Unlock The Best Key Methods Of Strategic Financial Management

Table of Contents

- jaro education

- 20, January 2023

- 5:42 am

Sales, marketing, operations, and finance are 4 crucial pillars of any organization. Of these 4 pillars, finance stands at the top giving directions to all other pillars. With a seamless strategic financial management businesses can succeed. If you like reviewing numbers, understanding costs, and flipping financial statements, you can consider building finance and strategic management. This article breaks down strategic financial management in its simplest form and helps you understand the importance of strategic financial management in today’s highly competitive market and the best resource available on the internet to build a solid career in finance and strategic management.

Let’s get going!

Defining Strategic Financial Management in Simple Terms

The ultimate goal of strategic financial management is to build concrete objectives and assess a company’s assets and liabilities to make concrete strategies that help companies achieve their long-term goals. While marketing managers, sales representatives, and operation experts discuss how to build authority in their target market, finance, and strategic management allocates resources and overlooks the flow of money in various departments.

Strategic financial management acts like a father to all other departments whose main objective is to look at where the money is flowing, and how much money is needed across various departments, and align the company according to their long-term objectives.

At the same time, it also assesses the financial impact of various decisions like – mergers and acquisitions, capital investments over time, new product development, and standardization.

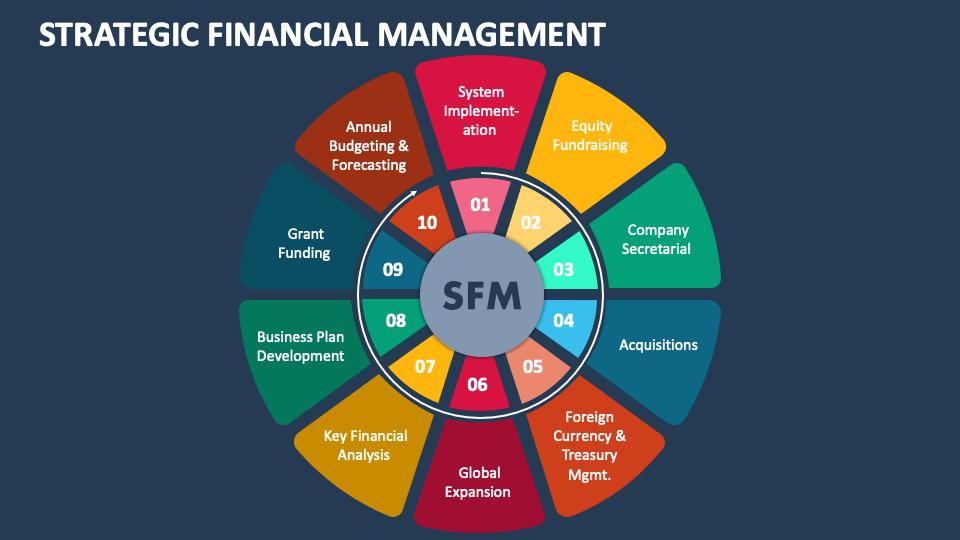

*collidu.com

What Is The Importance of Strategic Financial Management?

With strategic financial management, companies spend less time and resources on traditional accounting and divert their resources to high-value tasks that impact the business’s growth. While directors and CEOs focus on visions and missions, it’s strategic financial management that helps them establish principles under which companies operate fairly across departments and minimize costs.

All business strategies are based on finances where due diligence is given to assets, liabilities, cash flow, cost management, budgeting, risk, and returns. If companies are casual in their finance and strategic management then there are fair chances for misinterpretation of financial statements, improper allocation of resources, and spending too much at unnecessary avenues. Following are the reasons why companies need concrete strategic financial management from day 1:

- To judge and assess the company’s financial position from time to time.

- Identify financial risks from time to time and suggest ways to overcome them.

- Set income goals for the future at organizational and departmental levels.

- Highlighting the need for new partnerships to achieve long-term objectives.

- Maintain a balance between spending, savings, and revenues.

- Give directions in terms of cost-cutting.

- To ensure that various departments are allocated finances and resources based on their project needs and outcomes.

People who are experts in strategic financial management help top-level managers make decisions during complex situations. They are experts in evaluating trade-offs and ensuring that a company’s short-term needs and long-term goals are balanced.

Finance and strategic management bring financial and non-financial management benefits to the company. If the management is smooth and has minimal loopholes, then it becomes easy for companies to achieve their long-term goals. To duly understand the importance of strategic financial management, here’s how this profession adds value to companies –

- Finance and strategic management focuses on long-term goals and ensures that these goals are aligned company-wide. Every single person in the company understands in which direction they are going in terms of revenues and profitability.

- Strategic financial management improves the way a company manages its resources. When a company is able to manage its resources wisely, it leads to better financial performance over time, leading to higher revenues and profits.

- When financial strategies are combined with a company’s long-term goals, it not only improves the performance but shareholders and key stakeholders are put at ease and they tend to trust the company more.

- Finance and strategic management also help in solvency planning in terms of how a company can pay off its various liabilities without having to compromise its day-to-day operations.

- Strategic financial management encourages companies to make use of digital tools and embed technology to improve their financial stability.

*unstop.com

Strategic Financial Management Vs Tactical Financial Management

There are loads of arguments between tactical and strategic financial management theoretically as well as practically. For laymen, both are interchangeable terms but when it comes to organizations and their way of dealing with finance and strategic management – both have their own essence and importance.

If you are keen to build a career in strategic financial management then you should know the difference between the two. Let’s help you with it.

| Strategic Financial Management | Tactical Financial Management |

|---|---|

| Strategic financial management defines long-term goals and how the company aims to achieve them. | Tactical financial management helps companies achieve smaller steps along the way. |

| It defines the path that the company needs to achieve its organizational missions. | It involves best practices, specific plans, and resources. |

| It involves setting long-term goals and a plan to achieve organizational mission. | It involves laying down the tactics to specify how these goals will be achieved. |

| Strategic financial management is a long-term vision. | Tactical financial management deals with short-term actions that complement long-term goals. |

| Financial strategies can change to adapt to internal or external factors. | Tactics can change based on the success of the strategy. |

| To measure the success of strategic financial management companies use KPIs like net promoter score and the likewise. | To measure tactics companies use a combination of OKRs and KPIs |

Factors Determining Effective Strategic Financial Management

Finance and strategic management is not done by a single person, on a single day. It is an ongoing process where finance professionals have to step into the shoes of directors and CEOs and then build a one-of-a-kind financial strategy that is acceptable company-wide. Be it an exceptional employee, a senior manager, or a director – every person should be aligned with the planning and layout. For this reason, the success (or failure) of strategic financial management depends on the following factors –

1. Team Participation

No single person can build a strategy and no single person can fully execute it. Thus, it becomes highly crucial for the entire team to participate in strategic financial management and planning. Each department will play a certain role in achieving the company’s long-term goals and this is why finance and strategic managers should involve all the departments while laying down company-wide strategy.

2. Deadlines

As a strategic financial manager, you must break overall business goals into short and long-term objectives. While short-term objectives will be taken care of by tactical finance managers, long-term objectives are a part of strategic financial management.

3. KPIs

Once people know what to do and how the resources will be used by different departments, it is time for Key Performance Indicators (KPIs). If the KPIs are pre-set, it becomes easier to monitor business objectives.

4. Planning

Planning is the heart and soul of strategic financial management. Once you are clear about KPIs and deadlines, you start preparing a concrete plan based on team participation.

5. Budgeting

Strategic financial management deals with creating budgets for finances to achieve production and profitability goals. You evaluate time, people, and money and align all three to meet long-term company-wide goals. Budgeting helps the company visualize how it allocates resources to identify opportunities for effective management.

6. Risk Management

You will also be analyzing and identifying the amount of risk organizations can withstand. Risk management is a crucial aspect of finance and strategic management that helps managers evaluate opportunities and plan investments.

7. Execution

Strategic financial management involves establishing and adjusting a framework for achieving a company’s long-term goals. A carefully planned execution allows the company to make informed strategic decisions.

8. Evaluation

Today, businesses are rapidly changing, hence their long-term goals need to be carefully evaluated from time to time to incorporate those sudden changes. The success of a strategic financial management plan depends on the company’s ability to evaluate its plan, budget, and procedures to determine effectiveness and success. As a manager, you will be reviewing various metrics, KPIs, budget compliance, and the overall effectiveness of the plan.

Scope of Finance And Strategic Management in 2025

-

- Strategic leadership and business partnerships.

- Embracing digital transformation.

- Data-driven decision making.

- Rick management and cybersecurity.

- Help organizations achieve sustainability.

- Talent development and leadership.

| Experience in Years | AveraAverage Annual Salaryge Salary (INR) |

|---|---|

| 2-3 years | ₹6.70 lakhs |

| 3-4 years | ₹7.50 lakhs |

| 4-5 years | ₹9.30 lakhs |

| 5-6 years | ₹10 lakhs |

| 6-7 years | ₹13 lakhs |

| 7-8 years | ₹15 lakhs |

| 8-9 years | ₹21.7 lakhs |

| 9-10 years | ₹22.2 lakhs |

| 10+ years | ₹23.4 lakhs |

Kickstart Your Finance And Strategic Management Career with IIM Tiruchirappalli’s PG Programme

Time to unleash your career in finance and strategic management with the Post Graduate Certification Programme in Financial Management – IIM Tiruchirappalli. This certification course is open to all graduates, post-graduates, and professionals who want to dive deep into the intricacies of banking, corporate finance, and costing.

-

- Analysis of financial statements

- Fundamentals of Corporate Finance

- Introduction to Financial Markets

- Strategic Cost Management Techniques

- Portfolio Management

- Entrepreneurial Finance

- Valuation

- Financial Derivatives & Risk Management

- Sustainable Finance

- Project Finance

- Fixed Income Securities

- Financial Analytics & Fintech

| Admission Criteria | -Must have 50% score in Graduation or Post Graduation (whichever is more) -Minimum 1 year of post-qualification experience. |

| Fee Structure | Application Fees: ₹2000 Total Program Fee: ₹2,25,000 Installment 1: ₹85,000 Installment 2: ₹70,000 Installment 3: ₹70,000 |

| Course Duration | 1 year |

Strategic Financial Management Made Easy With Jaro Education

Jaro Education – India’s most trusted online higher education and upskilling company having exclusive partnerships with IIMs across India intending to offer world-class education to students and working professionals to help them upskill and build a solid career in finance and strategic management and other exciting career avenues. Jaro Education not only has unbeatable educational assistance, but it also believes that finance doesn’t come between students and their aims. This is why when you sign up for a strategic financial management course through Jaro, you can get a no-cost EMI option.

Jaro Education not only partners with India’s top institutes and colleges, but every time a student applies, Jaro ensures

- Unparalleled career guidance.

- Student support.

- Lifelong learning experience.

- Peer-to-peer learning experience.

- Get access to Jaro’s alumni network of 3,50,000+ professionals.

Frequently Asked Questions

If you love numbers and financial statements ring your bells then strategic financial management is the right choice for you as a career option. India is a growing economy and the world’s leading companies are joining forces with the nation to scale their businesses. During the rise of the expanding economy and businesses, there is always a dire need for professionals in finance and strategic management.

The Post Graduate Certificate Programme in Financial and Strategic Management is one of the best financial management courses for students and working professionals. It’s a 1-year course where brilliant minds at IIM help students take a deep dive into corporate finance and strategic financial management. financial management.

No. If you sign up for the Post Graduate Certificate Programme in Financial Management by IIM Tiruchirappalli then you don’t have to visit campus to get the insights because it’s a 100% online learning course with 171 hours of interactive learning. However, you will have a 3-day campus immersion experience through this program.