What Customer Lifetime Value (CLV) Is & How to Calculate It

Table of Contents

If you are a marketing professional or an entrepreneur in making, you must know that understanding your customers is key to driving long-term business success. One metric that encapsulates the value of your customer relationships over time is Customer Lifetime Value (CLV).

In this guide, we’ll explore what CLV is, why it matters, how to calculate it, and actionable strategies to maximize it for sustainable growth.

What Is Customer Lifetime Value?

Customer Lifetime Value, or CLV, is a calculation that approximates how much revenue an individual business can expect from one individual customer over the course of their relationship. In contrast to short-term metrics such as purchase value in a one-time transaction, CLV gives businesses a long-term view of what makes sense in terms of customer retention and loyalty.

In other words, CLV tells you, “How much is a customer really worth to my business long term?”

By examining Customer Lifetime Value, companies can optimize marketing budgets better, enhance customer retention plans, and determine the most profitable segments of customers.

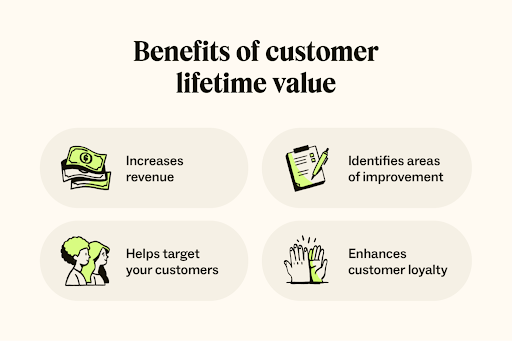

Primary Advantages of CLV

- Improved Customer Segmentation: Target high-value clients for campaigns.

- Marketing ROI Maximization: Spend effectively on acquisition and retention.

- Retention Plans: Prioritize long-term ties over isolated transactions.

- Product & Service Enhancements: Know what retains customers.

How Customer Lifetime Value Is Different From Other Metrics

| Metric | Attention | Horizon | Application |

|---|---|---|---|

| Average Order Value (AOV) | Revenue per transaction | Short-term | Promotions, pricing tactics |

| Customer Acquisition Cost (CAC) | Cost of acquiring a customer | Short-term | Budget planning for marketing |

| Customer Lifetime Value (CLV) | Total revenue per customer | Long-term | Strategic planning, retention |

Whereas CAC indicates how much it costs to get a customer, CLV indicates how much revenue you can anticipate from them. The CLV/CAC ratio is key to measuring business sustainability.

Why Customer Lifetime Value Matters

*zendesk.com

Suppose you spend $100 to gain a customer who spends just $50 with your business. That is unsustainable. On the other hand, gaining a customer who generates $500 in value over time is obviously worth the investment. Monitoring CLV helps your business to:

- Maximize Profitability: Prioritize high-value customers.

- Predict Revenue: Plan long-term growth based on repeat customers.

- Enhance Personalization: Offer personalized experiences for repeat customers.

- Allocate Resources Efficiently: Refrain from overspending on low-value segments.

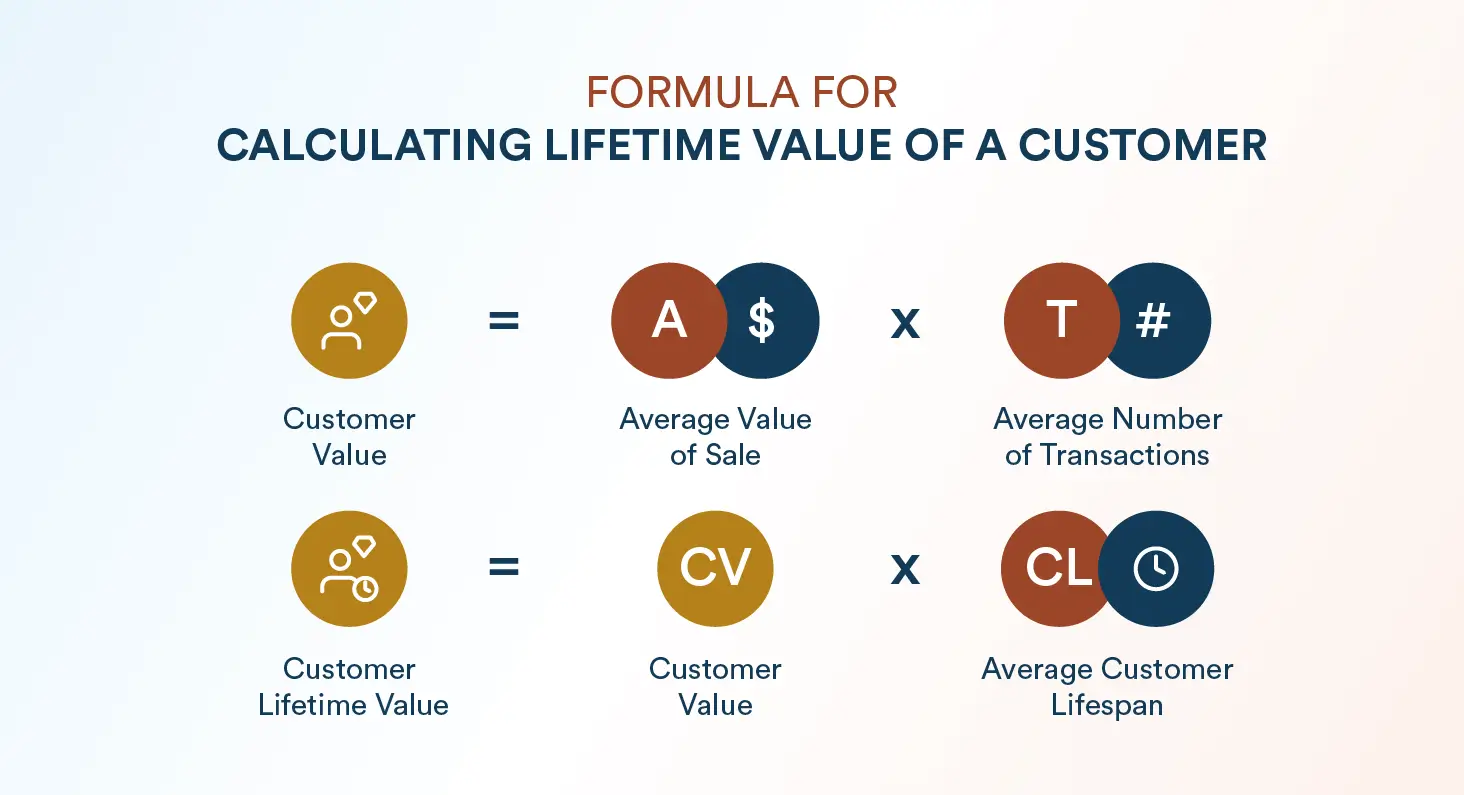

How to Calculate Customer Lifetime Value

*clevertap.com

There are several ways to calculate CLV, based on your business model and data at hand. Let’s dissect it.

1. Simple CLV Formula

The simplest CLV formula is:

CLV=Average Purchase Value×Purchase Frequency×Customer LifespanCLV = \text{Average Purchase Value} \times \text{Purchase Frequency} \times \text{Customer Lifespan}CLV=Average Purchase Value×Purchase Frequency×Customer Lifespan

| Component | Explanation |

| Average Purchase Value | Revenue per transaction |

| Purchase Frequency | Frequency of the customer’s purchases in a period |

| Customer Lifespan | Average customer relationship duration |

Example:

- Average purchase value = $50

- Purchase frequency = 4 times per year

- Customer lifespan = 5 years

CLV=50×4×5=1000CLV = 50 \times 4 \times 5 = 1000CLV=50×4×5=1000

So each customer is worth $1,000 for their lifetime.

2. Advanced Customer Lifetime Value Formula (Taking Gross Margin into Account)

To be more accurate, add profit margins:

CLV=(Average Purchase Value×Purchase Frequency×Customer Lifespan)×Gross MarginCLV = (\text{Average Purchase Value} \times \text{Purchase Frequency} \times \text{Customer Lifespan}) \times \text{Gross Margin}CLV=(Average Purchase Value×Purchase Frequency×Customer Lifespan)×Gross Margin

| Component | Explanation |

| Gross Margin | Profit percentage after costs have been deducted |

Example:

- CLV (from above) = $1000

- Gross Margin = 60%

CLV=1000×0.6=600CLV = 1000 \times 0.6 = 600CLV=1000×0.6=600

This equates to profit per customer of $600 throughout their lifetime.

3. Discounted CLV

If you wish to include the time value of money, use a discounted CLV formula:

CLV=∑t=1nRevenuet×Gross Margin(1+Discount Rate)tCLV = \sum_{t=1}^{n} \frac{\text{Revenue}_t \times \text{Gross Margin}}{(1 + \text{Discount Rate})^t}CLV=t=1∑n(1+Discount Rate)tRevenuet×Gross Margin

This is helpful for companies with long customer relationships, such as subscription services.

How to Calculate Customer Lifetime Value in Practice

Here’s a practical process:

- Collect Customer Data: Transaction history, purchase frequency, average spending, and retention rates.

- Segment Customers: Group by behavior, demographics, or acquisition source.

- Apply CLV Formula: Use simple or advanced formula based on your needs.

- Visualize CLV: Create charts to identify trends and high-value segments.

- Integrate with Strategy: Adjust marketing spend, loyalty programs, and retention tactics.

Sample CLV Table

| Customer | Avg Purchase (₹) | Purchase Frequency | Lifespan (Years) | Gross Margin | CLV (₹) |

|---|---|---|---|---|---|

| Riya | ₹1,200 | 8/year | 4 | 45% | ₹17,280 |

| Arjun | ₹2,500 | 5/year | 5 | 55% | ₹34,375 |

| Neha | ₹3,000 | 3/year | 3 | 60% | ₹16,200 |

This table enables companies to instantly see leading customers and concentrate on retention.

CLV in Various Business Models

| Business Model | Focus of CLV Calculation | Example |

|---|---|---|

| E-commerce | Repeat buys, AOV | Clothing retail store with online sales |

| SaaS | Subscription value, retention rate | Project management software |

| B2B | Contract value, renewal frequency | Software license or service agreements |

| Brick & Mortar | Foot traffic, purchase history | Coffee shops, retail outlets |

CLV delivers actionable insights independent of business models. It identifies areas of potential to enhance retention, pricing, and cross-selling initiatives.

Practical Hints to Boost Customer Lifetime Value

Maximizing Customer Lifetime Value is as much an art of strategy as of calculation. Here are practical tips:

- Customize Customer Experiences: Recommend products based on past purchases.

- Upsell and Cross-Sell: Offer complementary products or premium offers.

- Improve Customer Support: Timely, friendly support invites repeat business.

- Loyalty Programs: Reward repeat customers with points, discounts, or early access.

- Regular Communication: Engage with email, SMS, or push notifications.

- Optimize Pricing: Value must match perceived quality.

- Reduce Churn: Keep an eye on customer behavior to act before they leave.

Example: Customer Lifetime Value Growth Strategy Table

| Strategy | Goal | Expected Impact on CLV |

|---|---|---|

| Loyalty Program | Retain existing customers | +20% |

| Personalized Emails | Increase purchase frequency | +15% |

| Upselling Premium Products | Higher average purchase | +25% |

| Improved Support | Reduce churn | +10% |

These programs, when integrated, can really drive long-term revenue per customer.

Customer Lifetime Value in Marketing Decisions

CLV is especially useful for optimizing marketing ROI. For instance:

- High CLV segments warrant greater investment in acquisition costs.

- Low CLV segments might require cost-effective campaigns or qualification prior to conversion.

- Marketing practices such as retargeting, email automation, or subscription offers are informed by CLV insights.

Integrating Customer Lifetime Value with Data Analytics

Today’s advanced analytics tools facilitate tracking and predicting CLV. Capabilities include:

- Customer Segmentation: Segment most profitable segments.

- Predictive Analytics: Predict revenue from new customers.

- Campaign Performance: Evaluate ROI against projected CLV.

- Retention Alerts: Identify at-risk customers early.

With the inclusion of CLV in your CRM or ERP systems, you can use data-based insights to optimize long-term profitability.

Key Takeaways

- CLV is a forward-looking measure of customer profitability over time.

- CLV calculation includes average purchase, frequency, lifespan, and margins.

- CLV can be used by businesses to manage marketing spend, drive retention, and increase long-term revenue.

- Boosting CLV serves both your bottom line and customer experience.

Upskill with Jaro Education

We at Jaro Education realize that becoming proficient in metrics such as Customer Lifetime Value is essential for business growth-orientated professionals. This is why we provide a range of courses meant to make you more competent in data analysis, marketing, and customer management so that you can make strategic, informed decisions.

From learning customer lifetime value formulas to putting them into practice in everyday situations, our courses arm you with the information and tools to maximize customer relationships and drive long-term profitability.

Conclusion

Knowing Customer Lifetime Value gives you the power to focus on high-value customers, enhance retention, and sustain growth. By calculating and using CLV efficiently, you can make better marketing and business decisions that maximize profitability while building long-term loyalty among customers.

Frequently Asked Questions

What is the customer lifetime value?

Customer Lifetime Value (CLV) calculates how much total revenue a customer contributes throughout the course of a business relationship.

How to calculate customer lifetime value?

CLV can be computed using straightforward, complex, or discounted models with regard to purchase price, frequency, lifespan, and profit margin.

Why is Customer Lifetime Value beneficial for businesses?

CLV assists in allocating marketing funds according to priority, maintaining valuable customers, and predicting long-term revenue.

What is the formula for CLV?

Simple CLV = Average Purchase Value × Purchase Frequency × Customer Lifespan. More advanced formulas incorporate gross margins and discount rates.

How do I maximize customer lifetime value?

Enhance retention, personalize, upsell/cross-sell, optimize prices, and institute loyalty programs.