Career Options in Economics: Top 9 Career Opportunities in India [2024]

Table of Contents

![Career-Options-in-Economics-Top-9-Career-Opportunities-in-India-[2024]](https://jaro-website.s3.ap-south-1.amazonaws.com/2024/05/Career-Options-in-Economics-Top-9-Career-Opportunities-in-India-2024.jpg)

- jaro education

- 20, May 2024

- 6:34 am

Economics delves into the intricate science of decision-making amidst scarcity, where individuals and societies grapple with limited resources against boundless desires. Vital elements like labor, land, and raw materials form the backbone of production for goods and services. However, these resources are finite, as is the universal commodity of time.

Consider Canada’s scenario in 2016, boasting a labor force exceeding 19 million workers and a vast landmass of nearly 10 million square kilometers. Despite these substantial figures, resources remain constrained when compared to the insatiable demands of people. This inherent scarcity serves as the driving force behind economic choices, shaping how individuals, businesses, and communities prioritize their needs and distribute resources.

Exploring Career Options in Economics unveils a realm teeming with opportunities and intricacies. From deciphering market dynamics and shaping policies to grasping global economic dynamics, this dynamic field encompasses a spectrum of roles. Join us as we delve into the diverse pathways within Economics, unraveling the varied roles, essential skills, and promising prospects that define this ever-evolving domain.

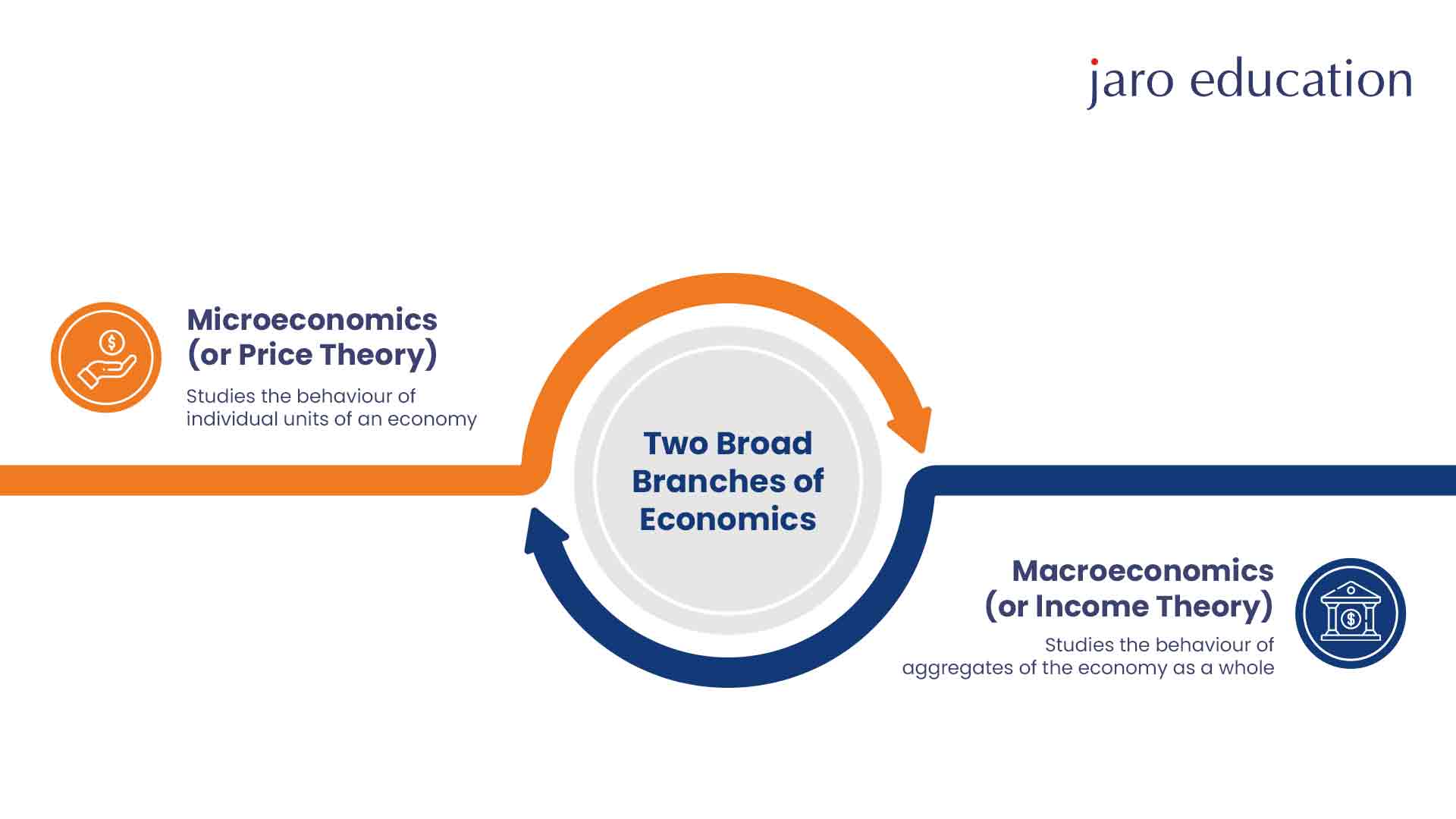

What is Economic Studies?

Economic Studies is a domain that thoroughly examines how societies achieve the organization of limited resources, produce commodities of significance, and distribute the riches among individuals. In addition to theoretical underpinnings, the discipline also provides vast professional alternatives through a career in economics. Economic studies, via rigorous instruction, result in well-developed analytical skills and expertise that allow graduates to proficiently address authentic economic problems. Among the areas of economic activity, there is finance, market research, public policy, and corporate strategy, among others, which cover the entire spectrum of options for engaging in dynamic economics.

For those aspiring to excel in economics, the Online Master of Science (Economics) Programme offered by Symbiosis School for Online and Digital Learning (SSODL) offers a transformative learning experience. This course features a comprehensive curriculum designed to hone advanced analytical skills, strategic decision-making capabilities, and a profound understanding of economic principles. Through interactive learning modules and practical case studies, students gain hands-on expertise in applying economic theories to solve intricate business challenges.

Top 9 Career Options in Economics

Here are nine career options in economics that are prominent in India

1. Economist

Economists are pivotal in shaping our understanding of economic phenomena and informing policy and business strategy. Their work spans various sectors, leveraging economic theories and models to analyze data, predict trends, and evaluate the outcomes of economic policies or market behavior. Here’s a closer look at what they do, how they impact decision-making, and the skills required for the profession.

Role and Responsibilities

- Research and Analysis: Economists conduct research to collect data and analyze economic issues. This research might involve historical data review, current economic conditions, or policy evaluations to understand their impact on the economy.

- Forecasting and Modeling: Using economic models, they forecast future economic conditions, including growth rates, inflation, and employment trends. These predictions are vital for government policy-making and business planning.

- Policy Development and Evaluation: In government roles, economists contribute to the development and assessment of economic policies, such as tax reforms, monetary policy, and public spending. Their analyses help determine policy effectiveness and guide adjustments.

- Consultation: Economists provide expert advice to businesses, government agencies, and non-profit organizations on economic trends, policy impacts, and strategic planning. This advice can influence critical decisions on investment, expansion, and resource allocation.

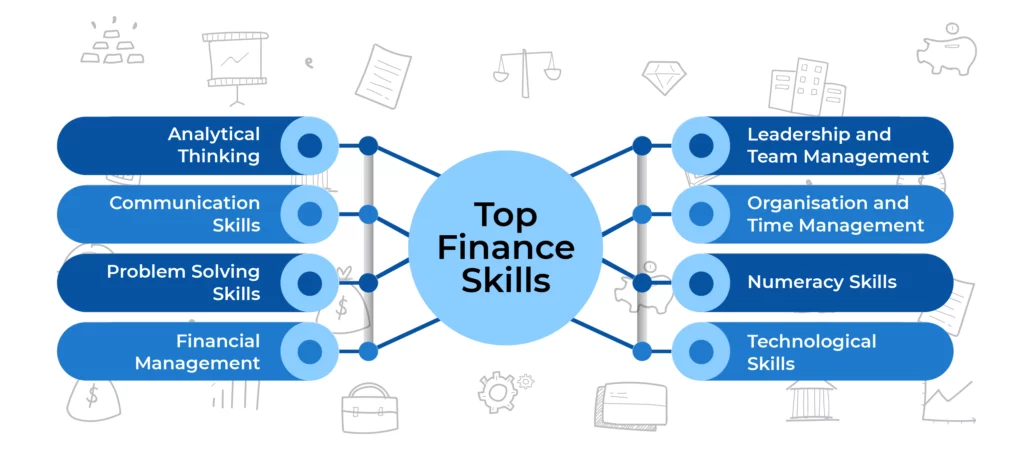

Skills Required

- Analytical Skills: Ability to dissect complex data and economic trends to derive meaningful insights.

- Quantitative Skills: Proficient in statistics and econometrics, with the capability to use various software tools for data analysis.

- Communication Skills: Clear and effective communication of complex economic concepts to non-specialists, through reports, presentations, and consultations.

- Critical Thinking: Evaluating current economic issues, models, and policies to provide reasoned advice or critiques.

Salary Outlook for Economist

As per Ambitionbox, salaries of Economists in India vary widely based on experience. Entry-level positions offer ₹2.5-5.0 Lakhs per year, rising to ₹5.0-8.0 Lakhs with 1-3 years’ experience and ₹8.0-12.0 Lakhs with 3-5 years’ experience. Senior economists earn ₹12.0-18.0 Lakhs (5-8 years) and seasoned professionals can make ₹18.0-38.0 Lakhs (8-12 years). On average, economists earn ₹16.2 Lakhs annually, influenced by factors like location and industry.

2. Financial Researcher

Financial researchers play a crucial role in the financial industry by analyzing financial data, market trends, and economic indicators to forecast a company’s future performance and guide investment decisions. Their work is fundamental to investors, corporate executives, and policymakers, providing them with the insights needed to make informed financial and strategic decisions.

*edoxi.com

Role and Responsibilities

- Data Analysis: Financial researchers dive deep into financial statements, sales figures, market trends, and economic reports to understand a company’s health and prospects. They use statistical software and models to analyze data, looking for patterns and insights that can inform investment decisions.

- Market Research: They monitor and interpret market conditions, staying ahead of trends that could affect industries or specific companies. This involves understanding both macroeconomic indicators (like GDP growth rates, inflation, and interest rates) and microeconomic factors (such as company leadership, competitive advantages, and market position).

- Forecasting: One of the primary roles of a financial researcher is to forecast future performance based on historical data and predictive modeling. They might predict revenue growth, market trends, or stock performance, providing essential guidance for investment strategies.

- Reporting: Financial researchers compile their findings into reports and presentations that communicate complex financial information in an understandable and actionable way. These reports are crucial for stakeholders to make informed decisions about investments, corporate strategy, and policy formulation.

- Risk Assessment: Identifying and assessing financial risks is a significant part of their job. By understanding potential risks, financial researchers can recommend strategies to mitigate them, such as diversifying investments or hedging.

Skills Required

- Quantitative Skills: A strong foundation in mathematics, statistics, and quantitative analysis is essential for developing complex financial models and analyzing data.

- Analytical Skills: The ability to analyze financial statements, market trends, and economic reports to derive meaningful insights.

- Research Skills: Proficiency in conducting thorough and efficient research, using a variety of sources to gather relevant data.

- Technical Skills: Knowledge of financial databases, analytics software, and tools like Bloomberg, FactSet, or Thomson Reuters.

Salary Outlook for Financial Researcher

The salary range for Financial Research Analysts in India varies based on experience, with those having less than 1 year up to 6 years of experience earning between ₹2.0 Lakhs to ₹15.2 Lakhs annually. The average annual salary for this role is approximately ₹5.3 Lakhs, derived from a dataset comprising 467 recent salary entries, as per Ambitionbox.

3. Consumer Credit Manager

Consumer Credit Managers play a pivotal role in the financial services industry, overseeing the process of assessing and determining the creditworthiness of potential borrowers. Their work directly impacts a financial institution’s risk management and its ability to maximize profitability while minimizing losses due to non-repayment of loans. Here’s a breakdown of what their job entails, the skills needed, and the importance of their role.

Role and Responsibilities

- Credit Risk Assessment: They evaluate the credit risk associated with lending to individuals by analyzing their credit history, income stability, current debts, and other financial factors.

- Credit Scoring and Decision Making: Using various credit scoring models, they assign credit scores to applicants, which help in making decisions regarding loan approvals or denials. Higher scores typically indicate lower risk.

- Policy Development: Consumer Credit Managers are involved in developing or updating the credit policies of an institution to ensure they align with regulatory standards and industry practices.

- Portfolio Management: They monitor the performance of loan portfolios, identifying trends or patterns that may indicate increased risk, and adjust lending criteria accordingly.

- Compliance and Regulatory Oversight: Ensuring that the credit operations comply with all relevant laws and regulations is a crucial part of their role, to avoid legal penalties and maintain the institution’s reputation.

Skills Required

- Analytical Skills: A deep understanding of financial statements and the ability to analyze credit data and financial documents to make informed decisions.

- Decision-Making Skills: The capacity to make sound judgments quickly, considering the potential risk versus the benefit of loan approvals.

- Knowledge of Credit Scoring Models: Familiarity with the models and methodologies used to evaluate creditworthiness.

- Regulatory Knowledge: An understanding of the legal and regulatory framework surrounding consumer credit is essential to ensure compliance.

- Communication Skills: Ability to communicate credit decisions, policies, and risk assessments effectively to colleagues, management, and sometimes to the clients themselves.

Salary Outlook for Consumer Credit Manager

As per Indeed, the typical salary for a credit manager in India stands at ₹5,80,263 annually. This figure varies based on factors such as geographic location, industry sector, and professional experience. Increased levels of responsibility often correspond to higher income levels for credit managers.

4. Personal Financial Advisor

Personal Financial Advisors play a vital role in helping individuals manage their finances, offering tailored advice on wealth management, investment strategies, and comprehensive financial planning. Their expertise is aimed at enabling clients to reach their short-term and long-term financial goals, whether that’s saving for retirement, investing in the stock market, buying a home, or ensuring financial security for their families.

Role and Responsibilities

- Financial Planning: Creating personalized financial plans that detail strategies for savings, investments, insurance, and budgeting based on the client’s financial situation and goals.

- Investment Advice: Offering recommendations on various investment opportunities and asset allocation strategies to help clients grow their wealth.

- Retirement Planning: Advising on strategies for saving for retirement, considering factors like retirement age, expected lifestyle, and current assets.

- Tax Planning: Providing guidance on how to minimize tax liability through tax-efficient investing strategies.

- Estate Planning: Helping clients plan for the management of their estate and the distribution of assets to beneficiaries in a tax-efficient manner.

Skills Required

- Knowledge of Financial Markets: A deep understanding of financial markets, investment vehicles, and economic trends is essential for offering sound investment advice.

- Analytical Skills: The ability to analyze financial data and economic conditions to develop effective financial plans and investment strategies.

- Interpersonal Skills: Strong communication skills are crucial for explaining complex financial concepts in understandable terms and building trust with clients.

- Ethical Judgment and Integrity: Advisors must adhere to high ethical standards, providing advice that is in the best interest of the client.

Salary Outlook for Personal Financial Advisor

The salary range for Personal Financial Advisors in India with less than 1 year to 11 years of experience varies from ₹1.0 Lakhs to ₹8.0 Lakhs, averaging at ₹3.0 Lakhs per year, as per data from 42 recent salaries, as per Ambitionbox.

5. Professor

Professors in economics play a multi-faceted role within academic institutions, blending teaching, research, and often, administrative duties, to advance the understanding and application of economic principles. Their work is pivotal in shaping the economic thinkers and policymakers of tomorrow, contributing to the broader academic community and often influencing public policy.

Teaching

- Curriculum Development: Professors design courses that cover a wide range of economic theories and models, ensuring content relevance and rigor for undergraduate and postgraduate students.

- Instruction: They employ various teaching methods to deliver lectures, seminars, and workshops, focusing on critical economic concepts, mathematical models, and their real-world applications.

- Mentorship: Beyond classroom teaching, professors mentor students on academic development, career advice, and research projects, guiding them through their academic and early professional careers.

Skills and Qualifications

- Educational Background: A doctoral degree (Ph.D.) in economics or a closely related field is typically required to become a professor in economics.

- Research Skills: Proficiency in statistical software, data analysis, and a strong record of published research in reputable academic journals are essential.

- Teaching Skills: Excellent communication and interpersonal skills to effectively convey complex economic theories and engage with students of diverse backgrounds.

Salary Outlook for Professor

As per Glassdoor, the average annual salary for a Professor of Economics in India is ₹1,04,46,042, reflecting the significance and demand for expertise in economic analysis and research in academic institutions and research organizations.

6. Indian Economic Service Officer (IES)

Indian Economic Service (IES) Officers hold a prestigious position within the Indian government, dedicated to economic policy formulation, implementation, and analysis. Their work is crucial for the country’s economic development, advising on policies that impact various aspects of India’s economy.

Role and Responsibilities

- Policy Formulation: IES Officers play a significant role in shaping economic policies by conducting research, analyzing current economic trends, and recommending policy measures.

- Implementation and Monitoring: They oversee the implementation of economic policies and programs, ensuring that they achieve their intended outcomes and adjusting strategies as necessary.

- Economic Analysis: IES Officers analyze data on various economic parameters, providing insights into the health of the economy and identifying areas for improvement.

- Advisory Role: They advise various government departments on economic issues, helping to integrate economic principles into decision-making processes.

- International Representation: Some IES Officers represent India in international economic forums, engaging in discussions and negotiations that impact global economic policies.

Skills Required

- Analytical Skills: The ability to interpret complex economic data and trends to make informed policy recommendations.

- Communication Skills: Clear and effective communication is essential for drafting policy documents and presenting economic analyses to policymakers and stakeholders.

- Problem-Solving Skills: Identifying economic issues and devising strategic solutions to address them.

- Research Skills: Conducting thorough research to inform policy development and economic forecasting.

- Adaptability: The economic landscape is ever-changing, and IES Officers must adapt their strategies and policies to reflect new data and circumstances.

Salary Outlook for Indian Economic Service Officer (IES)

An officer in the Indian Economic Service (IES) or Indian Statistical Service (ISS) receives a base salary ranging from INR 15,600 to INR 39,100, reflecting the government’s recognition of their expertise in economic and statistical analysis.

7. Income Tax Officer

Income Tax Officers play a vital role in the fiscal structure of a country, tasked with enforcing tax laws, assessing tax liabilities, and ensuring compliance among taxpayers. Their work ensures the efficient collection of taxes, which is crucial for funding public services and infrastructure.

Role and Responsibilities

- Tax Law Enforcement: Enforcing the tax laws and regulations set forth by the government, ensuring that individuals and businesses comply with their tax obligations.

- Assessment of Tax Liabilities: Evaluating financial records and activities of individuals and businesses to accurately assess their tax liabilities.

- Collection and Processing: Overseeing the collection of taxes and processing of tax returns, ensuring timely and accurate submission.

- Audit and Compliance Checks: Conducting audits and investigations to prevent tax evasion, fraud, and non-compliance with tax laws.

- Advisory Services: Providing guidance and advice to taxpayers on tax-related matters, helping them understand their tax obligations and benefits.

Skills Required

- Knowledge of Tax Laws: A thorough understanding of national and, if applicable, international tax laws and regulations.

- Analytical Skills: The ability to analyze financial documents and tax returns to assess tax liabilities accurately.

- Attention to Detail: Meticulous attention to detail is required to ensure all calculations and assessments are correct.

- Integrity and Ethics: High ethical standards to uphold the law fairly and impartially.

- Communication Skills: Effective communication skills are essential for explaining tax obligations to taxpayers and for working with other tax professionals.

Salary Outlook for Income Tax Officer

An Income Tax Officer’s starting basic salary is Rs. 56,100 per month, with potential earnings rising to Rs. 1,77,500 per month with career advancement, as per Naukri.com. This salary structure reflects the rewarding growth opportunities in this profession.

8. Statistical Investigator

Statistical Investigators play a critical role in the landscape of data-driven decision-making, employing their expertise in collecting, analyzing, and interpreting vast amounts of statistical data. Their work provides a solid foundation for policy formulation and strategic decisions at both national and regional levels, significantly influencing public policy, economic strategies, and social programs.

Role and Responsibilities

- Data Collection: Designing surveys and research studies to collect data on various socio-economic parameters.

- Data Analysis: Applying statistical methods to analyze collected data, identify trends, patterns, and relationships within the data.

- Interpretation: Interpreting the results of statistical analyses to draw meaningful conclusions that inform policy and decision-making.

- Reporting: Preparing detailed reports and presentations that communicate findings to policymakers, stakeholders, and the public.

- Advisory Role: Providing expert advice based on statistical findings to guide policy formulation, program development, and strategic planning.

Skills Required

- Statistical Knowledge: Profound understanding of statistical theories and methodologies.

- Analytical Skills: The ability to analyze and synthesize large datasets to extract actionable insights.

- Technical Proficiency: Expertise in statistical software (such as R, SAS, SPSS) and database management.

- Attention to Detail: Precision in handling data to ensure accuracy and reliability of findings.

- Communication Skills: The ability to convey complex statistical concepts and findings in a clear and accessible manner to non-specialists.

Salary Outlook for Statistical Investigator

The Statistical Investigator Grade-II’s monthly salary ranges from 46,000 to 55,000, subject to location. It comprises basic pay, DA, TA, and HRA, adjusted periodically as per regulations.

9. Audit Officer

Audit Officers are vital in maintaining the financial integrity and compliance of organizations. They perform thorough examinations of financial statements, ensuring accuracy and adherence to laws and regulations. Their role is fundamental in identifying discrepancies, mitigating risks, and ensuring that financial practices align with legal standards and ethical norms.

Role and Responsibilities

- Financial Statement Review: Examining an organization’s financial reports to verify their accuracy and compliance with accounting standards and principles.

- Compliance Checks: Ensuring that the organization adheres to all relevant laws, regulations, and internal policies.

- Risk Assessment: Identifying financial and operational risks within an organization and recommending measures to mitigate these risks.

- Report Preparation: Compiling audit findings into detailed reports that highlight issues, provide an analysis of financial data, and suggest improvements.

- Advisory Role: Offering advice based on audit findings to help organizations improve their financial reporting processes, internal controls, and compliance procedures.

Skills Required

- Analytical Skills: The ability to scrutinize complex financial records and identify inaccuracies or non-compliance.

- Attention to Detail: A meticulous approach to ensure that all financial data is examined thoroughly and accurately.

- Knowledge of Laws and Regulations: A deep understanding of the legal and regulatory framework affecting financial reporting and compliance.

- Communication Skills: Effectively communicating findings and recommendations to management and stakeholders.

- Ethical Judgment: Upholding the highest standards of integrity and confidentiality in handling sensitive financial information.

Salary Outlook for Audit Officer

Auditors’ salaries in India vary based on location, experience, organization size, and performance. As of December 2023, the average salary is ₹3,46,395 (Indeed India). Despite these variations, the job outlook for auditors in India is promising, reflecting the growing demand for their expertise in financial transparency and risk management.

Conclusion

The pursuit of a career in economics in India is a journey within a field that offers a plethora of opportunities. Economists work to guide the development of policies in the government to advise individual clients on how they can mitigate their financial acumen. According to the Becker, Elliott, Moritz, and Stark taxonomy, applying data to guide policy formation, enforcing tax legislation, and managing investment portfolios are some of those careers. The emerging requirements create a pattern requiring a demand for a skilled economist to address the numerous challenges that emerge in dynamic environments and are relied upon to remedy by innovating and working toward the prospect of creating a violence-less society. Thus exploring models and acquiring valuable data-analytics skills build a career in economics.

Explore the Online Master of Science (Economics) course offered by Symbiosis School for Online and Digital Learning (SSODL), which provides a comprehensive platform to develop expertise in economics and data analytics. This course equips students with the necessary skills to navigate the complexities of economic analysis, policy formulation, and strategic decision-making in today’s dynamic business environment.