What is the Balance of Payments (BOP) in Economics?

Table of Contents

- jaro education

- 7, May 2024

- 10:00 am

The balance of payments (BOP) is an indicator in the global economy, showing how healthy a country’s finances are and how it interacts with others worldwide. It is a metric used by both policymakers and economists to see how well a country is doing economically, including its currency strength and how much it trades with other countries.

Learning about the balance of payments helps us grasp a country’s economic picture better. It helps us understand things like why currency values change and whether a country buys more from other nations than it sells to them. In this article, you will learn the balance of payments in simple terms. You will learn its definition, types, and many factors that affect the balance of payment.

Understanding the Balance of Payments (BOP)

The balance of payments (BOP) serves as the mechanism through which nations monitor all international financial transactions over a specified period. Typically, BOP calculations are performed quarterly and annually.

Every transaction, whether conducted by the public or private sectors, is recorded in the BOP to ascertain the inflow and outflow of funds into and out of a country. In this accounting system, when a country receives money, it is recorded as a credit, whereas when it pays or transfers money, it is noted as a debit.

In principle, the BOP should ideally balance at zero, indicating that credits (assets) equal debts (liabilities). However, in reality, achieving this equilibrium is uncommon. Consequently, the BOP serves as an indicator of whether a country experiences a deficit or surplus, revealing the specific sectors contributing to these discrepancies.

Categories of Balance of Payment

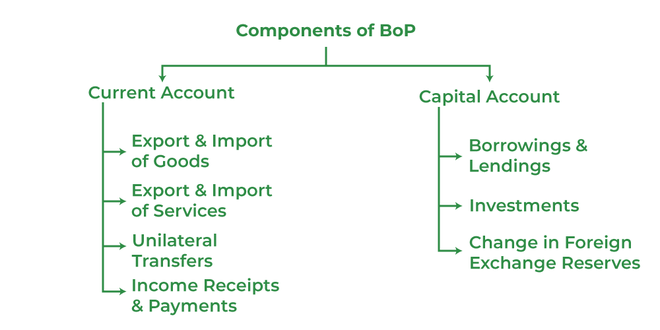

The Balance of Payments (BOP) is structured into three primary categories, namely the current account, the capital account, and the financial account. Each of these categories includes various subcomponents, representing distinct types of international financial transactions.

*geeksforgeeks

1. The Current Account

The current account serves to monitor the inflow and outflow of goods and services across a country’s borders. It also includes earnings from investments, both public and private. Within the current account, transactions are categorized as credits and debits related to the trade of merchandise and services. Merchandise trade encompasses goods such as raw materials and manufactured products, including those exchanged through aid programs. Services encompass revenues from tourism, transportation, engineering, business services, and royalties from intellectual property rights.

Goods and services collectively contribute to a country’s balance of trade (BOT), which represents the disparity between total imports and exports. A BOT deficit occurs when a country imports more than it exports, while a surplus indicates the opposite scenario. Additionally, income generated from assets like stocks, in the form of dividends, is recorded in the current account. Unilateral transfers, such as workers’ remittances and foreign aid receipts, constitute the final component of the current account.

It can be calculated as:

Current Account = (Exports of Goods and Services + Primary Income + Secondary Income) – (Imports of Goods and Services + Payments to Foreign Investors + Gifts/Transfers Paid)

2. The Capital Account

The capital account documents all international transfers of capital. This includes transactions involving nonfinancial assets, such as land, and non-produced assets crucial for production, like mineral reserves. The breakdown of the capital account encompasses monetary flows stemming from debt forgiveness, transfers of goods and financial assets by migrants, changes in ownership of fixed assets, proceeds from the sale or acquisition of fixed assets, taxes on gifts, inheritances, and damages to fixed assets that are not insured.

It’s often much smaller than the other two accounts and includes:

Capital Account = Capital Transfers + Sales/Purchases of Non-Produced, Non-Financial Assets

3. The Financial Account

The financial account records international monetary flows associated with investments in various financial instruments, including business ventures, real estate, bonds, and stocks. It also includes government-owned assets like foreign reserves, gold holdings, and special drawing rights (SDRs) held in the International Monetary Fund (IMF). Moreover, private assets held abroad and direct foreign investments are accounted for in the financial account. Assets owned by foreign entities, both private and official, are also documented within this category.

The calculation includes inward and outward flows:

Financial Account = Direct Investment + Portfolio Investment + Other Investments (Inflows – Outflows)

Overall Balance of Payments

The overall BOP should theoretically equal zero, meaning that all debit and credit entries should balance out, accounting for financial account transactions, errors, and omissions. If they don’t, it indicates that the country is spending more foreign currency on foreign trade than it is earning, or vice versa.

Overall BOP = Current Account + Capital Account + Financial Account (+/- Balancing Items)

Balance of payment is one the crucial parts of economics and it is connected with various aspects of economics. You can explore in depth about economics with the Online Master of Science (Economics) offered by Symbiosis School for Online and Digital Learning (SSODL). Crafted by experts hailing from the top 10 Symbiosis Institutes in India, the curriculum is delivered by proficient faculty members, guaranteeing participants an exceptional educational experience. Through this course, you can gain the skills to analyze and interpret information concerning various core aspects objectively and critically.

Benefits of Balance of Payments

The balance of payments is a vital financial record that helps understand a country’s economic health and transactions. Here’s why it’s so important:

- It tracks all imports and exports of goods and services over a certain period.

- It helps the government figure out which industries have the potential to grow in exports, so they can create supportive policies.

- It gives the government a clear picture of import and export tariffs, helping them adjust taxes to encourage exports and discourage imports, which boosts self-reliance.

- The government can use it to plan and allocate resources like money and technology to sectors that need help, especially when the country depends too much on imports.

- It helps detect how the economy is doing, which is useful for making plans to expand and for deciding on monetary and fiscal policies, based on the country’s balance of payments.

Balancing Mechanism in BOP

International monetary systems play a vital role in fixing economic imbalances effectively.There are three main ways to deal with differences in Balance of Payments (BoP), usually used together. These methods are: changing exchange rates, adjusting a country’s internal prices and demand, and following rules-based adjustment systems. Also, countries work on boosting productivity and making their exports more appealing to keep improving their economic standing.

Fixing Imbalances by Adjusting Exchange Rates

When a country’s currency value changes compared to others, it can fix current account surpluses or deficits. If a currency’s value goes up, exports become less competitive but imports become cheaper, which helps with a surplus. If the currency’s value drops, imports become more expensive, making exports more competitive and fixing a deficit. Governments can control exchange rates in certain systems, while in others, rates adjust naturally.

Correcting Imbalances through Internal Price and Demand Changes

In systems like the gold standard or in currency unions like the Eurozone, fixing imbalances means making changes within the country’s economy. For example, when a country has a trade surplus under the gold standard, it gets more gold, which increases the money supply, causing inflation and reducing the surplus. Conversely, trade deficits lead to deflation, making exports more competitive. Countries like Germany could reduce their surplus by increasing domestic demand, changing how much they save and invest.

Using Rules to Correct Imbalances

Countries can agree on fixed exchange rates and use negotiated adjustments to fix imbalances. The Bretton Woods system is an example of this approach. Some economists, like Keynes, suggested making surplus countries share the burden of balancing by imposing penalties if they keep their surplus. However, these ideas were not accepted. Nowadays, economists like Paul Davidson are revisiting these ideas, proposing new ways to fix global imbalances without causing other problems.

Factors That Affect BOP

The Balance of Payments (BOP) stands as a pivotal economic metric depicting a nation’s engagements with the global market. It encompasses the current account, financial account, capital account, and a complementary balancing item. Let’s delve into the factors that influence the equilibrium of the BOP:

- Consumer Spending on Imports: In periods of economic prosperity, heightened consumer expenditure frequently triggers a deficit in the current account due to increased imports.

- International Competitiveness: When a nation encounters elevated inflation relative to its competitors, its exports may lose competitiveness, leading to diminished demand and a potential deficit in the current account.

- Exchange Rate Dynamics: An overvalued exchange rate can render exports relatively more expensive, consequently causing a deterioration in the balance of the current account.

- Economic Structure: Structural shifts like deindustrialization can detrimentally impact the export sector, thereby influencing the overall balance of payments.

What is Balance of Payment Deficit?

Balance of Payment Deficit refers to a situation in which a country imports more capital, goods, and services than it exports, leading to an imbalance in its economic transactions with the rest of the world.

Mathematically, the balance of payment deficit is represented by the equation:

Current account+Capital account receipts<Current account+Capital account payments

To address a Balance of Payment deficit, a country may utilize its foreign exchange reserves to cover the shortfall in its balance of payments.

Several important points to note about the Balance of Payment deficit include:

- Correction through official reserve sale: A country can rectify a Balance of Payment deficit by selling foreign exchange reserves through the intervention of the Reserve Bank.

- Role of monetary authorities: When a deficit occurs in the balance of payments, the monetary authorities of a country act as financiers, whereas they become recipients in case of a surplus in the balance of payments.

- Decline in official reserves: A decrease in a country’s official reserves indicates a deficit in the balance of payments.

- Relevance of official reserve transactions: Transactions involving official reserves are applicable only in the context of fixed exchange rate regimes and are not considered under floating exchange rate systems.

What is Balance of Payment Surplus?

A balance of payment surplus signifies a scenario where a nation’s total exports surpass its imports. This surplus contributes to accumulating capital that can be utilized to support domestic production. Moreover, with a surplus in its balance of payments, a country gains the capacity to extend financial assistance beyond its borders.

Balance of payment surplus arises when the sum of receipts in the current account and capital account exceeds the total payments in the current account and capital account:

(CurrentAccountReceipts+CapitalAccountReceipts)>(CurrentAccountPayments+CapitalAccountPayments)

A surplus in the balance of payments can act as a catalyst for short-term economic growth within a country.

Example of Balance of Payment

In the year 2023, Country X recorded its transactions for goods and services with other nations. Their exports amounted to $100 million, while their imports totalled $60 million. Additionally, Country X received net capital transfers of -$20 million during the same period. Moreover, their non-financial assets abroad amounted to $25 million. However, when considering foreign investments, including foreign direct investments, portfolio investments, and asset funding, Country X experienced a net outflow of -$30 million.

Summing up these figures, we can analyze Country X’s balance of payments. Firstly, the trade balance reveals a surplus of $40 million, indicating that the country exported more than it imported.

Moving on to the capital account, there’s a deficit of $20 million. This signifies that Country X had more capital outflows than inflows during the period.

Examining the financial account, there’s a deficit of $30 million, suggesting that Country X experienced a net outflow of financial assets to other countries.

By applying the balance of payments formula and combining the balances of all three accounts, we find that Country X’s balance of payments indicates a negative balance of $10 million. This negative balance points towards an overall deficit in the economy, which may warrant the attention of policymakers and financial experts for potential corrective measures.

Conclusion

The Balance of Payments (BOP) statement is crucial for understanding how countries interact financially. Its different parts give a big picture view that’s essential for managing international finances well. The major benefits of the BOP statement is it helps us see how a country’s currency is doing compared to others. It also shows how valuable a country is as a business partner and where it stands in the global economy.

Moreover, through careful analysis of the BOP statement and its components, nations can identify trends that could either support or hinder economic growth. This empowers them to implement suitable measures. In short, the BOP statement isn’t just a financial report—it’s a guide that helps countries make smart economic choices, leading to long-term growth and success.