Top 20 Finance Interview Questions and Sample Answers (2025 Guide)

Table of Contents

- jaro Education

- 4, September 2023

- 4:00 pm

Finance interview questions are very important and challenging. It is even harder for freshers or for people making a job switch to a finance job from a different background. Whether you are applying for a finance executive job role or your first job in finance, it is helpful to know a list of basic finance interview questions to build your confidence before the interview. In this guide, we’ve collated a list of the top 20 finance interview questions and answers, appropriate for freshers and experienced price professionals based on concepts, scenarios, and behavioural questions. Let’s help you nail your next job interview in finance!

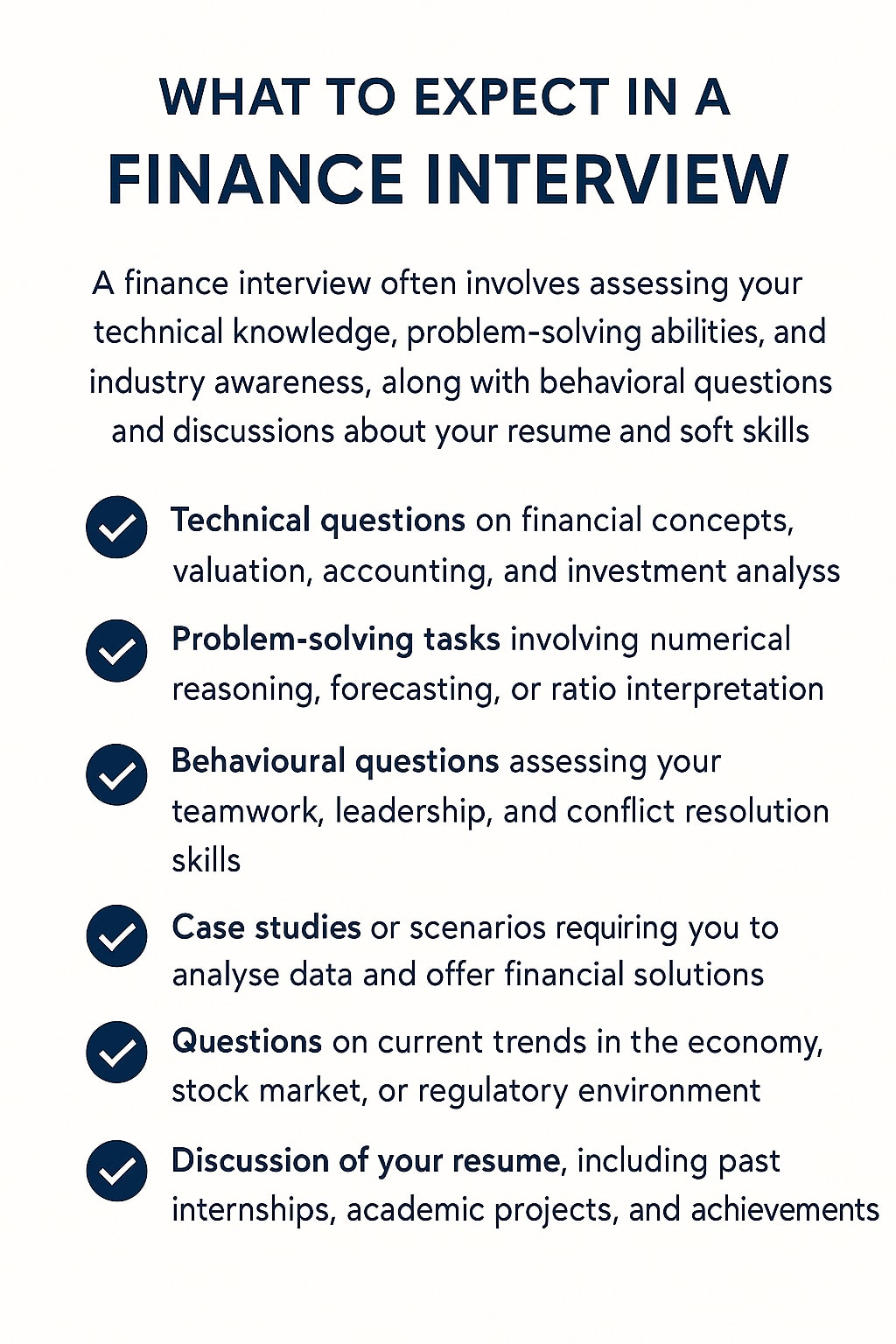

What to Expect in a Finance Interview?

Top 20 Finance Interview Questions and Answers

1. Why did you decide to go into finance?

Interviewers usually want to hire individuals who are excited about what they do — therefore, they might ask this question to find out why you are excited about a career in finance. You can describe your reasoning for choosing finance and how you enjoy what you do, as well as what part of finance you enjoy most.

Example: “I decided to work in finance because I enjoy math, and I enjoy solving puzzles. I like that when I work on financial equations, there are multiple ways to come to an answer. Sometimes, you can see a financial equation from a certain angle that helps you find the answer — such as determining how you can find more available funds”. I find it very rewarding when I can find that angle.

2. Can you share your proudest accomplishment in your finance career?

Your potential employer may ask this question to identify your experience and determine your worthiness for the finance position. The interviewer may also be using this question to seek the types of accomplishments that you value as most significant.

Example: “I think my biggest achievement was as a financial planner; I helped one of my clients pay off Rs. 50,00,000 worth of debt over three years and establish a college fund for his daughter to pursue an education. It gives me a great deal of satisfaction to see my services impact people’s lives in such a positive way.”

3. What are your strengths and weaknesses in finance?

An interviewer could ask this question to assess your current skill set and to find out how you are working on the weaknesses you mentioned. In response to the question, you could discuss your financial skills, but also discuss the weaknesses honestly, and discuss how you are working on those weaknesses to develop your work performance.

Example: “My financial strength is budgeting. I enjoy looking at various budgeting methods and thinking about which methods can help produce the most accurate forecasts. My weakness is that I do not like working with routine methods because I like trying new ways of doing things. I do understand that this position may require some routine tasks, and that stakeholders may want reporting to be in the same format, so I am working in that area, and I will comply with all requirements.”

4. If we acquire an asset, how would it affect the various statements?

This question can test your financial knowledge of asset purchases. Attempt to answer this question in a clear, concise manner, using straightforward language that is easy for any professional to understand, as your interviewer could be from outside of finance interview questions.

Example – “The acquisition will increase the assets on the balance sheet. The acquisition will be depreciated in the income statement this year. The purchase can be listed as an investment activity in the cash flow statement.”

5. What is the benefit of funding operations through equity instead of debt for a company?

This type of question may allow the interviewer to assess how you handle funding activities. Equity financing and debt financing are options businesses may consider to fund operations.

Example: “Equity financing is less risky than debt financing; therefore, an organization may choose to issue equity to lower its risk. Issuing equity may help to provide the organization with stability, so that it may plan for the future.”

6. In what ways could you value a company, and how would you value our company?

This question is an opportunity to demonstrate your knowledge of the company for which you are interviewing and its industry. Your ability to determine the value of a business should help the interviewer determine how you’ll be able to value the company you work for and the companies it competes against.

Example: “There are multiple ways to evaluate a company, such as by looking at assets, past earnings, discounted cash flows, or future maintainable earnings. Given your concentration in the past, I would look at past earnings for your firm to determine the long-term trends.”

7. Please walk me through the three financial statements

The balance sheet shows assets, liabilities, and shareholders’ equity (what it owns, what it owes, and its net worth). The income statement attempts to show the company’s revenues, expenses, and net income/loss. The cash flow statement shows cash inflows and outflows from three activities: operating activities, investing activities, and financing activities.

8. If I could only use one of the financial accounting statements to view the overall health of a company, which of the three statements would you use and why?

Cash is king. The statement of cash flows provides a true picture of how much cash the company is generating, and oddly enough, it often gets the least amount of attention. You could likely pick a different answer for this question, but you must provide a solid rationale (ie, the balance sheet because assets are the true drivers of cash flow; or the income statement because it provides the earning power and profitability of a company on a smoothed-out accrual basis).

9. If it were dependent on you, what would our company's budgeting process look like?

This is somewhat subjective. A good budget has buy-in from all departments in the company, is realistic but challenging, has been risk-adjusted to allow for a certain margin of error, and is aligned and connected with the strategic plan of the company. To be a good budget, the budget has to be a process that is removed from the usual budgeting process and one that includes everyone in the company. It can be zero-based (start from zero every time), or it can be built from the previous year; it just depends on the business type to decide which is better. Having a good budgeting/planning calendar and time frame is also something that can help everyone stay together.

10. When should a company consider debt versus equity?

A company should always try to optimize its capital structure. If the company has taxable income from operations, it can benefit from a tax shield for issuing debt. If the firm has a cash flow that is stable right now to make interest payments, then it might make sense for the company to issue debt, as long as it lowers the cost of capital, meaning some or all of the cost of debt is cheaper than its weighted average cost of capital.

11. How is WACC calculated?

WACC (stands for weighted average cost of capital) is calculated by taking the percentage of debt to total capital, multiplied by the debt interest rate, multiplied, again, by 1 minus the effective tax rate, and added to the percentage of equity to capital, multiplied by the required return on equity. Learn more in CFI’s free Guide to Understanding WACC.

12. What is cheaper, debt or equity?

Debt is cheaper because it is paid ahead of equity, and it has collateral behind it. Debt is senior to equity in a liquidation of the business. There are tradeoffs to financing with debt vs. equity that the business must weigh. Just because debt financing is cheaper does not mean it is better to finance with debt. A good answer to the question may illustrate the tradeoffs if any follow-up is required. Learn more about the cost of debt and the cost of equity.

13. A company has determined that, because of an accounting rule change, it can start capitalizing R&D costs rather than expensing them

The question has four parts to answer:

- What is the impact on the company’s EBITDA?

- What is the impact on the company’s net income?

- What is the impact on the company’s cash flow?

- What is the impact on the company’s valuation?

Answers:

- EBITDA will increase by exactly the amount of R&D expense that is capitalized.

- Net income will increase; it just depends on how they depreciate the expense and the tax treatment.

- Cash flow will be almost unchanged, although cash taxes could change because of changes in depreciation expense, and therefore, cash flow could be somewhat different.

- Valuation should be roughly constant, except for the possible cash taxes impact/timing changes on the net present value of the cash flows.

14. What do you consider makes an excellent financial model?

The most important aspect is to follow strong financial modeling practices, in the sense of keeping modeling assumptions (inputs) in one place and distinctly colored (i.e., bank models use a blue font for model inputs). Good Excel models will also allow the user to easily understand how inputs are transformed into outputs. Good models also contain error checks to confirm that the model is functioning correctly (e.g., its balance sheet balances, cash flow calculations are correct, etc.). They provide a good level of detail but not too much detail, and a dashboard that summarizes the main outputs in charts & graphs at a glance. For more, see CFI’s comprehensive guide to financial modeling.

15. What does the income statement have to say about, say, $10 increase in inventory?

Nothing! This is a trick question—only the balance sheet and cash flow statement are affected by purchasing inventory.

16. What is working capital?

Working capital is usually defined as current assets minus current liabilities, but within formal banks, we are typically dealing with working capital in a narrower definition as current assets (less cash) minus current liabilities (less any interest-bearing debt). Sometimes it can even be further defined if receivables and inventories are known as accounts receivable plus inventories less accounts payable. If you learn all three definitions, you can provide a very good answer!

17. What is negative working capital?

Negative working capital is common in certain industries like grocery retail and the restaurant business. Grocery retail is a business where the customer pays up front for items that are purchased. The product in grocery retail moves relatively quickly, many items have a short shelf life, and suppliers typically provide suppliers with 30 days (or more) credit. Thus, grocery stores actually collect cash from customers before they actually need that cash to pay their suppliers. Negative working capital can be an indication of efficiency for businesses that have low inventory and accounts receivable. However, in some cases, negative working capital might be indicative of deteriorating financial health if a company has insufficient cash to pay its current liabilities.

If you are asked this question in a job interview, be sure to understand the company’s regular working capital cycle.

18. Immediate expense or capitalize?

If the purchase is long-term and has a life pertaining to business purposes greater than one year, it is capitalized and depreciated, based on the company’s accounting policy.

19. How do you record PP&E, and why do you need to know?

When recording Property, Plant & Equipment (PP&E) in the balance sheet, there are four areas to think about: (I) initial purchase, (II) depreciation, (III) additions (capital expenditures), and (IV) dispositions. In conjunction, you may also need to consider revaluation. For many businesses, PP&E is the largest capital asset to create revenue, profitability, and cash flow.

20. Why would two companies merge? What major factors drive mergers and acquisitions?

Mergers and acquisitions (M&A) happen for many reasons: to gain synergies (cost savings), enter new markets, obtain new technology, eliminate a competitor, and because it’s financially “accretive.” Accretion/dilution is explained further under M&A.

Note: Social reasons are also important, but you need to be careful how you word them and with whom you are interviewing. These reasons include working for ego, honouring empire-building, and justifying a higher level of executive pay.

Top Tips to Prepare for a Finance Interview Questions

Preparing for finance interview questions requires a focused process that balances technical abilities with the need to effectively communicate your skills. Whether you are applying for an entry-level position as a financial analyst, investment banker, or some other finance-related job, these strategies will maximize your chances of being noticed.

Let’s review the basic steps to ensure you are ready for your next big interview.

How to Prepare For Finance Interview Questions

Research the Firm: The first step is to assess the financial performance of the company, including revenues, margins, and growth trends. Understanding the industry trends as well as the company’s competitive position is valuable in formulating your responses to fit into their respective needs.

Review Basic Topics: Finance interview questions often include technical questions related to accounting principles, valuation methods, and financial models. It is best to review these basic concepts so you are ready to discuss and resolve any financial issues during the interview.

Practice Your Answers: Use the guide to formulate answers that are brief but still in-depth. Remember, being succinct and straightforward will illustrate your knowledge while continuing to engage the interviewer.

Mock Interviews: Practice interviews with friends, mentors, or online platforms to recreate the pressure of an interview. This will help you improve your responses, build confidence, and prepare for the experience of being interviewed.

Stay Informed: Stay on top of financial news, market fluctuations, and current events. If at any point a conversation turns to current events, being able to comment on the past few weeks and, if relevant, months will show that you are cognizant of the industry posture, a sign of your “proactive” nature in learning.

Recommended Certification: Financial Reporting and Corporate Governance at IIM Ahmedabad

If you are serious about building a strong career in finance interview questions, then you have a huge opportunity to differentiate yourself—the IIM Ahmedabad Financial Reporting and Corporate Governance certification. The name IIM Ahmedabad alone draws attention, but what’s more impressive is what’s in this programme. It was designed for finance professionals, finance analysts, future CFOs studying for financial accounting and management courses, and of course, the governance segment is the critical pillar of financial transparency, corporate ethics and responsibilities, board accountability and governance, and strategic governance.

So, what does all this mean? What makes this certification a game-changer? More than just theory, it connects you to real-world case studies and global standards, taught by faculty who have shaped corporate India. If you desire to positively impact their decision-making ability and leadership positions in choice corporate leadership roles, or perhaps simply want to study and clarify the nuances and subtleties of boardroom dynamics, this is a path towards that objective.

Do you want to be credible and meaningful in your leadership claim and stand out from the crowd in the world of finance?

This is where it begins — at IIM Ahmedabad.

Jaro Education: Personalized Career Support for Future Leaders

With the present competitive environment, determining the pathway to pursue can be a daunting task, but rest assured, as Jaro Education will assist you in simplifying the process with expert career advice that is customized to your needs and aspirations. Regardless of whether you are a fresh student, a working professional, or an upcoming leader, the Jaro Education counselling team will assist you in matching your strengths and interests with the right academic and professional programs. From the best IIM levels finance certifications to executive programs that increase your leadership potential, Jaro Education is the strategic partner on your career journey from the get-go. They will not only provide you with one-to-one mentoring and skill-based advice, but also provide you with learning pathways that are relevant to your industry, so that you are not just making career moves – you are making the right career moves.

Conclusion

Mastering finance interview questions comes down to preparation, clarity, and confidence. With these 20 frequently asked questions and expert-supported answers, you should now be ready to tackle any finance interview. Use this information, your own experience, and reality, and also stay up to date in your field. Don’t forget, you can also add some credibility by enrolling in top finance programmes, such as IIM programmes, through Jaro Education. Finally, the right preparation today will lead to the right opportunity tomorrow.

Frequently Asked Questions

Some of the most commonly asked finance interview questions include:

- What is working capital?

- How do you calculate net present value (NPV)?

- Explain the difference between debt and equity.

- What are financial statements, and how do you analyze them?

These are among the top finance interview questions asked by employers to test your fundamental understanding of finance principles.

Basic finance interview questions typically include:

- Define balance sheet, income statement, and cash flow.

- What is the role of a finance department?

- Explain the term depreciation.

- What is the difference between accounts payable and accounts receivable?

These questions help assess a candidate’s foundational knowledge in finance, especially for entry-level roles.

For freshers, interviewers usually focus on academic knowledge and internships. Examples include:

- What is ratio analysis?

- Explain time value of money.

- What are the types of budgets in finance?

- Why did you choose finance as a career?

Make sure to review both theoretical and practical finance interview questions and answers for freshers before appearing for the interview.

Yes! Here are a few key finance-related interview questions with sample answers:

Q: What is DCF, and why is it used?

A: DCF (Discounted Cash Flow) is used to estimate the value of an investment based on its expected future cash flows.

Q: What is a deferred tax liability?

A: It’s a tax amount due in the future due to temporary differences between book and tax accounting.

Refer to the top 20 interview questions for freshers shared in this blog for a comprehensive list with sample answers.

The top 20 interview questions for freshers in finance typically cover:

- Financial definitions (e.g., EPS, ROI, T-Bills)

- Core concepts (e.g., working capital, DCF, hedging)

- Accounting basics

- Industry awareness

- Behavioural insights