How to Predict Stock Market Using Machine Learning?

Table Of Content

- How Is Stock Market Prediction Done Using Machine Learning?

- Why Do We Need Machine Learning for Stock Market Forecasting?

- Key Data Sources for Stock Market Prediction

- Types of Machine Learning Used in Stock Market Prediction

How Is Stock Market Prediction Done Using Machine Learning?

With a tremendous amount of data being generated daily by financial markets, stock market predictions via machine learning approach enable investors to take decisions swifter and emotionally unbiased.

.blog-page h3{

font-size: 20px !important;

margin-bottom: 15px !important;

font-weight: 800 !important;

}

.blog-page h4{

font-size: 18px !important;

margin-bottom: 15px !important;

font-weight: 800 !important;

}

.blog-page h3 b, .blog-page h4 b{

font-weight: bold !important;

}

.blog-page p{

margin-bottom: 20px !important;

}

.blog-page li, .blog-page span{

font-size: 16px !important;

}

.blog-page ul {

margin-bottom: 20px !important;

}

.blog-page tbody, .blog-page td, .blog-page tfoot, .blog-page th, blog-page thead, .blog-page tr{

border: 1px solid !important;

border-color: inherit !important;

padding: 10px !important;

}

.blog-page table{

margin-bottom: 15px !important;

}

.blog-page img{

width: 90% !important;

}

@media (max-width: 600px){

.mob-t {

width: 200px;

overflow: scroll;

min-width: 100%;

}

}

Why Do We Need Machine Learning for Stock Market Forecasting?

Moreover, machine learning models are competent of dealing with non-linear relationships of stock prices, especially in volatile markets. This feature makes stock prediction based on machine learning more reliable than rule-based methods.

Key Data Sources for Stock Market Prediction

The news sentiment, social media trend, or a world event is one of the alternative data sources that have been increasingly used in modern stock market prediction using machine learning. These kinds of datasets help the model capture market psychology and external influences.

Types of Machine Learning Used in Stock Market Prediction

Unsupervised learning enables finding patterns, clusters, or anomalies in the stock market data when no predefined labels are assigned to them. The performance of unsupervised learning will thus uncover hidden structures and improve stock market prediction.

Reinforcement learning is another advanced technique that is applied in the stock market to predict, while machine learning algorithms learn optimal trading strategies by interacting with the market environment in order to maximize returns.

Popular Machine Learning Algorithms for Stock Market Prediction

SVM performs well in classification-based machine learning stock prediction and is especially effective in stock price direction forecasting. Nowadays, neural networks, deep learning among them, are increasingly tried for high-accuracy stock market prediction.

Among different Machine Learning approaches, particularly powerful performance for LSTMs is awaited in stock market predictions because of their ability to grasp dependencies between time series and market trends within long spans.

Step-by-Step Process of Stock Market Prediction Using Machine Learning

The next step is the partitioning of this data into training and testing. The training of machine learning models is based on the historical data, and then these models need to be evaluated by performance metrics. Much work in model optimization and tuning needs to be done for improving the accuracy of stock market predictions.

It is used finally to deploy the trained model for real-time stock market prediction using machine learning, where it is continuously learning from new data to refine forecasts.

Role of Technical Indicators in Machine Learning Stock Prediction

Technical indicators coupled with machine learning will in one way or another help traders make informed decisions based on facts rather than mere guesses, hence increasing the overall reliability of the stock market forecast.

Fundamental Analysis in Stock Market Prediction Using Machine Learning

Merging these fundamental data with technical indicators results in hybrid models, which greatly improve stock market prediction outcomes for various investment horizons.

Sentiment Analysis and Stock Market Prediction

Adding sentiment data gives stock market prediction models a better understanding of market psychology and behavioral trends.

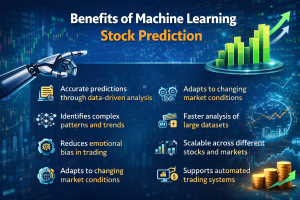

Benefits of Machine Learning Stock Prediction

- Machine learning stock predictions allow for informed decision-making through the evaluation of massive amounts of data from both past and current market trends, thereby increasing levels of accuracy when predicting the stock market.

- One of the main advantages of using machine learning for predicting the stock market is the capability to recognize complex patterns and trends that cannot be easily observed through human eyes and observation.

- Using machine learning algorithms in stock predictions helps minimize biased investments that may result from emotions since machine learning relies on algorithms rather than intuition.

- The stock market prediction via machine learning model is one that is constantly updated through the use of new data.

- Machine learning-based stock prediction has another advantage of fast analysis since a computer algorithm can run through several years of stock market data in seconds.

- Stock market prediction also becomes scalable with machine learning as the same model can be used for different stocks, sectors, and markets.

- The stock market prediction conducted through machine learning techniques enhances risk management by predicting possible stock price volatility in advance.

- Stock prediction based on machine learning uses both technology indicators and sentiment information to provide more accurate results.

- Machine learning stock prediction helps automated stock trading systems by allowing for the immediate execution of ‘buy’ or ‘sell’ commands.

- In general, the use of machine learning technology for stock market prediction helps investors maximize profits, minimize losses, and make informed investment choices.

Challenges in Stock Market Prediction Using Machine Learning

Data quality, market noise, and regulatory issues also impact the accuracy of stock market predictions. Tackling these challenges requires ongoing model validation and risk management strategies.

Risk Management in Machine Learning Stock Prediction

Effective risk management increases the reliability of stock market predictions while protecting investors from large losses.

Real-World Applications of Stock Market Prediction Using Machine Learning

These real-world applications show the growing significance of machine learning in stock market prediction within the global financial landscape.

Future of Stock Market Prediction Using Machine Learning

As artificial intelligence becomes more sophisticated, machine learning in stock market prediction will be central to the future of investing.

Conclusion

Predicting the stock market has always been a challenging task, but machine learning has changed how investors analyze and predict market behavior. By using data, algorithms, and detailed analytics, machine learning offers more accurate and scalable insights than traditional methods.

While there are challenges, the advantages of machine learning-powered stock market prediction outweigh the downsides. As technology progresses, machine learning will continue to change financial forecasting, enabling smarter, quicker, and more informed investment choices.

For investors open to innovation, using machine learning for stock market prediction is not just a trend; it is the future of smart investing.

Frequently Asked Questions

Find a Program made just for YOU

We'll help you find the right fit for your solution. Let's get you connected with the perfect solution.

Is Your Upskilling Effort worth it?

Are Your Skills Meeting Job Demands?

Experience Lifelong Learning and Connect with Like-minded Professionals