Capital Structure: Definition, Types, Importance & Examples

Table of Contents

- jaro education

- 27, September 2023

- 4:00 pm

Capital structure is the combination of equity and debt that is employed to finance the operations and assets of the company. In business, equity is a long-term and expensive source of financing offering greater flexibility. On the other hand, debt is a cheaper capital market source that legally binds a company to make specific cash flows on a predetermined timetable with the need to refinance at an unknown cost in the future. When the capital structure is optimal, there will be a trade-off between the cost-effectiveness of debt in comparison to the greater cost of equity and the costs of a financial crisis.

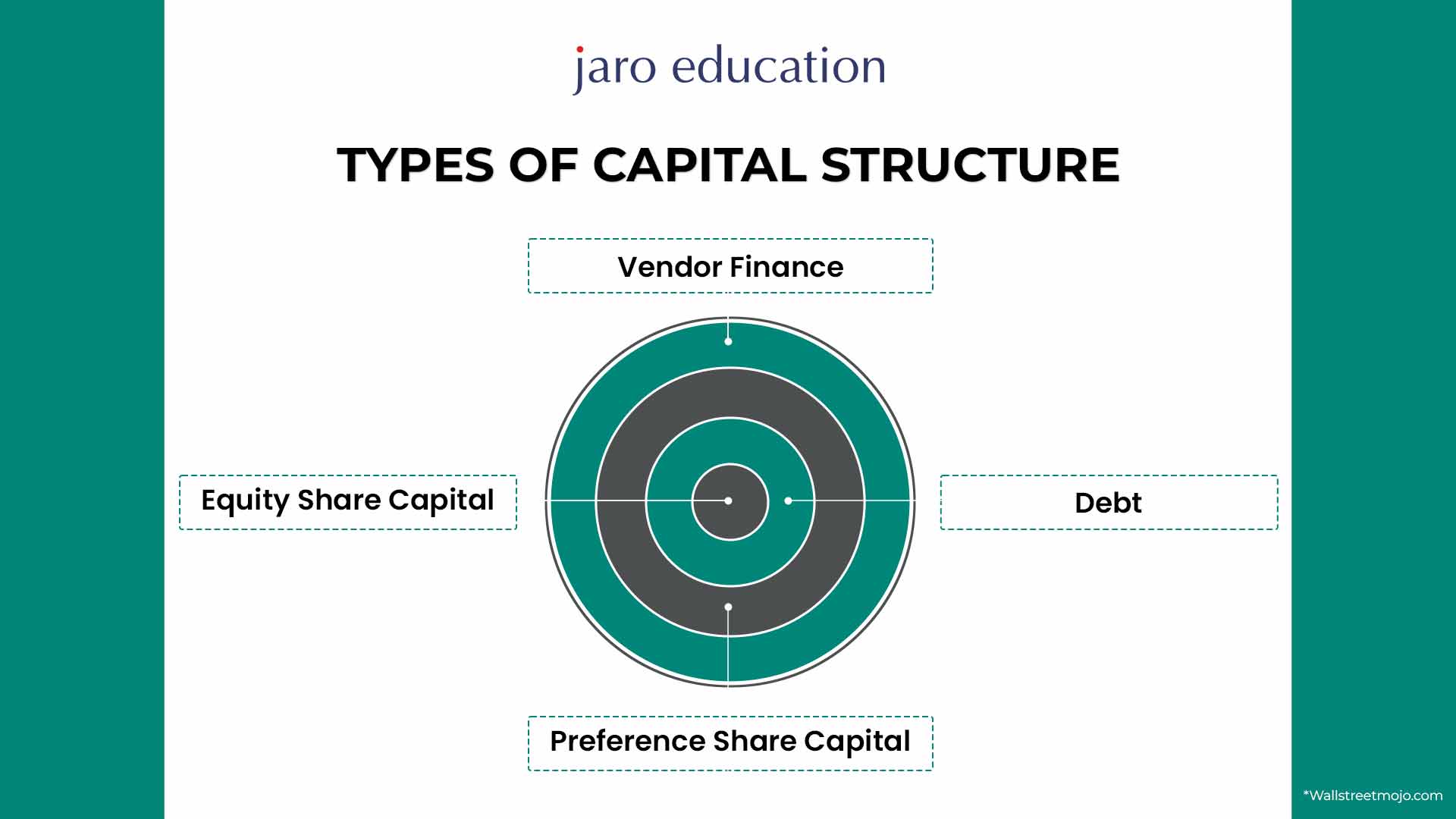

Types of Capital Structure

It is crucial to be familiar with the different forms of capital structure in order to evaluate a company’s state and its prospects. Below are the types of capital structure:

1. Debt

Debt capital includes the procurement of financial capital budgeting by the business entity. This could be in any form: loans, bonds, and debentures. These refer to funds companies have obtained from other unconnected sources on agreed terms and conditions, whereby the borrowing company is supposed to return the borrowed sum, together with some extra amount in the form of interest, within some stipulated duration. Despite this, debt financing has certain advantages, including tax benefits in that interest rates are recoverable as expenses.

However, it also incurs credit risk since, under this type of facility, the borrower is expected to pay the principal with interest, which puts a strain on cash flow if not properly managed.

2. Equity Share Capital

Equity share capital shows the ownership of the company and is issued when the company floats its share in the market. Those who invest in equity shares become part owners of the company and can even receive a part of the profits of the company, which may be in the form of dividends. Unlike debt, equity does not involve regular payments, which is why it can have a flexible type of financing.

Nevertheless, offering equity can water down the stock stakeholders and will generally affect the control of the original owner.

3. Vendor Finance

Vendor finance is a popular capital structure in which a supplier of goods or services offers a product or service on those terms that may defer or postpone payments for some time. This also helps in managing cash since it reduces the businesses’ cash costs as they occur over time.

Conventionally, the credit period for the vendors extends to 60-90 days, within which the company is free to use the products sold by the vendors without making cash payments upfront. This type of financing literacy is good because the cost of capital is relatively less than that of conventional lines of credit because interest is generally charged post-credit period.

4. Preference Share Capital

Preference share capital implies the issue of shares that give preference shareholders certain privileges over ordinary shareholders in terms of dividends and in the event of the company’s winding up. The preferred shareholders get fixed returns before the payout of dividends to the common shareholders, making this form of capital less volatile for investors than equity shares.

However, preference shares do not generally have voting rights. As a result, shareholders have minimal control of company operations. Such capital structure makes it possible for organisations to fund their activities without surrendering control and, at the same, offer more stable returns than those that come with common equity.

Capital Structure Formula with Examples

The capital of a company is expressed as a percentage, is calculated using the following capital structure formula:

Capital Structure (%) = % of common equity + % of debts + % of preferred stock

To determine these percentages, use the following methods:

- Common Equity Weight (%) = Common Equity ÷ Total Capitalization

- Debt Weight (%) = Total Debt ÷ Total Capitalization

- Preferred Stock Weight (%) = Preferred Stock ÷ Total Capitalization

The total of these percentages should always add up to give 100%.

Let’s consider Company A, which has the following financial details:

- Total Assets: ₹1,12,500,000 (₹1.125 crore)

- Total Liabilities: ₹37,500,000 (₹0.375 crore)

To determine the equity of Company A, we subtract total liabilities from total assets:

Total Shareholders Equity= Total Assets−Total Liabilities

= ₹1,12,500,000−₹37,500,000

= ₹75,000,000

Now, we can calculate the Debt-to-Equity Ratio:

Debt to Equity Ratio= Total Liabilities / Total Shareholders Equity

= ₹37,500,000 / ₹75,000,000

= 0.5

This means that for every ₹0.50 of debt, Company A has ₹1.00 of equity. Thus, Company A is characterised as having a low-leverage or low-risk capital structure.

Now let’s look at Company B, which has the following financial details:

- Total Assets: ₹90,000,000 (₹0.9 crore)

- Total Liabilities: ₹75,000,000 (₹0.75 crore)

To find Company B’s equity:

Total Shareholders Equity=Total Assets−Total Liabilities

= ₹90,000,000−₹75,000,000

= ₹15,000,000

Next, we calculate the Debt-to-Equity Ratio:

Debt to Equity Ratio= Total Liabilities / Total Shareholders Equity

= ₹75,000,000 / ₹15,000,000

= 5

This indicates that for every ₹5.00 of debt, Company B has only ₹1.00 of equity. Therefore, Company B is considered “highly leveraged,” which implies a higher risk profile due to its significant reliance on debt financing.

Importance of Capital Structure

The importance of capital structure can be summarised as follows:

- Maximising Shareholder Wealth: A good blend of capital structure seeks to increase the market value of a firm, hence increasing shareholders’ wealth.

- Cost Minimization: Capital structure should also ensure that the firm’s cost of capital is at the lowest level possible through the identification of the right proportion of debt instruments and equity.

- Increasing Share Price: A proper capital structure can improve the market price per share in the company’s market by increasing earnings per share for ordinary shareholders and improving dividend payments.

- Increasing Financial Flexibility: Appropriate capital structure means financial strategy, which gives the opportunity to use different types of funding depending on the needs of the company and market situation.

- Managing Financial Risk: The management of debt and equity reduces financial risk since it is distributed across many different individuals and gives the firm the best risk-reward chance.

- Offering Tax Benefits: As part of its capital structure, the use of debt has benefits over the fact that interest costs are tax-deductible, which in turn contributes to taxes paid and profitability levels.

- Preventing Over or Under Capitalization: A good capital structure reduces the chances of over or under capitalisation thereby utilising the available capital optimally.

- Increasing Profits: The appropriate capital structure helps the company to increase stakeholders’ returns in terms of profits.

- Providing Borrowing Flexibility: If, for example, the value of the debt-equity ratio is lower, the firm receives the option to borrow new debts at lower interest rates.

Final Thoughts on Capital Structure

Capital structure, therefore, refers to the proportions of an organisation’s structure that it employs in its operations, including debt, equity and preferred stock. The right balance can help in reducing the cost of capital, increase the level of profitability and increase the shareholders’ value. Of course, the optimal capital structure for any company will depend on many factors, including the company’s industry of operations, its stage of growth and business risk appetite but there is no denying that capital structure management is crucial to any sustainable business model.

If you want to learn more about how a company uses money, Jaro Education has courses for you from different famous institutions. These programs, led by experts, help you understand things like stocks, loans, and shares. You will learn how to use these to make a business do well. The courses will teach you how to manage money in smart ways for greater financial results.

Frequently Asked Questions

Capital structure can be defined as the relative proportion of debt, equity and preferred stock through which a company’s financing is accomplished. It shows the percentage of each component of the total financing of the company.

There are two classifications of capital structure, namely equity capital and debt capital. Equity financing comprises ordinary and preferred stock, whereas debt financing comprises loans and bonds. The two may be used together by the companies in funding their activities.

The fundamentals of an organisation’s capital structure are significant since they relate to risk, cost of funding, and general stability. The right proportions may reduce the costs of financing and provide high rates of return for shareholders as well as minimise the probability of insolvency of the enterprise.

In other words, the ‘ideal’ capital structure of a firm reflects factors such as the nature of the business, cost of debt and equity, future earnings expectations, tax rates, and risk appetite. The objective is to keep the overall cost of funds low and, at the same time, preserve as much financial manoeuvrability as possible.