A Brief Analysis of Business Analytics Predictive Modelling

Table of Contents

- jaro education

- 25, July 2023

- 5:13 am

Business analytics predictive modelling is an effective tool that has opened new doors for companies to make informed decisions and plan for the future. In today’s dynamic business landscape, data-driven insights are crucial in gaining a competitive edge. Predictive modelling, a key component of business analytics, enables organisations to forecast trends, anticipate customer behaviour, optimise operations, and mitigate risks.

This brief analysis aims to provide a comprehensive analysis of business analytics predictive modelling. It will explore its fundamental concepts, methodologies, and applications. By scrutinising historical data and statistical algorithms, predictive modelling uncovers patterns and relationships, allowing businesses to make accurate forecasts and proactive strategies.

To simplify business analytics, the Adani Institute of Digital Technology Management has introduced an impactful Executive Program in Business Analytics. The program offers online live sessions with over 360 hours of immersive learning. By choosing this course, you get the opportunity to interact with industry experts from Adani Group and others.

Defining Predictive Modelling

By harnessing the power of artificial intelligence and machine learning, predictive analysis helps retrieve meaningful information enabling businesses to forecast and anticipate future scenarios based on historical data. By employing a data mining process and a set of algorithms, predictive analytics empowers organisations to make informed decisions. It also helps explore “what-if” scenarios and gain a competitive edge in various domains.

Through an extensive exploration of vast databases, predictive modelling helps with data analysis, identifying patterns and extracting valuable information that serves as the foundation for comprehensive reports. This invaluable output is then utilised by analysts to provide insightful projections.

By utilising predictive models, businesses gain a competitive edge by proactively staying ahead of the others in the field. The ability to regulate volatility within companies is enhanced through the provision of accurate and statistically supported insights. Predictive analytics models are instrumental in shaping a more stable and informed business landscape where data-driven decision-making takes precedence.

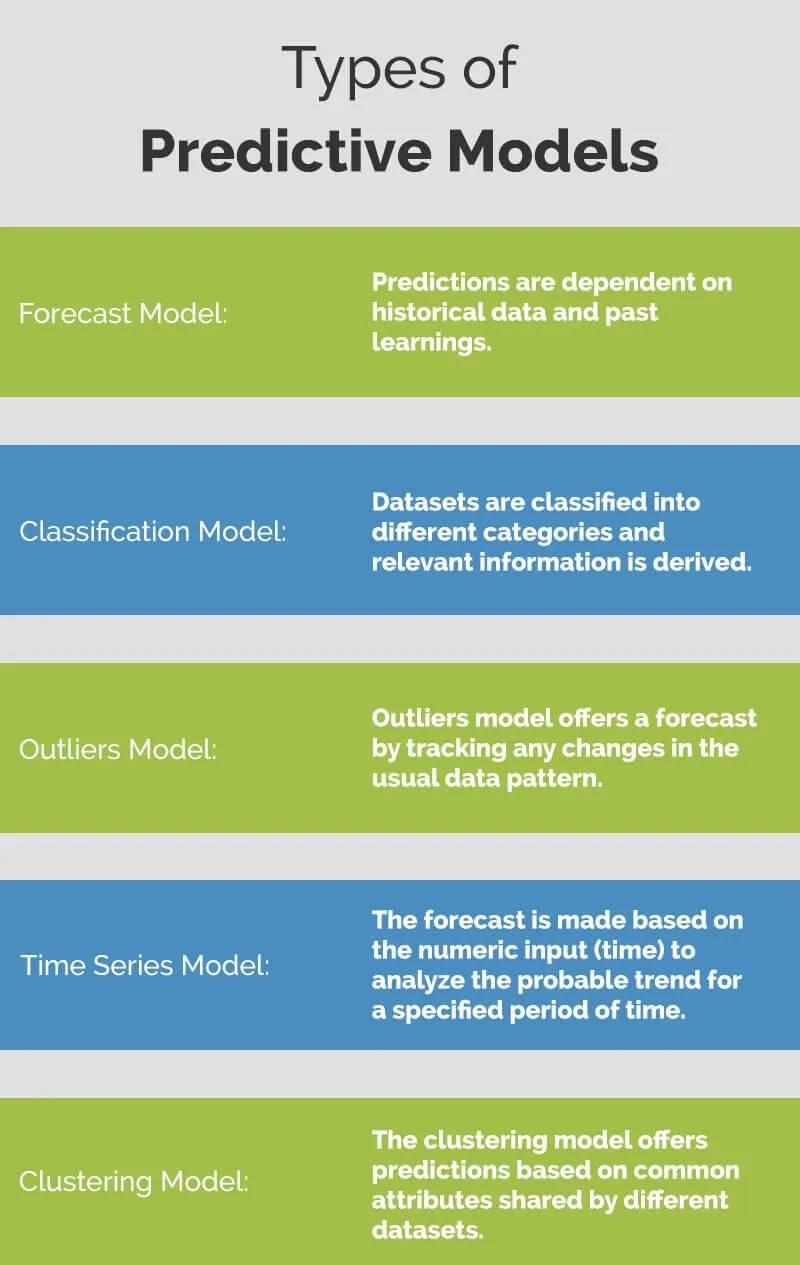

Variants of Predictive Modelling

Given the diverse needs and available resources across various businesses, the selection of predictive model types varies to ensure the best fit. As a result, predictive models include a vast range of techniques tailored to make relevant and accurate predictions. Let’s explore a few examples of these predictive models popularly in use.

1. Classification Models

This is one of the most frequently used predictive modelling types across multiple industries. Classification models focus on categorising data according to the information gathered from historical evidence. By working with newer data, data categories analyse trends and generate insightful projections.

2. Clustering Model

The Clustering Model simplifies data management by categorising data into distinct groups based on shared characteristics. This approach streamlines datasets, making them more user-friendly and facilitating their utilisation for several purposes.

3. Forecast Models

Predictive models are widely utilised for their versatility, with Forecast Models being among the most prominent ones. These models leverage historical data patterns and metric values to make predictions. For example, consider a clothing store that aims to estimate the quantity of products needed for an upcoming sale. By analysing historical data from previous sales, they can employ Forecast Models to forecast their future requirements accurately.

4. Outliers Models

Unlike traditional predictive models that primarily handle homogenous types of data or data with shared attributes, Outlier Models present to the users a distinct approach focusing on anomalous data. These predictive models can seamlessly identify and analyse data points that deviate significantly from the norm. Outlier Models excel at capturing and leveraging information that falls outside the expected patterns, providing valuable insights into unusual occurrences within a dataset.

5. Time Series Models

For analysing data that exhibits temporal patterns like weather conditions, sales figures, or stock prices, the Time Series Models are particularly helpful. By organising the data chronologically, Time Series Models can capture trends, seasonality, and other time-related dynamics that impact the data. This approach enables businesses to make informed predictions and forecast future values based on historical patterns. Whether it’s estimating future sales, predicting stock market trends, or forecasting demand for resources, Time Series Models can be impressive tools for leveraging time-dependent data and extracting valuable information.

Predictive Modelling Methods

When it comes to analysing data structures, business analysts have a range of predictive modelling methods at their disposal. Here are some of the commonly employed models in this context.

1. Simple Linear Regression

This method is extensively used for comprehending and quantifying the relationship between 2 continuous variables. It assumes a linear relationship between the predictor variable (also known as the independent variable or X) and the response variable (dependent variable or Y). The goal is to create a linear equation that best fits the data, allowing us to estimate the value of the response variable based on the given predictor variable.

2. Multiple Linear Regression

Multiple Linear Regression employs a statistical method to model the relationship among multiple continuous variables. In this method, the aim is to create a linear equation that best fits the data by estimating the coefficients for each independent variable. These coefficients represent the strength and direction of the relationship between the predictors and the dependent variable.

3. Polynomial Regression

To analyse nonlinear relationships between predictors and residuals, polynomial regression is extensively beneficial. This helps with a more comprehensive modelling process. While Simple Linear Regression assumes a linear relationship, Polynomial Regression expands the modelling capability by incorporating polynomial terms to capture curvilinear patterns in the data.

4. Support Vector Regression

To characterise the underlying algorithms, Support Vector Regression (SVR) is a regression method that leverages critical data features. This regression technique extends the principles of Support Vector Machines (SVM) to the field of regression analysis. Similar to SVM, SVR focuses on identifying key data features to create a regression model capable of accurately predicting continuous outcomes.

5. Decision Tree Regression

Decision Tree Regression utilises a tree-like structure to construct predictive models. This method employs a division of data into smaller subsets and recursively processes them to generate accurate predictions.

6. Naive Bayes

This method utilises historical data to make predictions concerning production rates and inventory. Moreover, it effectively identifies failures through inconsistencies, offering opportunities for improvement and enhancing risk management capabilities.

Benefits of Using Predictive Modelling in the Field of Business Analytics

Predictive models offer a wide range of advantages that can greatly benefit business analysts in their analytical practice. Let’s navigate through some of the benefits that can be savoured by creating and implementing predictive models.

1. Detecting Frauds

Predictive modelling plays a pivotal role in detecting and preventing both internal and external business fraud. By utilising advanced algorithms, predictive models identify discrepancies and inconsistent behaviours, enabling businesses to map out the possibilities of criminal activities. These models effectively identify vulnerabilities and polish cybersecurity measures, creating a robust and reliable system to combat the growing challenges in cybersecurity.

2. Managing Risks

Predictive models offer significant benefits in risk management. For instance, in institutions like banks, the use of credit scores to assess an individual’s creditworthiness and determine eligibility for services and investments can pose risks if a background check is not conducted. However, predictive models address this issue by analysing historical data, assessing the likelihood of fraud, and evaluating an individual’s creditworthiness, thus enabling more informed risk management decisions.

3. Conducting Effective Marketing Campaigns

With insights into customer behaviour statistics and metrics, predictive modelling enables the execution of unique and effective marketing campaigns. By analysing buying trends, consumer preferences, and other relevant information, businesses can tailor their marketing strategies to align with customer demand, resulting in more effective and targeted campaigns.

Predictive Modelling’s Application in Diverse Industries

Predictive modelling finds applications across diverse industries, delivering numerous benefits. Below are a few examples of how predictive modelling is applied in different domains.

1.Banking Sector

Predictive modelling is extensively explored in the banking sector for conducting background checks and assessing credit risk. With that, it enables banks to leverage customer information to extend personalised offers.

2. Retail Industry

The retail sector leverages predictive modelling to strategically plan product assortments and pricing. By analysing customer behaviour, retailers can curate targeted promotional events and determine which offers will drive the highest sales.

3. Manufacturing Industry

This industry employs predictive models to assess the inconsistencies in supply chain performance and amplify the availability of limited resources. Business analytics models are frequently utilised to assess various aspects of the industry and ensure operational efficiency throughout all sections.

Takeaway

The analysis of business analytics predictive modelling highlights its significance as a valuable resource in driving data-driven decision-making. By taking advantage of historical data, identifying patterns, and applying advanced algorithms, predictive models provide businesses with valuable insights and a competitive edge in various industries.

The use of predictive modelling enables businesses to make accurate forecasts, optimise operations, and enhance risk management. It allows for efficient marketing campaigns by leveraging customer behaviour data and aligning strategies with customer preferences. As technology advances and data availability grows, the adoption of predictive modelling will continue to shape the business landscape. It will enable organisations to stay ahead of the competition and remain abreast in the data-centric world.

To understand all the discussed aspects of predictive modelling through an elaborate course, you have the predictive modelling business analytics online course by AIDTM. This program is uniquely curated by industry experts to effectively transfer knowledge. You can join this course by contacting Jaro Education and boost your professional growth in no time.