Financial Planning in 2025: 5 Crucial Salary Budgeting Tips

Table of Contents

Every year, you try to create new money habits. Fewer money worries, more control. Less “Where did my pay go?” and more “Here’s what I’m growing.” If you’re really tired of unexpected expenses and scattered savings, it’s time to reset your salary budgeting.

In 2025, financial planning does not mean complicated spreadsheets or complex vocabulary. It means a straightforward plan for your income, expenses, savings, and goals. In this blog, you will learn about what financial planning is, why it matters, and easy budgeting tips. Let’s get started.

What is Financial Planning?

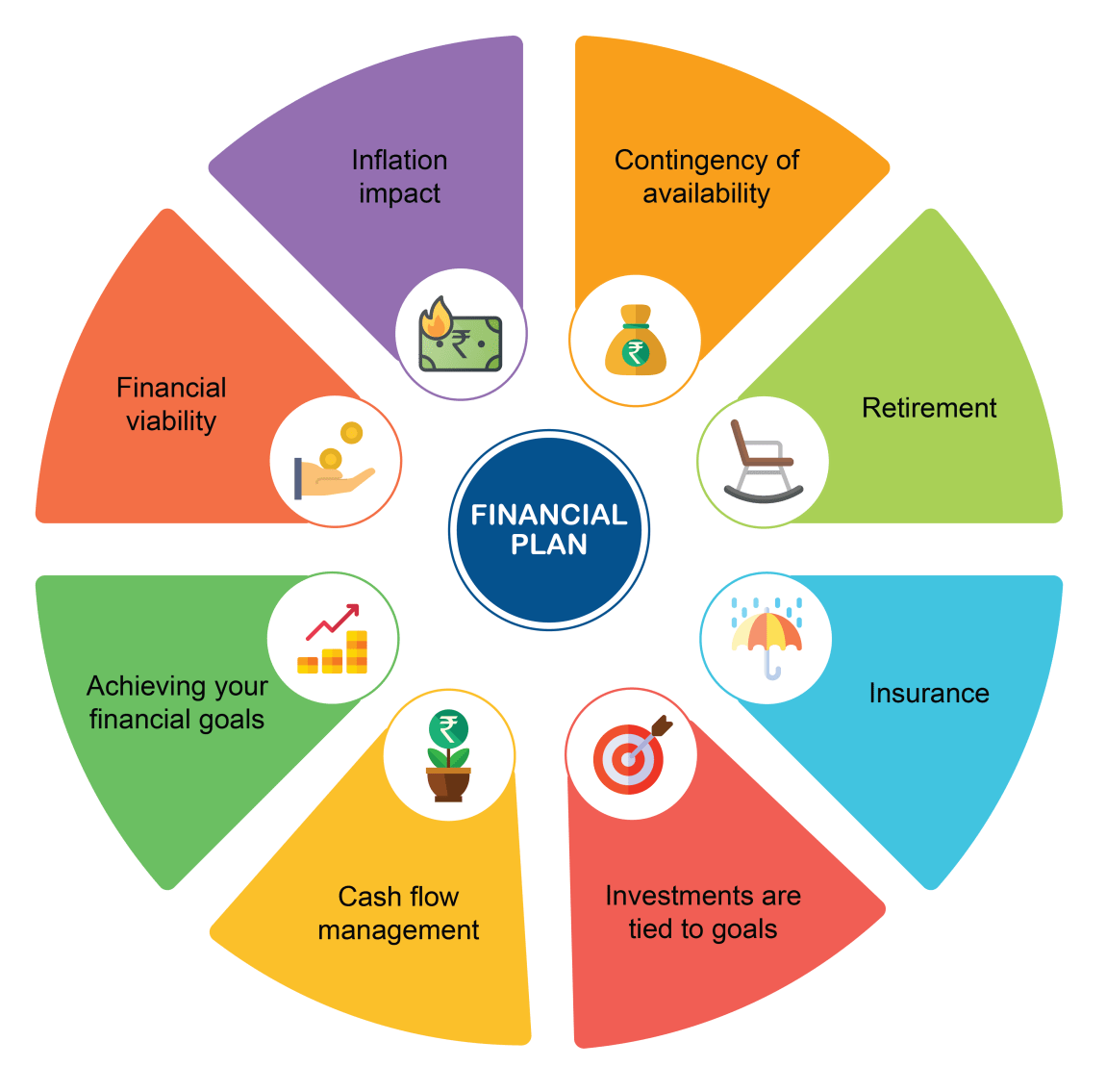

*blog.investyadnya.in

Financial planning definition: Financial planning is the process of developing financial goals (short-term, medium-term, and long-term), understanding your income and expenses, then deciding how to save, invest, protect, and spend to reach your financial goals on time and with room to spare.

To put it simply, it’s a step-by-step plan that tells your money what to do – before your feelings or impulses do. It includes:

- Listing your goals (e.g., start an emergency fund, buy a home, fund your children’s education, retire comfortably).

- Mapping your cash flows (your salary comes in, your spending goes out).

- Creating a monthly budget that includes needs, wants, savings, and investing.

- Protecting that plan with the right insurance and a financial crisis fund.

- Review and adjust regularly as your life changes.

Importance of Financial Planning in 2025

Clear financial planning means that you control your money instead of “money” controlling you. Knowing how much money goes toward expenses versus savings and investing will relieve the urgency to chase your money all the time, and it will take away stress and uncertainty.

Relieve Financial Stress

When you know how much money you have reserved for your savings and investments, it will keep you stress-free about your finances. You will feel you are in charge of your money rather than in a constant position of damage control in case of emergencies.

No Debt, No Stress

Having a strong financial plan helps you to predict your spending instead of becoming dependent on a high-interest loan. A better financial plan also allows you to pay off your existing debts quickly.

Creates Wealth Efficiently

Building wealth is about banking regularly (automatically) into your savings or investment account. Even if the deposits are small, the money will compound over time. The importance of financial planning makes relatively small deposits turn into significant milestones without radically changing your habits.

Protects Your Family's Security

Having sufficient protection with insurance coverage and a will ensures that your family won’t have to suffer in any unexpected event, such as accidents or health issues. With the right financial planning, they will be able to maintain their financial stability during one of the worst times in their lives.

Provides Clarity and Perspective

A comprehensive financial plan allows you to put together a game plan, which can assist you in determining deliberate actions, reducing risk, and knowing where to allocate the money.

Salary-Smart Budgeting Tips for 2025

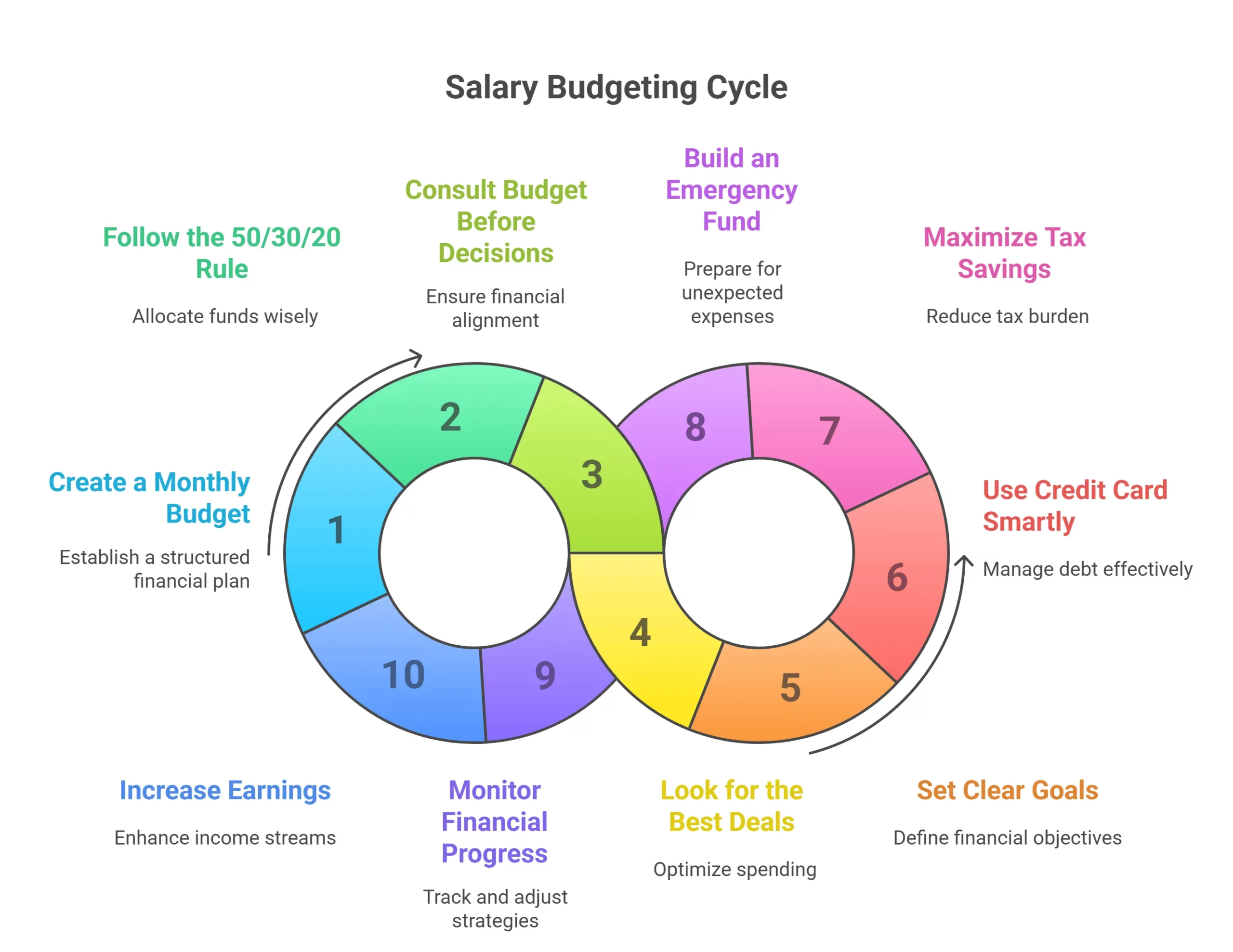

*upgrad.com

Let’s discuss the 10 steps in financial planning and budgeting your salary smartly in 2025:

1) Create a Monthly Budget

A budget is simply a plan for your money before the month begins. Without a budget, small “innocent” spills turn into big leaks. With financial planning, you understand what is included, what can wait, and what is growing. The objective is not perfection, but visibility and control, so your salary covers the life you want. You must be wondering why it matters so much. Without a written plan, lifestyle creep and impulsive purchases can erode your income.

How can you create a monthly budget?

- Write down your total monthly income.

- Sort what you spend on essentials (rent, utilities, groceries, EMIs) and non-essentials (dining out, shopping, subscriptions) into two categories.

- Write down the amount in rupees for each category before the month starts.

2) Implement the 50/30/20 Rule

It is essential to remember that this rule serves as a general guideline, not a strict law. It also minimises guesswork and accounts for every rupee: needs first, then wants, then your future. You simply adjust the sliders according to your city, rent, and family size, and you get the utility of the structure. It works as a balancing of needs, wants, and savings without calculus.

This is how it breaks down:

- 50% Needs: Rent, bills, groceries, transport.

- 30% Wants: Eating out, movies, shopping.

- 20% Savings/Debt: Emergency fund, investing, extra loan repayments.

3) Check Your Budget Before Every Purchase

A small pause can save you thousands over a year. When you look at your categories before you purchase, you will avoid “deal drunk” choices while maintaining the momentum in realising your goals. It’s simple: look, think, then tap “Buy”. These budgeting tips can save you from two months of regret.

How to make it happen:

- Create an “impulse limit” (say, ₹ 1500). If it’s above that → wait 24 hours.

- Check if it’s within your category limit for that month.

- If it is outside your plan – delay, reduce, or drop.

4) Look for the Best Deals

A little patience and comparison shopping can almost always get you 10–20% savings on big-ticket items. Those savings aren’t just a little discount—they will make your emergency fund, SIPs, or loan repayments a little easier. Buying deals can be a smart option if you ensure that it fits your plan. These tips for financial planning have a golden rule: “Prioritise the most important items first; deals are great as long as they fit within your budget.” You should never be buying just because it is on sale; you should be buying when it is in your plan.”

How can you implement it in your financial planning?

- Check prices from multiple websites/stores.

- Choose to buy during festive/seasonal sales.

- Register for price-drop alerts to trigger the best deal, and don’t forget to check out your cashback wallets.

5) Set Clear Money Goals

Money without a cause gets spent aimlessly and often foolishly. When goals are specific and dated, saving becomes natural and satisfying. You can break down big aspirations into 1/12th of what it will cost you, and you’ll begin to feel progress, even on a low income.

How to achieve it?

- Short-term (0-2 years): Trip particular (Rs.-50k), laptop (Rs.-60k), course fee (Rs.-30k)

- Medium-term (2-5 years): car down payment, Master’s tuition, wedding savings

- Long-term (5+ years): house down payment, retirement corpus.

- Turn every goal into a monthly SIP.

6) Smartly Use Credit Cards

Credit cards are tools—they’re valuable if you are careful; they are expensive if you aren’t careful; at the end of the day, you will want to reap the rewards, without the interest. To do this, you should aim to pay in full, with low usage, and automate the process so you don’t miss payments!

Financial planning Tips to use credit cards smartly

- Pay in full every month—no exceptions.

- Keep utilisation ≤30% of your limit.

- Only have credit card charges related to essentials (groceries, fuel) to obtain a meaningful reward.

- Enable reminders or auto-pay the full amount due.

7) Maximise Tax Savings and Legally Keep More of Your Salary

While we all pay taxes, it is not always in our best interest to pay more than we owe. By planning and choosing the right tax regime, we can keep more of our income and use that money to build wealth. The money you can legally save today can be compounded and become a decent amount in the future.

The benefit of tax savings with financial planning is that every rupee you save in taxes is money you can spend on your financial goals. Whether you can use it for investments, pursuing education, or fulfilling your dreams.

Tips to Maximise Tax Savings

- Choose the Best Tax Regime: Compare the old regime versus the new regime and decide which benefits you the most in net terms, based on your income and benefits.

- Use Tools Available to You: EPF/VPF, PPF, NPS, ELSS, health premiums, and home loan interest are ways to claim deductions as per tax law.

- Start tax planning early: Start planning with the new financial year in April (not March), and distribute your contributions throughout the year to ensure you do not leave them to the last minute.

8) Create an Emergency Fund

Life is unpredictable and not always fair, and there are costs no one can anticipate, such as hospital bills, getting laid off, or car repairs. An emergency fund will allow you to address these costly instances without needing to borrow money at high-interest rates or sell off investments prematurely. An emergency fund can act as your financial shock absorber and give you peace of mind.

General Rules to Create an Emergency Fund:

- Target Amount: 3-6 months of living expenses that are vital for every month.

- Saving options: High-liquidity and low-risk options, such as high-interest savings accounts or liquid mutual funds, are best.

9) Track Your Financial Progress Each Month

Financial planning can slip over time (rising costs, changing lifestyle, changing objectives). Reviewing your finances each month helps you stay on top of your plan – and make any corrections early enough before the little issues become big ones.

Tips to Track Your Financial Progress:

- Actual spending compared to planned spending.

- Net worth review on at least a quarterly basis (what you own minus liabilities).

- Ongoing SIP: Are you on target or falling short?

- Every month, find at least one recurring expense leak to eliminate (like an unused subscription or take-out charges).

10) Increase Your Money

While there is a limit to how much you can cut, you can always increase your income with side hustles or improve skills to advance your financial goals faster, reduce debt more quickly, and give you more freedom to make decisions. Indeed, with extra income, you can make larger investments, get to your goals quicker, and have more resilience with your financial position.

Some Smart ideas for extra income:

- Freelance or consulting: Writing, graphic design, programming, tutored lessons, and social media management.

- Remote jobs: Virtual assistant, researcher, data entry jobs.

- Micro-businesses: Resell products, create a content business, and affiliate marketing projects.

- Upskilling: A series of online courses that will improve your professional rate or career path.

How Jaro Education Can Support Your Financial Growth and Salary Management

Understanding the right strategy for salary budgeting is essential. You can indeed implement a few salary budgeting tools, such as creating a monthly budget, allocating expenses, and tracking your spending. But these qualities come when your financial management and leadership skills are strong enough to balance priorities.

So, if you want to sharpen your skills, Jaro Education’s online courses can help. Our flexible and accredited programmes are designed to guide you in mastering advanced budgeting techniques, financial planning, and, of course, career development. Reach out to us and understand what courses suit you the best.

The Bottom Line

In a nutshell, financial planning in 2025 is not just about surviving; it is about achieving a balance between saving, investing, and enjoyment. Once you start to track every rupee, start to understand realistic goals, and consistently and confidently say to yourself, “First Saving”, then Wants”, you begin the move from being in control of your money to using your money to control your life.

Your salary is not just money. It is your bargaining chip. In life, you are the main star. Because no matter how good the supporting actors are, it is your money that takes the lead. The next time you manage your money, do it clearly, with discipline, and with good thoughts around the decisions you make.

Frequently Asked Questions

What is financial planning?

Financial planning is a process made up of specific steps to help you meet your goals, budget your money, save and invest wisely, protect against risks, and review regularly so you have enough money for your life plans when you need it.

Why is financial planning important?

Financial planning will help reduce stress, avoid getting into debt, help you build wealth quickly, ensure you have the right protection for your family and future, and prepare you for future milestones like education, home ownership, and retirement.

What are the basic steps in financial planning?

Goal Setting → Calculate net worth → Income/expenses mapping → Create a workable budget → Build an emergency fund → Beware insurance protections → Align investments with goals → Tax management → Repay debt → Regularly review and update your plan.

How much should I save every month?

Generally, aiming for 20% of your take-home pay (50/30/20!), but if you are unable to save 20% because of high rent or other obligations, just save what you can sustainably and then grow it slowly over time. Consistency trumps intensity.