How to Prepare a Cash Flow Statement: Steps & Examples

Table of Contents

Cash flow is the lifeline of any business. While making profits on paper is important, a company must manage its cash flow prudently to survive. The cash flow statement plays a crucial role in this scenario. It clearly shows how cash flows in and out of a business, and learning how to prepare a cash flow statement goes a long way toward providing the information to make informed decisions.

So, whether you are an aspiring entrepreneur, an upcoming finance student, or a working professional, learning the cash flow statement format helps you to understand business health and liquidity.

*istockphoto.com

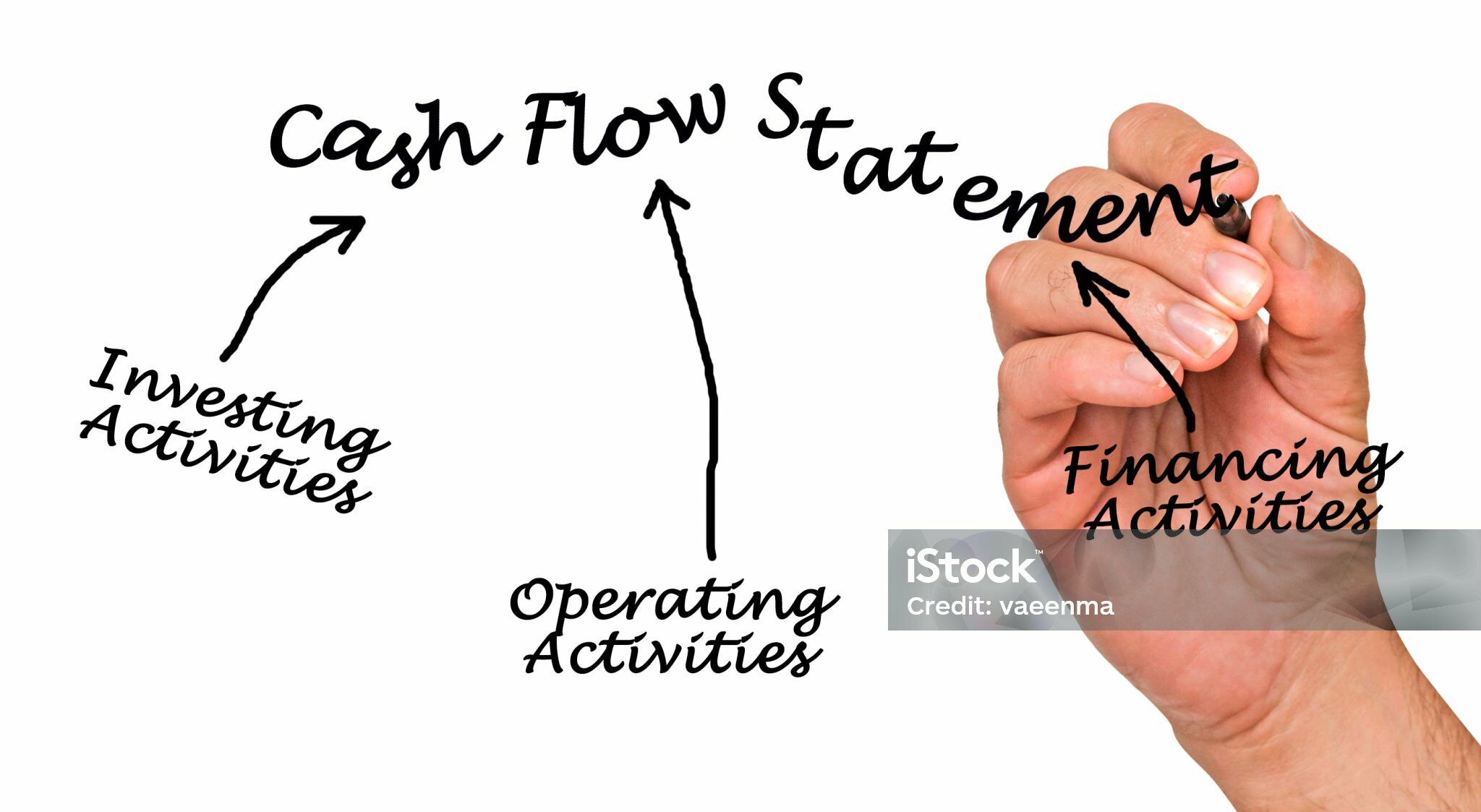

What is a Cash Flow Statement?

A cash flow statement is one of the foundational accounting statements for any business. Accompanied by the balance sheet and the income statement, it provides a clear financial picture of a company. These three accounting components show how cash and cash equivalents enter and leave the company in a given period.

Moving on, the cash flow statement format is divided into three major sections –

- Operating activities

- Investing activities

- Financing activities

Importance of a Cash Flow Statement

The cash flow statement is more than a financial report; it’s a decision-making tool. Here’s why it’s important:

Tracks Liquidity

A cash flow statement helps to evaluate whether the business has adequate cash to cover its short-term obligations.

Supports Budgeting

This accounting document plays a key role in planning and projecting the business’s future financial demands and, therefore, aids in budgeting.

Builds Investor Confidence

Documenting the business’s current financial position, including the cash component, helps build investor confidence.

Improves Financial Control

Cash flow documentation also enables firms to track and identify areas of overspending and inefficiency in the operation and in the organization’s sections.

Regulatory Compliance

Managing the cash flow statement is also essential to comply with the regulations in the country.

*istockphoto.com

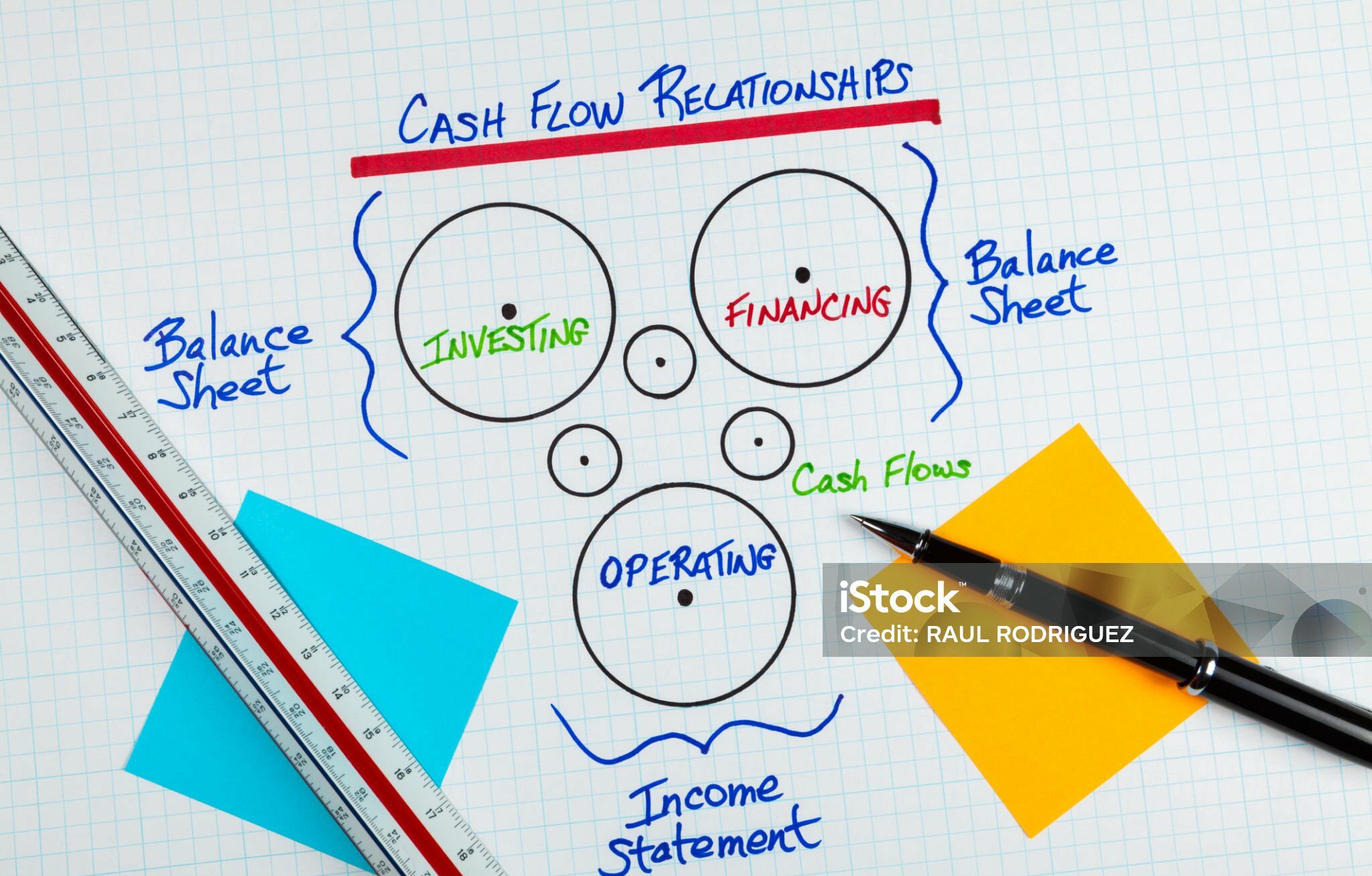

Components of a Cash Flow Statement

The cash flow statement comprises three major components indicating various cash activities.

a) Operating Activities

This section depicts the core business operations and consists of:

- Money received from the sale of goods and services

- Payments to suppliers and employees

- Cash paid for operating expenses

The cash flow from operating activities indicates how well the business can generate cash from day-to-day operations.

b) Investing Activities

In this section, there are to be transactions on:

- Purchase or sale of assets

- Investments in other businesses

- Loans made to third parties

The cash flow from investing activities is normally indicative of long-term investment in the growth of the company.

c) Financing Activities

This part addresses the aspect of how a company funds its operations and expansion. It includes:

- Issuance of shares or debt

- Loan repayments

- Dividend payments

Financing activities indicate how the company generates capital and how it repays the investors or lenders.

How to Prepare a Cash Flow Statement: Methods

There are two main methods of preparing a cash flow statement, which are:

a) Direct Method

Valid cash receipts and disbursements are used directly. It includes:

- Cash collected from customers

- Cash paid to suppliers

- Cash is utilized to pay salaries, rent, and other charges.

This technique provides more details, but it is difficult to compile because of the need for data.

b) Indirect Method

This process begins with the net income that is taken from the income statement and then adjusted for:

- Non-cash expenses like depreciation

- Changes in working capital

- Gains/losses in investing activities

The indirect method is common, and it is easily prepared based on data from the existing financial statements.

How to Make a Cash Flow Statement: Steps to Follow

Let us look at a simple guide on how to prepare a cash flow statement using the indirect method:

Step 1: Gather Necessary Financial Data

Get the company’s income statement and balance sheet for the period under study. They contain all the needed values.

Step 2: Calculate Operating Activities

Start with net income. Adjust for non-cash disbursements and working capital changes.

- Add depreciation/amortization

- Subtract increases in current assets

- Add increases in current liabilities

Step 3: Determine Investing Activities

Make a list of the cash transactions involving purchasing or selling long-term assets.

- Subtract asset purchases

- Add proceeds from asset sales

Step 4: Evaluate Financing Activities

Enter debt and equity transactions.

- Include proceeds of loans or the issuing of shares

- Subtract repayments and dividends paid

Step 5: Compute Net Cash Flow

Add cash flows from operating, investing, and financing activities. Add it to the opening cash balance to arrive at the closing cash balance.

Cash Flow Statement Format

Here’s a sample format:

ABC Pvt. Ltd.

Cash Flow Statement

For the Year Ended March 31, 2025

Cash Flow from Operating Activities:

Net Income ……………………………… ₹500,000

Add: Depreciation ………………………… ₹50,000

Increase/Decrease in Receivables ………… (₹20,000)

Increase in Payables …………………….. ₹15,000

Net Cash from Operating Activities ………… ₹545,000

Cash Flows from Investing Activities:

Purchase of Equipment ……………………. (₹100,000)

Sale of Investment ………………………. ₹30,000

Net Cash from Investing Activities ………… (₹70,000)

Cash Flows from Financing Activities:

Loan Proceeds ……………………………. ₹200,000

Dividends Paid …………………………… (₹50,000)

Net Cash from Financing Activities …………. ₹150,000

Net Increase in Cash ……………………….. ₹625,000

Opening Cash Balance ……………………….. ₹100,000

Closing Cash Balance ……………………….. ₹725,000

Cash Flow Sheet Example

Let’s understand this with a fictional company, XYZ Ltd:

Income Statement Summary:

- Net Income: ₹400,000

- Depreciation: ₹40,000

- Gain on Sale of Asset: ₹20,000

Balance Sheet Changes:

- Accounts Receivable: +₹30,000

- Inventory: -₹10,000

- Accounts Payable: +₹25,000

Investing Activities:

- Purchase of Machine: ₹(120,000)

- Sale of Old Equipment: ₹50,000

Financing Activities:

- Issued Equity Shares: ₹100,000

- Repaid Loan: ₹(60,000)

- Paid Dividends: ₹(20,000)

Final Cash Flow Statement:

Operating Activities:

Net Income:…………………..₹400,000

Add: Depreciation:……………₹40,000

Less: Gain on Sale:…………….₹(20,000)

Changes in Working Capital:…..₹5,000

Net Cash:……………………………₹425,000

Investing Activities:

Purchase of Machine:…………….₹(120,000)

Sale of Equipment:……………………..₹50,000

Net Cash:……………………………………₹(70,000)

Financing Activities:

Issued Shares:…………………₹100,000

Repaid Loan:…………………….₹(60,000)

Dividends Paid:…………………₹(20,000)

Net Cash:………………………….₹20,000

Net Increase in Cash:………..₹375,000

Common Mistakes to Avoid

Do not make the following errors while preparing a cash flow statement:

Skipping Non-Cash Adjustments

Depreciation, amortization, and gains/losses should always be taken into consideration.

Incorrect Categorization

For instance, do not put loan repayment under cash flow operating activities.

Ignoring Working Capital Changes

These have a tremendous effect on cash flow operating activities.

Miscalculating Cash from Investments

Investigate new values for asset purchase and sale.

Inconsistency in Method

Do not change from a direct to an indirect approach at random.

Accuracy matters. Minor errors may distort a company’s liquidity. That is why it is essential to learn how to prepare a cash flow statement.

Upskill with a Financial Course

If you are willing to master how to prepare a cash flow statement along with cash flow analysis and financial reporting, a specialized course will be a good choice.

One of these courses is a Postgraduate Certificate in Financial Management. This program suits professionals and students who are interested in having a good foundation in:

- Financial statement analysis

- Working capital management

- Strategic investment decisions

- Risk and return optimization

- Budgeting and forecasting

The curriculum combines theory with realistic case studies. You will be practically able to prepare reports like the cash flow statement. By enrolling in this course, you can enhance your career in finance, accounting, and business leadership.

It doesn’t matter whether you are trying to become a CFO or just understand business finance better, this program is a step in the right direction.

Conclusion

Preparing a cash flow statement feels like an overwhelming task at first sight, but once you learn how to prepare a cash flow statement, it becomes easy. This statement offers critical information on the cash position of your business and enables you to make informed operational, investing, and financing decisions.

Each step is important, from collecting financial statements to calculating net cash flow. The cash flow statement format is standardized, making interpretation easier for stakeholders.

Investing in professional training can further sharpen your financial skills and give you a competitive edge. Comprehending and applying cash flow statistics can ultimately improve business performance.

Frequently Asked Questions

Is it possible for a successful company to experience cash flow-related issues?

Yes. A business could be profitable on paper but may still lack cash when receivables are late or if costs are high. This is why the cash flow statements are important.

Which one of the given methods of working is preferable: direct or indirect?

Both are effective, but the indirect one is more widely used because of the data already available in the form of the income statement and balance sheet.

How often should cash flow statements be prepared?

Cash flow statements are prepared by the majority of businesses either quarterly or annually. Nevertheless, startups or firms with cash-strapped budgets can have them done weekly or even monthly.