Top 8 Differences Between CA and CS (2026 Guide)

Table Of Content

- What is a CA?

- What is CS?

- Top 8 Differences Between CA and CS

- CA vs CS: Which is Better for You?

When it comes to building a career in commerce, two well-known professional qualifications are Chartered Accountancy (CA) and Company Secretary (CS). Both CA and CS are respected, lucrative, and very challenging fields, but they lead to two very different professional pathways.

A CA plays an important role in financial management, tax, and audit matters, and in ensuring businesses are healthy and compliant. Whereas a CS specialises in the policies, law, and guiding operations within corporations to ensure disciplinary actions are legal.

So, if you’re confused about which career path to take in 2026, knowing the most important differences between CA and CS can help you make a well-informed decision. In this blog, we will talk about the top 8 important differences between the CA vs CS qualifications, including eligibility, course structure, difficulty level, and job roles, to help you shortlist the best course of either CA or CS that fits your career aspirations.

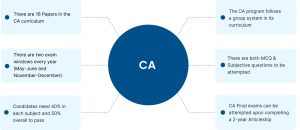

What is a CA?

*lakshyacommerce.com

*lakshyacommerce.comChartered Accountancy (CA) is a professional degree provided by the Institute of Chartered Accountants of India (ICAI). It trains students to become finance specialists who work with accounting, taxation, audit, and financial advice for individuals and businesses.

A CA assures the accuracy of financial records, whether taxes have been paid correctly, and that the appropriate accounting standard has been applied. CAs are often employed within corporate firms, auditing firms, banks, and government agencies. Additionally, many CA practitioners have their own practices offering advisory and audit services to clients.

The key areas of Chartered Accountancy include:

- Financial Accounting and Reporting

- Taxation (Direct and Indirect)

- Cost and Management Accounting

- Auditing and Assurance

- Corporate and Financial Laws

In short, if you enjoy numbers, strategy, and compliance, CA vs CS clearly positions CA as the path for finance-driven professionals.

What is CS?

Key areas of focus include:

- Corporate Governance and Ethics

- Company Law

- Securities Laws and Capital Market

- Secretarial Practice

- Business and Economic Laws

A CS can serve as the internal advisor to the board of directors, facilitate and prepare for statutory and due diligence meetings, draft legal documents, and provide support to management in connectivity between all stakeholder communications and regulatory agencies.

Top 8 Differences Between CA and CS

*linkedin.com

*linkedin.comHere’s a detailed breakdown of the top eight differences between CA and CS that can help you understand which one fits your career goals better.

1. Governing Bodies

| Aspect | CA | CS |

| Regulating Body | Institute of Chartered Accountants of India (ICAI) | Institute of Company Secretaries of India (ICSI) |

| Nature | Focuses on finance, taxation, and auditing | Focuses on corporate governance and legal compliance |

Both ICAI and ICSI are statutory bodies established by Acts of Parliament, ensuring high educational and ethical standards. The difference between CA vs CS starts with their governing approach: finance-driven for CAs and law-oriented for CS professionals.

2. Eligibility Criteria

| Aspect | CA | CS |

| After Class 12 | Students from any stream (except fine arts) can enrol in the CA Foundation Course | Students from any stream (except fine arts) can enrol in the CS Executive Entrance Test (CSEET) |

| After Graduation | Graduates can skip the foundation and directly join the CA Intermediate (if eligible) | Graduates can skip CSEET and directly enrol in the CS Executive level |

Both are open to commerce, science, and arts students. However, commerce students may find CA vs CS more relatable due to their academic background in accounting, economics, and business law.

3. Course Levels and Duration

| Aspect | CA | CS |

| Levels | Foundation → Intermediate → Final | CSEET → Executive → Professional |

| Duration | 4.5 to 5 years (including articleship) | 3 to 4 years (including training) |

While both are long-term commitments, CA takes slightly longer because of the mandatory 3-year articleship under a practising CA. In the CA vs CS timeline comparison, CA demands more field training, while CS emphasises theoretical learning and corporate compliance.

4. Syllabus and Focus Areas

| Aspect | CA | CS |

| Core Subjects | Accounting, Auditing, Taxation, Finance, Costing | Company Law, Corporate Governance, Business Laws, Ethics |

| Nature of Study | Quantitative, Analytical, and Technical | Legal, Regulatory, and Administrative |

The CA course is math-heavy, focusing on financial management and audits, while CS leans toward legal interpretation and corporate governance.

If you enjoy working with numbers and financial systems, CA may suit you better. If you’re more inclined toward law, compliance, and administration, CS could be the right choice.

5. Difficulty Level

| Aspect | CA | CS |

| Passing Rate | Around 10–15% | Around 20–30% |

| Challenge Level | Very High | Moderate to High |

In terms of difficulty for CA vs CS, CA is considered one of India’s toughest exams. It requires analytical problem-solving, practical exposure, and consistent dedication. CS, though challenging, is more theoretical and law-centric, making it slightly easier for those with a knack for memorisation and interpretation.

6. Career Scope and Roles

| Aspect | CA | CS |

| Career Focus | Accounting, Auditing, Finance, Taxation | Legal Compliance, Corporate Governance, Secretarial Practice |

| Job Titles | Auditor, Tax Consultant, Financial Advisor, CFO | Company Secretary, Compliance Officer, Legal Advisor |

| Industries | Banking, Finance, Manufacturing, Government, IT | Corporate Firms, Law Firms, Stock Exchanges, PSUs |

A CA can lead finance teams, manage audits, or provide consulting services. A CS handles corporate laws, secretarial duties, and governance roles. Both roles complement each other in a corporate setup, highlighting the dynamic partnership in CA vs CS career paths.

7. Salary Comparison

| Level | Average CA Salary (per annum) | Average CS Salary (per annum) |

| Freshers | ₹7–8 LPA | ₹5–6 LPA |

| Mid-level | ₹10–15 LPA | ₹8–10 LPA |

| Senior-level | ₹20–40 LPA+ | ₹15–25 LPA+ |

When it comes to CA vs CS salary, Chartered Accountants generally earn higher starting pay due to their financial expertise. However, Company Secretaries enjoy steady growth and strong corporate demand over time.

So, if your goal is higher initial pay, CA might win the CA vs CS salary comparison. But if you value long-term stability and governance authority, CS can be equally rewarding.

8. Work-Life Balance

| Aspect | CA | CS |

| Nature of Work | High-pressure, client-based, deadline-driven | Relatively structured and stable |

| Flexibility | Moderate (depends on firm or practice) | Higher flexibility in corporate setups |

CAs often face intense work pressure during audits and tax seasons, while CS professionals usually enjoy steadier schedules. In terms of work-life balance, CA vs CS tips in favour of CS for its predictable routine and defined compliance cycles.

CA vs CS: Which is Better for You?

- Enjoy working with numbers, finance, and analytics

- Want to work in auditing, taxation, or financial management

- Are you ready for a demanding study lifestyle

Choose CS if you:

- Enjoy law, regulations, and corporate compliance

- Want to work directly with board members and policy matters

- Prefer a somewhat balanced work-life structure

In many businesses, CA and CS work together to complement each other’s skill sets; one manages the financial side of the business, and one ensures the business is operating within the law and its own regulations.

In fact, many ambitious people pursue both CA and CS to become dual-qualified professionals sought after in the corporate world.

Final Thoughts

Without a doubt, CA vs CS are regarded as the most respected qualifications in India, with rewarding career opportunities, solid job security, and much respect in the business community. Chartered Accountants provide financial management for companies, while Company Secretaries provide for the ethical and timely operation of those companies legally.

If you have a strong affinity for numbers, accounting, and finance, CA will be advantageous. But if law, compliance, and governance catch your attention, CS would likely make more sense.

No matter which option you pursue, success will be determined by your rigour, consistency, and professional curiosity. The business world is changing in 2026, and there is significant demand for new CA and CS professionals, making it a good time to consider your path toward a fulfilling career.

For broader business and legal knowledge, you can enrol for the online MBA(Master of Business Administration) offered through Jaro Education.

Frequently Asked Questions

After completing CS, you can work as a Company Secretary, Compliance Officer, Legal Advisor, or Governance Consultant in corporate houses, law firms, or PSUs.

Both offer strong career growth, but in different areas. CA offers higher financial roles and independent practice options, while CS provides growth in corporate law and governance positions.

Find a Program made just for YOU

We'll help you find the right fit for your solution. Let's get you connected with the perfect solution.

Is Your Upskilling Effort worth it?

Are Your Skills Meeting Job Demands?

Experience Lifelong Learning and Connect with Like-minded Professionals