12 Types of Accounting to Know in 2025

Table of Contents

Accounting, often referred to as the language of business, plays a crucial role for individuals and companies to track their financial condition. By monitoring daily expenditures and making financial statements, accounting provides a clear understanding of economic health, enabling individuals and organisations to make informed decisions, optimise resource allocation, and achieve their financial goals.

Accounting is a broad field with various specialisations, essential for financial management. There are several types of accounting, each serving different purposes within organisations and the financial landscape. This blog will explore 12 types of accounting, shedding light on their importance in the financial ecosystem.

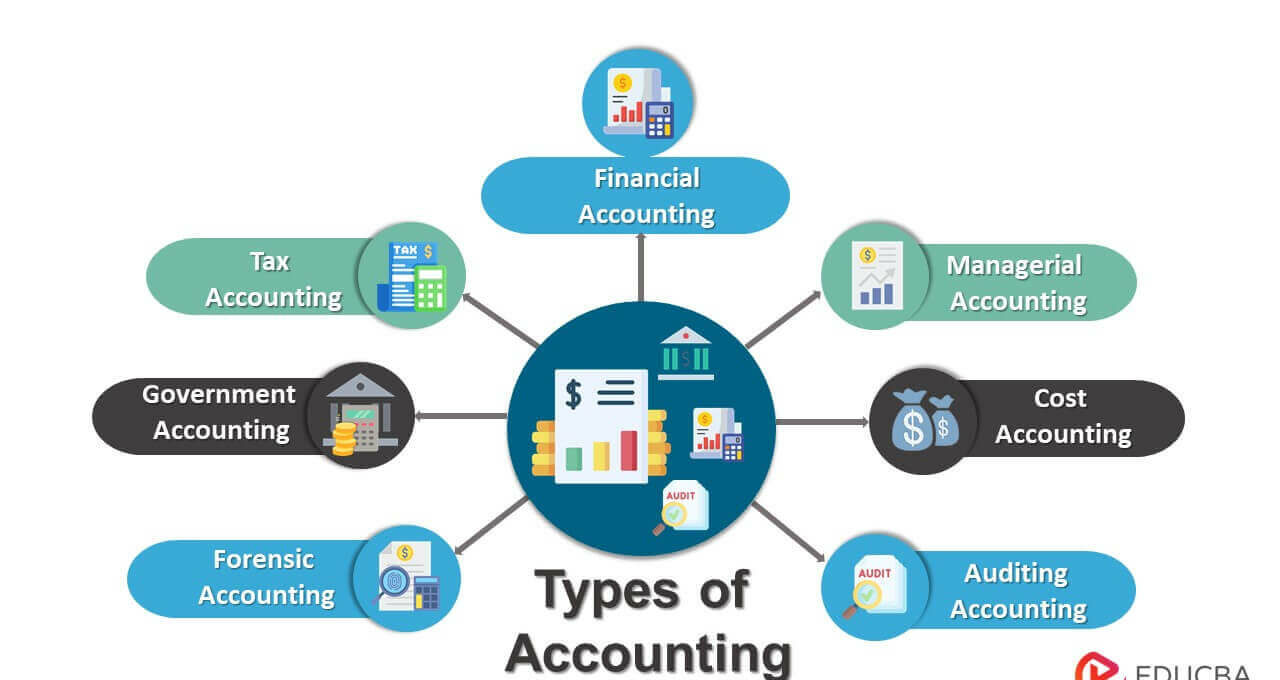

What are the 12 Types of Accounting?

*educba.com

The 12 common types of accounting that cover different aspects of financial performance include:

1. Financial Accounting

Financial accounting is the process of recording, summarising, and reporting a company’s financial transactions to create financial statements. These types of accounting statements provide insights into a company’s financial health and overall performance. It is a systematic process administered by accounting standards to ensure transparency and comparability.

The primary purpose of these types of accounting is to provide a clear and accurate picture of a company’s financial position and performance to external stakeholders, including investors, creditors, suppliers, and regulatory bodies, who depend on it for making informed decisions.

2. Tax Accounting

Tax accounting focuses on preparing and filing tax returns, as well as ensuring compliance with tax laws and regulations. These types of accounting helps businesses and individuals maximise deductions, manage tax liabilities, minimise tax burdens and avoid unnecessary penalties. Tax accounting plays a vital role in financial reporting by providing accurate information related to a company’s tax obligations.

3. Management Accounting

Management accounting, also known as managerial accounting, is the process of providing detailed financial reports to internal management to help make informed decisions and improve business performance. These types of accounting focuses on providing financial information for internal use, unlike financial accounting, which is primarily for external stakeholders.

4. International Accounting

International accounting encompasses the standardisation and harmonisation of accounting practices across different countries, simplifying financial reporting for multinational companies and enabling cross-border evaluations. These types of accounting focuses on addressing the complexities of international business, including currency exchange, fluctuating regulations, and global financial markets.

The main purpose of these types of accounting is to provide a framework for examining and interpreting financial information from a global perspective, enabling investors, managers, and other stakeholders to make informed decisions.

5. Cost Accounting

Cost accounting involves recording, analysing, and reporting a company’s expenses, specifically focusing on the costs related to producing goods or services. It is an internal management tool that helps businesses understand their cost structure, find areas for cost reduction, and make informed decisions about pricing, resource allocation, and profitability.

6. Fiduciary Accounting

Fiduciary accounting is the process of accurately tracking and reporting the financial activities related to a trust, estate, guardianship, or conservatorship. These types of accounting involves creating a detailed record of all income, expenses, assets, and distributions within a certain period, ensuring transparency and accountability to beneficiaries and, in some cases, the courts.

The primary purpose of fiduciary accounting is to provide a clear and accurate picture of how assets are being managed and distributed.

7. Auditing

Auditing focuses on independently examining and evaluating a company’s financial records and reports to determine if they are accurate, reliable, and comply with applicable standards and regulations. These types of accounting entails inspecting financial statements, internal controls, and other related information to create an opinion on whether the information is fairly stated in the organisation’s financial position.

8. Governmental Accounting

Governmental accounting, also known as Government accounting, is a particular type of accounting that focuses on managing the financial transactions and activities of government units at all levels (federal, state, and local). It includes recording, classifying, summarising, and reporting financial information related to government incomes and expenses. These types of accounting ensures transparency, accountability, and effective resource allocation in the public sector.

9. Forensic Accounting

Forensic accounting is a type of accounting that involves reviewing financial records to detect and prevent financial crimes, such as fraud, misconduct, and other irregularities. It includes accounting, auditing, and investigative skills to examine financial data, often in preparation for legal proceedings. Forensic accountants generally work with lawyers and other legal professionals to provide expert testimony and support in lawsuits or other legal matters.

10. Project Accounting

Project accounting focuses on tracking and managing the financial aspects of individual projects, such as construction or software development projects, within a company. This type of accounting enables businesses to monitor costs, revenue, and profitability throughout a project’s development, ensuring it stays within budget and delivers financial benefits. This approach provides a rough idea of financial performance based on projects, helping make informed decisions and improve project outcomes.

11. Social Accounting

Social accounting is a type of accounting used by organisations to evaluate and report on the social and environmental impact of their operations, alongside their financial performance. It considers how a company’s actions affect various stakeholders and the broader society. It involves measuring and reporting on aspects such as environmental sustainability, community engagement, and ethical labour practices.

The primary purpose of social accounting is to provide transparency related to an organisation’s social and environmental performance, enabling stakeholders to hold it accountable for its actions. This type of accounting is not only about reporting but also about using the information gathered to recognise areas for improvement and to develop more sustainable practices.

12. Environmental Accounting

Environmental accounting is a process to integrate environmental considerations into traditional accounting practices. It identifies the economic costs of activities, such as pollution, resource reduction, and habitat destruction, that should be factored into financial reporting. This type of accounting involves evaluating and reporting both the environmental impacts of economic activities and the economic value of natural resources.

How to Choose the Best Type of Accounting

Choosing the best type of accounting depends on individual interests, career goals, and the specific needs of a business. Thus, here are some factors to consider while selecting the best one.

Strengths and Interests

In order to choose the best type of accounting, it is crucial to identify your strengths and interests. Match your skills required for a specific accounting field to achieve a more fulfilling and successful career. For instance, strong analytical skills might be suitable for auditing or forensic accounting, while an interest in helping businesses grow could be a great fit for management accounting.

Career Goals

Career goals play a crucial role in selecting the best types of accounting. This is because they help classify the specific skills, knowledge, and experience required for success in a preferred field. Defining career objectives helps individuals align their education, certifications, and job search with their long-term goals, leading to better job satisfaction and great opportunities.

Job Demand

Job demand plays a key role in choosing the best types of accounting, as it directly impacts your career opportunities and earning potential. Understanding the high-demand accounting roles can help you align your career paths with areas where your skills and expertise will be most valued. This can lead to better job security, faster career development, and higher salaries.

Education and Certifications

Education and certifications play a crucial role in selecting the best types of accounting careers. A strong educational foundation, along with relevant certifications, not only boosts career prospects but also helps focus on specific accounting domains. For example, a CPA (Certified Public Accountant) is suitable for public accounting roles, while a CMA (Certified Management Accountant) is a great fit for management accounting and strategic decision-making.

Professional Advice

Seeking professional advice from experts helps you navigate the diverse world of accounting and assists you in choosing the most suitable type of accounting.

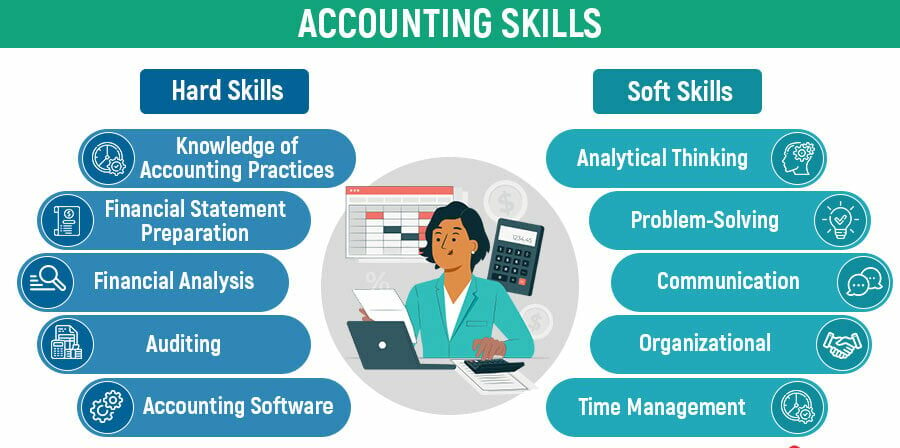

Essential Skills Required for Accounting in 2025

*educba.com

Developing a strong foundation in both technical skills and soft skills is essential for thriving in the evolving financial landscape of 2025. So, let’s explore the essential skills required for accounting in 2025.

Technical Skills:

- Financial Modelling and Analysis: This skillset is essential for accountants to make informed decisions in various finance roles, such as investment banking, corporate finance, and private equity. Financial modelling and analysis include the process of creating mathematical representations of an organisation’s financial situations to estimate performance, assess risks, and evaluate investment opportunities.

- Data Analysis and Interpretation: This technical skill involves the ability to analyse large datasets, identify trends, extract actionable insights, and support informed decision-making.

- AI and Automation Proficiency: AI and Automation proficiency encompasses a range of technical skills essential for developing, implementing, and managing AI-powered systems and automated processes. These skills include programming languages like Python and R, machine learning frameworks, data analysis, and cloud computing, as well as non-technical skills, such as problem-solving and communication.

- Accounting Software Proficiency: Accounting software proficiency is a crucial technical skill for accountants, allowing them to efficiently manage financial data, streamline processes, and generate accurate reports. Expertise in this area helps accountants automate tasks, minimise errors, and enhance productivity. Examples of common accounting software include QuickBooks, Xero, SAP, Oracle NetSuite, and Tally.

- Risk Management: Risk Management as a technical skill encompasses identifying, analysing, and mitigating potential risks that could negatively affect an organisation’s objectives, operations, or reputation.

- Taxation Knowledge: This skillset is crucial for accountants, involving a deep understanding of tax laws, regulations, and compliance procedures. This technical skill allows them to accurately prepare tax returns, reduce tax liabilities for clients, and ensure compliance with all relevant tax obligations.

- Auditing Skills: Auditing skills are crucial for accountants, as they involve the ability to examine and validate financial records and processes, recognise potential risks, and ensure compliance with regulations. These skills include understanding accounting principles, using data analysis tools, and effectively communicating findings.

Soft Skills:

- Communication (Verbal and Written): Effective communication is essential for accountants, enabling them to convey complex financial information to stakeholders.

- Problem-solving and Critical Thinking: This skillset enables accountants to analyse complex financial situations, identify problems, and develop effective solutions.

- Adaptability: Adaptability is a crucial soft skill for accountants, allowing them to thrive in the dynamic accounting field. It helps them manage change, solve problems effectively, and maintain client relationships.

- Time Management: Effective time management is crucial for accountants as they often work under tight deadlines. This skill set enables them to manage multiple tasks and deadlines efficiently.

- Business Acumen: Business Acumen involves the ability to understand business principles and make informed decisions about a business’s operations, market, and financial health.

- Ethical Decision-making: Ethical decision-making is essential for accountants to ensure transparency in financial reporting and build trust with stakeholders.

- Continuous Learning: As the accounting field is constantly evolving with new regulations, technologies, and business practices, continuous learning is essential for accountants to stay current through ongoing professional education and development

The Bottom Line

Understanding the different types of accounting is essential for any organisation or individual, as each serves distinct purposes in managing and reporting financial information. While financial accounting focuses on preparing financial statements for external stakeholders, management accounting provides internal reports for decision-making. Cost accounting analyses costs, and forensic accounting examines financial irregularities. Other types include tax accounting, fiduciary accounting, and governmental accounting, each with its specific focus and application.

So, planning to enhance your career in the accounting field in 2025? Then, explore different certification programs and degree courses offered by Jaro Education. One of the most popular certification programmes is Financial Reporting and Corporate Governance by IIM Ahmedabad, which is a 4-month duration programme. It will prepare you with fundamental expertise in financial accounting, financial statement analysis, and corporate governance.

Frequently Asked Questions

What is the difference between financial and management accounting?

Financial accounting is meant for preparing financial statements and reporting for external stakeholders, while management accounting is used for providing financial information to internal users (like management) for decision-making purposes.

What is the role of an auditor?

The role of an auditor is to independently examine and validate the accuracy of an organisation’s financial records and statements. They ensure compliance with regulations and identify potential risks.

What is the purpose of forensic accounting?

The purpose of forensic accounting is to examine financial discrepancies, fraud, or other irregularities. It involves inspecting financial records, gathering evidence, and providing expert testimony in legal proceedings.

What is the purpose of Fiduciary Accounting?

The primary purpose of fiduciary accounting is to provide a clear, transparent, and accurate record of financial transactions within a trust, estate, guardianship, or conservatorship. It ensures that the fiduciary (executor, trustee, guardian, etc.) fulfils their responsibility to the beneficiaries by properly managing accounting for all income, expenses, assets, and liabilities.

What are the three golden rules of accounting?

The three golden rules of accounting are debit what comes in and credit what goes out, debit the receiver, credit the giver, and debit all expenses and losses and credit all incomes and gains.

What are the main accounting methods?

The cash method and the accrual method are the two main accounting methods. The cash method identifies revenue when cash is received and expenses when cash is paid, while the accrual method recognises revenue when earned and expenses when incurred.