RPA Developer Salary In India: For Freshers & Experienced [2024]

Table of Contents

- jaro education

- 23, September 2024

- 6:00 pm

The Robotic Process Automation (RPA) market is booming, with projections from Forrester estimating it will reach nearly $3 billion by 2023. This rapid growth is not only transforming industries but also creating a surge in job opportunities. Among the most sought-after roles is that of an RPA Developer, also known as a robotics engineer.

But what exactly does an RPA Developer do, and why is the RPA Developer salary in India rising so significantly? Before we dive into the responsibilities and salary details, let’s first explore the basics of RPA and how this cutting-edge technology works. If you’re considering a career in this high-demand field, now is the perfect time to understand the opportunities that await.

Let’s begin by understanding who an RPA Developer is and the typical RPA Developer salary trends in India.

What is an RPA Developer?

An RPA (Robotic Process Automation) developer is a professional who specializes in using AI (Artificial Intelligence) and machine learning algorithms to automate repetitive and complex business tasks. RPA technology enables software applications to perform tasks across various websites and applications, allowing businesses to maintain records, perform calculations, and manage transactions efficiently. Today, industries across all sectors rely on RPA to boost efficiency, cut costs, and minimize the need for human intervention. As a result, the demand for skilled RPA developers who can implement and manage automated systems is on the rise.

*bradsol.com

Salary of RPA Developers Based on Experience

RPA Developer Salary for Fresher (Entry level)

An RPA Developer (Fresher) automates repetitive business processes with tools such as UiPath, Automation Anywhere, and Blue Prism. As a beginner in this sector, their tasks include helping to design and implement automation workflows, writing and debugging scripts, supporting testing and quality assurance, maintaining and monitoring bots, and interacting with business teams to understand process needs. They are also expected to consistently learn and adapt to new RPA tools and technologies.

In Bangalore/Bengaluru, the RPA Developer salary for someone with less than 1 year of experience to 5 years ranges from ₹3.0 Lakhs to ₹10.0 Lakhs per annum, with an average annual salary of ₹6.5 Lakhs, based on the latest data from 3.6k reported salaries.

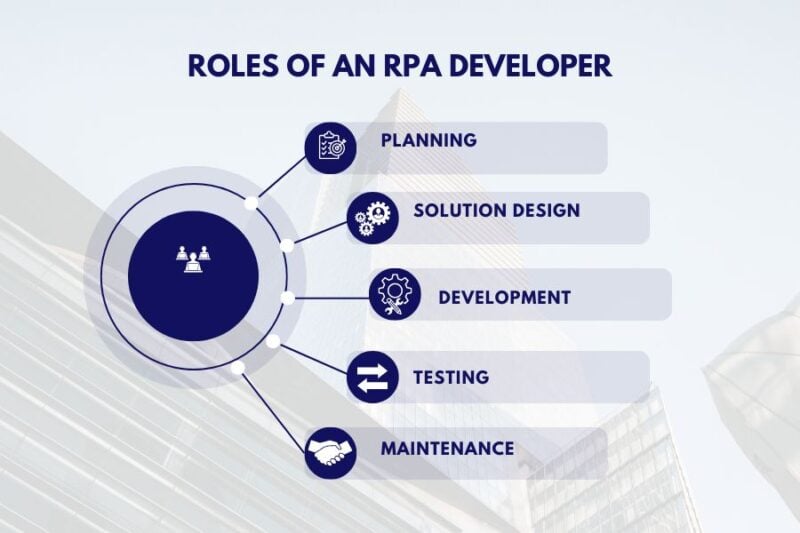

Roles and Responsibilities:

- Assist in Designing and Developing Automation Workflows

- Process Documentation

- Script Writing and Debugging

- Testing and Quality Assurance

RPA Developer Salary Mid Level

A mid-level RPA Developer plays a crucial role in designing, developing, and deploying robotic process automation solutions to enhance business processes. They are responsible for analyzing complex workflows, collaborating with stakeholders, and developing automated solutions using tools like UiPath, Automation Anywhere, or Blue Prism. In addition to hands-on development, they also focus on optimizing existing automation scripts, troubleshooting errors, and providing ongoing support.

In the Bangalore area, the estimated total pay for an RPA Developer is around ₹6,15,000 per year, with an average base salary of ₹5,80,000 per year. Additional pay, which could include cash bonuses, commissions, and profit sharing, is estimated at ₹35,000 per year.

Roles and Responsibilities:

- Create and optimize automation solutions.

- Work with business analysts to identify automation opportunities.

- Regularly monitor and maintain deployed bots.

- Provide guidance to junior developers.

Senior RPA Developer Salary

A Senior RPA Developer is responsible for leading automation projects, mentoring junior engineers, and working with business stakeholders to implement RPA solutions. Their knowledge of tools like UiPath, Automation Anywhere, and Blue Prism enables them to manage complex workflows, integrate systems, and troubleshoot issues effectively.

The estimated total pay for a Senior RPA Developer is around ₹12,59,512 per year, with an average base salary of ₹10,59,468 per year. This compensation reflects the demand for experienced professionals driving digital transformation through automation.

Roles and Responsibilities:

- Lead Automation Projects

- Develop Complex Automation Solutions

- Mentor and Train Junior Developers

- Collaborate with Stakeholders

- Perform Code Reviews and Troubleshooting

As the demand for RPA developers continues to grow, the RPA Developer salary in India is rising significantly. Mastering RPA tools, combined with continuous learning and upskilling, can lead to a rewarding career in this field.

RPA Developer Salary Based on Skill Set

An RPA Developer salary in India can vary significantly depending on the individual’s skill set. Certain in-demand skills can substantially impact earning potential:

- Python: 50% salary increase potential

- Blue Prism: 44% salary increase potential

- Robotics: 26% salary increase potential

- SQL: 24% salary increase potential

- VBA: 24% salary increase potential

- Automation Scripting: 18% salary increase potential

- Robotic Process Automation (RPA): 11% salary increase potential

For 2024, here’s how different skills influence the average RPA Developer salary in India:

- Developers with Python skills can earn around 7.5 LPA.

- Those proficient in Blue Prism might expect about 7.3 LPA.

- RPA Developers specializing in Robotics can earn approximately 6.3 LPA.

- Developers skilled in SQL or VBA typically earn around 6.2 LPA.

- Expertise in Automation Scripting can lead to earnings near 5.9 LPA.

Impact of Location on RPA Developer Salaries in India

Understanding how experience and location influence your salary as an RPA Developer in India is essential for career planning. Starting out, compensation may be relatively modest, but it can increase significantly as you move from a junior to a senior position with more experience.

Location also plays a critical role in determining RPA Developer salary variations across India. Here’s a breakdown of the average annual salaries in key cities:

- New Delhi: ₹ 7.7 LPA

- Mumbai: ₹4 LPA

- Bengaluru: ₹5.3 LPA

- Hyderabad: ₹5.0 LPA

- Pune: ₹7 LPA

- Chennai: ₹6.1 LPA

These figures illustrate that where you work in India can have a substantial impact on your RPA Developer salary.

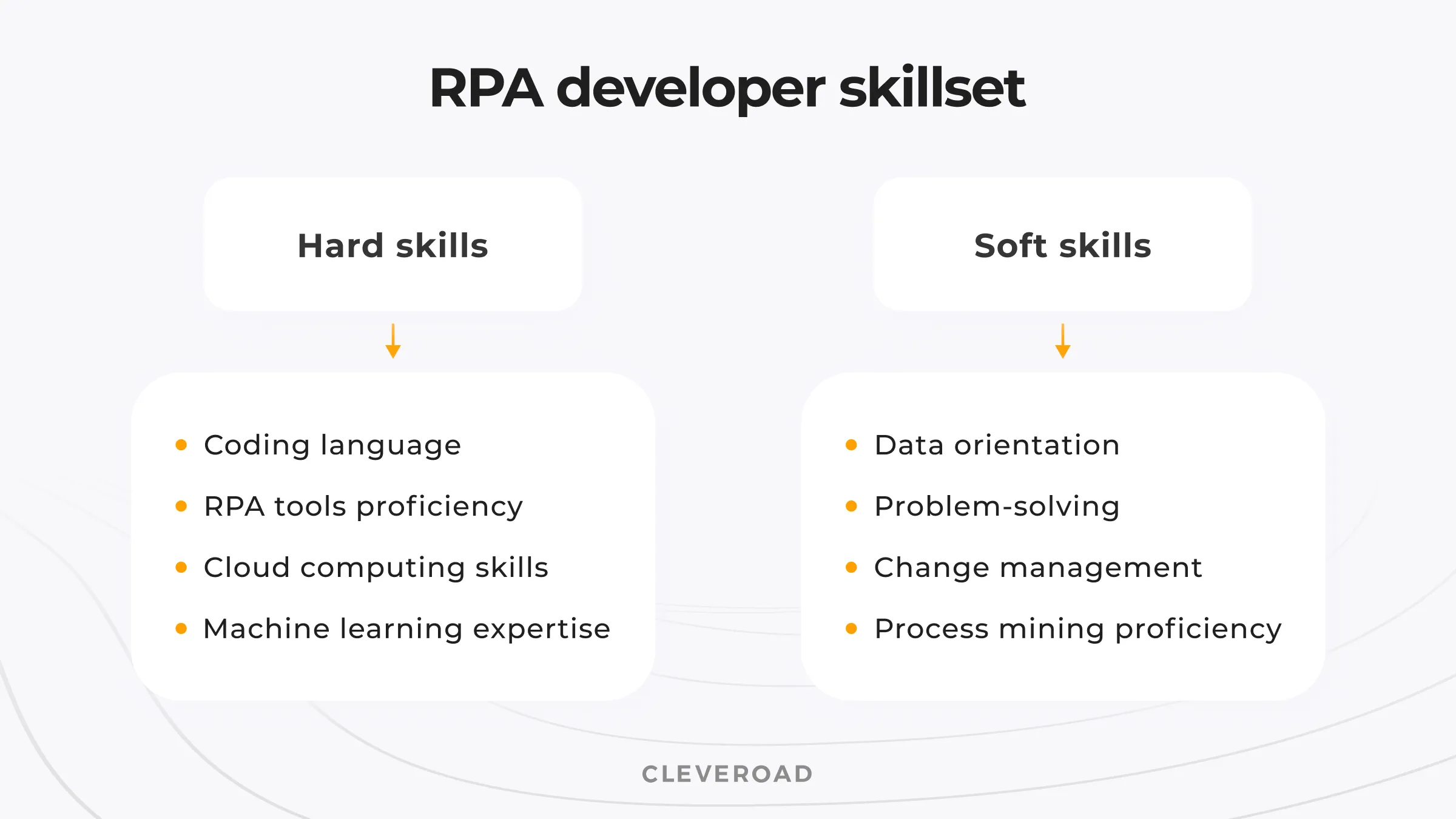

Essential Skills for an RPA Developer

*cleveroad.com

When considering a career in RPA, it’s important to understand the essential skills that can significantly impact your RPA developer salary. While specific programming knowledge varies by company, certain skills are universally expected from RPA developers. A review of job listings frequently highlights the following key competencies:

Analytical Skills

A background in business analysis is crucial, as RPA developers need to understand internal process flows and identify automation opportunities. This skill directly influences an RPA developer salary, as employers highly value those who can streamline processes effectively.

Problem-Solving

RPA is designed to solve business challenges, optimize budgets, and boost productivity. As a result, candidates with a blend of RPA experience and business development expertise are highly sought after. The ability to problem-solve efficiently often leads to a higher RPA developer salary.

Communication Skills

Strong communication is essential for coordinating between end users, development teams, and stakeholders. As RPA developers often act as a bridge between business analysts and software developers, effective communication can also play a role in influencing your RPA developer salary.

UX Understanding

Familiarity with user experience (UX) principles is vital, as RPA software is typically used by non-technical business users. Intuitive interfaces and user-friendly bot training are critical for smooth integration, which can impact the demand for RPA developers and subsequently, their salary.

Process Mining Proficiency

A deep understanding of process mining is often required for RPA developer roles. This core part of RPA activities is valuable in identifying automation opportunities, further enhancing your RPA developer salary potential.

Programming Language Knowledge

- Python: Widely used in scripting for automation bots.

- Visual Basic (VB): Popular with platforms like Automation Anywhere and UiPath.

- C/C#: Commonly used for desktop RPA software.

- .NET/ASP.NET: Essential frameworks for developing cross-platform applications in C/C# or VB.

- JavaScript: Necessary for web-based RPA and tools like Automation Anywhere.

Proficiency in these programming languages can greatly impact your RPA developer salary by showcasing your technical versatility.

Experience with RPA Tools

Familiarity with leading RPA tools such as UiPath, Automation Anywhere, and Blue Prism is crucial, especially for senior roles. This experience directly correlates with higher levels of compensation, often elevating your RPA developer salary.

Cloud Technology Knowledge

Experience with cloud infrastructure (e.g., AWS, Azure) is beneficial for deploying bots in cloud environments, another factor that can influence your RPA developer salary.

Machine Learning Expertise

As RPA evolves into Cognitive Automation, combining machine learning, AI, and RPA is increasingly valuable. Having expertise in this area can make you a highly competitive candidate and significantly boost your RPA developer salary by extending traditional bot capabilities.

Conclusion

In conclusion, the rapid growth of RPA is driving high demand for skilled developers, with salaries expected to rise further as the talent gap widens. Upskilling through online training and certifications can accelerate career growth in Advanced Certificate Programme in Generative AI & Machine Learning by IITM Pravartak. Alongside technical expertise, cultivating business acumen and staying updated on emerging technologies like AI/ML will help you thrive.

With RPA revolutionizing industries, now is the perfect time to build your skills and capitalize on the expanding opportunities for RPA developers, especially in India.

Frequently Asked Questions

The average RPA Developer salary at TCS in India is ₹6.4 Lakhs for professionals with 1 to 8 years of experience, ranging between ₹2.0 Lakhs to ₹10.2 Lakhs. This is about 2% higher than the national average for RPA developers.

The average salary for an RPA Developer at Amazon India is ₹5.9 Lakhs, typically for professionals with 2 to 3 years of experience. Salaries at Amazon range from ₹3.1 Lakhs to ₹7.8 Lakhs, depending on experience and role.

Yes, RPA developers are in high demand as industries rapidly adopt automation technologies to streamline processes and improve efficiency.

The salary of an RPA developer at IBM typically ranges from ₹6.5 to ₹12 LPA, depending on experience and location.

After 5 years of experience, an RPA developer can earn between ₹10 to ₹20 LPA, depending on expertise and the company.

![Marketing-Executive-Salary-in-India-in-2024-[Average-to-Highest]](https://jaro-website.s3.ap-south-1.amazonaws.com/2024/06/Marketing-Executive-Salary-in-India-in-2024-Average-to-Highest.jpg)