What is an Auction and Reverse Auction: Benefits and Examples

Table of Contents

- jaro education

- 5, April 2024

- 2:00 pm

What is an Auction and Reverse Auction: Benefits and Examples

Auctions have been a cornerstone of commerce for centuries, providing a platform for buyers and sellers to determine the value of goods and services. In 2022, the global sales at public auctions of art and antiques amounted to nearly 27 billion U.S. dollars. The United States, China, and the United Kingdom accounted for the highest share of public auction sales worldwide, with the U.S. alone holding 37 percent of the market.

However, in the modern era, a new form of auction has emerged: the reverse auction. Unlike traditional auctions where buyers compete to offer the highest price, reverse auctions see sellers vying to offer the lowest price. This method has gained popularity with large corporations and government entities, with approximately 15,000 reverse auctions conducted by six federal agencies in the U.S. in 2016.

In the upcoming sections, we’ll dive into the details, types, benefits, and real-world uses of auctions and reverse auctions. Whether you’re a seasoned economist, a new entrepreneur, or just curious, this blog will help you understand these important market concepts better.

Understanding Auction

An auction works as a method for trading goods or services through a bidding process, wherein individuals place bids with the aim of acquiring the item being auctioned. The highest bidder ultimately secures the purchase.

Participants in an auction engage in competitive bidding, each successive bid surpassing the previous one. Upon initiating the sale, the auctioneer typically begins with a modest asking price to attract a broad range of bidders.

As bidding progresses, the price escalates with each new bid until reaching a point where no further offers are forthcoming. At this juncture, the highest bidder prevails, acquiring the item. The auction concludes when the seller acknowledges the top bid and the buyer completes the transaction by remitting payment and taking possession of the goods or services.

While auctions are commonly associated with the sale of antiques, rare items, and artwork, they also have a presence in investment banking. In this realm, investment bankers leverage auctions to secure the most favorable price when selling a company. The process involves inviting numerous potential buyers to participate in the auction.

A greater number of interested buyers typically results in heightened competition during bidding, thereby driving up the price and allowing the bank to maximize its proceeds from the sale. Conversely, many buyers prefer proprietary sales over auctions, as they often afford more control over the purchase price.

The Auction Procedure

Prior to the commencement of an auction, prospective buyers are typically granted a preview period to inspect the items available for sale and assess their condition. This preview period might be scheduled for the evening before the auction day or a few hours preceding the start.

Once prospective buyers have concluded their inspection of the items and wish to participate in bidding, they are required to register with the auctioneer. Registration entails providing buyer information such as phone number, address, and identification details like passport or driver’s license number. Each registered bidder is then issued a bidder card bearing a unique number for participant identification.

Traditionally, the beginning of an auction is signaled by the ringing of a bell. The auctioneer delivers a brief description of the item being auctioned and initiates bidding with an opening price deemed reasonable.

Alternatively, the seller may have specified a minimum bid price, from which bidding commences. Bidders then vocally declare their bids, each exceeding the preceding one. Bidders raise their bidder card to announce their bid price, facilitating identification by the auctioneer.

The process concludes when there are no further bids, and the highest bidder secures ownership of the item by paying their bid price immediately.

Type of Auction

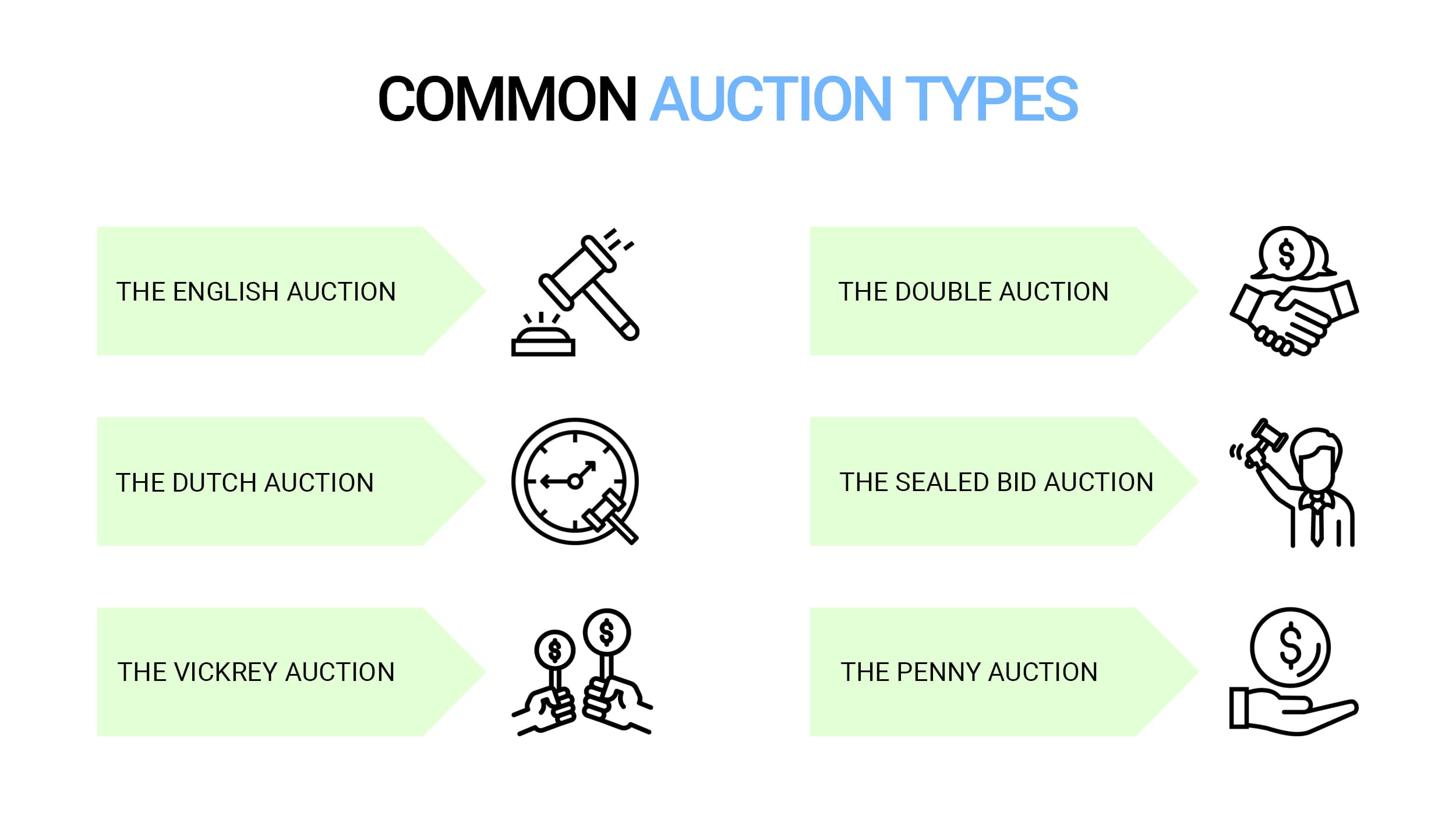

William Vickrey introduced four main types of single-unit auctions:

English Auction

This type, also known as an open outcry auction, is the most common today. In an English auction, participants bid against each other, with each bid being higher than the previous one. The auctioneer announces the prices, and bidders call out their bids until no one bids higher. This type of auction is often used for selling items like wine, antiques, tobacco, and art.

Dutch Auction

In a Dutch auction, the auctioneer starts with a high asking price and gradually decreases it until a bidder agrees to the price or the seller’s reserve price is reached. The goods are allocated based on the bid order, with the highest bidder selecting items first, followed by others in descending order. Dutch auctions are commonly used for perishable goods such as flowers, fish, and occasionally for investment securities. A well-known example of a Dutch Auction IPO is Alphabet (Google).

First-price Sealed-bid Auction

The first-price sealed-bid auction, commonly referred to as a blind auction, involves all participants submitting their bids simultaneously in sealed envelopes, ensuring that each bidder remains unaware of the bids placed by others. Each bidder is permitted to submit only one bid and cannot revise their bid once submitted.

In a buyer-bid auction, the highest bidder secures the item at their bid price, while in a seller-bid auction, the lowest bidder earns the right to sell their goods at the highest bid price accepted by a buyer. This type of auction is frequently employed in various sectors such as government contract tendering, mining leases, military procurement, refinancing credit, and foreign exchange.

Second-price Sealed-bid Auction

The second-price sealed-bid auction operates similarly to the first-price sealed-bid auction, except that the highest bidder obtains the item at the price of the second-highest bidder. For instance, if the highest bid in an auction is $500 and the previous highest bid was $480, the winning bidder only pays $480 for the item.

In a seller-bid auction of this type, the lowest bidder sells the item at the second-lowest bid. This form of auction finds application in automated scenarios such as real-time bidding for online advertising.

*code-care.com

Benefits of Auction

Here are some benefits of auctions:

- Price Discovery: Auctions allow buyers and sellers to discover the true market value of goods or services. Bidding reveals what people are willing to pay, leading to fair prices.

- Competition: It creates a competitive environment. Bidders compete to win, driving prices up (in regular auctions) or down (in reverse auctions).

- Efficiency: Auctions efficiently allocate resources. They match supply and demand, ensuring goods go to those who value them the most.

- Transparency: Auctions are transparent processes. Participants can observe bids and outcomes, promoting trust and fairness.

- Speed: Auctions can be swift, especially online. Sellers can quickly sell excess inventory, and buyers can find what they need promptly.

- Unique Items: Auctions are ideal for selling rare or unique items (e.g., art, antiques, collectables) that don’t fit traditional retail channels.

Example of Auction

Let’s examine a couple of instances to grasp the process of bidding.

Example #1

Roshani, a businesswoman, is preparing to relocate and needs to sell off her assets. She enlists the services of an auctioneer who charges a fee of Rs. 900. Among Tulip’s possessions are a mansion and an assortment of valuable paintings and collectables. Forty potential buyers attend the auction, and all items are successfully sold except for the mansion.

When the auctioneer initiates the bidding for the mansion, Rachana starts with an opening bid of Rs. 300,000, swiftly followed by Roshni with an offer of Rs 450,000. This sparks a flurry of bids, with multiple buyers engaging in rapid bidding. The price escalates to Rs. 720,000 before Roshani puts forward a bid of Rs. 800,000. In response, Rachana counters with an offer of Rs. 900,000, causing Roshni and other buyers to withdraw from the competition. Despite the auctioneer’s final call, no further bids are made, and Rachana emerges as the new owner of the coveted mansion.

Example #2

Rahul Singh, inheritor of a sizable ancestral property, faces the dilemma of numerous repairs needed for the house. Struggling to cover the expenses, Rahul decides to put the property up for sale with the intention of purchasing a smaller residence. Employing the services of an auctioneer, Rahul hopes to attract potential buyers. However, due to the dilapidated condition of the property, no bids are made during the auction. In such cases, prospective buyers may be hesitant to participate, fearing inflated prices. In an attempt to generate interest, the auctioneer initiates bidding on behalf of the seller. Despite Rahul’s efforts to sell the property through direct negotiations with potential buyers, the process proves to be time-consuming. Ultimately, the deal falls through, resulting in further complications for Rahul.

Achieving success in auctions demands strategic planning and vigilant monitoring. You can develop these skills through an Online MBA Degree Programme. By enrolling in this course offered by Symbiosis School for Online and Digital Learning (SSODL) you can stand out with exceptional expertise and global market knowledge. This course is tailored for individuals looking to enhance their strategic intelligence and excel in the modern business landscape.

What is Reverse Auction?

In a typical auction, a seller showcases an item, and potential buyers submit bids until the auction concludes with the highest bid winning the item. Conversely, a reverse auction involves a buyer issuing a request for desired goods or services, with sellers then competing by bidding their prices for the specified goods or services. The seller offering the lowest bid at the end of the reverse auction emerges as the winner.

A reverse auction may not be suitable for all types of products and services. When a product or service is only available from a limited number of sellers, a reverse auction may not be the most appropriate method. It is most effective when numerous sellers offer the specified products and services, fostering a competitive environment.

Conversely, there is a risk that sellers might prioritize winning the bid by offering substandard goods at a lower price. As a result, the buyer may encounter quality issues with the lowest-priced bid from the reverse auction. Therefore, it is crucial for the buyer to clearly communicate all specifications for the goods/services they require to ensure clarity for the sellers.

Type of Reverse Auction

Several other terms are also used interchangeably with reverse auction, so deciphering the synonyms can be difficult for newcomers. The reverse auction process may be referred to as B2B auctions, eRA, a sourcing event, eSourcing, or procurement auctions, among others.

Although the essence of reverse auction bidding remains consistent, there are four distinct types of reverse auctions you can engage in:

- Ranked Reverse Auction: In this variant, bidders compete at comparable price levels, with only the successful bidder aware of the current best price. While ranked reverse auctions can instill confidence in certain suppliers, those consistently unsuccessful in securing bids may become disheartened.

- Japanese Reverse Auction: Here, the buyer establishes the rules for the reverse auction process before it begins. In a Japanese reverse auction, the buyer initiates with an opening bid, and all bidders must concur. As the auction progresses, prices decrease, and buyers either accept or decline these prices. The auction concludes with the last remaining supplier securing the business.

- Dutch Reverse Auction: In this type, the buyer specifies in advance the price they are willing to pay, the product, and the quantity required. The auction starts with a relatively low price and incrementally increases at fixed intervals. The first supplier to accept the bid wins the auction.

- Open Outcry Reverse Auction: Also known as an English reverse auction, this format is highly transparent, allowing suppliers to constantly observe the leading bid. While bids may not always be awarded solely on price, this type is advantageous in reverse auctions where price holds significant importance.

Process of Reverse Auction

Here is step by step process of reverse auction:

- Study The Marketplace: Before initiating a reverse auction, thorough market research is essential. Understanding market dynamics and trends empowers you to set realistic expectations and make informed decisions.

- Be Clear About Your Requirements: Clear and concise requirements are the foundation of fruitful supplier relationships. Ambiguity leads to confusion and hampers effective communication.

- Set Up Supplier Expectations: Transparency is key to fostering trust and cooperation. Ensure all participating suppliers are well-informed about the auction rules, expectations, and guidelines.

- Never Skip Auctions: While familiarity with certain suppliers is comforting, overlooking auctions may lead to missed opportunities. Each auction presents a chance to explore new suppliers and potentially discover better offerings.

- Emphasize The Pros of a Reverse Auction: Reverse auctions benefit both buyers and suppliers by facilitating market evaluation and fostering competition, ultimately leading to optimized outcomes for all parties involved.

- Conduct Pre-bidding When Needed: Pre-bidding activities, such as supplier qualification assessments or negotiations, may be necessary to ensure the readiness of participating suppliers.

- Go Over All Logistics Involved: Clear communication and meticulous planning are vital to eliminate confusion and ensure seamless execution of the auction.

- Set Auction Rules: Define parameters such as bid extensions, decrements, and any other relevant terms to maintain fairness and transparency throughout the auction process.

- Run The Auction: With the necessary support systems in place, initiate the auction, and remain accessible via a dedicated phone hotline to address any queries or concerns from participants.

- Make Award Decisions: While price is a significant factor, consider other criteria such as quality, reliability, and long-term partnership potential when making award decisions.

- Incorporate Award Optimization: Utilize optimization techniques to maximize the value obtained from the awarded contracts, ensuring mutually beneficial outcomes for both buyers and suppliers.

What are the Benefits of Reverse Auction?

Reverse auctions are utilized across various industries and cater to businesses of all scales, ranging from commonplace products to essential services. They enable organizations to explore a wide range of relevant suppliers. Here are some additional benefits that reverse auctions offer:

- Reduced Purchase Expenses: Reverse auctions leverage heightened competition among suppliers to drive down the overall procurement costs of goods or services. This empowers buyers to establish terms rather than being subjected to the supplier’s terms.

- Streamlined Negotiation Process: Reverse auctions streamline the process of identifying and negotiating with multiple suppliers simultaneously, resulting in faster and more efficient eAuctions. Buyers can engage with a diverse pool of suppliers until they discover the most suitable match.

- Enhanced Budget Management: Reverse auctions provide a simpler approach for buyers to define a budget. Particularly with Japanese reverse auctions, which operate on a descending price mechanism, buyers can set a definitive limit on their expenditure.

Example of Reverse Auction

An instance of reverse auction can be found in the process of bidding for government contracts. In such auctions, governments lay out the requirements for a project, and pre-approved contractors bid by proposing a cost structure to complete the project.

For example, when the Indian Department of Defense (DoD) requires a specific service or product, such as 50 fighter jets, it broadcasts a message to potential suppliers. This message outlines the DoD’s needs and deadlines, inviting interested contractors to submit price proposals within a designated time period. Typically, the winning bid is awarded to the contractor offering to fulfill the specified job at the lowest cost.

Difference between Auction and Reverse Auction

| Aspect | Auction | Reverse Auction |

|---|---|---|

| Initiator | Seller (puts up an item) | Buyer (requests a good or service) |

| Bidding Process | Buyers place bids to raise the price (highest bidder wins) | Sellers compete to lower the price (lowest bidder wins) |

| Goal | Maximize sale price for the seller | Minimize cost for the buyer |

| Typical Use Cases | Art auctions, real estate auctions, eBay-style auctions | Procurement of goods/services by corporations, government entities |

| Suitable Goods/Services | Goods/services with unique features or limited availability (few sellers) | Goods/services with many similar providers (multiple sellers) |

| Integrity of Process | Ensures competitive bidding but may drive prices higher | Ensures competitive bidding and pushes prices down, but quality may be compromised |

| Common Platforms | Traditional auction houses, online marketplaces (e.g., eBay) | Internet-based tools enabling real-time bidding among multiple sellers (e.g., government contracts) |

| Example | Bidding on a rare painting at an art auction | Government inviting contractors to bid on a project (e.g., fighter jets) |

Conclusion

Auction and reverse auction are economic models, originating from ancient civilizations, that have evolved significantly to become essential components of modern commerce. Auction and Reverse auction offer numerous benefits, such as saving costs, promoting supplier diversity, ensuring transparency, saving time, and providing data-driven insights. However, to effectively implement them, it’s crucial to plan carefully, engage suppliers, monitor in real-time, and analyze the results.

Throughout this blog , we have covered the intricacies of these models, exploring their types, advantages, and real-world applications. Understanding these concepts helps you to make better decisions, whether you are a buyer, seller, or just watching.

4 thoughts on “What is an Auction and Reverse Auction: Benefits and Examples”

The quality of the content of your blog was great. Very impressive and useful write-up. Will be waiting for more updates. Keep posting.

Thank you for your kind words! We’re glad you found our content useful. We will keep posting relevant information.

Hi friends! Immerse yourself with positivity. Uplifting vibes attract positive outcomes.

Thanks for spreading positivity! We appreciate the encouraging message.