IIM Nagpur’s FinTech Course: Full Overview and Insights

Table of Contents

Are you curious about fintech courses that your office colleagues or friends have been doing? Of course, your curiosity is not invalid here, especially when you are in the same industry. But pause for a moment, and let’s talk about some facts.

As we know, digital banking and investment services are ruling the world, and this makes the sector more promising for a career. In fact, the global fintech market is predicted to reach a whopping $556.58 billion by 2030. Isn’t it amazing? Well, yes, it is.

So, among so many career growth and development opportunities, fintech courses in India shine like a beacon for those who can not wait to tap the potential of this shining sector. Whether you’re a graduate or an experienced professional, today we bring you one of the best online courses available that can not only enhance your long-term investment in your future but also equip you with the right skills and knowledge in the finance industry.

We are talking about the PG Certificate Programme in Financial Technologies (FinTech) offered by IIM Nagpur. It is one of the leading management institutions that shapes the management system, policy and government through its high-quality education and industry engagement programme. Now, let’s get deeper into what this programme brings for you. Stay tuned to learn more.

About IIM Nagpur’s FinTech Course

The IIM Nagpur PG Certificate Programme in Financial Technologies (FinTech) programme is designed to develop your overall understanding of the modern technologies that have transformed the banking and financial ecosystem. With this programme, you will learn to live with a diverse group and will also learn emerging areas such as Blockchain, Cryptocurrency, Machine Learning, Artificial Intelligence, and Big Data. These technologies do not exist just as terms with little value; they are the tools that can assist you in creating and managing novel financial products and services.

As we know, the global fintech industry is changing in different ways, and it also impacts the future of the financial services industry. Thus, to stand out and also to courageously change your career, register for the IIM Nagpur PG Certificate Programme in Financial Technologies. In addition, the course also studies contemporary innovations that have reshaped finance, including insights into important tools and technologies that would enable you to design and manage financial products or services.

Programme Key Highlights:

- A credential to demonstrate your knowledge and industry credibility.

- Undertake a project supervised by the IIM Nagpur faculty, transitioning knowledge into experiences.

- Interact with industry professionals in overcoming different business challenges.

- Participate in bespoke consulting sessions, depending on faculty discretion.

- Gain an understanding of the technologies that enable the FinTech ecosystem.

- Attend a three-day campus immersion for project presentations and graduation.

How IIM Nagpur’s FinTech Courses Benefit Your Career

Finance technology courses provide skill-based training and knowledge to give learners the upper hand in the fintech industry. This is how the FinTech courses in India at IIM Nagpur can benefit your career greatly:

1. Learn In-Demand Skills

The fintech sector is changing quickly, and it is becoming necessary for professionals in the field to have a range of skills, including data analytics, programming, blockchain, machine learning, cybersecurity, and digital banking. IIM Nagpur’s FinTech courses underlie the relevant expertise required to provide meaningful skills in these areas. Developing these skills can be a significant boost to your career options in the finance industry, making you a great asset for prospective employers.

2. Gain Industry Insights

The fintech landscape has undergone significant changes in a short time, driven by the integration of various technologies and digital innovations. To thrive in this fast-paced environment, it’s essential to stay updated on industry insights and emerging trends. IIM Nagpur’s courses provide industry-specific knowledge that enhances your understanding of market dynamics, ultimately increasing your chances of securing high-paying positions in fintech.

3. Expand Career Opportunities

The convergence of finance and technology has created an abundance of career opportunities for qualified individuals. At IIM Nagpur, the FinTech courses describe pertinent topics like blockchain and automation and allow you to identify and develop the career path that best meets your capabilities and interests. Establishing a knowledge base of these evolving domains will set you up for flexible and potentially interesting roles across the entire Fintech landscape.

4. Explore Entrepreneurial Potential

In addition to preparing you for traditional roles, IIM Nagpur’s FinTech courses encourage entrepreneurial thinking. Through case studies, practical projects, and assignments, you’ll learn to develop innovative fintech solutions. The curriculum also helps you navigate regulatory frameworks and understand market dynamics, equipping you with the tools needed to create successful business models. This entrepreneurial focus empowers you to explore new ventures and grow your career in exciting ways.

5. Get Networking Opportunities

Networking with industry experts and students is one of the best things about IIM Nagpur’s FinTech courses. When you attend courses and interact with instructors and other students, you will be around people similar in educational level and potential employers. Networking is important for gaining a mentor, pathfinding, and ways to collaborate, etc. As a professional, a network is something you are expected to build throughout your career and your life. In the highly competitive fintech ecosystem, it is especially important. Networking is facilitated at IIM Nagpur because workshops, group work, and film reviews programme you to communicate openly and freely while developing your brand.

Syllabus Breakdown

The curriculum is designed to cover a wide range of topics essential for understanding and navigating the FinTech landscape:

| Module | Description |

| Basics of Finance | Understand fundamental financial concepts and principles. |

| Introduction to Financial Services & FinTech | Gain insights into the structure and dynamics of the fintech sector. |

| Blockchain and Cryptocurrencies | Explore the technology behind cryptocurrencies and their applications. |

| Basics of Analytics | Learn essential analytical skills for data-driven decision-making. |

| Behavioral Finance | Study how psychological factors influence financial decisions. |

| Strategy for Competitive Advantage | Develop strategies to stand out in the competitive fintech landscape. |

| Payment Systems | Understand various digital payment methods and their functionalities. |

| WealthTech | Explore technologies that enhance wealth management services. |

| InsurTech | Learn about innovations in the insurance sector and their implications. |

| Financial Inclusion, LendingTech, and Neobanking | Examine technologies that promote financial accessibility and new banking models. |

| Implementation Strategies for FinTech Providers | Discover effective strategies for deploying fintech solutions successfully. |

| Integrative Project | Apply your knowledge in a hands-on project that synthesises course concepts. |

The Importance of FinTech Education

In a world where technology is rapidly evolving, understanding FinTech is no longer optional; it’s essential. The financial services landscape is shifting, influenced by advancements in technology that are reshaping customer expectations and operational efficiencies. Fintech online courses equip individuals with the knowledge and skills to navigate this complex environment.

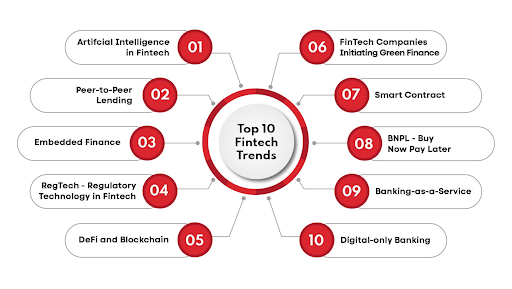

Some Popular Trends in FinTech

*onlinemanipal.com

Blockchain Technology: This revolutionary technology is not just about cryptocurrencies; it offers solutions for secure transactions, enhanced transparency, and reduced fraud in various financial services. Its decentralised nature allows for secure peer-to-peer transactions, which can significantly lower costs and improve efficiency.

Artificial Intelligence and Machine Learning: These technologies are transforming data analysis, enabling financial institutions to predict market trends, assess risks, and personalise customer experiences. By leveraging AI, companies can analyse vast datasets to uncover insights that drive strategic decision-making, leading to improved service delivery and customer satisfaction.

RegTech: Regulatory technology is becoming crucial for compliance in the rapidly changing financial landscape, helping firms manage compliance processes more efficiently. As regulations evolve, RegTech solutions automate compliance tasks, reducing the burden on financial institutions and minimising the risk of non-compliance.

Digital Wallets and Payment Systems: The rise of digital payment solutions is reshaping how consumers interact with financial services, providing convenience and security. These systems facilitate quick transactions, enhance customer experiences, and pave the way for innovations like contactless payments and mobile banking.

Financial Inclusion: FinTech is playing a vital role in increasing access to financial services for underserved populations, thereby fostering economic growth. By providing affordable banking solutions and micro-lending options, FinTech companies are empowering individuals and small businesses, contributing to broader economic development.

Career Opportunities in FinTech

*onlinemanipal.com

By enrolling in IIM Nagpur’s PG Certificate Programme in FinTech, you position yourself for a range of exciting career opportunities. The skills and knowledge gained can lead to roles such as:

- FinTech Product Manager: Overseeing the development and launch of innovative financial products. Product managers bridge the gap between technology and user experience, ensuring that offerings meet market needs.

- Data Analyst: Analysing data to inform business decisions and improve customer experiences. Data analysts leverage statistical tools and techniques to interpret complex datasets, providing actionable insights.

- Blockchain Developer: Creating and implementing blockchain solutions for financial applications. This role involves designing secure and scalable blockchain systems that enhance transaction efficiency and transparency.

- Risk Manager: Identifying and mitigating risks associated with financial services. Risk managers assess potential threats to an organisation’s financial health and develop strategies to manage these risks effectively.

- Regulatory Compliance Specialist: Ensuring adherence to financial regulations and standards. Compliance specialists monitor regulatory changes and implement practices to ensure that the organisation remains compliant while minimising legal risks.

Register for the IIM Nagpur Fintech Course with Jaro Education

Jaro Education provides the perfect platform to register for the FinTech programme, offering an immersive learning experience alongside valuable career counselling and academic guidance. As a technology partner for many programmes offered by IIT and IIM, Jaro ensures you have access to top-notch resources and support. With their expertise, you can navigate your educational journey effectively. Don’t miss this opportunity to enhance your skills and advance your career. Enroll in the fintech online courses through Jaro Education today and unlock numerous career advantages that will set you apart in the competitive FinTech landscape

Conclusion

In conclusion, IIM Nagpur’s PG Certificate Programme in Financial Technologies is more than just a course; it’s a gateway to a promising future in the ever-evolving world of finance. With a curriculum designed to equip you with critical skills and insights, this programme is an excellent investment in your career.

As the fintech landscape continues to expand and evolve, staying ahead of the curve is vital. By choosing to study at IIM Nagpur, you’re not just gaining knowledge; you’re becoming part of a transformative movement that is reshaping the financial sector.

Whether you’re looking to kickstart your career in fintech or elevate your existing expertise, IIM Nagpur’s programme offers the resources, knowledge, and network to help you succeed. Leap and embark on your journey towards becoming a leader in the fintech revolution.

Frequently Asked Questions

Are FinTech courses worth it?

Yes, FinTech courses are a great choice for those looking to tackle challenges and make a real impact in companies. People with skills in math and computer science are especially valued in this field. If you have a background in programming and planning, that will be beneficial too.

What is the FinTech course about?

FinTech, short for financial technology, involves using technology to improve financial services that many people rely on. Examples include mobile banking apps, online lending, and digital investment platforms. In FinTech courses, you’ll learn about topics like artificial intelligence and how they apply to finance.

How is FinTech useful?

FinTech makes financial services easier to access, quicker, and often less expensive. By using technology, FinTech apps can gather more data, process payments faster, and enhance security. The advancements in AI and machine learning are expected to make FinTech even more effective.

Why should I join FinTech?

Joining the FinTech field opens up exciting career opportunities. New jobs are being created every day in this fast-moving industry. Unlike more established sectors, you’ll have the chance to learn new skills that can be applied in various roles and environments.