What is Tax Planning? Scope, Features, & Strategies

Table of Contents

- jaro Education

- 22, July 2024

- 5:00 pm

Taxes are something we all pay, yet smart planning can somehow lower the amount of tax due from an individual legally. However, tax planning is crucial.

Tax planning meaning is looking after one’s financial affairs in such a way as to minimize tax liability within the framework set down by law. Hence, it will allow an Individual, a Salaried Employee, and a Business to take advantage of as many tax-saving deductions, exemptions, and investment opportunities as are permitted under the Income Tax Act of India.

This blog will put forward what tax planning means, its scope, its features of tax planning, and the smart strategies you could use to reduce income tax. This will help you make a choice on financial matters, whether for the first time filing taxes or to increase your savings.

What is Tax Planning?

Tax planning occurs as a process when the taxpayer arranges financial affairs so that maximum benefits under various tax laws can be enjoyed and the tax burden levied thereunder can be minimized. It deals with the absorption of the income of an individual or an organization that comes under the head of income, expenditure, investments, and other financial activities for the identification of potential areas of tax avoidance.

Thus, the taxpayers can plan the payment of taxes and take advantage of other provisions of the tax laws. Tax planning basically considers expenses and investments undertaken with the sole aim of saving tax and is otherwise a legitimate financial planning activity which is purely legal.

Why Tax Planning in Income Tax is Important?

Tax planning plays a crucial role in managing your income tax effectively. By implementing smart tax planning strategies, you can:

- Reduce your overall tax liability

- Increase your savings and investments

- Achieve long-term financial goals

- Comply with tax laws and avoid penalties

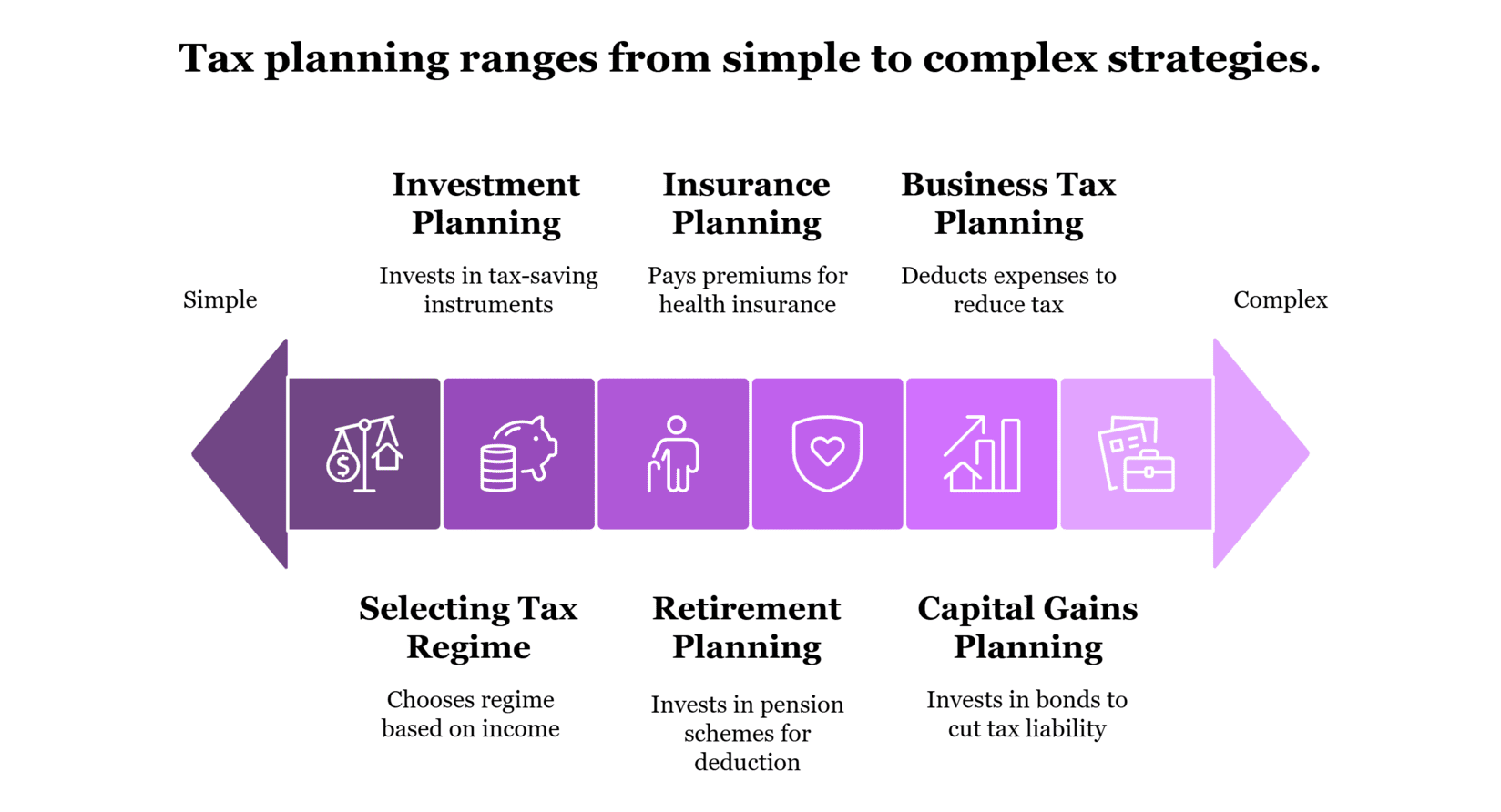

Scope of Tax Planning: More Than Just Saving Taxes

Tax planning is a very broad activity, and it extends well beyond selecting the old and new tax regimes. This normally consists of the following:

- Selecting the Correct Tax Regime

Taxpayers can choose among:

- Old Tax Regime: Provides such deductions as 80C, 80D, HRA, etc.

- New Tax Regime: Lower tax rates plus no deductions.

Engaging in effective tax planning means selecting the regime that is most suitable for your income and expenditures.

- Investment Planning

Investments in tax-saving, like:

- Equity Linked Savings Schemes (ELSS)

- PPF (Public Provident Fund)

- NSC (National Savings Certificate)

- Premiums of Life Insurance

- Retirement Planning

The investments made in the National Pension Scheme (NPS) attract deductions under Section 80CCD(1B).

- Insurance Planning

Section 80D allows claiming the premiums paid to the policies of health insurance.

- Capital Gains Planning

You will be able to cut the tax liability on capital gains by investing in certain bonds (such as under Section 54EC).

- Business and Freelance Tax Planning

As part of their income tax planning, businesses and self-employed professionals are allowed to deduct several expenses such as rent, travel, equipment, and so on.

Key Features That Define Smart Tax Planning

Knowledge of the characteristics of tax planning assists you in utilizing it better. The main features of tax planning are the following:

Legality

It has to be done under the provisions which are provided in the Income Tax Act. It is legal to avoid taxes; it is not to evade taxes.

Flexibility

Your income flow can allow you to take part in tax planning annually, on a monthly basis, or in the long run.

Goal-Oriented

This assists you in accomplishing individual financial objectives such as purchasing a house, investing in child education, or early retirement.

Incessant Process

Tax planning is not a task that is carried out once. Your tax strategy also should change, as with your lifestyle and income change.

What are the Different Types of planning Strategies in Income Tax Slabs in India?

In India, the income tax you pay depends on how much money you earn. The more you earn, the higher the percentage of tax you pay. This is called a progressive tax system.

India has two tax systems: the Old Tax Regime and the New Tax Regime. Each system has different tax rates for different income levels, called tax slabs. Tax planning is associated with different types that suit diverse financial requirements. Here’s a simplified table showing the tax rates for both regimes:

- Short-term Tax Planning

Accomplished at the end of the financial year and participating in short-term tax-saving products and instruments (e.g., ELSS, insurance, donations).

- Tax Planning over time

Strategized at the start of a financial year or over the years. This consists of retirement plans, real estate investments, or NPS.

- laissez-faire Tax Planning

Tax avoidance involves the utilisation of the statutory concessions provided by the government to minimise taxation.

- Purposive Tax Planning

This also involves the creation of certain financial goals, such as wealth building or asset creation through tax planning.

| Tax Saving Option | Section | Maximum Deduction |

| ELSS, PPF, LIC | 80C | ₹1.5 Lakhs |

| Health Insurance | 80D | ₹25,000 (₹50,000 for senior parents) |

| NPS | 80CCD(1B) | ₹50,000 |

| HRA | 10(13A) | Based on rent/income |

| Education Loan | 80E | No limit |

| Donations | 80G | 50% to 100% deduction |

Limitations of Tax Planning

While tax planning is beneficial, it’s important to understand its limitations:

- Changing tax laws: Tax laws are subject to change, which can affect your long-term planning strategies for tax.

- Complexity: Planning of taxes can be complex and may require professional assistance to navigate effectively

- Time-consuming: Proper planning of taxes requires regular monitoring and adjustments, which can be time-consuming.

- Investment risks: Some tax-saving investments may carry market risks, potentially affecting your returns.

Conclusion

So now you know what tax planning is, why it’s important, and how to do it effectively. Whether you’re a salaried employee, self-employed, or a business owner, the right income tax planning strategy can help you save big and secure your financial future.

Don’t wait until March to think about your taxes. Start now, plan smartly, and use all available deductions and benefits to make your money work harder for you.

Frequently Asked Questions

Yes, tax planning is a legal way to reduce your tax liability using provisions allowed under the Income Tax Act.

Absolutely. With some research and planning, you can manage your taxes well. But for complex incomes, a CA or tax advisor can help.

Tax planning is legal and follows the law. Tax evasion involves hiding income or false claims, which is illegal.

It depends on your income, deductions, and financial goals. If you claim a lot of deductions, the old regime may be better. Otherwise, consider the new regime.

Yes, apps like ClearTax, Quicko, and TaxBuddy help with income tax filing and planning.

1 thought on “What is Tax Planning? Scope, Features, & Strategies”

A comprehensive guide to tax planning! The tips are practical and easy to follow, making financial management much simpler. Great job!