Mutual Funds: Meaning, Types, Features, Benefits & Prices

Table of Contents

- jaro Education

- 15, September 2023

- 4:00 pm

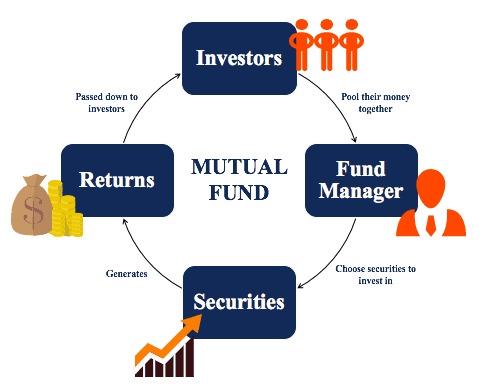

Mutual funds are a type of pooled investment that allows several shareholders to participate in bonds, stocks, and other assets. It can be difficult for individual investors to buy shares in high-profile portfolios. Various kinds of features of mutual funds are available in the market depending on their risk-to-return ratio. Features of Mutual funds enable investors to diversify their investments rather than putting all their money in one single place. A mutual fund manager selects where and when people can invest their money in this fund. Each investor has units, a percentage of the fund’s holdings. After subtracting certain fees, the income/gains created from this mutual fund investment are dispersed proportionately among the participants by computing a scheme’s Net Asset Value, or NAV.

Mutual fund investment and other types of investment are great areas of study in the commerce sector. If commerce interests you and if you are a 10+2 qualified student, you can pursue ample courses such as Online B.com Courses. For now, let’s dive deeper into the fundamentals of mutual funds.

Mutual Funds: Meaning

*PrimeInvestors

This is an investment body that merges capital from shareholders and places it into financial instruments such as bonds, stocks, securities, and other assets with value. These funds are secured and upheld to align with the investment goals outlined in the prospectus by the shareholders. Expert financial managers handle these resources and utilize them for financial returns and profits for the investors of the fund.

One can choose features of mutual funds as an ideal investment option as it provides entry to professionally managed portfolios of bonds, equities, stocks, and other financial instruments. As a result, each stakeholder shares equal profits or losses. The advantages of mutual funds invest in a broad array of assets and their success is often measured as the change in the fund’s total market value, calculated by summing up the performance of the underlying investments.

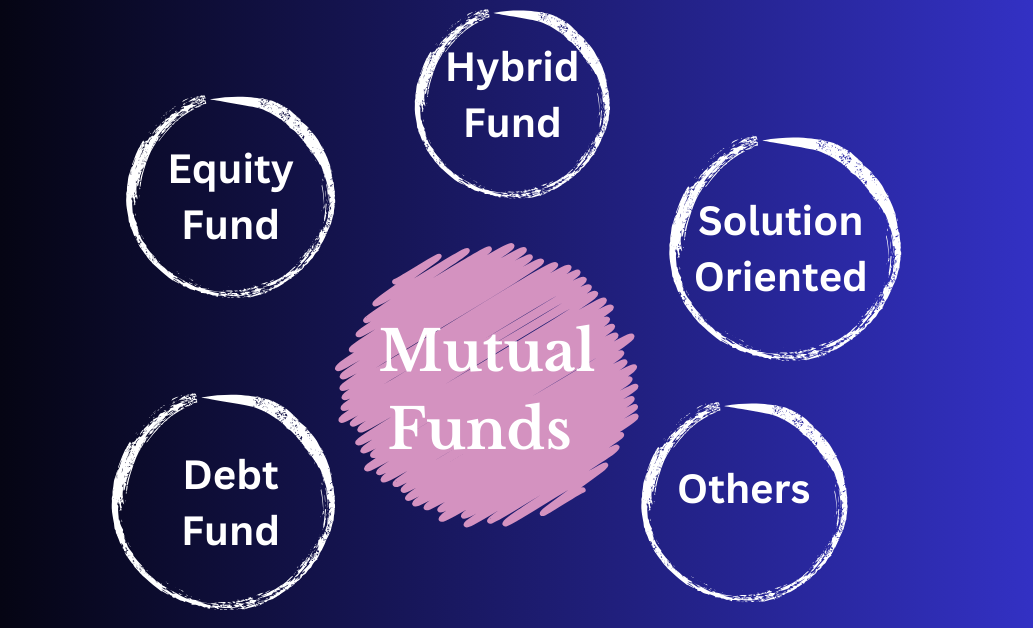

Types of Mutual Funds

*Holistic Investment

Different types of features of mutual funds are available in the commerce industry. These funds are tailored in terms of structure, asset class, and investment objectives.

1. Interval funds

These features of mutual funds allow for transactions at certain times. When the trading window opens, investors can buy or sell their units.

2. Open-ended funds

These funds have no restrictions on when or how many units can be acquired. Investors can enter and depart at the current net asset value throughout the year. Investors wanting liquidity might choose open-ended funds.

3. Close-ended funds

The funds that have a predetermined unit capital amount and may only be bought within a specific period are called closed-ended funds. The maturity date governs redemption in this case. Schemes, on the other hand, trade on stock markets to enhance liquidity.

4. Debt funds

Debt funds put money into fixed-income investments, including treasury bills, corporate bonds, and government securities. People focusing on stability and a consistent income while posing little risk should go for debt funds.

5. Equity funds

Equity funds put money in company shares, and their returns are determined by how the stock market performs. While offering significant returns, these funds are also considered dangerous, like every other investment scheme.

6. Solution-oriented funds

It is designed to achieve certain goals, such as saving for a person’s children’s marriage, education or retirement, solution-oriented funds are commonly opted for by individuals with various liabilities. These types of mutual funds have a minimum five-year lock-in duration.

7. Hybrid funds

To balance debt and equity, hybrid funds invest in both debt and equity products. Depending on the funding company, the investment ratio might be fixed or variable. Balanced and aggressive funds are the two primary categories of hybrid funds. Multi-asset allocation funds invest in a minimum of 3 asset classes.

8. Capital protection funds

Capital protection funds invest partly in equities and partly in fixed-income instruments. This ensures capital protection, which ensures minimal loss. But, returns from this fund are taxable.

9. Growth funds

These funds invest largely in high-performing companies with capital appreciation as the objective. These funds may appeal to investors seeking large returns over a lengthy period.

10. Pension funds

Pension funds invest to produce consistent returns over a long period. These are hybrid funds that produce low returns but are capable of providing consistent returns in the future.

11. Tax-saving funds

Tax-saving funds are features of mutual funds that primarily invest in corporate stocks. They qualify for tax breaks under Section 80C of the Income Tax Act, having an investment term of a minimum of 3 years.

12. Fixed-maturity funds

These funds invest in debt market securities with the same or a comparable maturity length as the fund.

13. Liquidity-based funds

Some funds can be classified depending on the liquidity of their investments. For short-term goals, ultra-short-term and liquid funds are excellent.

Features of Mutual Funds

1. Investment flexibility

*Nirmal Bang

This is one of the most appealing features of mutual funds. To invest in the advantages of mutual funds, individuals can choose between SIP and lump sum payments.

2. Great for portfolio diversification

*Grip Invest

Mutual funds can be invested evenly in high and low-risk funds on people’s behalf to balance one’s profits and losses instead of putting all money into one place. This gives individuals access to a diverse portfolio that can generate profits even during economic downturns.

3. Professional operation

To operate features of mutual funds, every fund house hires experts known as fund managers. They analyze market trends and invest the money in shares or bonds based on the scheme’s objectives.

4. Tax benefits

*Mahindra Finance

Because of their great tax efficiency, the features of mutual funds are a good long-term investment. Investing in tax-saving funds while producing large returns might also result in income tax deductions.

5. Liquidity

In case of an emergency, people can withdraw or redeem money from the fund. Depending on the scheme, people get the ransom in 3-4 business days in the form of liquid money. Thus, features of mutual funds have adequate liquidity, since investors can redeem them at any moment.

6. Minimal charges

*The Economics Times

Mutual funds are also accessible to people of all income levels. To invest in features of mutual funds, you must pay a tiny fee to your fund companies, known as the expense ratio. The fee ratio and any extra charges may differ between investment companies. However, the fees are lower than those of comparable managed funds.

Advantage of Mutual Funds

Mutual funds come with various advantages. Some of the most important ones are as follows:

| Accessibility | Many firms enable consumers to contribute as little as Rs.1000 in advantages of mutual funds as a single amount. Furthermore, one may choose a SIP and begin investing with a minimum of Rs.10. |

| Diversity | Mutual funds come in various distinct forms, as previously stated. Investors can choose features of a mutual fund scheme that meet their financial goals. They may develop a diverse investment portfolio at a low cost, because of the various possibilities that are offered. |

| Systematic investing | A mutual fund fosters long-term investment, which is essential for large asset accumulation. Furthermore, you may select a Systematic Investment Plan (SIP) and invest a certain amount at regular intervals, allowing you to invest systematically. |

| Various methods of investment | The advantages of mutual funds can be bought as a one-time or lump-sum investment. You can even go for a Systematic Investment Plan (SIP), a Systematic Transfer Plan (STP), or a Systematic Withdrawal Plan (SWP). |

| Convenience | With the popularity of online features of mutual fund investment, people no longer need to visit a fund house in person. Using a phone or computer, individuals may invest in any fund of their choice. |

Prices of Mutual Funds

*5paisa

The price of a mutual fund depends on the securities’ performance where the money has been invested. When an investor purchases a unit or share of a mutual fund, he or she is purchasing the portfolio’s performance or, more accurately, a portion of the portfolio’s worth. Investing in mutual fund shares differs in many ways from investing in stocks. The features of mutual fund price share are known as the net asset value (NAV) per share, which is commonly abbreviated as NAVPS. The NAV of a fund is calculated by dividing the entire value of the securities in the portfolio by the total number of shares outstanding. All institutional investors, corporate executives, shareholders, or insiders own outstanding shares.

Mutual fund shares are normally redeemed or acquired at the fund’s latest net asset value (NAV). This does not differ during market hours. However, it is settled after each trading day. When the NAVPS is resolved, the price of a mutual fund is likewise adjusted. The average mutual fund invests in a variety of securities, providing features of mutual fund owners with diversification.

In The End

The advantages of mutual funds are a widely admired and effective form of investment through which an individual can diversify his/her portfolio and minimize risk to obtain his/her objectives. Thanks to the resources merged with that of others’ investments, funds provide a set of options for investments, including equity, debt, hybrid, and sectored funds. With their uniqueness in types, purposes, and benefits, the features of mutual funds cater to both novice and seasoned investors.

Yet navigating the crowded field of features of mutual fund options and deciding to invest can be quite a challenge. This is where Jaro Education comes into the picture. Through its financially advanced courses and certifications, Jaro will provide you with more and more knowledge about the advantages of mutual funds such as its operations and maximizing returns. Jaro Education’s platform has several structured industry-oriented programs in strategic partnership with top-ranked institutions that help you nurture skills to analyze investment banking, financial markets, mutual fund options, further read market trends, and make investment decisions that fit your financial goals.

Choose Jaro Education, which will also guarantee resources, knowledge, and learning support in walking the journey of mutual funds with confidence. Whether you are embarking on your investment journey or are an experienced investor seeking to optimize your investments, Jaro’s expert advice can be instrumental in facilitating career counseling and advancement. By selecting the right course, you can pave the way toward a brighter financial future. Jaro Education understands that navigating the complexities of investment can be a challenge, and is committed to providing accessible and comprehensive guidance to support your upskilling journey.

Frequently Asked Questions

Mutual funds work by pooling investors’ money to invest in various securities, providing diversification and professional management. Each investor holds shares in the features of a mutual fund, representing their portion of the portfolio. The value of these shares is determined by the fund’s performance, which fluctuates based on the value of its underlying investments.

- Open-End Mutual Funds: These funds allow investors to buy and sell shares at any time based on the fund’s Net Asset Value (NAV).

- Closed-End Mutual Funds: These funds issue a fixed number of shares through an initial public offering (IPO), and shares are traded on exchanges like stocks.

Mutual funds may charge various fees, including:

- Management Fees: Paid to the fund manager for managing the fund’s portfolio.

- Expense Ratios: An annual fee that covers the fund’s operational expenses.

- Sales Loads: A commission charged when buying or selling shares in the fund (not applicable to all funds).

- Exit Loads: A fee charged when you sell your units before a certain period.

To choose the right mutual fund, consider factors such as:

- Investment Goals: Identify your objectives (e.g., retirement, wealth growth, income generation).

- Risk Tolerance: Assess your ability to withstand market fluctuations.

- Fund Type: Select funds that align with your risk profile (equity, debt, hybrid).

- Performance History: While past performance is not a guarantee of future returns, it can provide insight into how the fund has managed different market conditions.

- Fees: Understand the costs associated with the fund to ensure they align with your investment strategy.