Capital Budgeting: What It Means in Corporate Finance

Table of Contents

Every business decision starts with one simple question: Is this investment worth it?

Companies go through the process of deciding where to spend their money; should they expand into new markets, purchase new equipment, develop a new product, or acquire another company? These are not incidental decisions. Since every company is spending millions in the hope of having a growing business and earning profits tomorrow, the decision about their investment, expenses, and budgeting should be well-informed. This is where capital budgeting comes in.

But what is capital budgeting? Well, to put it simply, it is the process of assessing longer-term investments in a company. Also known as investment appraisal, capital budgeting is done to make bigger decisions that are relatively larger in scope and are mainly made with projects that will change the future of the company. It also allows organisations to get an overview of whether they will be a growing organisation or a stagnant organisation.

What is Capital Budgeting in Corporate Finance?

The simple capital budgeting definition is: capital budgeting is not simply a financial process but rather the foundation for how firms think about growing and sustaining their growth. It is about evaluating, analysing, and committing to long-term investments of prospective cash flows that will have an impact on the future of your business.

These are not conventional expenses, such as employee salaries and office supplies, but rather investments that require a meaningful amount of money and will have longer-term implications. Consider it as you are planting a tree today in hopes you will have shade and fruit tomorrow.

The true goal of capital budgeting in corporate finance is to maximise the efficiency of scarce financial resources. All companies, no matter the size, face financial constraints- no company can fund every coming project. Thus, capital budgeting provides a systematic structure to help decision-making. It is designed to assist management in identifying which projects create the most value, and also to determine which projects will help advance the company’s long-term objectives, with the primary objective being shareholder wealth maximisation.

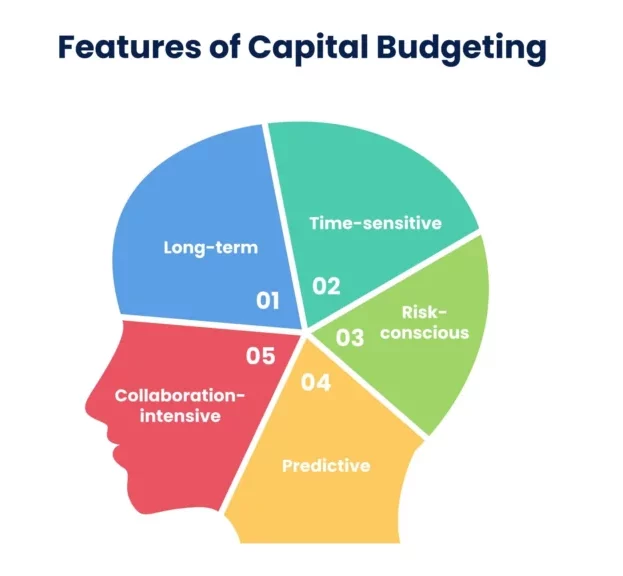

Capital budgeting decisions have four important features:

- Involves large amounts of money

- Benefits or returns will typically be received for many years

- High levels of uncertainty and risk

- Once decisions are made, they are often irreversible (once the money is spent, it is typically not recoverable).

Understanding Capital Budgeting With an Example

Think of capital budgeting as being the financial compass of an organisation. Without capital budgeting, an organisation would be sailing in the proverbial dark – choosing investment projects based on whatever guesses they may make. Capital budgeting allows leaders to critically analyse their potential risks and expected returns in order to select a capital budgeting project that will create value for their shareholders.

Take a straightforward example: let’s say a company is thinking about building a new manufacturing plant. The project will require an investment of ₹500 crores today, and is expected to generate a certain level of income over the next 20 years. Does the company proceed with the project? Not an obvious answer! Management must consider the future cash flows, make adjustments for inflation and uncertainty, and figure out whether the expected return is worth the associated risk. That is capital budgeting in action.

However, capital budgeting is more than simply performing calculations; it is about making sure financial decisions are in alignment with the company’s strategy. For instance, a company that is focused on sustainability may turn down a very lucrative project if the likelihood of it harming the environment is too great. Likewise, a luxury brand may avoid any type of mass-market project, even if the numbers make sense.

Why is Capital Budgeting Important?

*happay.com

As we know, capital budgeting exists to understand and manage large, strategic investments that will impact a company’s growth and sustainability for years to come. But what other importance does it hold in corporate finance? Let’s understand them one by one:

Long-Term Financial Health

All organisations want to ensure that internally and externally allocated resources or expenditures produce long-term value. Capital budgeting provides a way to assess projects and investments in a reasonable manner to facilitate expected sustainable returns. Therefore, in assessing all opportunities, organisations will be more likely to avoid expending their valuable resources on projects that will only incur costs without any benefit.

Risk Assessment

Future cash flows are uncertain, and when used poorly, organisational resources can result in substantial losses. By using capital budgeting evaluation techniques, businesses can feel confident they understand the associated risks, evaluate the potential uncertain outcomes, and adopt an attitude of caution. This will minimise exposure to projects that might seem attractive in the short term, but for which the sustainability and viability are uncertain in the future.

Efficient Resource Allocation

Resources are limited, and in that case, every investment decision counts. Capital budgeting guarantees that resources are assigned to those opportunities that have the highest likelihood of return on investment, making certain that financial capital is not wasted, and that money is being invested in alignment with organisational priorities.

Strategic Alignment

A project may be very profitable, but the question is, does the project fit within the organisation’s longer-term vision? Capital budgeting involves determining if a project supports the business strategy while also providing a competitive advantage to ensure that growth is deliberate and consistent.

Maximising the Value of Shareholder Equity

Ultimately, businesses exist to maximise wealth for their shareholders. Capital budgeting represents a means to ensure that investments are both profitable and increase shareholder value, thus serving to promote trust and capital growth for the benefit of all.

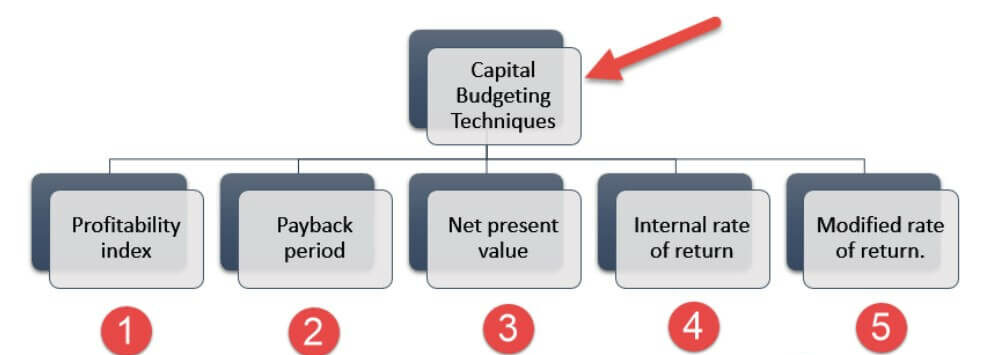

Capital Budgeting Techniques

*wallstreetmojo.com

When a business considers investing in a project, it does not simply go with its gut. They utilise a number of different techniques to test whether the project may be profitable. Here are a few of the more common steps in capital budgeting. We will discuss them in simple terms:

1. Payback Period Method

The payback method is pretty simple; it answers one question: “How long will it take for me to get my money back?”

- Benefit: It’s quick, simple and easy to describe.

- Disadvantages: It ignores the value of the money over time and doesn’t take into consideration what happens after you are not out of pocket.

2. Net Present Value (NPV)

Consider the NPV as the gold standard for capital budgeting techniques in assessing projects. It considers all the cash flows an expected project will generate over a period of time and discounts it back to one period in today’s dollars (money you have in your pocket is worth more than money you will have a week from now) and subtracts the initial amount you took out of your pocket.

- If NPV is positive (NPV > 0): The project has a cash value, so spend the money.

- If NPV is negative (NPV < 0): The project may reduce your cash position, so do not do it.

3. Internal Rate of Return (IRR)

The IRR is—in a way—the project’s own interest rate. It indicates the expected return on a project.

- If the IRR is higher than borrowing or investing costs for the company (the cost of capital), then the project is a winner.

- If it is lower, then the project is not attractive at all.

4. Profitability index (PI)

These Capital budgeting techniques are the definition of comparing your output versus your input. It is a ratio of the benefit of a project compared to its cost.

- If PI is greater than 1, the project generates a positive net profit.

- If PI is lower than 1, the project does not cover its costs.

5. Accounting Rate of Return (ARR)

ARR examines the profit that a project is expected to create (based on accounting numbers) in relation to the investment that you will make in the project.

- Why companies use it: It’s easy to calculate, simple to understand, and useful when you want a rough idea of whether the project is worth pursuing.

- The downside: You cannot rely on it, knowing that money today is worth more than the same amount in the future.

The Bottom Line

Undoubtedly, capital budgeting is much more than a simple exercise in calculating and crunching numbers; it is the lifeblood of corporate finance. Every key financial decision made by a company when they enter a new market, open a new product line, purchase or upgrade machinery, or acquire a new business relies on capital budgeting. Capital budgeting is used to make financially sound investment decisions rather than decisions based on a hunch or an estimate and limits the instances where mistakes are made when making decisions.

Frequently Asked Questions

What is the primary goal of capital budgeting?

The primary goal is to assess and choose between long-term projects that increase shareholder value and align with company objectives.

What is the best approach to capital budgeting?

Net Present Value (NPV) is the most appropriate, as NPV improves management’s understanding of the value of money over time and also measures monetary value as a whole.

Is capital budgeting a quantitative activity?

No. Although numbers are important, capital budgeting can also have strategic goals, risk, and impact on the environment/society.

How does capital budgeting differ from operational budgeting?

Operational budgeting deals with the daily cost of running a business, and capital budgeting typically deals with long-term spending that usually yields a payoff sometime in the future.