Revenue Cycle Management: Trends and Challenges in Healthcare Management

Table of Contents

Revenue cycle management becomes an essential pillar for efficient operations in the complex healthcare environment. From small clinics to large hospitals, it’s necessary to effectively manage the financial journey of the patient. It doesn’t mean taking care of the payments, but ensuring proper patient care while upholding the organizational viability.

So, revenue cycle management is a comprehensive process that touches every aspect of the healthcare workflow. With the integration of advanced digital tools and growing policies, it has also evolved to fulfill the demands of the time.

This blog will uncover the fundamental concepts, latest trends, and challenges of this cycle to give you a more comprehensive idea of the concept.

*apaana.com

What is Revenue Cycle Management?

Revenue cycle management refers to the financial process of the healthcare systems that track the patient care process from registration to payment. The stages of this cycle include –

- Patient registration

- Insurance verification

- Coding of diagnoses and procedures

- Billing and claim submission

- Payment processing and collections

- Reporting and analysis

The right revenue cycle management ensures timely reimbursements and reduces claim denials. Thus, it improves overall financial performance. Moreover, a well-optimized revenue cycle enhances patient satisfaction, providing streamlined and transparent payment processes.

Key Components of Revenue Cycle Management

Before moving on, it’s crucial to understand how revenue cycle management works. It also helps the readers to know why efficient management of the revenue cycle is necessary in every step of patient care. So, let’s learn the major components of it.

Patient Access and Registration

Before starting treatment, healthcare providers verify patient demographics and insurance information. Additionally, patient registration is conducted to prevent billing errors, ensure the delivery of quality services, and minimize delays in care. The registration also reduces the risk of claim denials.

Charge Capture

The provider records each service provided during the patient’s visit. It ensures that the charges levied for every service are correct. Additionally, it verifies that there are no miscoded or missed charges. If this occurs, it will result in revenue leakage.

Coding and Documentation

Medical coders assign standardized codes (ICD-10, CPT) to ensure a hassle-free diagnosis and procedure. This coding directly impacts reimbursement and compliance. Additionally, coders review clinical documentation to ensure the assigned code is accurate. Any discrepancies in documentation can lead to payment delays or other legal risks.

Claim Submission

After finalizing the code, the billing team submits claims to the insurance company. For this, they should send an accurate and complete claim to ensure faster reimbursement. Any errors can delay the entire process. Thus, by efficiently handling the claim submission, the coders ensure revenue cycle management without disruption.

Payment Posting

After that, the insurer evaluates the claim and posts the payment in the system. The process confirmed that the payment had been made. At the same time, the method also identifies if there are any discrepancies and highlights them. Again, accurate posting helps providers identify issues such as billing mismatches or underpayments.

Denial Management and Appeals

Efficient denial management ensures proper reimbursement and reduces revenue loss. It also improves future claim acceptance rates. When a claim is rejected, the team reviews the cause. It can be a documentation error or incorrect coding. After correcting the flaw, the claim is resubmitted. This way, the process becomes more transparent.

Patient Billing and Collections

After settling the insurance payments, the remaining charges will be billed to the patient. Clear communication, accessible payment options, and itemized billing encourage patients to make the right payment. Moreover, an established structure collection procedure leverages successful collection and improves the overall financial experience of the patient.

Emerging Trends in Revenue Cycle Management

The healthcare sector is rethinking its revenue cycle management strategies due to the rapid changes in technology, patient expectations, and regulations. Below are the most significant trends that are transforming revenue cycle management in healthcare.

1. Automation and Artificial Intelligence (AI)

AI and automation are transforming revenue cycle management by reducing manual errors. Thus, these technologies can speed up the critical processes by not wasting too much time in eliminating errors. From claim scrubbing to denial prediction, AI algorithms can analyze large volumes of data smartly, leaving faster decision-making. Additionally, robotic process automation (RPA) automates repetitive administrative tasks like payment posting, eligibility checks, and coding.

These technologies and innovations enable providers to reduce denial costs, eliminate unnecessary expenses, and enhance revenue realization. Thus, integrating AI-driven tools for revenue cycle management is no longer optional for healthcare organizations; it has become a strategic necessity.

2. Outsourced Revenue Cycle Management Services

The complexity of medical billing and compliance regulations has risen up due to the changing landscape of the healthcare sector. Thus, many providers are tending towards outsourcing specialized revenue cycle management services. These third-party experts can manage everything, including claim submission, patient collections, denial resolution, and coding.

Also, outsourcing improves operational efficiency and reduces administrative burden. Not only these, but outsourcing also ensures that revenue cycle practices remain aligned with government regulations.

For smaller healthcare providers and rural hospitals, outsourcing enables access to cutting-edge technologies and trained professionals. These become beneficial for the healthcare service providers who cannot afford to have in-house professionals and advanced technologies. So, by extending outsourcing strategies, the providers enhance patient care and save on additional costs.

3. Value-Based Care Models

In the past, doctors got paid for every service, test, or visit, whether it helped or not. That’s changing. Now, payments depend more on whether patients actually get better. If someone stays healthy after leaving the hospital, that’s a success. This new approach has changed how revenue cycle management is handled. It’s not just about sending bills anymore. Providers need systems that show how well they manage to cure the patient. That’s why many use revenue cycle management services to help link patient outcomes with payments. It’s a shift, but one that puts results and people first.

4. Patient Engagement and Transparency

Paying for healthcare has become a lot more personal. Patients now cover a bigger part of the cost. So naturally, they want to know what they’re being billed for. Nobody likes a surprise when it comes to medical expenses. That’s why providers are adding tools that break down costs ahead of time, let people pay online, or even answer billing questions through simple chat features. These additions aren’t just convenient—they help patients feel more in control. With the right revenue cycle management tools, clinics can reduce confusion, avoid delays, and get payments faster. And patients? They just appreciate being treated like customers, not just cases.

5. Data Analytics and Real-Time Reporting

In the healthcare industry, any delay in financial transaction processing can negatively affect day-to-day operations. As a result, it decreases overall revenue. To address these challenges, many healthcare administrators now rely on real-time dashboards. They help track essential financial indicators. These include claim denials, accounts receivable timelines, and patterns in patient payments.

These tools offer early warnings for issues like stalled claims or inefficient workflows. By acting on current data instead of retrospective reports, decision-makers can correct problems quickly. Predictive features in systems for managing revenue cycles also support better planning by forecasting risks before they escalate. Rather than relying on static summaries, healthcare teams are making informed decisions using live insights. This strengthens both short-term cash flow and long-term financial stability.

6. Regulatory Compliance and Cybersecurity

As healthcare laws continue to evolve, keeping up with regulatory standards has become more demanding for providers. Guidelines such as HIPAA, the No Surprises Act, and ongoing ICD revisions directly affect how billing and reimbursement are managed. With cyber threats growing, protecting data has also become a top concern for healthcare providers. Platforms that manage revenue often hold private patient and payment information, making them a common target for hackers. A data breach can lead to big fines and a loss of public trust. To stay safe, many healthcare providers now use revenue cycle management services that help with both billing and data protection. These services often include robust security measures, such as encrypting patient information, restricting access to sensitive data, and regularly verifying compliance with established rules. By implementing these safety measures, providers can better safeguard private records and continue to meet healthcare regulations.

7. Integration of Telehealth and Remote Services

When patients switch from office visits to virtual check-ins, the billing game changes—and that can leave providers out of pocket. Online consults, at-home tests, and video follow-ups all use different codes and rules from face-to-face patient care. Even small mistakes can lead to denied claims or delayed payments. To avoid this, healthcare providers need to adjust their revenue cycle management so it works well with telehealth services. A reliable revenue cycle management healthcare system should accurately record each remote visit, assign the correct billing codes, and ensure that all applicable rules are followed. By implementing these changes, clinics can minimize billing errors and maintain a steady cash flow as virtual care becomes increasingly common.

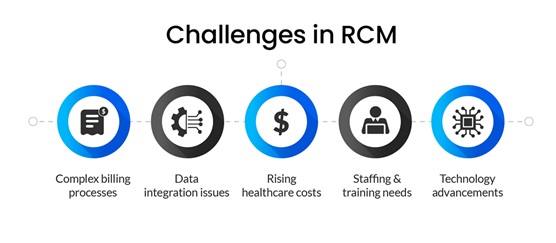

Major Challenges in Revenue Cycle Management

Besides the advantages, revenue cycle management faces several challenges. Here are the top challenges –

1. Frequent Changes in Payer Rules

Insurance billing rules don’t stay the same for long. One week, a user is utilizing a form that works fine. Then, suddenly, it needs new codes or extra steps. These constant updates make things confusing for billing teams. So, it becomes quite common for the users to miss something. As a result, the claim might get denied or held up. Hence, it becomes a nonstop hassle that makes staying current a real challenge.

2. Denied and Rejected Claims

Claims often bounce back for reasons that seem minor. For instance, it may be missing information, contain an incorrect code, or even have a minor error. If no one’s checking on these regularly, the money just slips away. Without a designated process of following and fixing these errors, more payments will be lost, leading to huge revenue loss. Over time, it causes an unnecessary financial burden for the healthcare organization.

3. Inadequate Staff Training

The healthcare team must be familiar with the latest codes, insurance rules, and paperwork procedures before performing any billing. But sometimes they’re new or haven’t had proper training. That leads to more mistakes and slower work. As a result, the whole process suffers. And that means longer waiting times to get paid or not getting paid at all.

4. Patient Payment Collection

Patients today are expected to pay a larger portion of their medical bills, but getting these payments isn’t always straightforward. Some find the bills too confusing, while others lack easy payment options. If the instructions aren’t clear or the process feels difficult, many just delay or skip payment, causing disruptions to the provider’s business cash flow.

5. Technology Integration

Hospitals and clinics often use a variety of different tools—one for billing, another for records, and yet another for communicating with patients. But the problem is that these tools don’t always work together. For instance, the staff end up typing the same stuff more than once. It slows things down, causes mix-ups, and wastes time. Thus, without a robust setup, managing the billing process just gets harder.

6. Cybersecurity Risks

Billing systems store a wealth of private information, including names, dates, payment statuses, and even health details. Since everything is online now, that data can be exposed if someone breaks in. Hackers are always looking for weak spots. One slip and the clinic could face fines or lose patient trust. Security isn’t a bonus anymore—it’s something you have to get right.

Learn More with Executive Programme in Healthcare Services Management

Want to know more about the changing healthcare landscape? The Executive Programme in Healthcare Services Management at IIM Ahmedabad may be the right choice. This course will provide in-depth exposure to financial management in healthcare, data analysis for healthcare management, operations management, and more.

With an exclusive partnership with Jaro Education, IIM Ahmedabad offers this course. As their marketing partner, Jaro Education offers a range of educational services that help students choose the right career path and achieve their ultimate goals.

Now, here are some KPIs of this course:

- Rigorous pedagogy by renowned IIMA

- Interactive lectures

- Group projects/exercises

- 2 campus visits covering 5 days on campus

Conclusion

Revenue cycle management is the financial backbone of every healthcare organization. From providing excellent patient care services to tackling financial challenges, this cycle covers everything. Now, with the advanced technologies, tools, and regulatory compliances, the cycle becomes more refined. So, every healthcare organization must adopt this revenue cycle to succeed in this modern healthcare landscape.

Frequently Asked Questions

What is the purpose of revenue cycle management in healthcare?

Revenue cycle management enables healthcare providers to handle billing and payments more efficiently. It ensures that claims are submitted correctly and on time, which reduces denials and maintains steady cash flow. Linking medical services to financial processes enables organizations to maintain financial health.

How does automation benefit revenue cycle management?

Automation handles routine tasks such as coding and claims submission. This reduces manual mistakes, speeds up payment collection, and makes the whole system run more smoothly and efficiently.

Why should healthcare providers consider outsourcing RCM services?

By outsourcing RCM tasks, healthcare providers can tap into expert support and advanced technology. They don’t have to manage it themselves. As a result, it helps improve accuracy, reduce delays, and cut overall costs. So, it allows the staff to focus more on patient care.

What are common causes of claim denials in RCM?

The most common causes of claim denials are incorrect medical codes, issues with insurance verification, and missing or incomplete records.