Things You Need to Know about Investment -Banking [Updated]

Table of Contents

![Things-You-Need-to-Know-about-Investment-Banking-[Updated]](https://jaro-website.s3.ap-south-1.amazonaws.com/2025/08/Things-You-Need-to-Know-about-Investment-Banking-Updated.webp)

Ever thought what’s the most influential engines behind how companies raise money, expand, merge, or go public?

Well, the answer is investment banking. More than just a high stake and often shrouded in mystery, the career is a gateway into the world of strategic finance, fast decision-making, and powerful problem-solving. From managing IPOs to structuring massive corporate takeovers, investment bankers are the ones pulling the financial strings that shape economies.

So, if you are eyeing how to become an investment banker, this is your place. In this guide, we will walk you through every aspect you need to know to decide if this career is for you and how to make it happen.

What Investment Banking Really Is and Why It Matters More Than Ever

If you’ve been exploring high-growth careers in finance, chances are you’ve already brushed up against “what is investment banking.” But here’s what separates people who just read about it from those who are actually building toward it: a practical understanding of what it really involves.

At its core, investment banking is about advising businesses on large-scale financial decisions, the kind that define how companies grow, exit, raise funds, or restructure.

It includes things like:

- Raising capital: through equity or debt (think IPOs, private placements, bonds)

- Advising on mergers and acquisitions (M&A): whether a company should acquire, sell, or merge, and how to structure the deal

- Valuation and financial modeling: which involves breaking down a company’s worth and forecasting its future value

- Underwriting: like taking on the risk of issuing securities, often for public listings

You’re not working on hypothetical scenarios. You’re working on live deals that impact stock markets, industries, and sometimes entire economies. Whether it’s helping a unicorn startup go public or guiding a conglomerate through a strategic acquisition, investment bankers are the ones mapping out the financial blueprint.

And the momentum in India is only growing. From high-profile IPOs like Zomato, Paytm, and Mamaearth, to consolidation deals in sectors like telecom and fintech investment banking has shifted from being a Wall Street export to a central player in India’s growth story.

In short, it’s not just about being good at numbers or finance. It’s about seeing the bigger picture, aligning business goals with capital strategy, and executing with precision.

If you’re serious about stepping into this space, understanding the weight and scope of what investment bankers do is your first real edge.

What Do Investment Bankers Actually Do? (Roles Explained)

It’s one thing to know that investment banking involves big deals. It’s another to understand what professionals in this space actually do day-to-day and how the entire structure operates from the inside out.

Let’s break it down by roles. Each of these positions plays a specific function within a larger deal team. If you’re considering a career here, knowing how each role fits into the bigger picture helps you find your entry point and your edge.

1. Analyst (0–2 years)

This is where most investment bankers begin. Analysts are the workhorses of the deal team. Their days revolve around:

- Building financial models (DCF, LBO, comparable comps, etc.)

- Creating pitch books and client presentations

- Running market research and industry benchmarking

- Supporting due diligence processes

It’s intense, Excel-heavy, and fast-paced but it’s also where your core technical skills are built. Most analysts work closely with Associates and get a front-row seat to live deal execution.

2. Associate (2–5 years)

Associates usually come in after an MBA or after getting promoted from an analyst position. They’re the bridge between junior execution and senior strategy.

Responsibilities include:

- Reviewing and refining analysts’ work

- Interacting with clients

- Managing timelines and deliverables

- Preparing materials for negotiations or investor meetings

Associates begin taking on more leadership in managing transactions, and they’re trained to start thinking like dealmakers, not just executors.

3. Vice President / Director

At this level, you’re shaping the strategy and structure of deals. You’re no longer deep in Excel models, you’re now leading client relationships, pitching new mandates, and guiding your team through high-stakes decisions.

This is where the transition happens from technical execution to strategic advisory. You’re expected to originate deals, not just close them.

4. Managing Director (MD)

The top of the pyramid. MDs are revenue generators. Their focus is on relationship building, high-level negotiations, and bringing in new business. They’re the ones clients call when they’re exploring a merger, entering a new market, or restructuring capital.

While MDs don’t create models or slide decks anymore, their deep experience and deal intuition shape how deals unfold.

Other High-Impact Careers Within Investment Banking

*dealroom.net

Beyond the classic front-end roles, investment banking jobs also includes:

- Equity Research Analysts – Offer in-depth reports and stock recommendations

- Risk and Compliance Officers – Ensure deals stay within legal and regulatory limits

- Capital Markets Teams – Focus specifically on raising funds via debt or equity

Each of these investment banking jobs leads to a different experience, but all are critical in making deals happen.

Key Takeaway

Investment banking is structured, but dynamic. Your role may begin in spreadsheets, but it grows into decision-making, strategy, and client trust. The skills you build at each level, analytical thinking, communication, financial storytelling, compound over time and shape you into a high-impact finance professional.

This isn’t just about the title you hold. It’s about how you execute under pressure, how you think through ambiguity, and how well you can align business goals with financial solutions.

Core Skills Needed in Investment Banking (And How to Build Them Right)

If you’re aiming to grow your career in investment banking, the right skills will not only open doors, they’ll keep you growing inside them. Whether you’re just starting out or transitioning from another finance role, here are the essential skills needed in investment banking that can truly set you apart.

- Financial Modelling & Corporate Valuation: Every deal begins with numbers. Knowing how to model financial statements, run DCFs, and evaluate market comps is one of the most in-demand technical skills in investment banking.

- Business Strategy & Market Awareness: You’re not just analyzing data you’re advising on business moves. Understanding how markets shift, how sectors evolve, and how strategy impacts valuation makes you more than just a numbers person.

- Communication & Presentation: Investment banking often means translating complex analysis into clear, compelling narratives whether for a client pitch or internal approval. Great communicators become trusted advisors.

- Time Management & Execution: With tight timelines and high expectations, staying organized, focused, and calm under pressure is key. Execution matters as much as insight in this field.

- Tool Fluency: Mastery of tools like Excel, PowerPoint, Bloomberg, and deal data rooms isn’t optional, it’s foundational. These let you deliver faster, cleaner, and more impactful work.

If you’re building these investment banking skills through structured learning and real-world exposure, you’re already ahead of the curve.

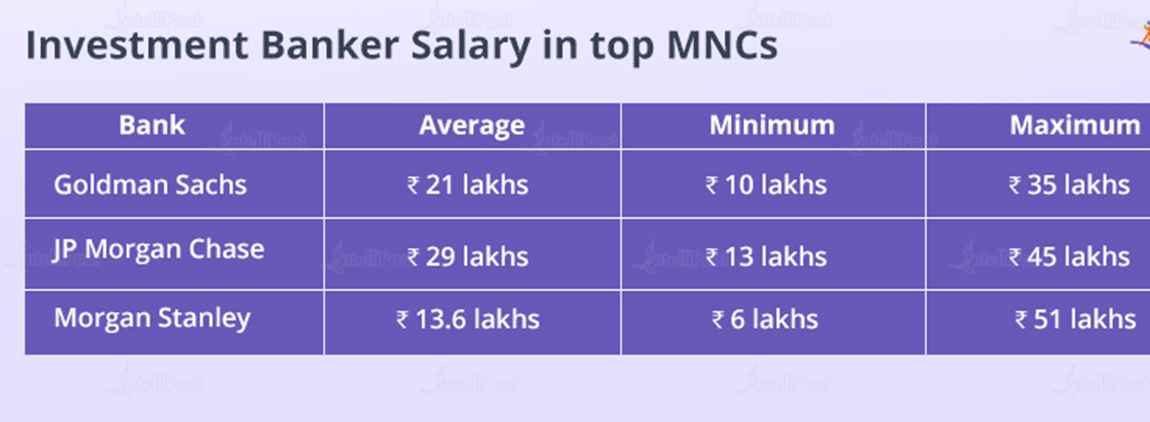

Investment Banker Salary in India: The Real Numbers

*intellipaat.com

Now, let’s get to the part everyone secretly wants to know: how much do investment bankers actually earn in India?

While the field is known for its long hours and intense pressure, it’s equally known for rewarding compensation packages.

Here is the list of investment banker salary in India based on experience:

| Experience Level | Average Salary (INR) |

| Entry-level (0–2 years) | ₹6 – ₹10 LPA |

| Mid-level (3–5 years) | ₹15 – ₹25 LPA |

| Senior roles (VP/Director) | ₹35 – ₹50 LPA (plus bonuses) |

| Managing Director (10+ yrs) | ₹70 LPA – ₹1 Cr+ (variable-heavy) |

Note: Bonuses, ESOPs, and deal commissions can significantly spike actual earnings, especially in top-tier firms.

What Drives Salary Variations?

- Tier of the Firm: Bulge bracket banks (like JP Morgan, Goldman Sachs) or top domestic firms (like Kotak IB or Avendus) pay more than mid-sized boutiques.

- Location: Investment banking roles in Mumbai, Bengaluru, and Gurugram command the highest packages.

- Your Background: MBAs from IIMs, ISB, or Tier-1 B-schools usually enter at higher packages but it’s not mandatory if your skills, experience, and training align.

- Performance: IB is a results-driven field. Those who bring value through modeling accuracy, client relationship handling, or deal execution rise faster and earn bigger.

How Jaro Education Can Help You Break Into Investment Banking

In a sector that values both precision and perspective, the right training can significantly shape your ability to stand out. That’s exactly where Jaro’s Professional Certificate Programme in Investment Banking by IIM Kozhikode steps in; it’s designed not just for theory, but for real-world entry into the industry.

This 10-month online program dives deep into corporate finance, valuation, M&A, and restructuring bringing global frameworks into the Indian context. Moreover, you’ll learn from top IIM faculty and industry leaders through weekend sessions, live case studies, and a capstone project that ties it all together.college

- Campus Immersion + expert mentorship

This means whether you’re pivoting from finance, consulting, or a completely different field, this programme gives you the conceptual tools and credibility needed to lead into the industry with confidence.

So, if investment banking is where you’re headed, this is where you start.

Conclusion

Investment banking isn’t just a job. It’s a high-pressure, high-growth space for people who thrive on strategic thinking, speed, and clarity under fire. From billion-rupee IPOs to complex M&A deals, investment bankers don’t just follow market trends, they shape them.

Last but not the least, the most important point to note is: To thrive here, you need more than ambition. You need specialized technical depth, real-world training, and the ability to translate numbers into decisions. And Jaro Education makes this elite learning experience accessible and career-ready to give you the edge that not only makes you compete but thrive.

Frequently Asked Questions

What exactly does investment banking involve?

Being an investment banker, you will handle big financial moves like raising capital, selling part of a business, merging with another firm, or launching an IPO.

What kind of jobs can I expect in India?

There’s a decent variety. The common starting roles are Analyst or Associate, but you’ll also come across more niche positions like working specifically on M&A deals, valuations, or IPO prep. In fact, many Indian firms like Avendus and Kotak have strong IB divisions, and global names like Barclays or Goldman also have offices in Mumbai and Gurugram. The actual work depends on the team you’re in but it’s hands-on from day one.

I didn’t study finance. Can I still get into investment banking?

Yes, and that’s more common than you’d think. What matters most is how well you understand the field. That’s where a structured program like the one by IIM Kozhikode, offered through Jaro Education can really help. It gives you the technical and strategic grounding investment banks expect.

What's the pay like in investment banking?

Entry-level salaries are usually in the ₹6–10 LPA range. With some experience, ₹15–25 LPA isn’t unusual. The top players with 5–10 years in can earn ₹40 LPA or more. And don’t forget, bonuses are a big part of the compensation.

Is investment banking a good long-term career choice?

If you’re the kind of person who enjoys solving business problems and thinking fast under pressure, it absolutely is. It’s not a 9-to-5, and you’ll work hard but the exposure, network, and growth potential are hard to match.