A Comprehensive Guide To Supply Chain Finance

Table of Contents

- jaro education

- 18, January 2024

- 9:00 am

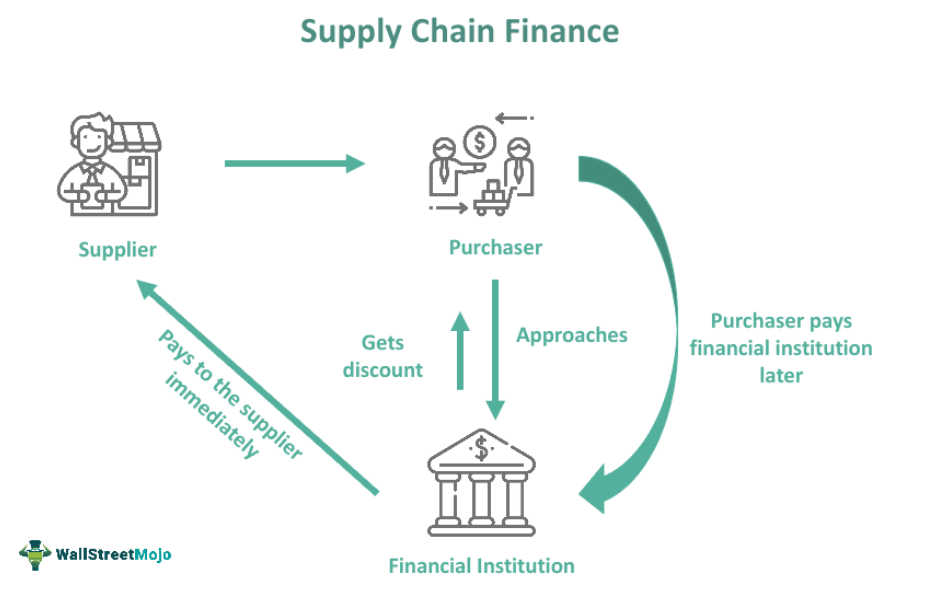

Supply chain finance (SCF) is a set of technology-based solutions that aim to lower financing costs and improve business efficiency for buyers and sellers linked in a sales transaction. SCF allows suppliers to use their accounts receivable as collateral, which gives them early access to payment of the invoices issued by buyers. Meanwhile, buyers can prolong supplier delivery time and improve liquidity while benefiting from using financing tools like syndicated loans or securitization on discounting credit balances to reduce financing costs. SCF can offset the risks and costs of trading activities, such as currency fluctuations, delays in making payments, and quarrels over overpayment settlement.

SCF is by no means an innovative concept, but it has gained new life in the face of rapidly increasing complexity and instability in global supply chains over recent years. For instance, the COVID-19 pandemic has revealed how weak and vulnerable many supply chains can be. More flexibility and resilience should be more important in designing a buying model. In the current business environment, with ecology and sustainability coming to the forefront, creating more value and efficiency in their operations is a crucial consideration for suppliers. And this is where SCF can help.

In this blog, you will explore the benefits, features, and types of SCF. Plus, will learn about the challenges and opportunities for its adoption and implementation. Besides that, it will also introduce an Executive Certificate Program In Supply Chain Analytics and Management, offered by IIM Mumbai (NITIE) in collaboration with Jaro Education, that can help you learn the latest concepts, tools, and techniques of supply chain management and analytics.

*wallstreetmojo.com

How Does Supply Chain Finance Work?

Supply Chain Finance works best when the buyer has a better credit rating than the supplier and can thus access capital from a bank or other financial provider at a lower cost. This advantage lets the buyer negotiate better terms from the supplier, such as extended payment schedules. Meanwhile, the supplier can unload its products more quickly and receive immediate payment from the intermediary financing body.

A typical SCF transaction involves the following steps:

- The buyer places an order with the supplier.

- The supplier delivers the goods or services and sends an invoice to the buyer.

- The buyer approves the invoice and sends it to the financier, who verifies it and offers to pay the supplier early at a discount.

- The supplier can accept the early payment offer or wait until the due date.

- The financier pays the supplier according to the agreed terms.

- The buyer pays the financier on the due date.

What Are The Benefits Of Supply Chain Finance?

SCF offers many benefits to both buyers and suppliers, such as:

Improved cash flow

Buyers can extend their payment terms and suppliers receive early payments with SCF, which enhances their cash conversion cycle and frees up cash for other purposes.

Reduced financing costs

SCF allows suppliers to access financing at lower rates than they could obtain independently, based on the buyer’s creditworthiness. SCF also reduces the need for suppliers to use other forms of funding, such as overdrafts, loans, or factoring.

Increased profitability

By utilizing SCF, buyers and suppliers can optimize their working capital and reduce their inventory and financing costs, which increases their profit margins and return on capital employed.

Enhanced supply chain stability

The relationship and trust between buyers and suppliers is strengthened by SCF, reducing the risk of payment delays, disputes, and defaults. SCF also helps suppliers to improve their liquidity and solvency, which reduces the risk of supply chain disruptions and insolvencies.

Greater flexibility and scalability

SCF allows buyers and suppliers to adjust their payment terms and financing options according to their needs and market conditions. SCF also will enable them to add or remove suppliers or financiers from the program as needed.

What are the Challenges of Supply Chain Management?

Supply chain management (SCM) is the process of planning, implementing, and controlling the flow of materials, information, and money from the source to the customer. SCM aims to create value for the customers and stakeholders by delivering the right products at the right time, place, and cost.

However, SCM faces many challenges in today’s complex and dynamic environment. Here are some challenges of supply chain management:

Demand volatility

SCM has to deal with the fluctuations and uncertainties in customer demand, which can affect production, inventory, and distribution decisions. It has to balance the trade-off between responsiveness and efficiency and use forecasting and demand management techniques to align supply and demand.

Supply disruptions

Supply Chain Management has to cope with the risks and uncertainties on the supply side, such as natural disasters, pandemics, wars, strikes, cyberattacks, or supplier failures. It has to mitigate the impact of supply disruptions on operations and customer service and use risk management and contingency planning techniques to ensure supply continuity and resilience.

Global competition

SCM faces increasing competition from international and local players who offer lower prices, higher quality, or faster delivery. SCM has to differentiate itself from the competitors, create a competitive advantage, and use cost leadership, differentiation, or focus strategies.

Regulatory compliance

It is integral for SCM to comply with the laws and regulations of countries and regions, which can affect the sourcing, production, and distribution of the products. Plus, it has to ensure that the products meet the customers’ and authorities’ standards and requirements and use compliance management and auditing techniques to avoid penalties and reputational damage.

Sustainability and social responsibility

SCM has to consider the environmental, social, and ethical impacts of its activities, which can affect the reputation and performance of the business. It has to adopt sustainable and responsible practices, such as reducing waste, emissions, and energy consumption, using renewable and recycled materials, ensuring fair and safe working conditions, and using sustainability and social responsibility reporting and certification techniques to demonstrate its commitment and performance.

How Can Supply Chain Finance Help Overcome The Challenges Of Supply Chain Management?

Supply Chain Finance can help Supply Chain Management overcome some of the challenges mentioned above, such as:

Demand volatility

SCF can help SCM cope with demand fluctuations by providing flexible and scalable financing options, which can adjust to buyers’ and suppliers’ changing needs and conditions. SCF can also help SCM improve its responsiveness and efficiency by reducing the lead times and costs of the supply chain.

Supply disruptions

Supply chain finance can help SCM reduce the risk and impact of supply disruptions by providing liquidity and stability to the suppliers, which can improve their resilience and reliability. SCF can also help SCM diversify and secure its supply sources by providing access to a broader network of suppliers and financiers.

Global competition

With the help of supply chain finance, SCM can gain a competitive edge over its rivals by providing lower financing costs and higher profitability to the buyers and suppliers, enhancing their financial performance and market position. SCF can also help SCM create value for the customers by providing better quality and service and faster delivery.

Regulatory compliance

SCM can comply with the regulations of different countries and regions by providing transparent and traceable financing transactions, ensuring the supply chain’s legitimacy and accountability with the help of SCF. Also, it can help SCM to meet the standards and requirements of the customers and authorities by providing financing based on the quality and performance of the products rather than the creditworthiness of the suppliers.

Sustainability and social responsibility

SCF can help SCM improve its environmental, social, and ethical performance by providing financing that supports sustainable and responsible practices, such as green and circular supply chains, fair trade and labor, and social impact and inclusion. It can also help SCM demonstrate its commitment and performance by providing financing linked to the supply chain’s sustainability and social responsibility indicators and goals.

Conclusion

Supply chain finance is a set of solutions that optimize the cash flow and working capital of the parties involved in a supply chain. SCF can provide various benefits to buyers and suppliers, such as improved cash flow and working capital, reduced costs and risks, increased efficiency and competitiveness, and enhanced sustainability and social responsibility. SCF can also vary in terms of features and types, depending on the timing, the direction, and the mechanism of the financing and can also face challenges and opportunities that influence its adoption and implementation.

Further, if you want to learn more about supply chain finance and how to apply it to your supply chain or business, in that case, consider enrolling in an Executive Certificate Program in Supply Chain Analytics and Management offered by IIM Mumbai (NITIE) in collaboration with Jaro Education. This program can help you learn the latest concepts, tools, and techniques of supply chain management and analytics and how to use them to create value and efficiency in your operations.