How to Become a CA After 12th: Step-by-Step Guide

Table of Contents

Chartered Accountancy is one of the most prestigious career paths in the commerce domain. Every year, thousands of students completing their 12th board exams aspire to take this route, attracted by the professional recognition, career stability, and rewarding opportunities it brings. However, one of the most common questions among commerce students is how to become CA after completing 12th.

If you’re from a commerce background, especially with Accountancy, Economics, and Mathematics in your stream, the Chartered Accountancy journey aligns naturally with your foundation. But even if you belong to other streams, the process remains open to you. What matters most is dedication and following the structured pathway set by the Institute of Chartered Accountants of India (ICAI).

This guide lays out everything clearly, with a step-by-step approach on how to become CA after 12th, so you can prepare without confusion or scattered information.

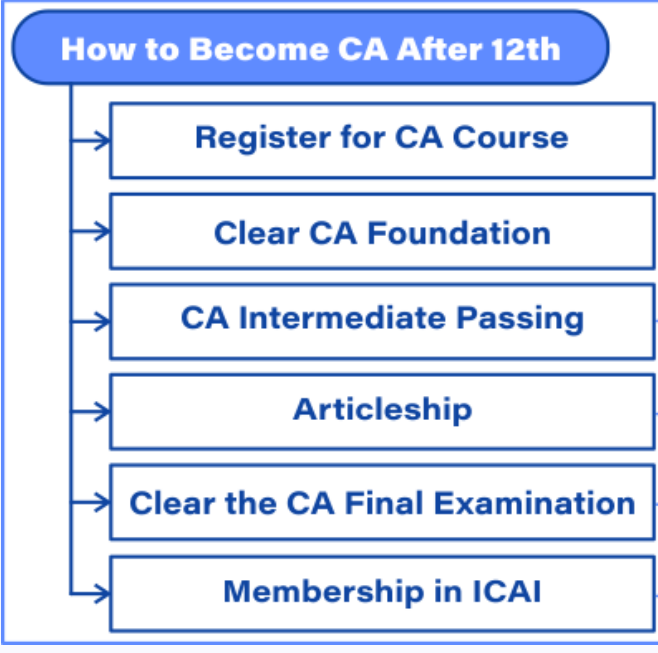

How to Become CA After 12th: Step by Step

*plutuseducation.com

To answer the core question, how to become CA after 12th step by step, let’s break it down into the major stages as per ICAI regulations.

Step 1: Register for CA Foundation

The first milestone in your “how to become CA” journey begins with CA Foundation, the entry-level examination. Students can register for CA Foundation right after completing their 12th board exams, though the exam attempt becomes available only after appearing for the boards.

Key details about CA Foundation:

- Registration opens twice every year (for June and December sessions).

- Subjects include: Principles & Practices of Accounting, Business Laws, Business Mathematics, Logical Reasoning, Statistics, and Business Economics.

- The exam format is a mix of subjective and objective questions.

For students wondering how to become CA after 12th commerce, this is the first and most crucial stage. Also, here you have an advantage due to familiarity with subjects like Accountancy and Business Studies.

Step 2: Prepare and Clear the CA Foundation Exam

Clearing CA Foundation requires not just subject knowledge but also practice and time management. On average, students spend four to six months preparing before their first attempt.

Some preparation strategies:

- Make use of ICAI’s study materials and mock tests.

- Dedicate time daily to problem-solving in Mathematics and Accountancy.

- Work on speed and accuracy since objective questions are negatively marked.

Passing CA Foundation confirms your eligibility to move to the next stage of how to become CA. This is where you prove your readiness for the professional challenges ahead.

Step 3: Register for CA Intermediate

After clearing the Foundation, the next step of “how to become CA” is CA Intermediate (CA Inter). Students can register for it only after successfully passing the Foundation exam.

CA Intermediate consists of two groups, and you can choose to attempt both simultaneously or one group at a time.

Group 1 Subjects:

- Accounting

- Corporate and Other Laws

- Cost and Management Accounting

- Taxation

Group 2 Subjects:

- Advanced Accounting

- Auditing and Assurance

- Enterprise Information Systems & Strategic Management

- Financial Management & Economics for Finance

The CA Inter exam demands deep understanding, and this is the stage where most students realize how vast the Chartered Accountancy curriculum is. If you’ve been searching how to become CA after high school, remember that consistent study and coaching support often play a decisive role at this stage.

Step 4: Complete Articleship (Practical Training)

Once you pass at least one group of CA Intermediate, you can begin Articleship Training, which lasts for 3 years under the supervision of a practicing Chartered Accountant.

This training is not just a formality, it’s a critical part of the Chartered Accountancy journey. Articleship exposes students to real-world practices in auditing, taxation, accounting, and corporate compliance.

Why is this important in how to become CA? Because practical training bridges the gap between theory and professional practice. You gain insights into handling client accounts, preparing tax returns, conducting audits, and advising businesses.

Step 5: Register for CA Final

During the last six months of your Articleship, you become eligible to appear for the CA Final exam, the last and most challenging stage.

CA Final has two groups, each with four papers:

- Group 1: Financial Reporting, Strategic Financial Management, Advanced Auditing and Professional Ethics, and Corporate & Economic Laws.

- Group 2: Strategic Cost Management & Performance Evaluation, Electives (like Risk Management, International Taxation, Financial Services), Direct Tax Laws, and Indirect Tax Laws.

Clearing CA Final is the ultimate milestone in becoming CA after 12th. Once you pass, you can apply for ICAI membership and officially call yourself a Chartered Accountant.

Step 6: Obtain ICAI Membership

The last step of “how to become CA” is applying for ICAI membership. Once admitted, you earn the CA designation, opening doors to careers in accounting firms, corporate finance, taxation, auditing, or even entrepreneurship.

This marks the completion of the roadmap for step by step guide to how to become CA.

Duration of Becoming a CA After 12th

*ksacademy.co.in

If you’re curious about timelines while figuring out how to become CA, here’s a rough estimate:

- CA Foundation preparation: 4–6 months

- CA Intermediate: Around 8–10 months of study

- Articleship: 3 years

- CA Final: Preparation overlaps with Articleship (6–8 months dedicated study)

In total, the journey typically takes 4.5 to 5 years after Class 12th, assuming you clear each level in the first attempt.

Skills You Need Alongside the Steps

While knowing the stages of how to become CA after 12th commerce is crucial, succeeding also requires additional qualities:

- Strong analytical ability for financial decision-making.

- Time management to balance study and articleship.

- Communication skills for client interaction.

- Ethical responsibility, since Chartered Accountants are trusted advisors.

These skills are what make the CA profession both challenging and rewarding.

Career Opportunities After Becoming a CA

A lot of students don’t just want to know how to become CA after 12th, but also seek answers to what happens after. The scope is vast, you can:

- Join multinational corporations as a financial analyst or compliance officer.

- Work in Big 4 firms handling auditing and taxation for global clients.

- Specialize in fields like investment banking, risk management, or consultancy.

- Start your own CA practice and build an independent career.

How a B.Com Degree Supports the CA Journey

While preparing for Chartered Accountancy, many students also choose to pursue a Bachelor of Commerce (B.Com) – Amity University. This not only strengthens their subject foundation but also ensures they don’t miss out on a graduation degree alongside their CA pursuit.

For commerce aspirants thinking how to become CA, a B.Com degree can add value in several ways:

- Subjects like Accounting, Taxation, and Corporate Law overlap with CA Foundation and CA Inter.

- The degree provides academic recognition, which is helpful if you want to explore opportunities abroad or in parallel career tracks.

- Balancing CA exams with B.Com studies helps diversify your qualifications without losing focus on Chartered Accountancy.

This is why many students consider enrolling in an online B.Com program, which offers the flexibility to manage both Chartered Accountancy preparation and graduation studies together.

How Jaro Education Can Help You

Now that you know the complete roadmap of how to become CA step by step, the next question is, how do you strengthen your preparation while also securing a graduation degree? That’s where Jaro Education steps in.

We are a trusted name in online higher education, known for offering future-ready degree programs in collaboration with top universities.

One of the standout options available through Jaro Education is the Online B.Com Programme from Manipal University Jaipur.

Key highlights of the programme:

- Flexible learning: Classes and study materials are delivered online, allowing you to schedule study time around your CA preparation.

- Industry-relevant curriculum: Covers core commerce subjects like Business Law, Financial Accounting, Auditing, and Economics, all directly useful for anyone exploring how to become CA.

- University accreditation: Manipal University Jaipur is a NAAC A+ accredited institution, ensuring academic credibility.

- Career-ready skills: Beyond theoretical knowledge, the program emphasizes practical understanding, giving you an edge in Articleship and professional practice.

By pursuing this B.Com programme alongside your CA exams, you create a strong academic portfolio without compromising on Chartered Accountancy. It’s a practical and future-oriented choice for anyone mapping out how to become CA after 12th step by step.

Conclusion

Becoming a Chartered Accountant is not a quick journey, it’s a structured, challenging, yet highly rewarding career path. The journey usually takes around 4.5 to 5 years, but the payoff in terms of professional recognition and career opportunities is unmatched.

At the same time, pairing your CA preparation with a degree like the Online B.Com Programme from Manipal University Jaipur, offered via Jaro Education, adds significant long-term value. It ensures you’re not just preparing for a professional course but also securing a strong academic foundation that broadens your career scope.

Frequently Asked Questions

How to become CA after 12th commerce?

To become a CA after 12th commerce, start by registering for the CA Foundation exam conducted by ICAI. After clearing it, move to CA Intermediate, Articleship, and finally CA Final. This is the structured roadmap for how to become CA.

How long does it usually take to become a CA after school?

For students exploring how to become CA after completing 12th, the entire process generally takes around 4.5 to 5 years. The timeline includes Foundation, Intermediate, Articleship, and the Final exam.

Is a commerce background necessary for becoming CA?

A commerce background makes the CA journey easier, but it isn’t compulsory. Students from science or arts can also become CA, though they may need more effort in core subjects like accounting.

Can I pursue a degree alongside my CA preparation?

Yes, many students combine a B.Com degree with their CA journey. While it isn’t required, a degree adds academic recognition and supports your professional growth.

What kind of careers can I expect after becoming a CA?

You can work in auditing, taxation, corporate finance, or consultancy. Many Chartered Accountants also choose to start their own practice.

Can I do CA without Maths in 12th?

Yes, you can still become a CA without Maths in 12th. The CA Foundation exam includes Business Mathematics, but with consistent practice, even non-Maths students can clear it and continue their CA journey.

What is the fee structure for CA after 12th?

For students planning how to become CA, the total cost (including Foundation, Intermediate, and Final exams with registration fees and study material) ranges between ₹2.5–3 lakhs. Articleship usually offers a stipend that helps balance expenses.

Is Articleship paid during the CA course?

Yes, Articleship is a paid practical training. While the stipend varies by firm and city, it typically ranges between ₹5,000–15,000 per month, depending on the experience level and location.