What is FinTech: Types, Examples And More

Table of Contents

These days, banks have become more like an old movie space, where files are piled on desks and employees shuffle through paperwork. But now take a look at your phone, where you have at least more than two applications where you can perform all the banking operations in just a few clicks. Isn’t it amazing? It’s a sign of new era payments. And one major development to this drastic change is: what is fintech – a small name but a big player.

Fintech is short for financial technology; it primarily refers to companies that heavily rely on the latest technology to conduct essential functions related to financial services, including storing, saving, borrowing, investing, paying, and protecting money. This sector gained immense popularity after 2019, reaching many people, particularly in the payment space. Today, it has expanded to every corner of the world, revolutionizing how we manage our finances, from digital banking to investment platforms and beyond.

In this blog, we will explore what is fintech, its types, some of the top fintech companies, and what the future holds for businesses and consumers. Read on to find out more.

What is Fintech?

Let’s start with the basic understanding of Fintech meaning – it is all about using technology to simplify and automate all types of financial services. It’s really a revolution, as the global fintech market is expected to exceed nearly $700 billion by 2030. That’s a huge expected advancement! Fintech goes into many areas: banking, investing, insurance, payments, fundraising, and even blockchain.

Now again, you must be confused. What is fintech? To be honest, it started as an effort to remove inefficiencies from bank systems, but the use of software and servers made paying or receiving money a more straightforward process. Still, it has rapidly grown and continues to evolve.

Fintech companies operate around providing speed, accessibility, and cost-effectiveness. The goal is to provide these services to those often overlooked by traditional financial institutions for better services at lower costs. For instance, instead of heading to a bank branch to apply for a loan or open an account, automate it all on your mobile phone. Right!?

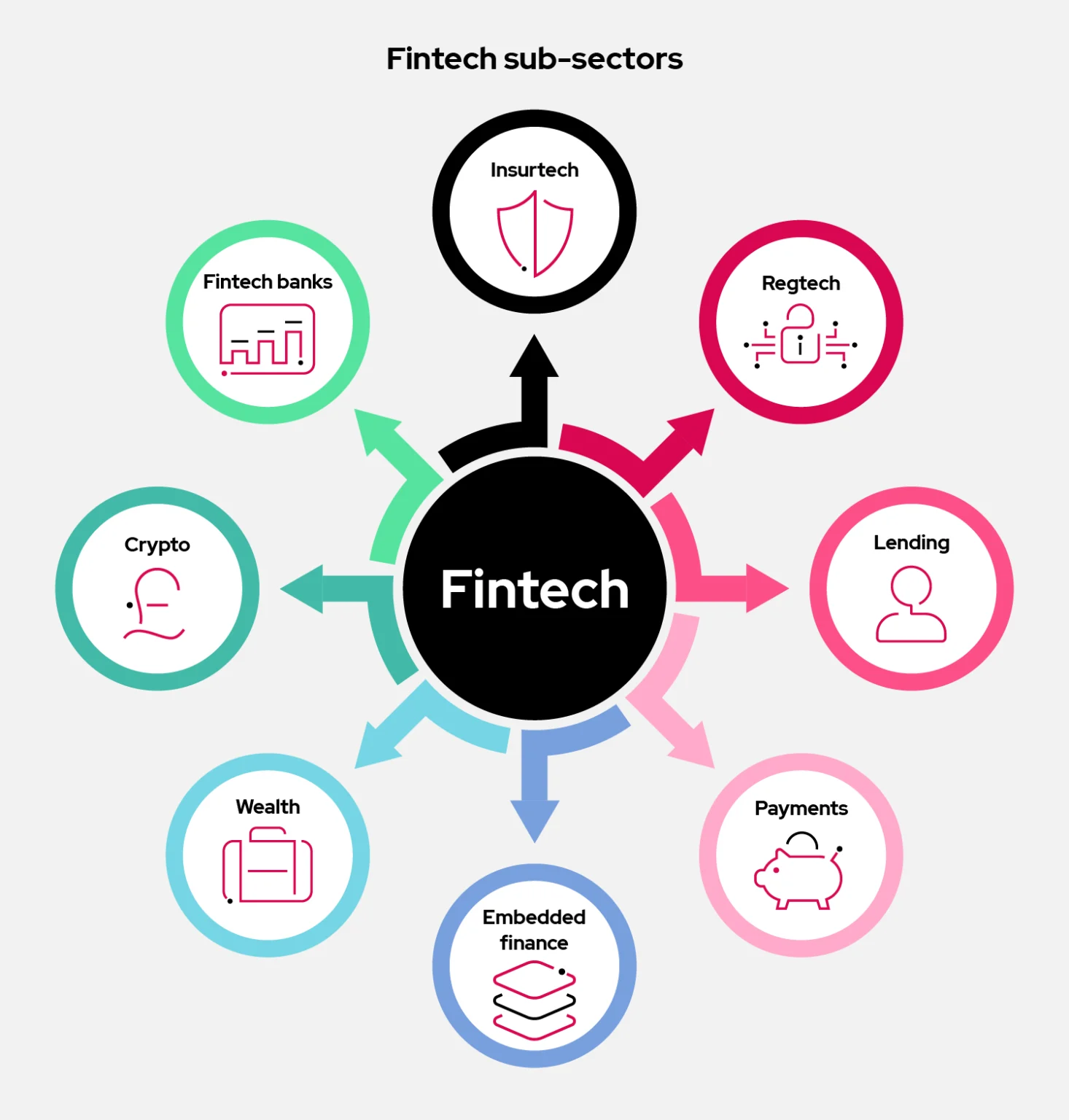

Types of Fintech and Fintech Products

*panintelligence.com

Now that you have understood “what is fintech”, it’s time to focus on its types. Do you know there are different types of fintech, and each category caters to the specific need it serves through technology to improve efficiency, access, and user experience? Yes. So, here are some of the major categories of FinTech, some of which are unique to themselves and others share similar contributions or characteristics.

Blockchain and Cryptocurrency

This area alone can reshape how we think about money, and it directly ties into the broader question of what fintech is and how it’s redefining legacy systems.

Blockchain technology acts as a decentralized, safe ledger for visible peer-to-peer transactions without intermediaries. Bitcoin and Ethereum use cryptocurrency technology to facilitate confidence in a trustless environment, and the launch of the daily average volume of Bitcoin, Ethereum or other cryptocurrencies represents an innovative and versatile model of financial interaction.

These innovative companies are not just providing back-end digital currencies; they are providing useful financial use cases daily. By providing information that improves value, service and efficiency, they are also competing against the established financial infrastructure. While blockchain applications and digital currency gain popularity, the aims of these technologies is an alternate way of thinking about money. This will likely lead to freedom from current banking institutions and allow the average consumer to financially participate in ways not accomplished in the past.

Insurance (InsurTech)

InsurTech is the application of technology within the insurance sector, aimed at streamlining and modernizing traditional practices. InsurTech companies leverage artificial intelligence and data analytics to optimize underwriting processes and assess risks more accurately. By utilizing telematics and IoT devices, these firms enhance the way insurance products are designed, marketed, and priced.

For instance, telematics can track driving behavior, allowing insurers to offer personalized premiums based on individual risk profiles. This shift towards customization not only improves customer satisfaction but also ensures that insurance products are tailored to meet the unique needs of each policyholder. In essence, InsurTech is redefining the relationship between insurers and consumers, making the insurance experience more transparent and user-centric.

Regulatory Technology (RegTech)

As financial regulation becomes more complex and difficult to comprehend and operationalize, it is increasingly clear that RegTech provides another valuable partner option for financial institutions. RegTech companies utilize innovative technology to streamline compliance methods that make the process more efficient and effective economically. Identity verification is one of the most crucial components of RegTech and consists of identity authentication of biometric features and documentary verification of many types to provide a method of completing digital transactions securely.

Automated reporting is another feature utilized by firms that allows firms to collect and provide information to regulators in real-time in a method consistent with regulatory requirements. RegTech also allows firms to better monitor and report on anti-money laundering (AML) programs by using machine learning to identify, escalate and check on suspicious activities. Using RegTech solutions improves compliance programs and generally reduces the cost burden associated with manually monitoring compliance and using suspension point methods.

Lending Technology (LendTech)

This is yet another angle to look at when exploring what is fintech, as it’s not just about apps, but rethinking the way money moves.

LendTech companies are dedicated to transforming the lending landscape by streamlining the loan application and approval processes. These firms utilize alternative credit scoring methods and advanced data analytics to assess borrower creditworthiness more accurately. By eliminating intermediaries, peer-to-peer lending platforms connect borrowers directly with lenders, fostering a more democratized lending environment.

This shift opens new avenues for small businesses and individuals seeking financing, enabling them to access funds that may have been previously out of reach. LendTech is not just about providing loans; it’s about reimagining the entire lending process to make it more inclusive and efficient.

Payment Technology (PayTech)

PayTech is revolutionizing the way we conduct transactions, offering innovative payment solutions that transcend traditional banking methods. This ecosystem includes digital payment systems, mobile wallets, and contactless payment options, all designed to enhance user convenience and security.

By enabling quick and safe money transfers via mobile technology, PayTech companies are reducing our reliance on cash. Consumers now have access to seamless payment experiences, allowing them to send and receive money with ease. This transformation is particularly significant in a world increasingly focused on digital interactions.

Trading Technology (TradeTech)

One cannot answer what fintech is without diving into TradeTech, where automation and data reshape stock market strategies.

TradeTech firms use advanced technology to optimize and automate trading processes in the financial markets. These firms use intelligent order routing, algorithms, and high-frequency trading to improve trade execution and efficiency.

By providing traders and investors with access to advanced analytics and rich market data in real-time, TradeTech helps participants make informed decisions and enable effective deals. The use of technology in trading not only improves a trader’s performance, but it also allows traders to take advantage of more options and new strategies in the financial markets.

Digital Banking

Digital banking is the delivery of all types of financial services through digital platforms and technologies. FinTech companies are leading this movement, using services like mobile banking apps, contactless payments, or virtual customer service to create a better user experience.

Digital banking allows consumers to do their banking and manage their money in more convenient and more efficient ways than traditional banking allows. The nature of digital banking, using digital channels, also helps reach consumers in an age of banking comfort with tech-savvy access availability.

Personal Finance Management (PFM)

Personal Finance Management (PFM) includes technology-based solutions that assist individuals in managing their fiscal lives better and in a more meaningful way. PFM solutions can help users establish financial goals, monitor their credit rating, manage their bills, create automated savings and investments, track expenses, facilitate budgets, and integrate accounts.

PFM tax firms put user security first and provide educational materials to improve financial literacy. PFM solutions improve the management of financial obligations, allowing users to take control of their financial future and encouraging better spending habits and more informed decisions.

Prominent Fintech Companies

To better understand how fintech is reshaping the financial industry, let’s examine some noteworthy companies as fintech examples making significant impacts:

- Chime: This neobank disrupts traditional banking with no-fee services, helping customers avoid overdraft charges.

- Brigit: This app supports financial health by providing budgeting tools, automated alerts, and interest-free cash advances.

- Qapital: Offers automated savings tools designed to help users achieve their financial goals.

- Placid Express: Facilitates secure and affordable international money transfers, reducing the risk of fraud.

- Prosper: A peer-to-peer lending platform that gives borrowers access to affordable credit.

- SoLo Funds: A platform aimed at assisting individuals with short-term cash flow needs without resorting to predatory loans.

- Adyen: Focuses on popularizing pay-by-bank solutions, enhancing payment processing efficiencies.

These companies exemplify the innovations driving change within the financial sector. The rise of no-fee banking and user-friendly services is becoming the norm, compelling legacy financial institutions to adapt and improve their offerings.

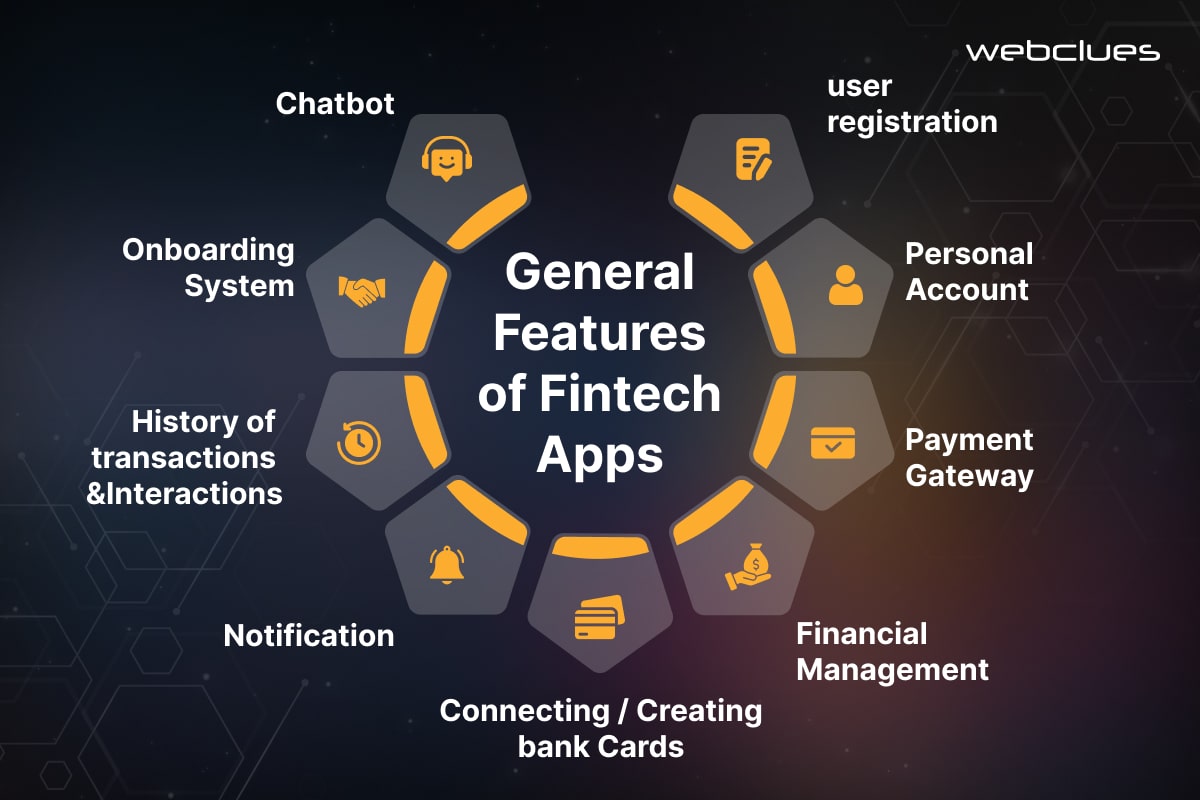

How Businesses Use Fintech Apps

*webcluesinfotech.com

To understand what is fintech exactly from a business perspective, it’s helpful to explore how companies are leveraging it day to day. So, here are some examples:

Payment Processing Solutions

Companies are using fintech apps to make payment processing simple and easy. Their mobile point-of-sale (POS) systems, online payment gateways, and electronic invoicing apps reduce the time taken to make payments or receive money. This, in turn, creates business cash flow, reduces processing time, and decreases transaction costs.

Financial Management

Fintech apps are useful for financial management as well. Businesses can use budgeting apps, spending trackers, and financial reports to better approximate their financial standing, reduce the time taken to make key financial decisions, and more accurately manage cash flow.

Access to Capital

When it comes to funding, businesses are turning to lending platforms and crowdfunding apps for quicker loan approvals. These options often provide access to a wider range of lending products than traditional banks, usually with better rates and terms.

Automated Accounting and Bookkeeping

Fintech applications also assist in automating accounting functions. They can classify expenses, sync transactions from bank accounts and credit cards, and help you prepare financial statements. All of this makes financial audits and tax preparation much simpler and cheaper.

Payroll Management

When it comes to payroll, getting it right is essential, and fintech products help make it a little easier. Businesses can pay employees accurately and on time while also automating calculations of taxes, withholdings, and benefit deductions. It is also assuring that they are complying with employment laws and tax regulations.

Fraud Detection and Risk Management

Part of answering what is fintech means understanding how it protects users and businesses from fraud with AI and real-time analytics.

Fintech apps play a vital role in detecting fraud and managing risks. They use AI and machine learning to analyze transaction patterns and identify potential fraudulent activities. With risk assessment tools, businesses can better protect themselves from financial vulnerabilities.

CRM

Many businesses enhance their customer relationship management through the use of fintech apps that work with CRM software to track customer engagements, manage deals, and provide better customer support, leading to strong client relationships.

Supply Chain Financing

Fintech apps also allow businesses to better manage their supply chain financing, enabling faster payments to suppliers, dynamic discounting alternatives, and visibility of the supply chain financing process, strengthening supplier relationships.

Insurance Services (Insurtech)

In the insurance sector, businesses are using fintech apps to simplify everything from purchasing insurance to managing policies and filing claims. This makes the whole process much more efficient.

Regulatory Compliance and Reporting

Finally, fintech apps focused on compliance help businesses navigate regulatory requirements and reporting obligations, ensuring they stay on the right side of financial regulations.

The Impact of Fintech on the Global Landscape

*digipay.guru

Fintech is experiencing an incredible growth trajectory and fundamentally changing how financial firms operate. The global digital payments market is projected to reach approximately $16.62 trillion by 2028 according to Statista. The World Economic Forum identified strong consumer demand as an important influencer for growth in the fintech sector.

This dramatic growth makes it even more important to understand what is fintech and why it’s central to the modern financial revolution.

Impact on Businesses

For consumers, fintech translates to increased control over their financial data and transactions. Consumers can now pick and choose how and when they want to share their information, giving them access to more services and improved flexibility. Overall, fintech solutions charge less than traditional banks and increase access by making financial services cheaper.

Fintech is on an unbelievable growth path and is impacting how financial firms operate in a transformational way. That’s why more professionals are actively researching what is fintech and how to become part of this transformation. The global digital payments market is projected to be roughly $16.62 trillion by 2028 (Statista). According to the World Economic Forum, something that indirectly influenced growth in the fintech sector has been consumer demand.

Impact on consumers

For consumers, fintech means giving them more control of their financial data and transactions. With fintech, consumers can now choose when and how they want to share their information, increasing access to more services and more flexibility overall. Most fintech solutions are lower in cost than traditional banks, ultimately increasing access to financial services in a way that is cheaper.

Getting Started in Fintech

If you are interested in pursuing a career in the fintech sector, one of the best ways to build strong foundational knowledge is to enrol in the Post Graduate Certificate Programme in Financial Technologies (FinTech) – IIM Nagpur.

Why this programme?

This interdisciplinary programme can help you gain a deeper understanding of the modern technologies that have transformed the banking and financial ecosystem. Learn Live with a diverse cohort about Blockchain, Cryptocurrency, Machine Learning, Artificial Intelligence and Big Data – use these technologies to design & manage financial products or services.

With this programme, you can also gain real-world experience through internships at fintech startups that can provide invaluable insights and connections.

Learning Opportunities Through Jaro Education

Online education platforms like Jaro Education offer a wealth of courses that explore various aspects of fintech. As the industry evolves, acquiring specialized skills will make you a more attractive candidate in this fast-paced environment. So, what are you waiting for? Register for the Post Graduate Certificate Programme in Financial Technologies (FinTech) – IIM Nagpur through Jaro Education and enjoy comprehensive career counselling, academic guidance, dedicated support, alumni meet-ups, and an exceptional learning experience.

Conclusion

Now you must have understood exactly what is fintech and how this innovation is changing the financial landscape with strategizing solutions that provide new ways to enhance accessibility, efficiency, and security. Fintech is affecting the financial landscape in so many different areas, from digital payments and online lending to AI-driven wealth management and blockchain-based cryptocurrencies.

Although we may be in the early stages of Fintech evolution, the fintech sector is evolving and will continue to advance into fintech 2.0, providing a clearer overall direction for the future of financial services. The future of fintech promises a financial ecosystem that will provide better access, efficiency, and experience through technology and the inclusion of digital networks. We will encourage both consumers and businesses to adjust to new ways and embrace digital innovation in a more digital world.

Frequently Asked Questions

What is Embedded Finance?

Embedded finance refers to the integration of financial services into non-financial platforms, enabling companies to offer financial products directly within their existing systems. This approach enhances user experience, fosters customer loyalty, and opens up new revenue streams.

How is AI Used in Fintech?

In the realm of fintech, AI plays a crucial role by automating processes and providing valuable insights into customer behavior. It helps predict financial needs, detects fraud in real-time, and offers robo-advisory services. These advancements make financial management more efficient and accessible for everyone.

What Are Upcoming Fintech Trends?

Looking ahead to 2025 and beyond, several key fintech trends are emerging. These include the growth of embedded finance, increased adoption of AI and machine learning, advancements in blockchain technology, and the rise of digital-only banks. These trends are set to drive further innovation and transformation in the financial industry.

What is Regulation in Fintech?

Regulation in fintech involves harnessing technology to help financial institutions comply with regulations more efficiently. Regtech solutions automate compliance processes, minimize the risk of human error, and ensure that companies meet legal requirements effectively.

![Journalism-and-Mass-Communication-Salary-in-India-in-2025-[Average-to-Highest]](https://jaro-website.s3.ap-south-1.amazonaws.com/2025/10/Journalism-and-Mass-Communication-Salary-in-India-in-2025-Average-to-Highest-1024x576.webp)