financing may contribute to superior financial results in the interest of the business. The following are some selective advantages and disadvantages of debt vs equity financing:

Pros

Debt Financing

- Repayment of interests is tax-deductible

- Absence of ownership dilution

Equity Financing

- Repayment of interests is tax-deductible

- Absence of ownership dilution

Cons

Debt Financing

- Debt financing attracts high-interest rates and potentially increases business risk.

Equity Financing

- Equity financing may lead to ownership dilution and demand the active involvement of shareholders.

You can visualize a scenario where a company depends heavily on debt financing. It suddenly experiences an economic upheaval, resulting in a notable decline in its revenue. The company might find it challenging to meet its debt obligations in these circumstances, eventually leading to bankruptcy. Conversely, a company with mainly equity funding encounters relentless shareholder pressure to generate profit.

Understanding the Trade-offs

The concept of trade-offs regarding capital structure is a crucial framework that answers the questions raised by financial leaders for opting for specific capital structures. They might observe an optimal debt-equity ratio where the marginal gains of debt equals the marginal cost. The trade-off theory of debt financing vs equity financing reiterates the presence of an optimal capital structure.

This theory puts forward the reality that companies trade off the advantages of receiving more debts, like tax shield benefits, against the costs that stem from potential bankruptcy. The tax shield gains come in the scenario because interest payments on debts are tax-deductible. This element of slashing tax minimizes a business’s tax liability and successfully serves as a tax shield.

Therefore, when analyzing the capital structure, companies should consider these factors and appropriately choose a combination of debt and equity that reduces their entire financing cost and boosts their asset values. The capital structure theory entails a pre-existence of optimal capital structure where the cost of capital is negligible, and the business’s market value is always high. Such optimal capital structure prevails where marginal gains from a surplus unit equals the marginal cost, as shown below:

MB=MC, where MB denotes marginal gains arising from an additional unit of debt, and MC represents the marginal cost of additional debt (increased possibility of financial distress).

Challenges of Trade-Offs in Debt and Equity Financing

Even though the trade-off theory provides a logical dimension for choosing a capital structure, it still has criticisms and challenges. Two significant drawbacks arising from the assumptions play a big role.

First, the trade-off theory assumes that markets are ideally favorable. It implies that market price always coincides with intrinsic value. However, this assumption only sometimes holds and is prone to producing inaccurate results when the market price does not replicate the inherent value.

The second challenge springs from the complexities of the natural world that the capital structure theory fails to transform into practicality. The theory anticipates that companies carry a single target debt ratio. However, in reality, these businesses typically possess a multitude of acceptable values. Besides, it does not cater to transaction costs related to capital structure adjustments. Also, it does not undertake the agency costs that emerge due to companies’ separation of ownership and control.

Impact of Business Risks on Capital Structure Decisions

The selection of capital structure may have a massive impact on business risk. Debt financing is primarily responsible for it because it demands mandatory refunds in a given period. Committing to periodic and regular business interest payments augments business risk as it requires procuring additional financial resources regardless of the company’s economic performance.

- Substantial debts can contribute to enhanced financial risks. It may be the risk of insolvency, as the company might need more sources of economic means to cater to its long-term commitments.

- The elements of debt obligations can compel a business to enter external bankruptcy proceedings if it does not comply with the contractual commitments.

- An overreliance on equity financing may dilute company ownership and abolish the owner’s right to control the business. Also, intermittent dividends will result in a remarkable reduction in earnings per share, which may adversely affect the company’s market perception.

- High levels of equity financing can eliminate risk, as equity does not mandate repayments like debt financing. However, a complete reliance on equity financing might inflate the capital cost and, in turn, depreciate the business’s value.

The above shows that a well-balanced capital structure coinciding with the company’s risk profile and operational model should minimize business risks and propel financial stability.

Risk Evaluation: Debt Financing vs Equity Financing

When comparing debt financing vs. equity financing, you should understand that each aspect has potential risks that the market leaders should thoroughly analyze. Comprehending these risk elements can contribute to making successful strategic financing decisions. Let’s understand the risks associated to equity and debt financing.

Equity Financing Risks

Equity financing appears more straightforward as it does not include repayment, unlike debt financing. Still, you cannot guarantee that this financing class is risk-free.

The fundamental concern in equity financing is the dilution of ownership. Companies issue fresh shares to raise funds, increasing the frequency of the total number of shares in circulation. This profound rise can reduce the ownership proportion of existing shareholders. If a business firm consistently raises money through equity financing, the stake of the company’s original owners may shrink to a negligible amount.

Besides, control and decision-making power also disappear in equity financing. New shareholders dominate the scene as they get voting rights and might suggest unique ideas about business operations. This situation may lead to internal conflicts that impact business stability.

There is also another risk: issuing dividends. Irrespective of legal bindings, companies usually release periodic dividends to shareholders through return on investments. This practice can dry up valuable financial resources, affecting cash flow.

Finally, equity financing carries the risk of disclosure of business financial information. Publicly traded firms are legally obligated to disclose their financial performances, which might help their rivals receive strategic information in their favor.

Aside from these primary risks, finance professionals must consider a few minor risk factors equally critical. For example, volatility in share prices can be a substantial risk. The market price of corporate shares can fluctuate significantly depending on business performance, the prevailing economic plight of the nation, and investors’ state of mind. This element of volatility may cause shareholders to lose a large portion of their invested money or even their primary investment.

Further, securing equity financing might indicate handling angel investors or venture capitalists. These categories of investors may have substantial expectations from the company. They may force the business authorities to provide a quick ROI. The company may react and adopt shortcut strategies or make impulsive decisions.

The risk of overcapitalization is another risk factor. It implies possessing excess capital than needed. It may look gainful but ultimately prove to be a waste of resources and relaxation in financial spending. The business performance will eventually decline.

Debt Financing Risks

The foremost risk associated with debt financing is the liability to repay the business debt. Debt financing mandates that firms repay the borrowed money with accrued interest irrespective of financial performance or stability. This mandatory clause can exert pressure and cause financial strain on company management, leading to financial insolvency if not managed efficiently.

The fluctuation in the interest structure can also be alarming. Even though fixed interest rates can provide solidarity in the context of repayment schedules, variable interest rates can enhance the cost of borrowing if the interest rates in the prevailing market are soaring.

Moreover, debt financing can amplify losses through financial leverage. The more debts a business carries, the more likely it is to struggle for earnings during an economic downturn or boost them during an economic upturn. In case of substantial loss, the business can further experience a financial setback and reach a point of no return.

Similar to equity financing, some minor dangers associated with debt financing intensely impact a company profile. One of the prominent risks in this regard is the covenants that include the loan conditions. These covenants are compulsory terms and conditions that corporate borrowers must follow throughout the loan tenure, like the upkeep of some specific financial ratios. The business may unintentionally violate any of the covenants. However, it can lead to severe penalties or bind the company to repay the entire loan amount instantly.

After liquidation or insolvency, companies usually prefer to pay secured creditors first instead of unsecured creditors and shareholders. This means that shareholders may stay upright if the company’s assets are adequate to cover the pending debts.

Finally, debt financing can restrict business owners’ capacity to secure future surplus financing. A significant level of indebtedness can make a company financially vulnerable, and prospective investors may stay away until they feel there is an ideal investment environment.

Debt vs Equity Financing Tax Implications

Both debt and equity financing outlooks possess diverse tax implications that can distinctly influence the financial planning and strategy of a business entity. When the majority of company owners contemplate on raising business capital, they fundamentally account for the extent of funds they can secure. Still, it is correspondingly paramount to consider the classes of tax benefits each financing process can generate. Most of the companies usually organize and manage their financing strategies to optimally capitalize on their tax benefits.

Yet, finance professionals must remember that these tax implications arising when comparing debt financing vs equity financing could either be beneficial or disadvantageous depending upon some specific scenarios and conditions of the business, existing rules of the land, and fluctuating tax environment. Tax benefit construes a reduction in tax liabilities that an individual or a legal entity (company) can avail themselves of through the provisions of native tax regulations.

Tax Implications: Debt Financing

In debt financing, you may encounter interest expenses, which denote the cost of borrowed funds. These expenses are deductible from the business’s taxable income. However, while interest deductibility may seem highly appealing and impressive, one should note that these deductions are only effective if the company is performing well with optimum revenue generation. Taxable income will only be accumulated if the business has been profit-making for a long time. Therefore, the question of tax deduction of interest expenses does not arise.

Additionally, another vital factor to consider is that despite the provision of tax deductibility of interest expenses, the company must adhere to the norms of repayment of the principal amount to the creditors. The repayment of principal debt does not offer any tax benefits. Therefore, the company owners involved in substantial debt financing must balance these factors cautiously and judiciously.

Tax Considerations: Equity Financing

Unlike the debt financing approach, equity financing does not facilitate instant tax benefits. As an aspiring finance executive, you may know that dividends (payments disbursed to shareholders from business profits) are not tax-deductible. Instead, they tend to attract tax at corporate and individual levels, such as when shareholders receive a chunk of company profits.

However, on a positive note, a company or corporate entity need not pay dividends to its shareholders if it does not profit in a given financial year. This relaxation can benefit businesses during periods of economic and financial setbacks or when company management desires to reinvest its profits into the business in the larger perspective.

A notable development in tax law in the United Kingdom was the promulgation of SSE (Substantial Shareholdings Exemption) in 2002. The SSE framework exempts companies from corporate tax on gains or losses. It is based on disposing of a sizable shareholding in another company, provided they meet varied qualifying conditions. The SSE exemption has become a global regulation in the TCGA (Taxation of Chargeable Gains Act), 1992, Schedule 7AC.

Given the intricacy of any country’s tax structure, its progressive evolution, and the fluctuating tax implications of diverse financing approaches, financial experts always recommend that companies seek advice from reputable financial professionals and institutions to distinguish the most appropriate financing method.

Sources of Debt and Equity Financing

While comparing debt financing vs equity financing, it is clear that while more significant and prominent companies can rely on conventional bank loans to fund their growth ventures, startups and middle-market businesses depend on other genres of debt financing.

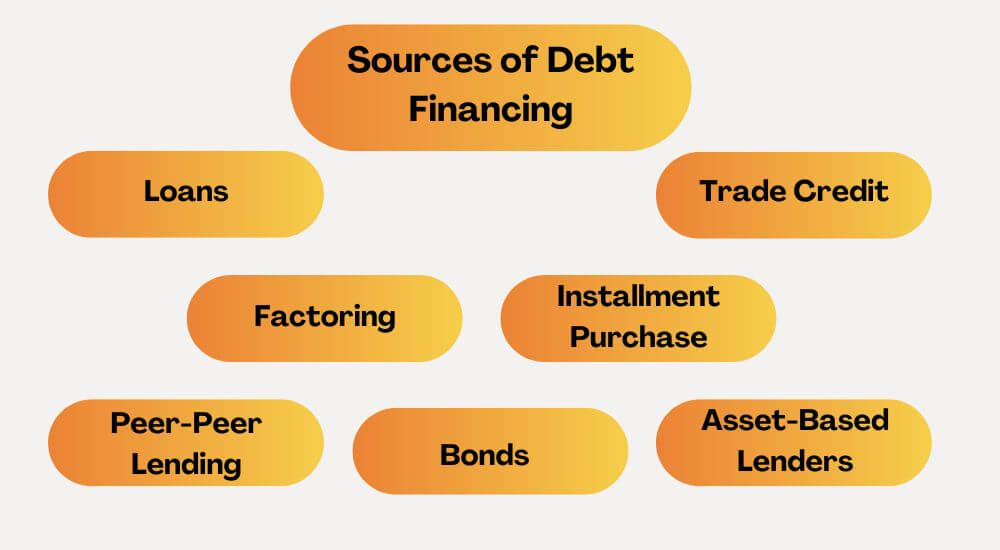

Debt Financing

In the debt financing domain, the following are some selective traditional sources of loan:

*invyce.com

Recurring Revenue Lending

This SaaS (Software as Service) credit funds companies as participants in their MRR (monthly recurring revenue). The amount of accessible funds fluctuates based on the revenue generated through client subscriptions.

Non-Bank Cash Flow Lending

This lending category analyses factors such as investment history, credit history, profits and cash flow. Then, the approval will be given after ascertaining loan viability.

Bank Loans

When banks assess companies for disbursing conventional loans, they stringently check the parameters like credit and investment history, profit consistency per financial year for a given time frame and business assets.

Loans from Financial Institutions

This loan class is most suitable for small and middle-market businesses and is the most common loan provider in the country. Small companies with a proven track record may qualify for these loans.

Bonds

Distinguished companies rely on bonds when capital is generated by investors who buy bonds from the companies that float them to receive funds for their financial requirements.

Debentures

A debenture functions precisely like a bond, but the main difference is that it is not backed by any collateral but by the borrower’s reputation. Therefore, debentures are high-risk and high-reward investments, and repayment involves higher interest rates than regular bonds.

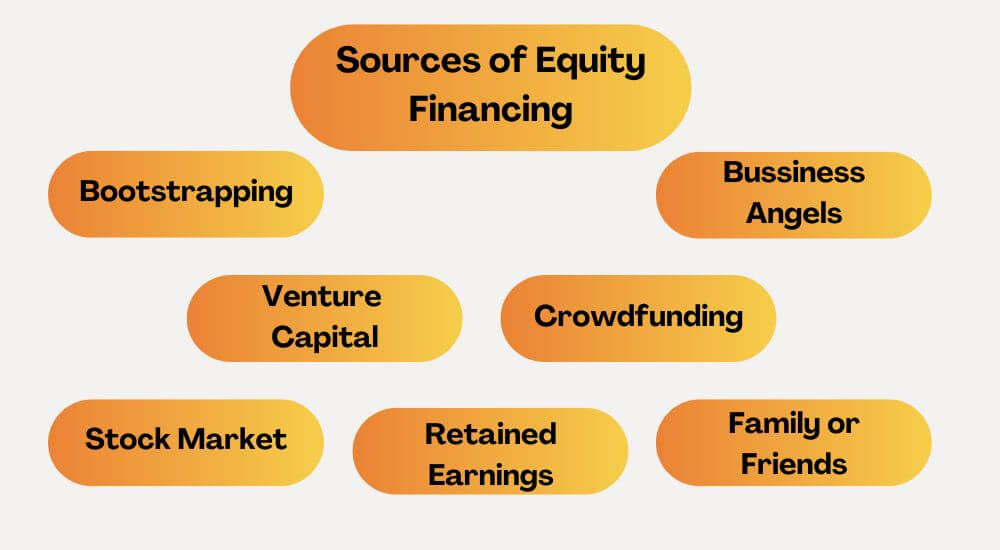

Equity Financing

There are various sources of equity financing. Some of them are as follows:

*invyce.com

Venture Capital

It is also known as private equity finance. High-growth businesses frequently use venture capital to raise money for sale or flotation in the stock market and seek more significant investments in return for equity.

Business Angels

BAs relate to wealthy groups of individuals who prefer to invest in high-growth businesses. They are experienced entrepreneurs who bring in their in-house skills, contacts, knowledge, and funds.

Enterprise Investment Scheme

EIS signifies a notable financial approach for limited companies. This scheme applies to small companies engaged in a qualified trade.

Stock Market

Companies can raise equity funds after joining the stock market territory. A functional share market listing can assist companies in accessing the capital they desire for further growth.

Conclusion

Debt and equity financing are the fundamental ways modern businesses adopt for funding. Company owners must decide which financing type is ideal for running their business. The essential factors are business objectives, risk tolerance, and control. Usually, startups prefer equity financing, while established businesses can opt for debt financing as they are capable of hassle-free repayments due to their infallible credit rating.

Want to learn further about debt financing vs. equity financing to gain professional proficiency? Enroll in the Executive Certificate Programme in Corporate & Strategic Finance offered by IIM Mumbai. The course contains critical learning that is most beneficial for aspiring market leaders and finance professionals. To know more, contact Jaro Education.