Indian Tax Laws: A Simple Overview Guide

Table of Contents

Taxes are levied on almost every rupee that you earn, spend, save or invest–so knowing a bit about Indian tax laws is essential for everyone (not just the finance experts).

We all earn money. Some of us are salaried employees, others are freelancers, business owners or maybe just starting your first job. Whatever your situation may be, being at least aware of some fundamentals about income tax laws in India, Indian tax law and the Indian tax rules and principles can help you save money, save you the anxiety of the impending tax bill and save you the rushed last minute decision.

In this guide, we will deal with several topics related to india tax laws including types, common related terms, and how you can choose the right tax regime. Let’s get started.

What Are the Common Terms Related to Income Tax?

*iifl.com

Before we dive into the vast world of Indian Tax laws, familiarise yourself with the most common terms related to Indian Taxation that you will come across at every turm:

Previous Year (PY): The previous year is simply the fiscal year (FY) you earn your income, For example, April 1 to March 31. So, if you earned an income from April 1, 2024 to March 31, 2025, the income falls in the previous year of 2024–25.

Income Tax Return (ITR): The ITR is the form where you declare your income and also claim deductions in order to compute your tax. You have different forms based on the nature of your status and income sources, ITR-1 to ITR-7. It is very important to file the correct form as part of the compliant income tax law in India.

Tax Deducted at Source (TDS): In Indian tax lawsTDS refers to tax that has been deducted before you received any payment – like salary, interest, professional fees, rent, etc. The person who deducted the TDS (the deductor) will report it; it will show up in either Form 26AS /AIS and will provide you with a TDS certificate. You will claim credit for this when you file your tax.

Net Taxable Income: This is the amount that is actually taxed: Gross Total Income minus your eligible deductions (e.g. under Chapter VI-A – the deductions allowed under Sections 80C, 80D, etc. if you are opting under the old regime).

Assessment Year (AY): The assessment year is simply the following year after the previous year in a fiscal year, and the year that your income is assessed and the return is filed. If you earn an income in the previous year of 2024–25, the income is assessed in your assessment year of 2025–26 (April 1, 2025 to March 31, 2026).

Assessment: In Indian Tax laws, this is the process by which the Income Tax Department examines the return you filed (checking correctness, calculating tax, raising questions as needed) in terms of verifying process (of your return) and it doesn’t mean assessment as used in other tax laws in other countries. Together with AY, this represents the following tax structure and verification process enacted by Indian taxation rules for tax.

Assessee: An assessee is anyone (individual or entity) obliged to pay tax or comply with provisions of the Act (individuals, HUF, AOP, BOI, firms, LLP, companies, local authorities, artificial juridical person).

Self-Assessment: In Indian Tax laws, tax After being offset by the advance tax and TDS paid you incur a shortfall—this shortfall is the self-assessment tax owing you must pay before filing your return for the relevant assessment year.

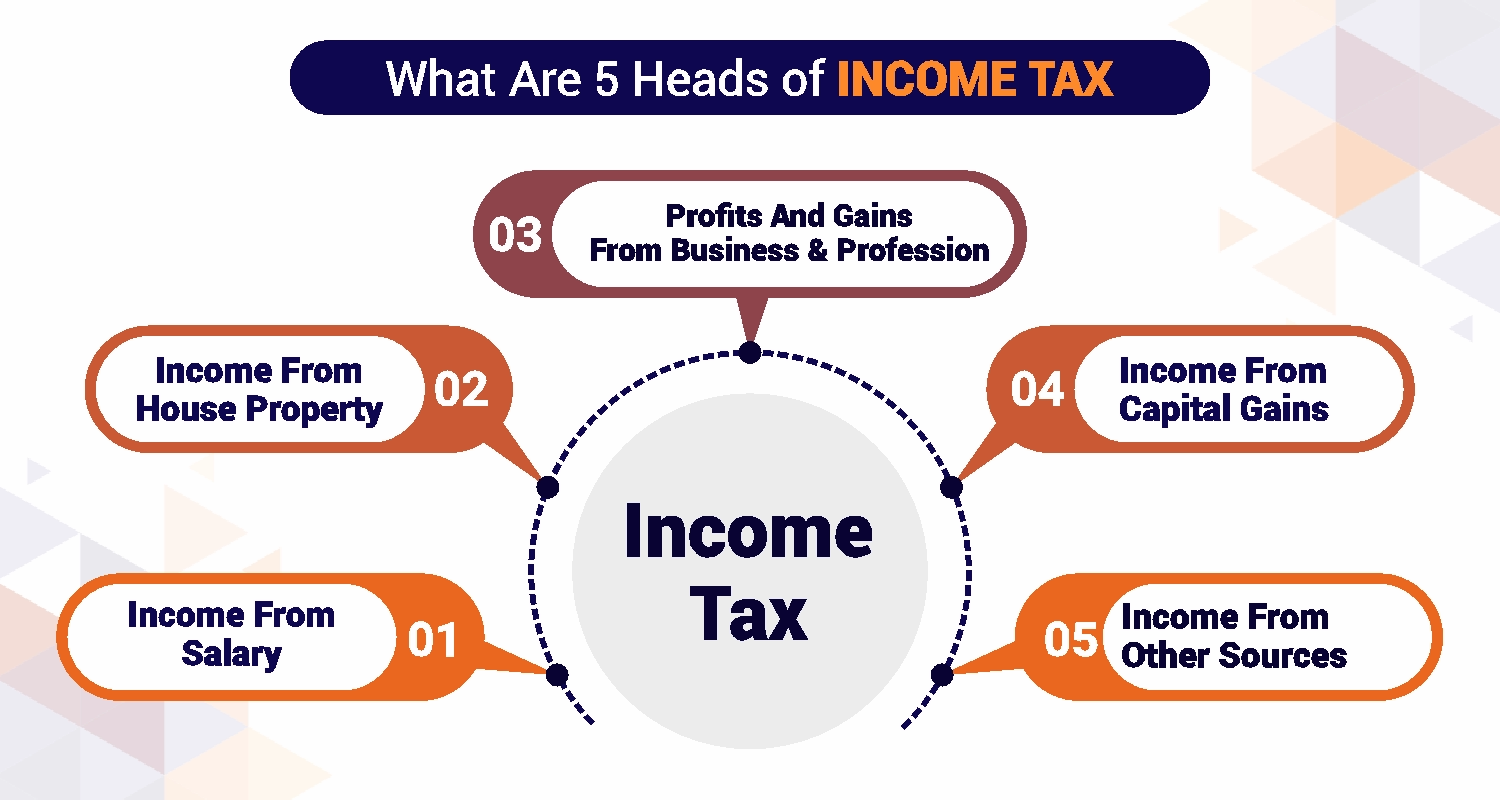

Gross Total Income (GTI): Gross total income is the total of all heads of income and not all heads of income have the same deduction allowances: salary, house property, business/profession, capital gains and other sources – after accounting for exemptions (like HRA for example if you are claiming).

Form 16: Given by your employer, Form 16 summarizes your salary, exemptions/deductions claimed, and TDS deposited. Part A has employer/employee details, TAN/PAN, and TDS summary. Part B breaks down salary components and deductions. If you’re salaried, Form 16 is your starting point every filing season.

Types of Income Tax Levied in India

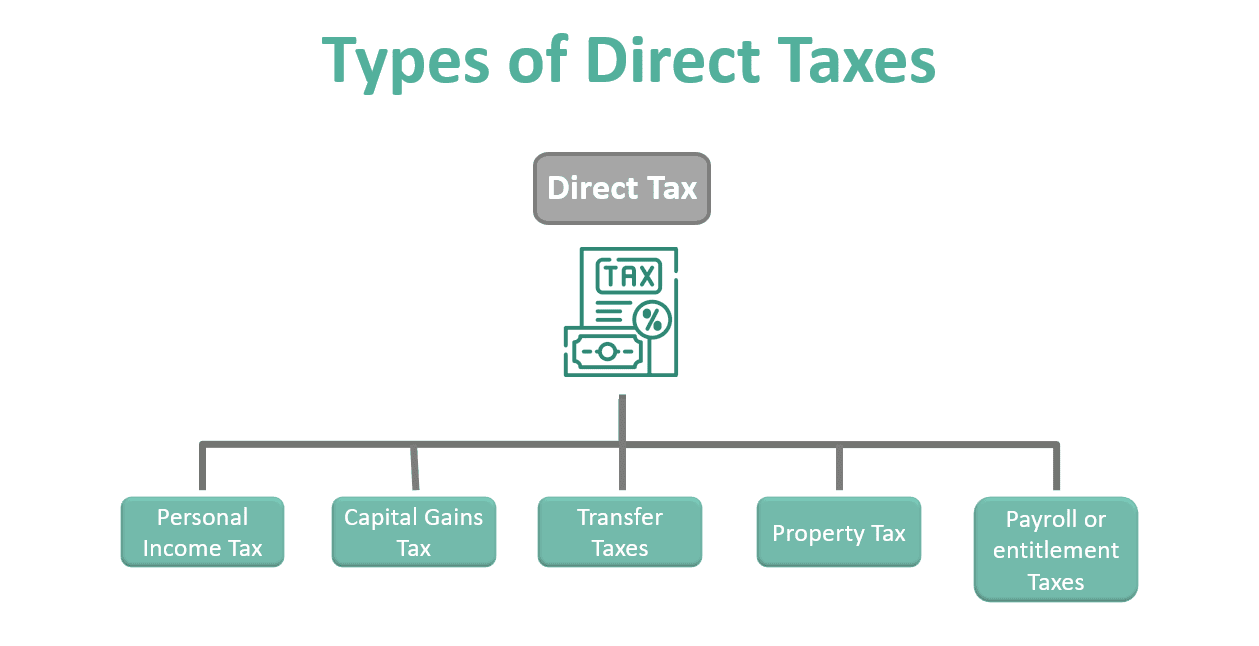

Under Indian tax law, taxes affect how we earn and how we spend. In general, there are two types of taxes you will come across: direct taxes (paid directly to the government based on income/profits) and indirect taxes (collected on behalf of the government from the seller/service provider).

Direct Taxes in India

Direct taxes in Indian tax laws are paid by the individual who goes through the economic burden- the principal direct taxes are income tax (comprising capital gains) and corporate tax. As a rule, direct taxes are progressive, in which higher income implies a higher charge, thus contributing to equitable treatment and macroeconomic stability in the framework of Indian taxation.

Types of Direct Taxes in India

*wallstreetmojo.com

Income Tax

This is the most important tax in Indian tax laws for individuals and numerous entities. The income tax is governed by the Income-tax Act, 1961, onsite the most recent legislation in full-time force and effect, and is subject to updates every so often (like through the aid of the annual Union Budget, for example). Appropriate rates, exemptions, and deductions are subject to the old or new regime.

Corporate Tax

Companies are taxed at certain rates and there is tax applicability provided, which, with certain qualifying conditions under those concessionary sections (like section 115BAA, 115BAB) may apply with reduced rates to achieve the intention of promoting competitively and biologically feasible investments, with a collective developing economy. In Indian tax laws, the rates above, can vary by the profile of the company and its chosen provisions defined under the applicable law.

Capital Gains Tax

Tax on a capital gain from selling capital assets (ie. shares, mutual funds, real estate). Short-term capital gain, long-term capital gain, indexation, types of assets sold and their holding periods all play a role in the type of tax applied.

- Securities transaction tax (STT)

In Indian tax laws, STT is charged on specific transactions on securities executed on recognized stock exchanges. The STT is applied to the traded value and is reasonable to work with since it is a tax that is transactional—thus, the tax is borne at the point it is created.

- Special tax – surcharge & cess

Surcharge, which may be collected for those that are in special kind of income brackets, and Health & Education Cess can also be applied on the income tax + surcharge under current regulations according to the applicable percentage. Percentages may change depending on fiscal policy.

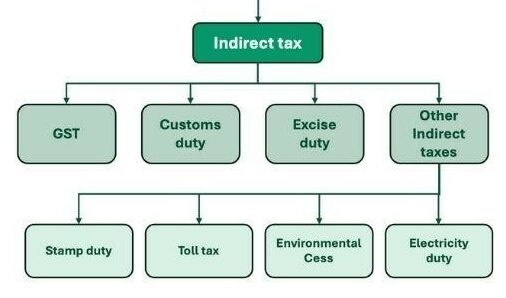

Indirect Taxes in India

Indirect tax is the tax levied on the consumption of goods and services. It is not directly levied on the income of a person.

Types of Indirect Taxes

*insightfulduo.com

Goods and Services Tax (GST)

GST includes most previous indirect taxes, and it is applied to the consumption of goods and services. If the supply is intra-state, GST is split into CGST and SGST; if the supply is inter-state, GST is IGST.

Input Tax Credit (ITC)

Registered businesses can claim their input tax credits (ITC) for any GST paid related to their eligible purchases, thereby reducing the tax component associated with value added. The only compliance obligation is the requirement to file returns on time, which includes matching invoices.

Customs Duty

This tax in Indian tax laws is imposed on both imports and exports. The tax rate applicable will depend on the tariff classification, trade agreements and product exemptions. This is a critical understanding for importers/exporters, as GST and Indian taxation law will apply.

VAT and Excise Duty (Selective)

GST has replaced most of the goods and/or services taxes, yet alcoholic liquor for human consumption and some petroleum products will continue with the advantages provided under legacy levies such as State VAT/Excise until the exemptions are notified.

Other Types of Taxes

- Entertainment Tax- Applied previously to films/shows, many components are now included in GST, but you may have local taxes as well.

- Entry Tax/Octroi- Most of this tax is covered by GST, but make sure to verify your state’s position.

- Toll Tax- Collection is based on user pay to fund the maintenance of roads/bridges above and is completely outside of GST.

- Gift Tax (current treatment)- There is no Gift Tax Act any longer, but gifts that exceed monetary thresholds are taxed as “Income from other Sources”, with exemptions including gifts from relatives, marriage gifts, and most gifts on occasions.

- Minimum Alternate Tax (MAT)- MAT in Indian tax laws is meant to ensure that companies with book profits pay tax, regardless of whether their normal income (subject to incentives and exemptions) is below their normal threshold (provisions and carve-outs apply).

How to Choose the Right Tax Regime?

There are typically two systems which are available for people under Indian income tax law:

Old Tax Regime

The old tax regime of Indian tax laws allowed a lot of exemptions and deductions (HRA, LTA, 80C for PPF/ELSS/EPF/life insurance, 80D for health insurance, allowance for home loan interest on self-occupied property of 24(b), etc.). There was utility if you invested/planned aggressively for tax savings or claimed exemptions such as HRA.

New Tax Regime

New India tax laws consist of the following:

- Lower slab rates but mostly give up deductions/exemptions to optimise.

- Most useful for people who prefer simplicity as no/less deductible investment/allowances.

Recent proposals have been created to minimise the tax burden on middle-class income earners and generally make the default system an appealing option.

New tax regime updated structure for 2025

Under the revised structure of Indian tax laws, taxpayers can benefit from lower rates if they choose the standard deduction and exemptions. The table below represents the proposed tax slabs:

| Income Range (INR) | Tax Rate |

| 0 – 400,000 | Nil |

| 400,000 – 800,000 | 5% |

| 800,000 – 1,200,000 | 10% |

| 1,200,000 – 1,600,000 | 15% |

| 1,600,000 – 2,000,000 | 20% |

| 2,000,000 – 2,400,000 | 25% |

| Above 2,400,000 | 30% |

Note: Important changes consist of an increased standard deduction—from INR 50,000 to INR 75,000—and adjusted surcharge rates for higher-income earners.

How to Calculate Your Individual Income Tax

Your total income tax will be calculated based on the law that is in effect on April 1 of the assessment year that follows your calendar year. Although the new regime of Indian tax laws is the default regime, individuals who do not have business income are free to choose the old regime every year. You may not be able to go back to the old regime if you move from the old to the new regime if you have income from a business—tread carefully.

What is “income from salary”?

Income from salary is not just your basic salary. It can include:

- Wages/Salary, pensions, bonuses and commissions

- Perquisites (i.e., rent paid on your behalf, certain reimbursements, etc.)

- Employer contributions to certain specified funds (within limits)

- Some reimbursements of personal expenses may be taxable

In a Nutshell

Now you know, learning Indian tax laws and Indian taxation law, as well as Indian taxation rules, doesn’t have to be challenging. If you get a better understanding of income tax law in India, you can make better decisions that will save you money and help you avoid stressful deadlines.

Tax affects everyone in India – salaried, self-employed, or owner of a business – so putting a little time into learning the basic principles is worth it in the way of peace of mind and better financial planning. You can trust Jaro Education – India’s leading higher education and upskilling company, brings online degree courses and programme certification for you. Think of the knowledge you gain in taxation as a financial toolkit for your life that you will use every year.

Frequently Asked Questions

What is the difference between direct and indirect taxes in Indian taxation law?

Direct taxes in Indian tax laws are paid directly to the government (like income tax), while indirect taxes are collected on goods/services (like GST).

Can I switch between old and new tax regimes every year?

Yes, if you don’t have business income.

What happens if I miss the income tax return filing deadline?

You may face penalties and lose certain benefits.

Is TDS the final tax I pay?

No, TDS is an advance. Final liability is adjusted during filing.

![Top 10 Highest Paying HR Jobs in India [2025 Guide]](https://jaro-website.s3.ap-south-1.amazonaws.com/2025/10/Top-10-Highest-Paying-HR-Jobs-in-India-2025-Guide-1-1024x576.webp)