Top Fintech Jobs in 2025: Skills, Salaries, and How to Get Hired

Table of Contents

Ever wondered how digital wallets and robo-advisors are changing the way we manage our finances? Well, the answer is here: Fintech jobs are connecting finance and technology and involve creating new ways, such as online banking, crypto exchanges, digital wallets, lending between people, and AI in the finance sector. Developers, analysts, specialists in cybersecurity, marketers, and customer service individuals also take on these roles.

Freshers, those considering a career, or employees aiming for a new opportunity can find fascinating and financially rewarding FinTech Jobs. We will look into what a FinTech career is about, the jobs there are, what skills are essential, where the top companies hire, and what the future holds as a fresh grad, and highlight Amrita Vishwa Vidyapeetham University’s contribution to the sector.

Fintech Companies Jobs: Roles & Career Paths

*GeeksForGeeks

With the rise of FinTech (Financial Technology), there are now many opportunities for professionals who have expertise in both finance and technology. FinTech companies are bringing about new ways to handle money using apps, blockchains, and AI, and they are seeking highly skilled professionals to help them achieve this.

These are the main positions in FinTech Jobs in India and businesses, and the career paths you can choose from:

Fintech Jobs | Roles | Skills |

Software Developer / Engineer | Build and maintain financial apps, digital wallets, and blockchain solutions. | Python, Java, Node.js, REST APIs, SQL. |

Data Analyst / Data Scientist | Analyze user behavior, detect fraud, and predict credit risk. | Python, R, Excel, Tableau, Power BI. |

Product Manager | Design and manage FinTech jobs and products; coordinate tech and business goals. | Agile, UX/UI, market research, customer journey mapping. |

Cybersecurity Specialist | Secure transactions and protect sensitive data. | Penetration testing, network security, and encryption protocols. |

UX/UI Designer | Enhance user interfaces of apps and digital platforms. | Figma, Adobe XD, and user research. |

Blockchain Developer | Build decentralized financial applications and smart contracts. | Solidity, Ethereum, cryptography. |

Compliance Officer / KYC Analyst | Ensure legal and regulatory adherence in FinTech operations. | AML/KYC rules, data privacy laws, and reporting tools. |

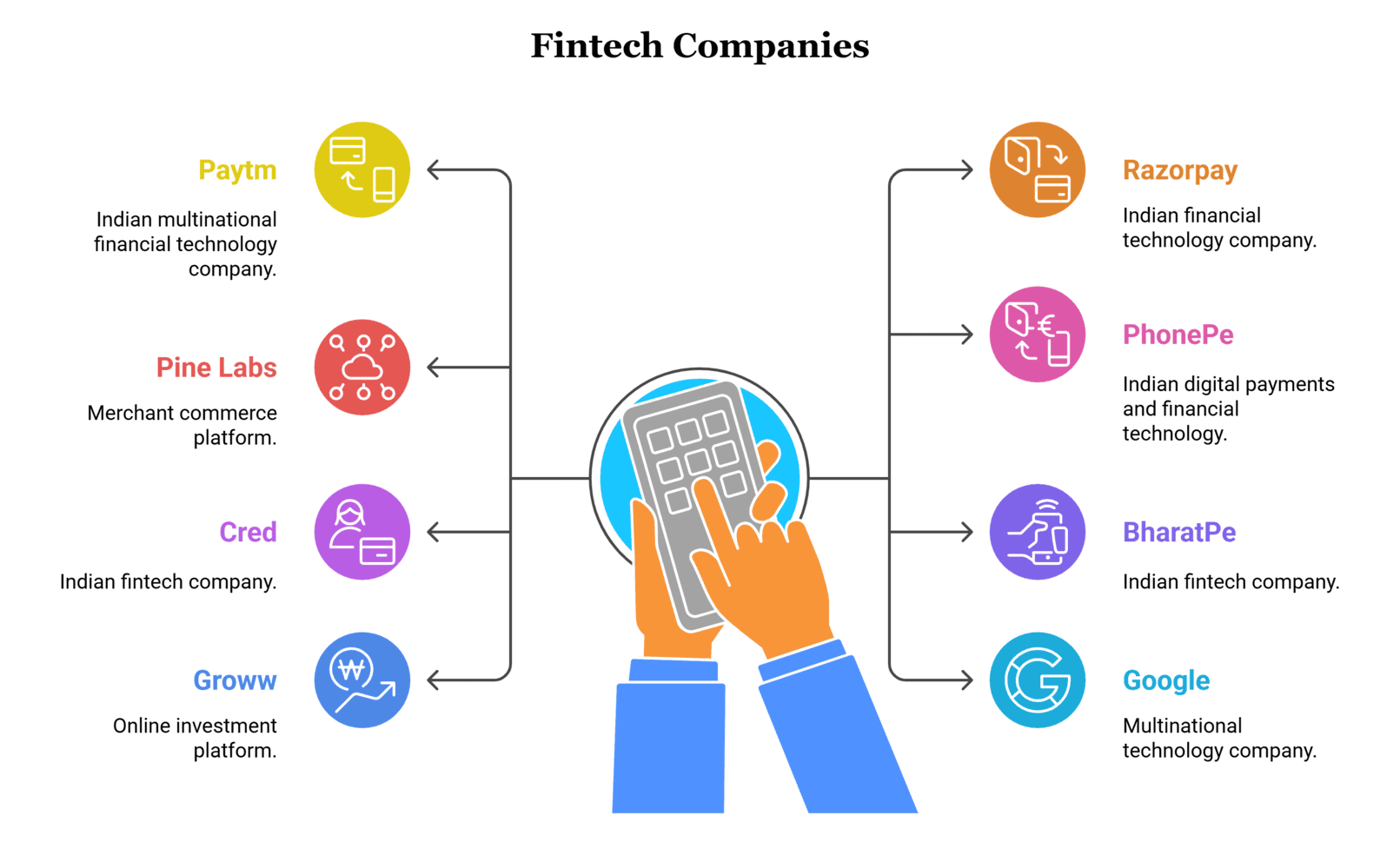

Top Fintech Companies Jobs

Established and startup companies in FinTech jobs are at the front of this change and need people to fill various positions like product management, data science, cybersecurity, software engineering, and handling regulatory compliance. They give competitive earnings, plus chances to contribute to important shifts in banking, investment, lending, and insurance.

Top Fintech Companies Jobs | Average Salary (INR/year) | Average Salary (USD/year) |

Paytm | ₹12–30 LPA | $18,000–$40,000 |

Razorpay | ₹10–35 LPA | $20,000–$45,000 |

Pine Labs | ₹8–28 LPA | $16,000–$38,000 |

PhonePe | ₹12–32 LPA | $22,000–$42,000 |

Cred | ₹15–40 LPA | $30,000–$55,000 |

BharatPe | ₹10–30 LPA | $18,000–$42,000 |

Groww | ₹9–25 LPA | $17,000–$34,000 |

Google (FinTech division) | ₹30–60 LPA | $50,000–$90,000 |

Source: Glassdoor

Fintech Jobs for Freshers: Your Launchpad to a Dynamic Career

It’s a real positive in the FinTech jobs, according to an industry that welcomes freshers novice professionals, who are welcomed. Whether you come from technology, business, or are analytically minded, FinTech jobs have roles available in both technology and non-technology areas.

They are usually introduced to challenging settings that let them pick up knowledge, help the team, and achieve key roles. Having the right abilities and being determined can help you forge a successful career in the areas of digital finance, inventing new products, data analysis, or customer service.

Best Entry-Level FinTech Roles | Role | Salary |

Business Analyst (Trainee) | Assist in data collection, reporting, and product documentation. | ₹4–6 LPA |

FinTech Internships | Short-term projects in app development, market research, or data analysis. | ₹10,000–₹25,000/month |

Customer Service Executive | Address queries, manage user onboarding, and maintain CRM data. | ₹3–5 LPA |

Junior Developer / QA Tester | Code, debug, or test digital finance products. | ₹3.5–6.5 LPA |

Digital Marketing Assistant | Run SEO, email campaigns, and manage digital ads for FinTech apps. | ₹3–5 LPA |

Tips on How to Get Ready as a Freshers

- Join online FinTech courses at platforms such as Amrita Vishwa Vidyapeetham, which offers the Best MBA in FinTech.

- You could try making a financial app for users or mimic how a UPI system works.

- FinTech communities online, join webinars, and reach out on LinkedIn for networking.

- Take part in events aimed at creating financial technology systems.

Important Skills for People in FinTech Careers

You need to have technical, analytical, and soft skills to succeed in a FinTech role. Below you’ll find the essential tools:

Technical Skills:

- Programming (such as Python, Java, SQL)

- Blockchain & Smart Contracts

- Use of Data Analytics & Machine Learning

- Cloud Computing includes Amazon Web Services (AWS) and Microsoft Azure.

- Cybersecurity Tools

Business Skills:

- Financial Modeling

- Being informed about Banking/Insurance

- Laws and Regulations (KYC, AML, GDPR)

- Agile-style Project Management

Soft Skills:

- Critical Thinking

- Communication

- Adaptability

- Team Collaboration

How to Start Your FinTech Career – Step-by-Step Guide

You can specialize in Tech, product, data, compliance, or marketing.

- Gain FinTech Qualifications: You may consider that Amrita Vishwa Vidyapeetham offers the Best MBA FinTech.

- Take up internships or small projects to learn more in the field.

- Display projects such as apps for finance, dashboards, or instances of applying analytics for case studies.

- Before interviews, focus on learning basic programming skills, recent changes in the industry, and practice aptitude questions.

Jaro Education: Your Trusted Partner in Career Counseling and Guidance

Jaro Education knows that everyone’s job search is different, and our goal is to support you with individual advice and real outcomes. Because more than 92 percent of Jaro Education’s students and professionals reach their targets, it is now recognized as a top player in career counseling and guidance. If you want to go into management, switch industries, or build your competencies for upcoming roles, our counselors guide you in choosing the right path.

First, we get a detailed understanding of your experience, what you are good at, and what you want to achieve. At that point, we give our clients:

- Pairing Students and Counselors: Each student is put in touch with a career counselor who follows updates in their area and takes individual needs into account.

- Personal Roadmaps: The team provides specialized advice for choosing programs, applying, understanding scholarships, and studying for required examinations.

- With the support of our relationships with prestigious universities and their networks, you get insights into new job prospects, internship opportunities, and up-to-date market requirements.

Workshops on writing a resume, doing job interviews, and soft skills help make you attractive to recruiters and admissions teams.

Conclusion

FinTech is growing so fast that it’s not just a fad; it’s a fundamental shift. Because of innovative mobile banking and AI-based investments, the financial industry is evolving quickly, and skilled workers are very much in demand. Fintech jobs are more than jobs; they open doors to significant and growing careers.

You can join this field at any point, and right now is a particularly good time to act if you are interested in Fintech jobs.

For anyone who wants to make a career in FinTech, getting a formal MBA degree with a specialization in FinTech from Amrita University is worthwhile.

Frequently Asked Questions

What exactly are FinTech jobs?

FinTech (Financial Technology) jobs encompass roles that combine finance and technology to create, maintain, and optimize digital financial products and services. Examples include software development for digital payment platforms, data analysis for credit scoring models, blockchain development, cybersecurity for financial networks, and product management for mobile banking apps.

What are the most in-demand FinTech roles today?

Some of the top FinTech positions currently in demand are:

- Software Developer/Engineer (building digital wallets, payment gateways, APIs)

- Data Scientist/Analyst (using data to detect fraud, model risk, and personalize user experiences)

- Product Manager (overseeing the roadmap and launch of FinTech products)

- Blockchain Developer (creating decentralized applications and smart contracts)

- Cybersecurity Specialist (securing digital transactions and safeguarding customer data)

- UX/UI Designer (designing intuitive interfaces for financial apps)

- Compliance/KYC Analyst (ensuring adherence to AML/KYC and regulatory guidelines).

Do I need a technical background to work in FinTech?

Not necessarily. While many technical roles (e.g., developers, data scientists, blockchain engineers) require programming or data-analysis skills, there are numerous non-technical FinTech positions as well:

- Business Analyst (translating market needs into product requirements)

- Digital Marketing Executive (promoting FinTech apps and managing campaigns)

- Customer Success/Support (guiding end users through onboarding and problem resolution)

- Compliance Officer (interpreting regulations and ensuring KYC/AML processes).

- For these roles, strong domain knowledge of finance, communication abilities, or regulatory understanding can be just as important as coding skills.

What skills do employers look for in FinTech candidates?

Typical skill sets vary by function but often include:

- Technical Roles: Programming (Python, Java, SQL), data analysis (R, Excel, Tableau), blockchain fundamentals (Solidity, Ethereum), cloud platforms (AWS/Azure), and cybersecurity basics.

- Analytical Roles: Financial modeling, statistical analysis, risk assessment, and familiarity with machine-learning toolkits.

- Product/Business Roles: Understanding of agile methodologies, market research, user-experience principles, and strong communication.

- Compliance/Regulatory Roles: Knowledge of KYC/AML/GDPR, attention to detail, and strong report-writing skills.

Are there entry-level FinTech jobs for freshers without prior experience?

Yes. Many FinTech companies offer roles designed for freshers:

- Internships (3–6 months) across development, analytics, and operations teams.

- Junior Developer/QC Tester (learning software testing or basic coding techniques under supervision).

- Business Analyst Trainee (assisting senior analysts with data collation and reporting).

- Customer Support/Onboarding Assistant (handling user queries and guiding new customers through digital platforms).

These positions often provide on-the-job training, mentorship, and a pathway to full-time roles.