Digital Finance for MCom Graduates: Career Prospects & Insights

Table of Contents

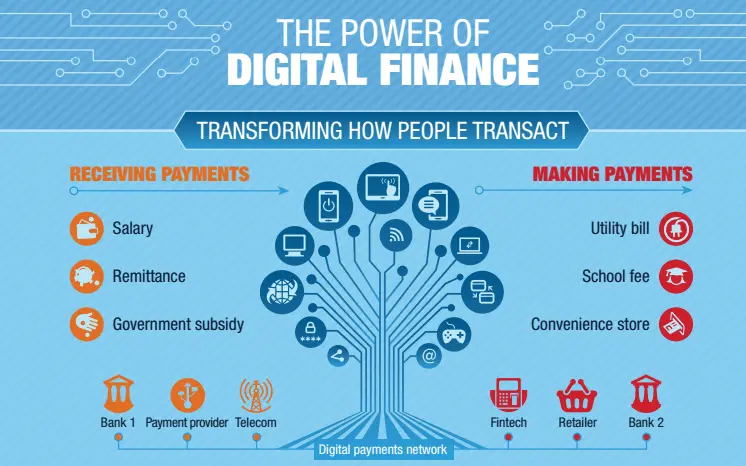

The finance industry is experiencing unprecedented transformation, driven by digital advancements rather than traditional methods. This shift is fueled by algorithms, cloud platforms, AI analytics, and blockchain technology, collectively forming what is known as digital finance. This convergence of numbers and technology allows for faster, smarter, and more secure financial transactions.

For MCom graduates, this is not simply an industry-changing career; it represents a massive opportunity. If you have the right skills and knowledge, you have the opportunity to be an integral part of a sector that is changing the way people bank, invest, manage risk, and make payments throughout the world. Digital finance is at the heart of this transformation with tools for real-time payment processing, real-time predictive analytics of future market trends, and multi-dimensional monitors available at layer 7 of the TCP/IP stack.

If you have completed or are undertaking your Master of Commerce, you have received an excellent grounding in finance. You can now combine this with competence in digital transformation in commercial finance, opening doors to unconventional, high-earning careers that safeguard you from future economic threats.

This blog will cover the scope, tools, career opportunities, and knowledge that you need to be successful in digital finance as you seek to transition into the next generation of finance professionals!

Understanding Digital Finance

*researchgate.net

‘Digital finance’ is a term used to refer to the technology-centric transformation of financial services, which is allowing faster, safer, and more accessible financial solutions for individuals and businesses alike. Traditional finance heavily relies on manual processes, such as completing forms and other workflows using paper, while digital finance is supported by technology, such as automation, cloud-based systems, Big Data, and Artificial Intelligence (AI) to streamline finance from accounting to international transfers.

Some of the main traits of digital finance are:

- Automation – Reducing risk with manual errors and increasing efficiency.

- Real-time Processing – Making decision-making quicker, with “live” data.

- Scalability – System capabilities can grow as the business grows.

- Data-driven Insights – Analytics form data to assist with strategy and risk determination.

Why Digital Finance is a Game Changer for MCom Graduates

An MCom degree already gives you solid foundations in taxation, accounting, business law, and corporate finance – skills that have been used in traditional areas of finance for decades. But with digital transformation in finance, the traditional landscape is quickly changing. Employers have increasingly moved beyond candidates who can read financial statements or produce reports, and are now looking for candidates who can apply their financial knowledge with digital finance tools and technologies. Here are 4 reasons why this is a game-changer for MCom graduates:

1. Future-Proof Career

The adoption of technology in finance is accelerating—AI, blockchain, digital payments, and automation have been assimilated into how we do business. By becoming proficient in digital finance, you will find your niche in a highly sought-after career where the skills you develop will be pertinent for many years to come. The demand for finance professionals who understand how to work with advanced technology will only increase as businesses continue to digitise.

2. Global Opportunities

One of the greatest aspects of learning digital finance is that you can apply your skills anywhere. Whether you are working in India or any other country, the nature of digital transformation does not change. ERP systems, blockchain platforms, and analytics software can be used globally, so when you steal tech employment from local markets, you have that knowledge that can be portable, and your job relocation will not be like starting a new job.

3. Higher Salary Packages

Specialisation is often more lucrative than generalisation—and this is definitely true for digital finance professionals. Those who have advanced skills in digital finance tools—SAP, Oracle, Tableau, blockchain, etc.—make significantly more money than their traditional generalist counterparts. Companies are willing to spend money for those finance professionals who can manage and use complex digital financial systems, interpret the output from real-time financial analytics, and support strategic decision-making.

4. Versatility Across Sectors

Perhaps the most exciting part is the variety of industries you can work in. You aren’t just limited to banking with digital finance skills. There are opportunities in startups in the fintech space, in multinational companies, in consulting units, with NGOs, with government, anywhere – payment systems optimisations, and consulting on regulatory compliance, and building AI driven investment models.

Essential Digital Finance Tools for MCom Graduates

*edureka.co

Knowledge of digital finance tools is no longer just a requirement, but it is compulsory to make yourself stand unique from others. These digital finance tools represent the basis of the modern digital transformation of finance, allowing professionals to work with some of the top companies and get a high package.

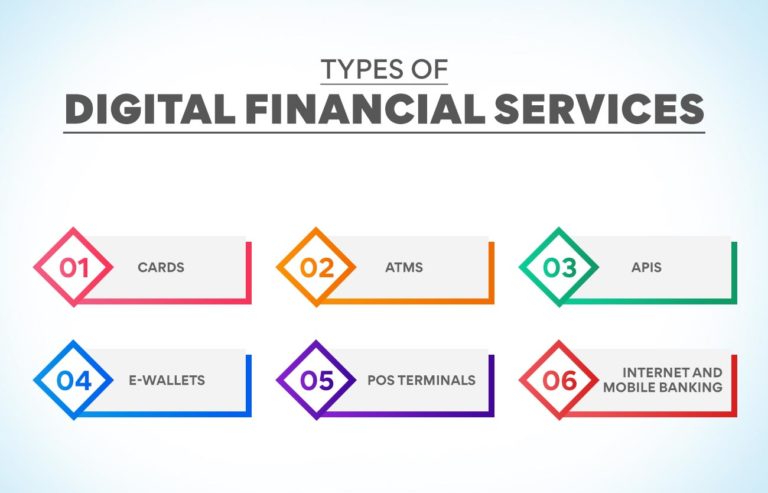

1. Enterprise resource planning (ERP) systems

ERP solutions like SAP, Oracle NetSuite, and Microsoft Dynamics provide a comprehensive look at financial data across departments, allowing professionals to include, monitor, and handle anything from payroll to budgeting on a single platform.

2. Business Intelligence (BI) tools

Tools like Tableau, Power BI, and Qlik enable finance professionals to visualize trends, create interactive dashboards, and ultimately create manageable insights from raw data.

3. Digital payment platforms

As e-commerce and global transactions continue to increase, digital payment platforms (e.g,. PayPal, Stripe, Razorpay) are essential to processing secure, fast, and seamless transactions.

4. Blockchain Technology

Platforms like Ethereum and Hyperledger provide secure, transparent, and immutable transactions, makinthemit very valuable in auditing, contract management, and financial settlements.

5. AI-powered Analytics Tools

Platforms such as IBM Watson and SAS utilize artificial intelligence to perform predictive modeling and risk assessments, enabling organizations to make data-informed decisions in real-time.

6. Cloud Accounting Software

Platforms such as QuickBooks, Xero, and Zoho Books provide remote access to financial information, work collaboratively with multiple users, and have secure cloud storage—ideal for hybrid working conditions.

Career Opportunities in Digital Finance for MCom Graduates

Without a doubt, the digital transformation in finance has opened new doors for MCom graduates in many specialised fields. By applying traditional commerce knowledge, along with highly developed technology skills, graduates can find demand in many roles across banking, fintech, corporate finance, consulting, and even government.

Given below are some of the most promising career opportunities, along with their main responsibilities, and why these matter in a digital economy:

| Career Role | Key Responsibilities | Why It’s Important in Digital Finance |

|---|---|---|

| Digital Finance Analyst | Utilises financial knowledge and data analytics tools to interpret large datasets, forecast trends, and guide strategic decisions. | Businesses rely on these professionals to merge financial theory with real-time analytics, improving profitability and efficiency. |

| Fintech Product Manager | Oversees the development, launch, and optimisation of finance-related tech products like payment apps, lending platforms, or investment tools. | Critical for bridging the gap between technical teams and business goals, ensuring products meet market needs. |

| Risk & Compliance Specialist | Implements digital monitoring tools to track risks, ensure compliance with regulations, and prevent fraud. | With increasing cybersecurity threats and complex regulations, this role safeguards organisational stability and trust. |

| Blockchain Finance Expert | Designs and manages blockchain-based systems for secure, transparent, and tamper-proof transactions. | As blockchain adoption grows in banking and auditing, this expertise is becoming a highly valued niche. |

| AI & Automation Specialist in Finance | Deploys AI-powered solutions to automate repetitive finance tasks, from invoice processing to fraud detection. | Boosts efficiency, reduces costs, and improves accuracy in financial operations. |

| Financial Data Scientist | Works with big data tools to analyse market behaviour, create predictive models, and identify investment opportunities. | Plays a vital role in leveraging data-driven insights for competitive advantage. |

Skills You Need to Succeed in Digital Finance

Finance is no longer just ledgers, balance sheets, and number crunching: it is about data, technology, and agility. If you are an MCom graduate trying to carve a niche for yourself in digital finance, mastering the right skills is crucial to help you stay ahead in a competitive job market.

1. Technical Skills

You can think of this as your professional toolbox. The ability to work on ERP systems, such as SAP and Oracle, and data analytics tools, such as Power BI, Tableau, and other readily accessible digital finance tools, is no longer optional but necessary. If using these tools allows you to make better decisions, automate processes, and analyze trends through reporting, why wouldn’t you use them?

2. Analytical Thinking

In digital finance, numbers tell a story, but only if you learn how to read them. How you interpret large data sets into manageable data sets, find patterns in the data, and decipher useful information and actionable insights is how much more valuable you will become to employers.

3. Cybersecurity Awareness

Finance used to be a weak link in technology, but that’s changed. An understanding of threats, how to protect sensitive financial data, and knowledge of compliance will keep you and the organisation out of trouble.

4. Adaptation

Technology in finance moves faster than you can say “blockchain.” Whether it’s AI-driven forecasting tools or a new payment platform, being up-to-date and willing to learn is instrumental in staying relevant.

5. Communication skills

Not everyone speaks the language of technology and finance. Your ability to explain complicated concepts in simple, relatable language is a valuable skill that spans technical teams, management, and clients.

Why Digital Finance Certification with Jaro Education is a Game-Changer

If you want to stand out in digital finance, a specialised certification can be the biggest career booster. It provides you with skills that are relevant to the industry, allows you to expand on your network, and enhances your employability in a competitive job market.

Jaro Education, India’s most trusted online higher education and upskilling partner, provides an enormous amount of personal success for its students, as its higher education offerings at IITs and IIMs come to them with premium learning. Career experts facilitate lifelong learning that comes with 24/7 student support and career counselling, and even a 3.5 lakh-plus alumni network! You don’t just get a course; you get a lifetime of career advancement.

Featured Programmes with Jaro Education as Marketing & Technology Partner

- Focuses on the latest FinTech innovations and applications.

- Professional Certificate Programme in Advanced Analytics & Business Intelligence – Offered by IIM Kozhikode

Teaches advanced analytics for data-driven decision-making. - Professional Certificate Programme in Data Science for Business Decisions – Offered by IIM Kozhikode

Equips learners with essential data science skills for business applications.

Final Thoughts

For MCom graduates, digital finance isn’t just another way to build your skillset – it’s the gateway to an exciting, lucrative, and sustainable career. By developing proficiency in digital finance tools, pursuing a Master’s in Digital Finance, and continuing to engage with the digital transformation in finance, you can confidently take your position on the leading edge of global financial innovation.

No matter whether you’re aspiring to work for a fintech startup company, a global bank, or a global company, it starts today with skill-building. The age of digital finance is upon us; are you ready to take the lead?

Frequently Asked Questions

How is Digital Finance different from Traditional Finance?

Traditional finance relies on many manual practices, paper documentation, and physical transactions. Digital finance applies technology—like artificial intelligence (AI), blockchain, enterprise resource planning (ERP) systems, and online payment platforms—to automate, expedite, and securitize financial processes. Digital finance is also much more flexible, data-driven, scalable, and accessible.

Which digital finance tools should an MCom graduate learn first?

You should focus on learning the same core platforms that are most widely used across industries:

- ERPs (SAP, Oracle NetSuite)

- Business Intelligence (Power BI, Tableau)

- Digital payments (PayPal, Stripe)

After you develop some competence, move into blockchain (Ethereum, Hyperledger) and AI (IBM Watson, SAS)

Is pursuing a Master's in Digital Finance worthwhile?

Yes – if your goal is to be future-ready in the finance industry. A Master’s in Digital Finance augments your MCom because it provides the deeper level of technical, analytical, and strategic skills required to be successful in modern finance roles, like a fintech product manager or an AI financial analyst.

What career roles can I explore in digital finance after an MCom?

Some of the most in-demand roles include Digital Finance Analyst, Fintech Product Manager, Risk & Compliance Specialist, Blockchain Finance Expert, AI & Automation Specialist in Finance, and Financial Data Scientist. These positions offer competitive salaries, global opportunities, and the flexibility to work across industries.