12 Best Financial Software Tools for Managing Money and Investments in 2025

Table of Contents

“Courage taught me no matter how bad a crisis gets … any sound investment will eventually pay off.” — Carlos Slim Helu

Nowadays, managing money is more complicated and overwhelming than it was a few years ago. We are no longer in an era where business or personal expenses were limited to notebooks or mental calculations. It’s 2025, and your finances require proper management; they need strategy, automation, and, of course, razor-sharp insights.

Whether you are an experienced investor, growing your financial portfolio or building a budget, you don’t have to take the hassle of where all your money is going – you have the right tool for that.

These financial software and tools are not only essential to maximise returns but also to manage risk and even help you achieve your financial goals. But as we know, in the market, there are more than 100 applications available, and sometimes it becomes difficult to choose the right one.

But fret not! In this guide, we have listed down the top 12 financial software and tools that will help you to maintain the financial health of the organisation by planning, organising and monitoring all transactions.

The Top 12 Financial Software Tools in 2025

If you’re planning to set up a reliable and efficient financial management system for your startup or are in the process of levelling up your current investment, take a look at the tools listed below.

Empower

*empower.com

Empower was formerly known as Personal Capital, and it provides financial planning, retirement management, and more investment-related services. Although this financial software tool is not technically a robo-advisor, it’s an automated investment manager, but one with a personal element, like any traditional financial advisor.

Empowers users to have free access to a range of free investment management analytical tools.

There are also three premium service layers. With at least $100,000 on deposit in investable assets, users can access fee-based investment advisory services. For those with $250,000 in investable assets, an expanded wealth management service is available. For people with $1 million or more in their accounts, clients can use its private client service.

Key Features of Empower:

- Comprehensive financial planning tools,

- Investment management

- Wealth management services

Quicken

*quicken.com

While Quicken is built for personal finance, it has enough financial tools that small business owners can benefit from. You can track expenses, manage accounts, and create reports, including tax reports, all in one place.

If you’re a freelancer or managing a small business, the Business & Personal plan enables you to manage both sides of your finances without managing two separate apps.

Key Features of Quicken:

- Connects to your bank accounts and tracks spending, income, and transactions automatically.

- Tools for budgeting, debt planning, and retirement planning.

- Comprehensive reporting tools, including tax reporting tools, to make taxes less stressful.

- Customisable dashboards so you can focus on what is most important to you.

- Quicken Simplifi, a streamlined version for users who like fewer complicated and fewer features.

Refresh Me

*refresh.me

Refresh.me is a financial software or management platform built for users who want a full and clear view of their financial well-being and are able to make informed decisions about their financial future.

This financial software tool is mainly known for having main features that include budgeting, expense tracking, and an easy way to set financial goals. In fact, it offers a user-friendly experience and minimal complexity, making it even more attractive to users looking to make their financial planning simpler without being overwhelmed with overly complex financial tools.

Key Elements/features of this financial analysis tool:

- A simple, user-friendly experience allows a simple way of budgeting and expense tracking.

- Robust budgeting and expense tracking features.

- A clear view of financial health, including clear visualised representations.

Zeta

*zeta.tech

Let’s talk about money and relationships—a combo that can be tricky. Zeta is one of the popular financial tools designed for couples, whether you’re dating, cohabiting, engaged, or married. It allows you to track both individual and shared finances, set budgets, and message each other about transactions (yes, really).

It’s part financial tool, part relationship coach—and in 2025, it’s more powerful than ever with joint banking features, savings buckets, and real-time sync.

Key Features of Zeta:

- Instant account opening

- Real-time notifications on transactions,

- Budgeting tools and seamless peer-to-peer transfers.

Mint

*livemint.com

If you love having all of your financial information in one app, without having to go through 10 apps and trying to remember what is where, Mint is your one-stop choice as the best financial software. Mint automatically pulls in live up to date information from your bank accounts, credit cards, and even investments, so you know exactly where you stand.

Not the greatest at sticking to a budget? Mint takes just minutes to set up, and you can then forget about it, tracking your spending without guilt. Mint also tracks upcoming bills and allows you to monitor your credit score, all for free.

With a clean, minimal layout and extensive integrations with financial institutions, this financial software simplifies money management and makes it less overwhelming.

Why People Love Mint:

- Budget, bills, and investments with real-time tracking

- Connects with most banks and credit cards

- Free credit score monitoring

Goodbudget

*goodbudget.com

Developed by Dayspring Technologies, Goodbudget is one of the well-known financial software solutions mainly designed for companies of various sizes. This application is seen in retail, hospitality, and other professional services.

This financial software consists of multiple features that helps businesses to efficiently manage their financial solution. It includes cloud-based and hybrid models. K

Key capabilities and features of the software for business benefits include:

- Enhanced decision-making through up-to-date financial data

- Improved visibility into spending patterns and trends

- Streamlined analysis of budget performance and resource allocation

- Effective monitoring and control of project costs

- Protection of sensitive financial information

FutureAdvisor

*wealth-tech-club

Not everyone has the time (or the patience) to manage their investments—and that’s where FutureAdvisor comes in. A robo-advisor, FutureAdvisor takes the investment process off your plate, applying smart algorithms and modern portfolio theory (MPT) to design and service an investment portfolio that actually aligns with your goals.

Whether you are saving for retirement or just trying to make your money work a little harder, these financial analysis tools can help your strategy by taking into consideration your age, risk tolerance, and time horizon.

Why it stands out:

- Manages taxable accounts (solo or joint) with ease

- Supports traditional, Roth, rollover, and SEP IRAs

- Offers diversified portfolios tailored just for you

Credit Karma

*creditkarma.com

Looking to keep tabs on your credit without paying for a report? Credit Karma makes it ridiculously easy. You get access to your credit scores and reports, free of charge, with tips and personalised tools for your financial well-being.

If you’re a small business owner, good credit doesn’t just help for personal use, but it can also help you financially with better financing options. Credit Karma allows you to keep track of your credit and be prepared for when opportunity knocks.

The catch? It allows you to recommend a load of financial products, which seem a little like spam if you aren’t looking to purchase.

Why people use it:

- Totally free credit score and report access (TransUnion + Equifax)

- Real-time alerts for changes to your credit profile

- Identity monitoring for security peace of mind

- Tailored credit card, loan, and mortgage recommendations

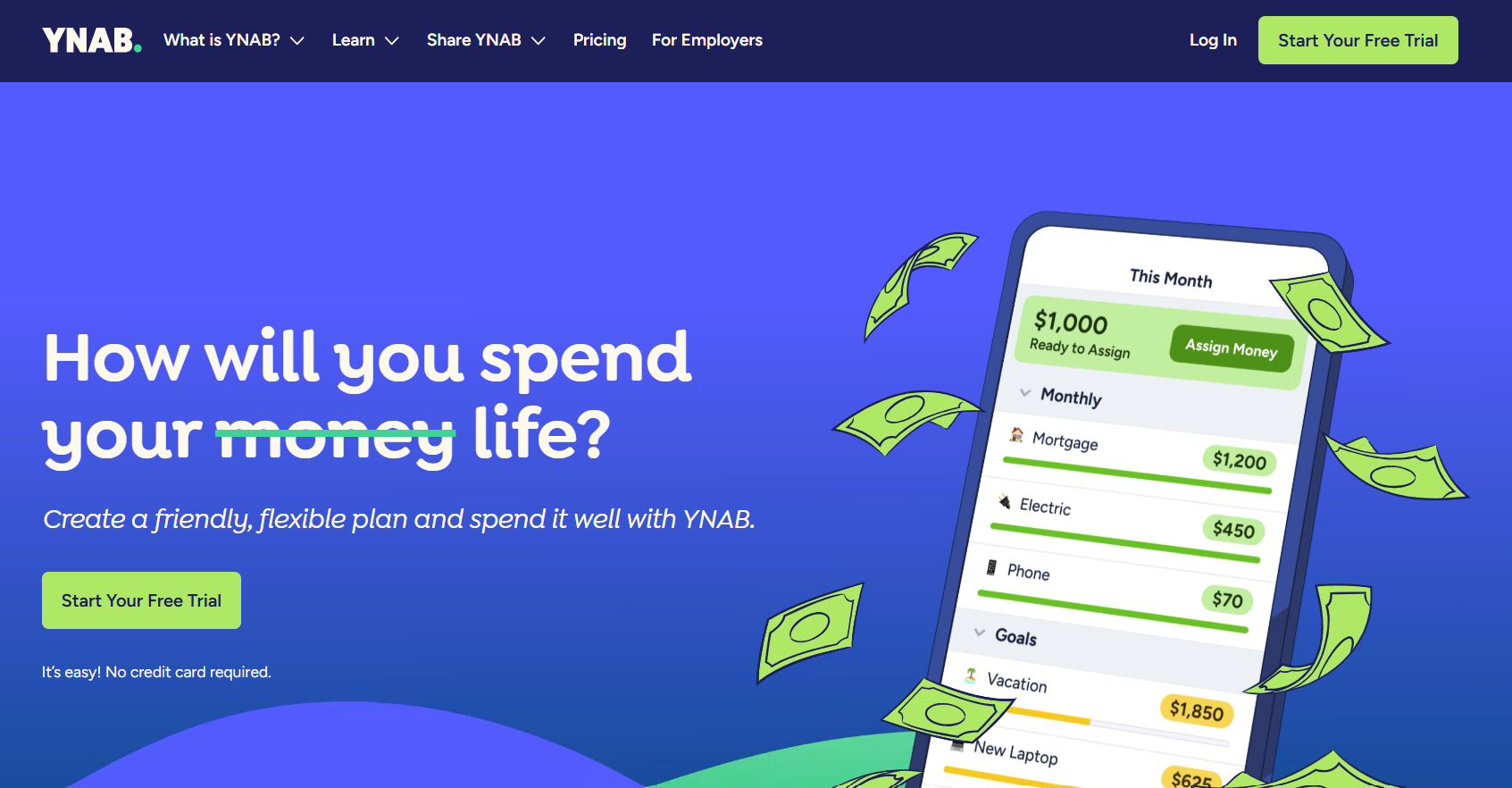

You Need a Budget (YNAB)

*ynab.com

If you’re tired of just guessing where your money went, YNAB will change everything. YNAB is not just about tracking spending, it is about assigning a job to every dollar you spend before you spend it. Yes, this is very hands-on, but this is where the power comes from.

If you are a freelancer, solopreneur, or even someone who regularly receives irregular income, you’ll love how YNAB helps you manage cash flow and plan for upcoming expenses. Budgeting finally feels proactive.

What makes it click:

- Uses zero-based budgeting (you tell every dollar where to go)

- Build sinking funds for things like holidays, taxes, or surprises

- Syncs with your bank and credit cards for real-time tracking

- Helps you set and hit savings goals without guesswork

TurboTax

*turbotax.intuit.com

Taxes can be overwhelming, but TurboTax keeps them manageable—even if your scenario isn’t simple. It walks you through the filing process step-by-step to ensure you know you didn’t miss anything and you’re getting every dollar you are entitled to.

It’s especially nice for freelancers or small business owners who need assistance with navigating deductions or handling self-employment income. And as a bonus, with integrations from tools like Credit Karma and QuickBooks, pulling in your data is effectively seamless.

Why people trust it:

- Easy, guided tax prep—even for complex returns

- Automatically imports W-2s, 1099s, and investment data

- Designed for both individuals and business owners

- Integrates with financial platforms to save time and avoid errors

EveryDollar

*ramseysolutions.com

EveryDollar is a financial software tool that helps user with their budgeting process. The platform provides a strong grip on their financial handling. The application offers two versions, free and Plus. In the free version, that data has to be entered manually by the users, whereas in the Plus version, the data entry is automatically achieved.

Why business owners love it:

- The platform’s categorisation system ensures that users don’t miss any expense categories, and they can also add personalised categories for their needs.

- EveryDollar allows users to set due dates for payments and enables reminders to prevent overdue bills.

- Users can generate custom budget reports for in-depth insights into their budgeting practices.

- Additionally, the platform provides an exclusive monthly newsletter filled with budgeting articles, tips, and tricks.

NetSuite

*netsuite.com

Effective financial management software is crucial for staying competitive in today’s fast-paced business environment. NetSuite Financial Software addresses diverse organisational needs, enhancing productivity and operational efficiency. As a leading NetSuite Solutions Provider, OpenTeQ is dedicated to offering exceptional NetSuite Support Services.

Key Features of NetSuite Financial Software

- Automates order processing, billing, and payments, reducing errors and accelerating cash flow while enhancing customer satisfaction.

- Provides real-time visibility into inventory levels and demand forecasting, optimising warehouse operations for timely deliveries and reduced costs.

- Automates procurement from requisition to payment, helping firms track orders and manage vendor relationships efficiently.

- Simplifies the management of contracts and project finances, ensuring better oversight and profitability.

How to Choose the Best Investment Management Software

Choosing the right investment management software isn’t just about picking the flashiest tool—it’s about finding one that truly fits your financial goals, workflow, and future plans. Whether you’re a solo investor or managing a team, here’s a breakdown of what you should be looking for.

Budget

First things first: how much do you want to spend? Some financial software is a one-time fixed fee, while others are charged month to month, and others yearly or biannually. Compare the upfront costs vs. the potential ongoing costs.

Also, consider the future. Will pricing increase as your portfolio grows? Some platforms charge based on assets under management or number of users, only hope you won’t get priced out as your business grows. The aim is to find something reasonable that satisfies your needs in a way that adds a lot of value without being restrictive.

Scalability

If your investments are going places (and we hope they are), you will want the kind of financial software that can grow with you. Whether your portfolio doubles or your team increases, your software should accept more data, more users, and more complexity, without being slow or messy.

Customization

Investors can have very different preferences for viewing their data. That’s why customisation is so important. Look for financial software that allows you to customise your dashboard, your charts, or reports that highlight what really matters to you.

And don’t underestimate the importance of alerts – the ability to set custom alerts for market drops or performance metrics can be highly beneficial.

Customer Support

Even the best financial software can have a learning curve. So, before you commit, take a look at the available customer support options. Is there support staff you’d be able to reach over the phone, chat, or email? Are they reliable and helpful?

Also, take a glance at the type of training resources available. Quality training tutorials, FAQs, and onboarding guides can save you a lot of time as you get up and running:

Security and Compliance

Last but definitely not least—security. Your financial data is sensitive, so make sure the software uses strong encryption and follows compliance standards like GDPR, SEC, or FINRA.

You’ll also want a solid audit trail feature. That way, if anything changes in your portfolio or settings, there’s a clear record of who did what and when.

The Bottom Line

In a nutshell, the choice of the right investment management technology and software can have a great effect on your level of financial success. Using these tools, businesses and individuals can enhance their overall capabilities (e.g., portfolio bookkeeping, performance analytics, etc.), help mitigate risk, and provide more heuristic capabilities in their investments and forecasts.

Whether you are a self-directed investor or managing a portfolio with a business, investment management software can truly change your results; it can be the difference between realising your financial objectives or failing to achieve them. As a result, we strongly advise investing the time to assess your requirements, reflect on the key investment software tools highlighted throughout this guide, and ultimately select an investment management solution that aligns with your needs and objectives.

Please keep in mind that investment management is not merely a means of making more money; it is about wealth preservation and preserving long-term financial stability. The investment management software and tools included in this guide are among the best of their kind and offer various benefits, including automation, cloud storage, analysis, and compliance features.

Frequently Asked Questions

What’s the Best Personal Budgeting App in 2025?

You Need a Budget (YNAB) is one of the best apps for managing personal finances in 2025. It helps you plan where every dollar goes, so you can stop living paycheck to paycheck. With tools to set financial goals and connect your bank accounts, YNAB makes it easier to save money and stay on track.

Which Financial Apps Are Best for Small Businesses?

For small businesses in 2025, two excellent financial apps are EveryDollar and Goodbudget. EveryDollar offers a user-friendly budgeting tool that helps manage expenses and track income easily. It allows for customizable budgeting categories, making it ideal for small business owners. Goodbudget, on the other hand, uses the envelope budgeting method, enabling users to allocate funds for various expenses.

Are Financial Apps Safe for Handling Sensitive Data?

Yes, especially with tools like NetSuite, It offers strong security features like:

- Two-factor authentication

- Automatic audit logs

- Secure data storage

- Compliance with standards like SOC 2 and HIPAA

Can I Use Financial Apps on More Than One Device?

Absolutely. Most financial apps in 2025 are cloud-based, which means you can use them on your phone, tablet, or computer. Your data stays in sync across all devices, so you can manage your finances anytime, anywhere.

Recent Blogs

It seems we can't find what you're looking for.